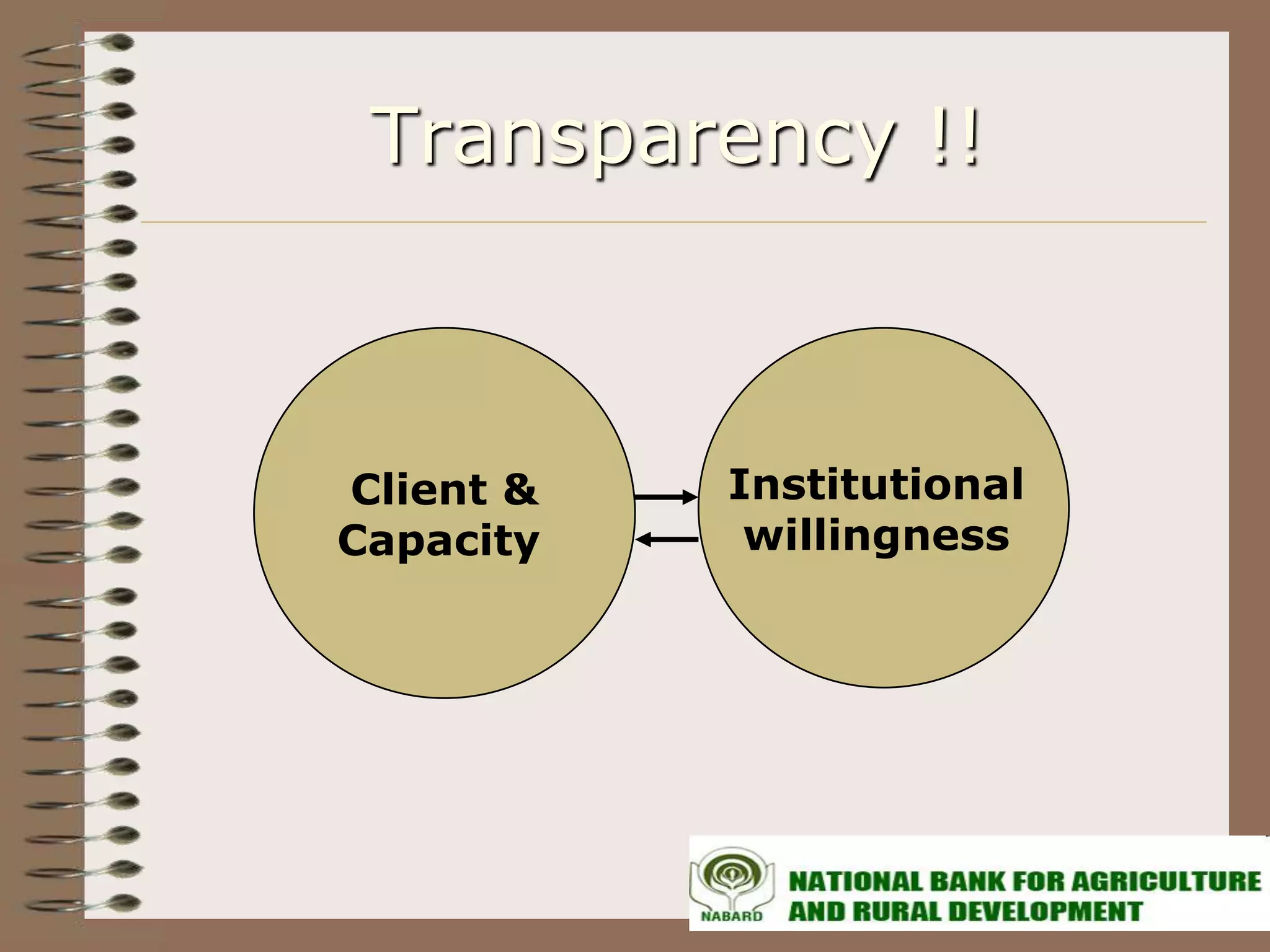

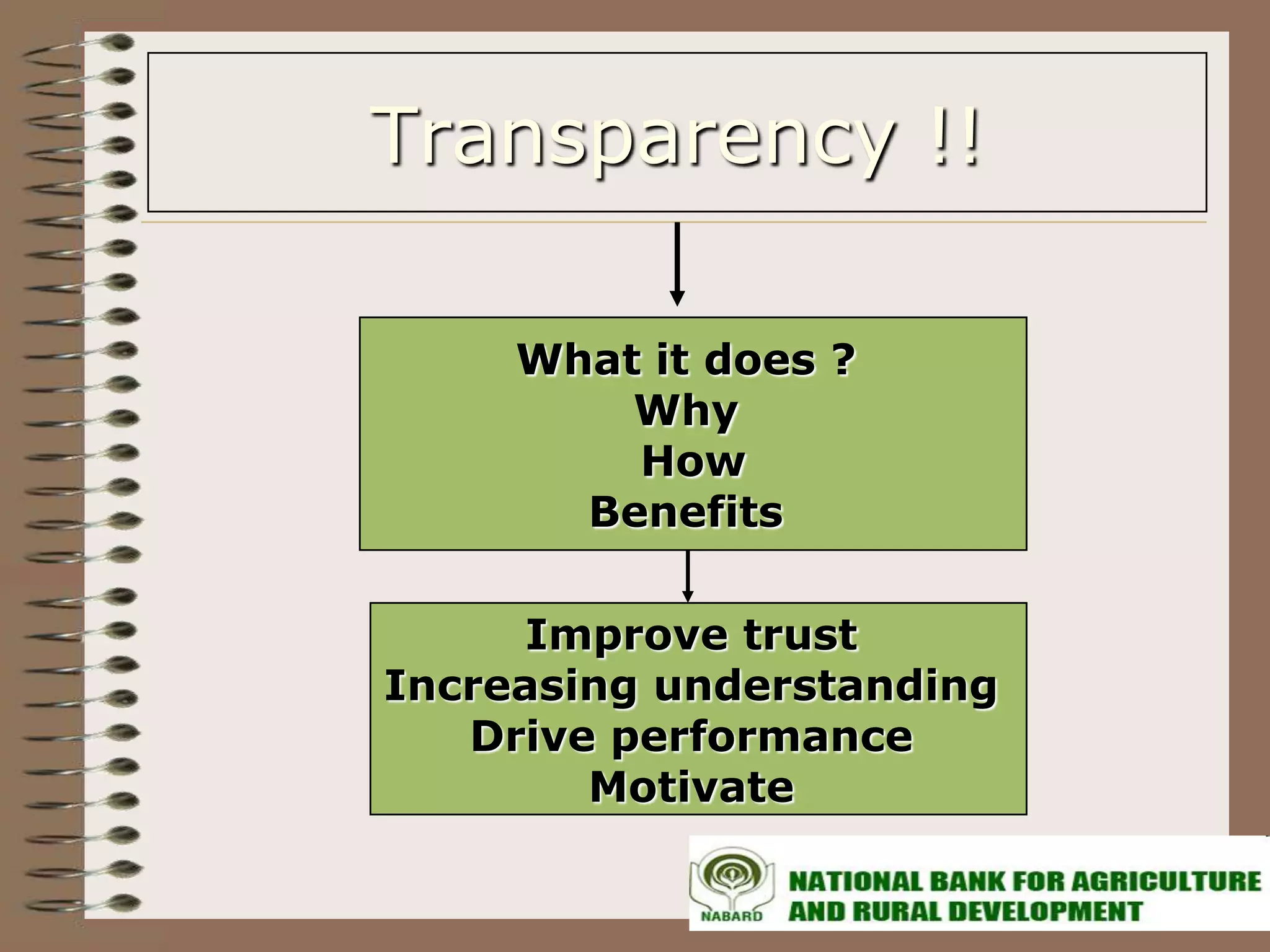

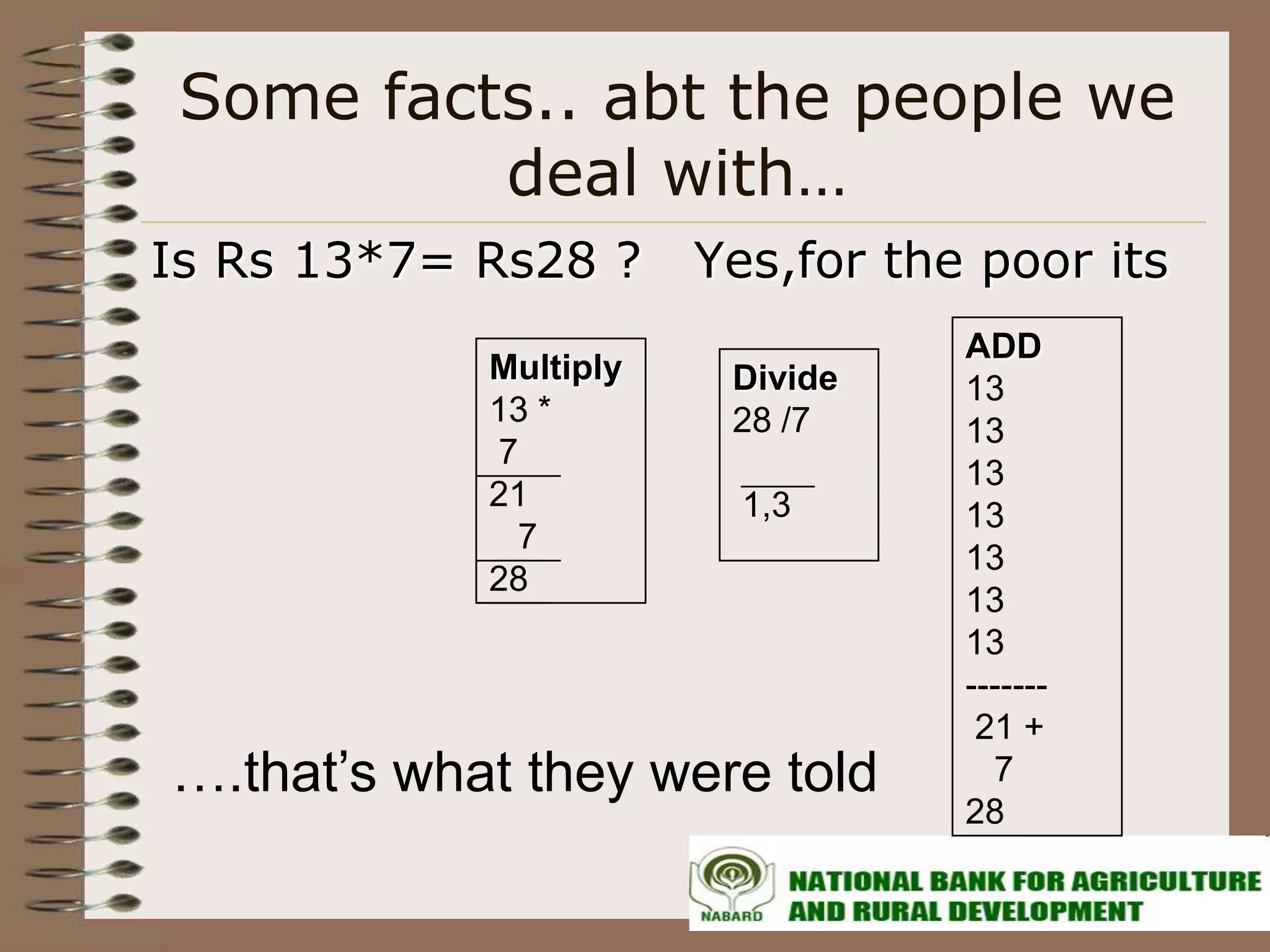

The document discusses the importance of transparency and responsible pricing in financial operations, especially for clients with limited understanding of financial concepts. It highlights the gap between what clients are charged versus what they pay, emphasizing that financial literacy is crucial for enhancing access and fostering trust. Various strategies, including the use of technology and educational initiatives, are suggested to improve financial literacy and ensure better communication regarding financial products.