This document provides an overview of convertible bonds, including:

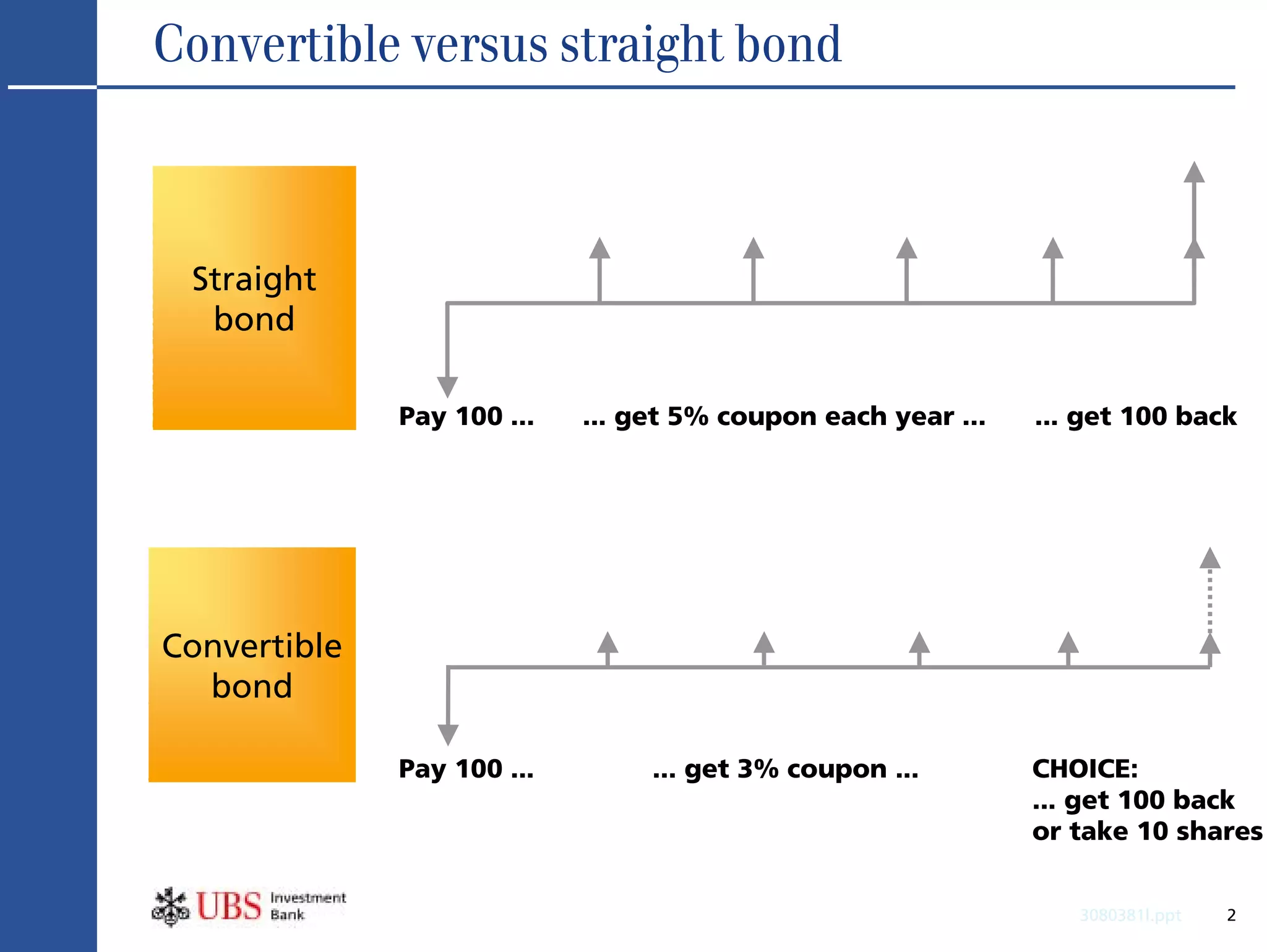

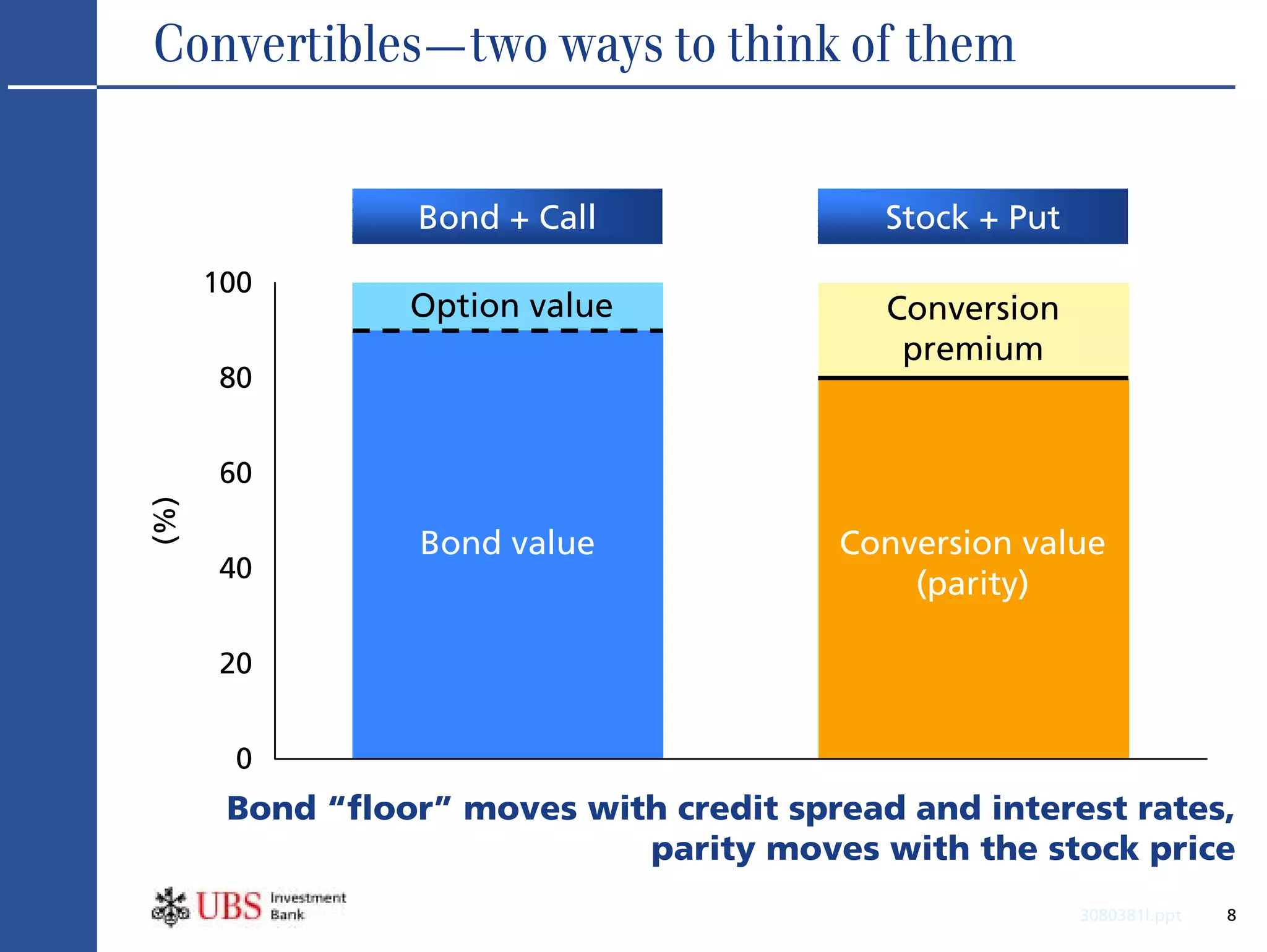

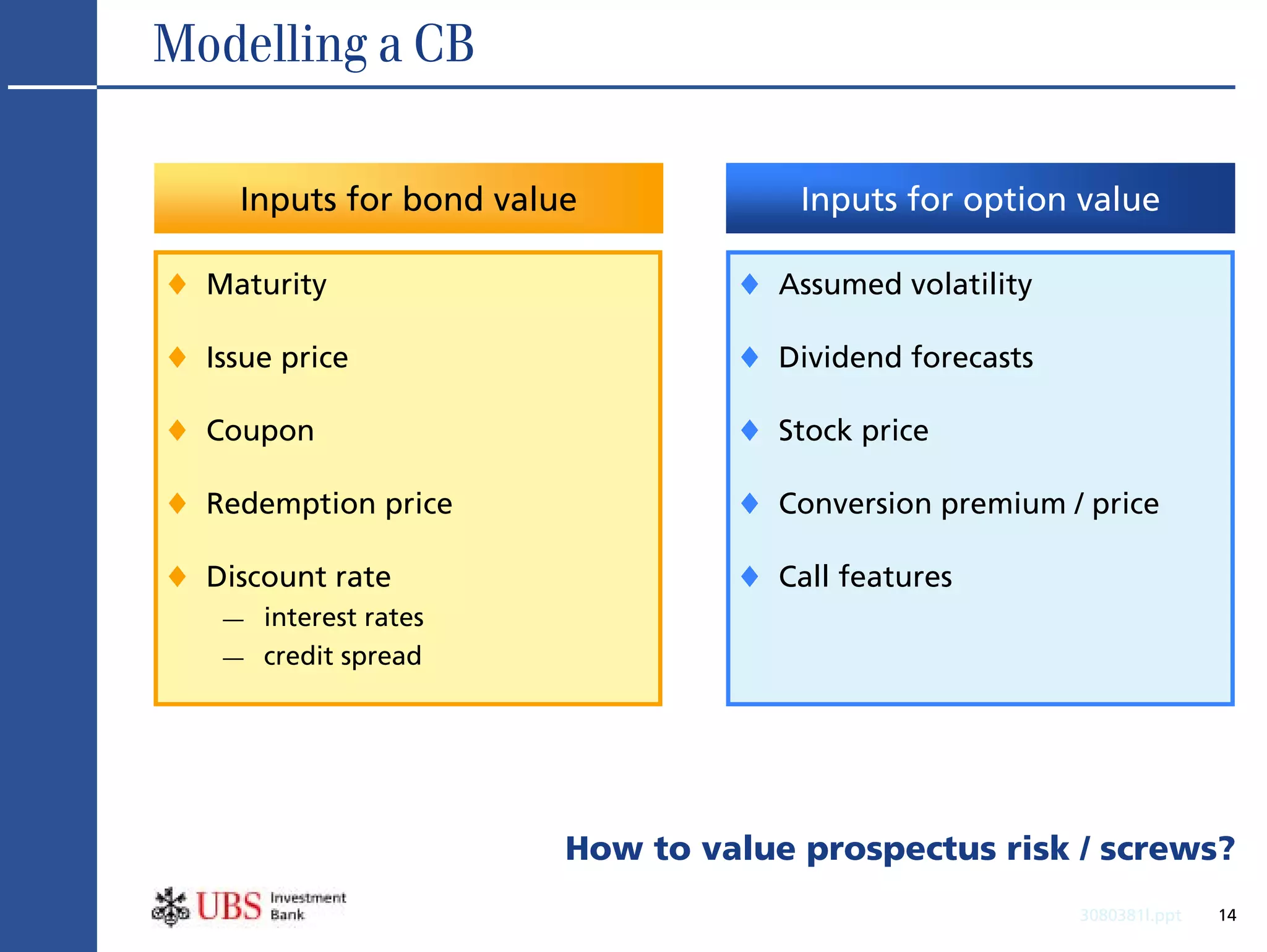

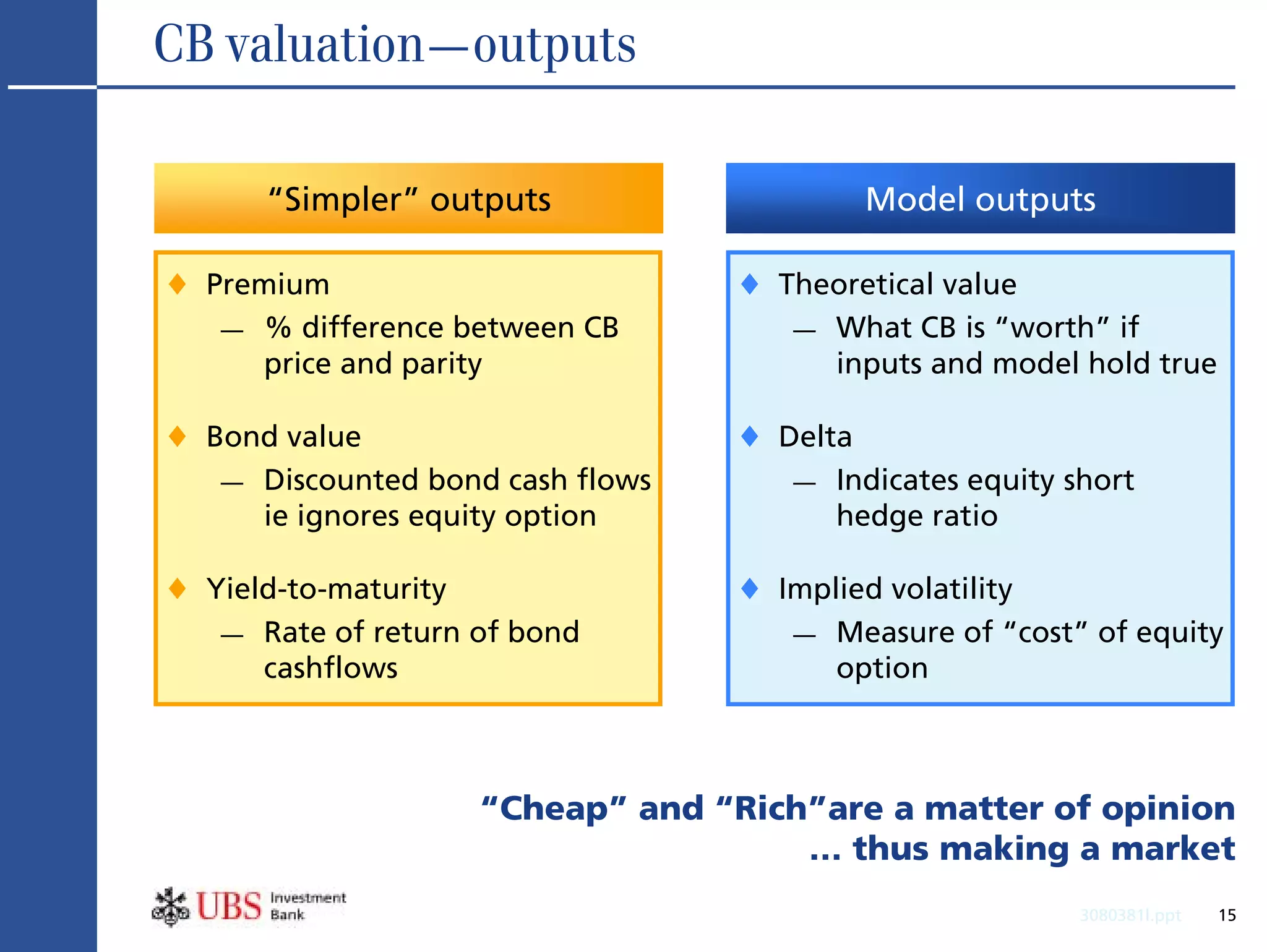

- Convertible bonds offer bond-like coupon payments but also allow conversion to equity, giving bondholders choice.

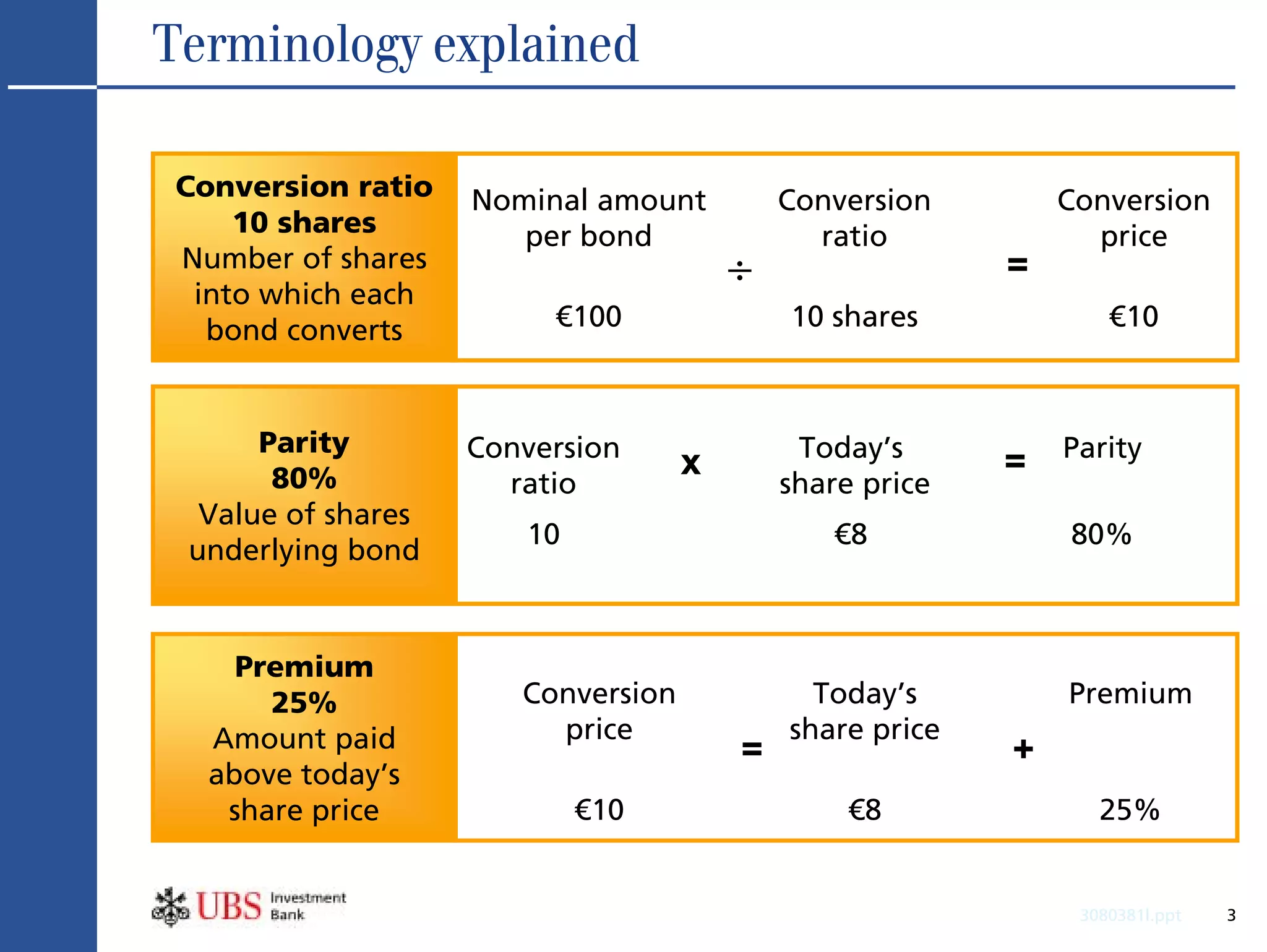

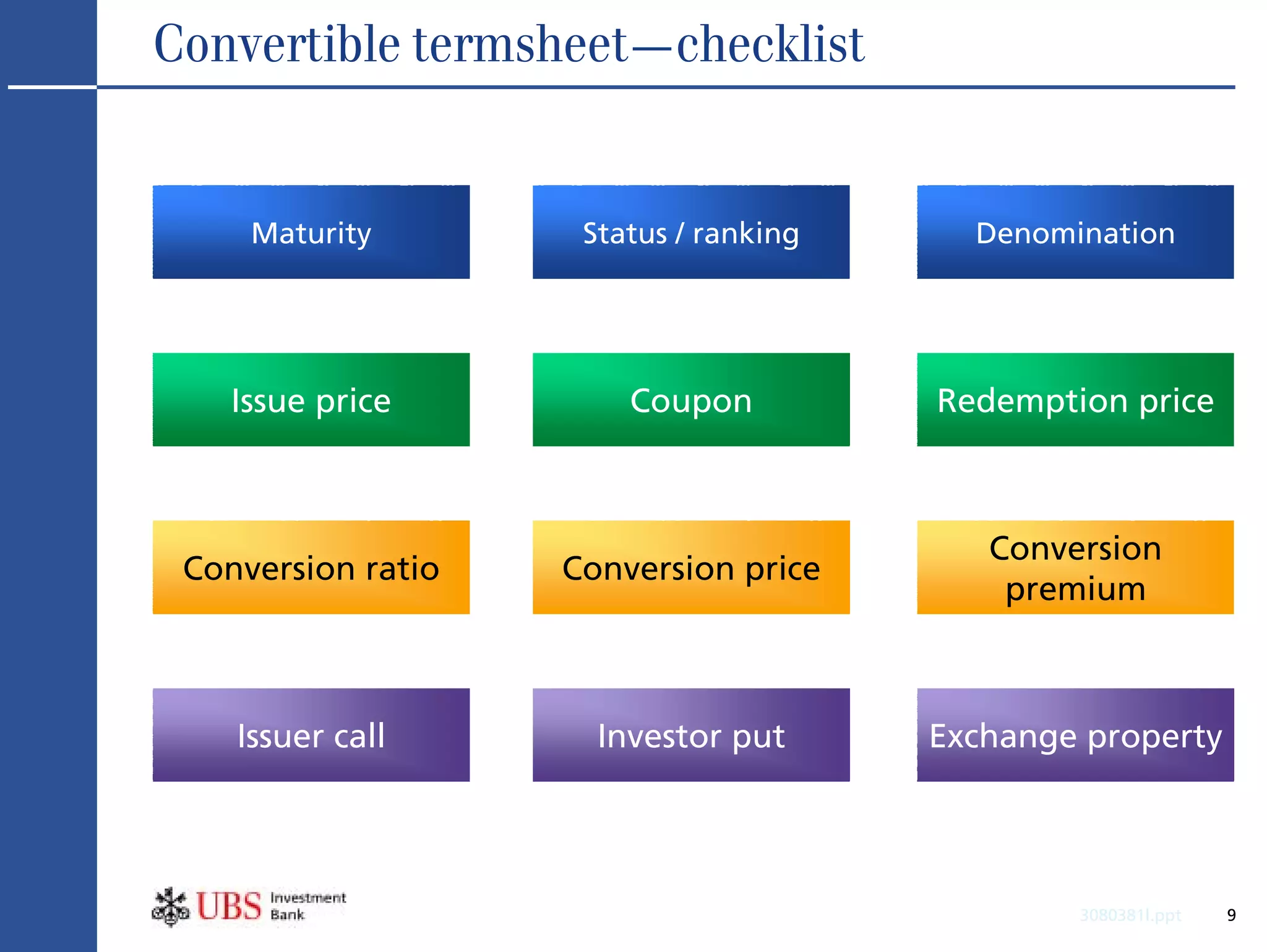

- Terminology around conversion ratios, prices, and premiums is explained.

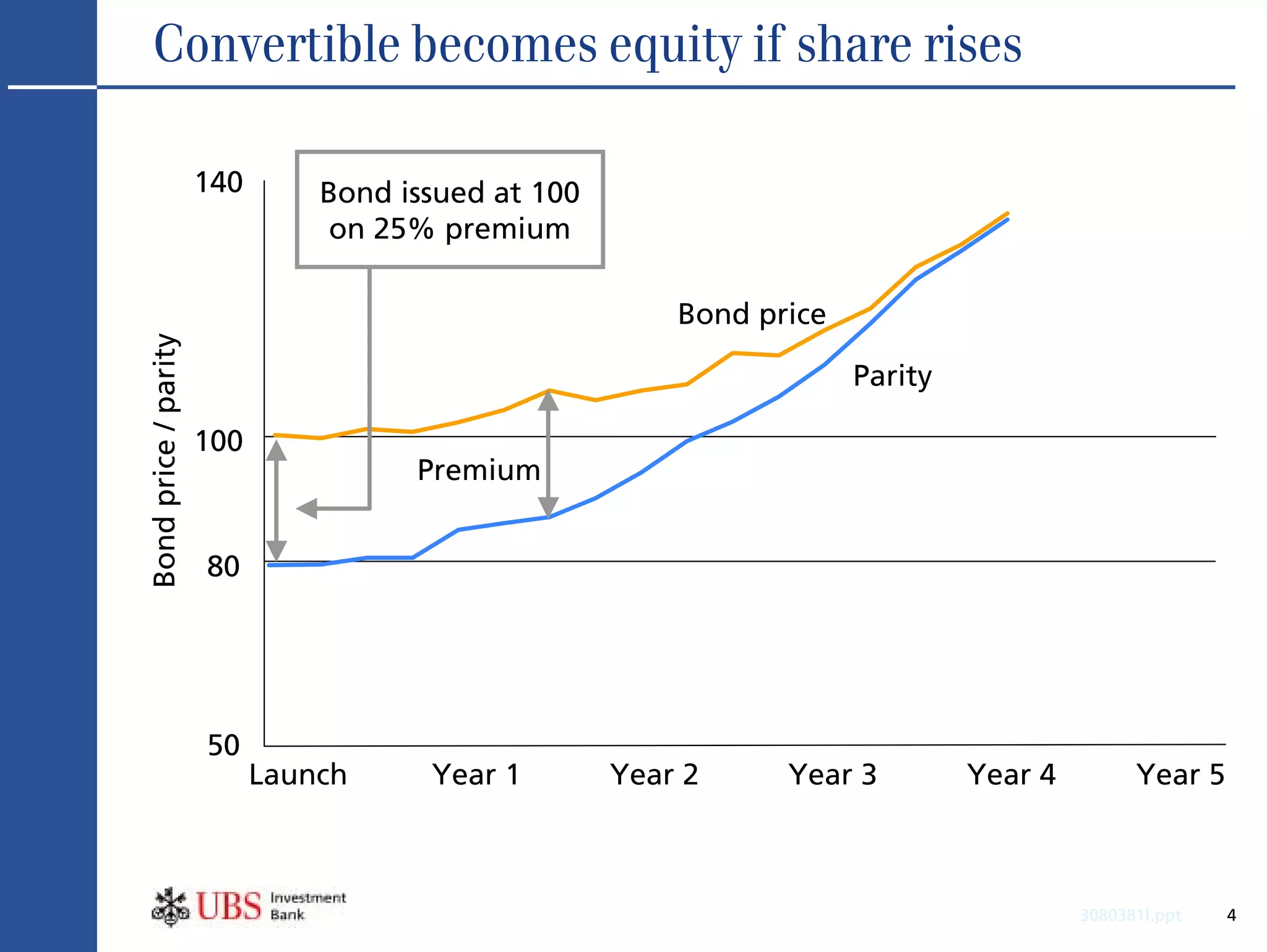

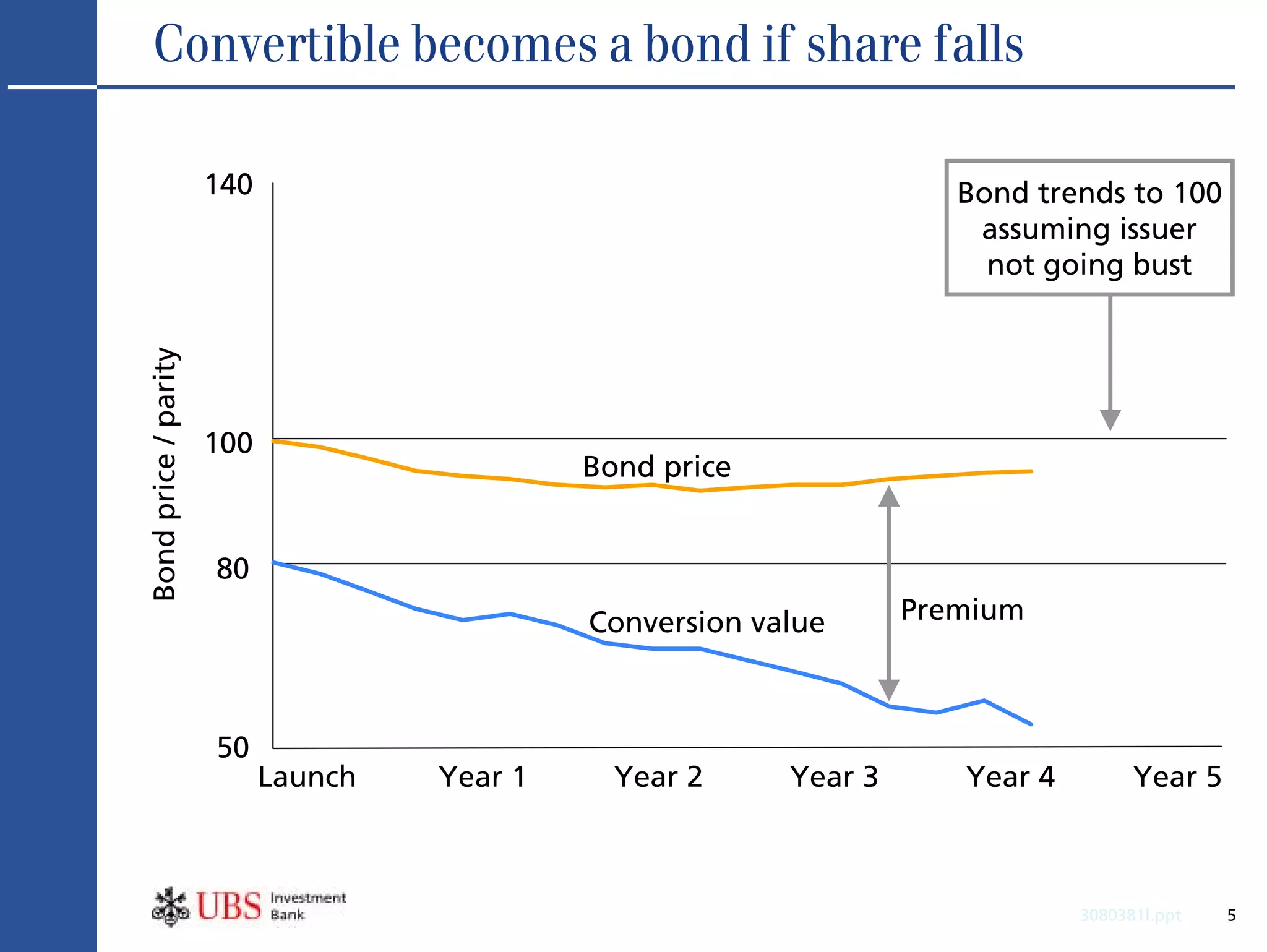

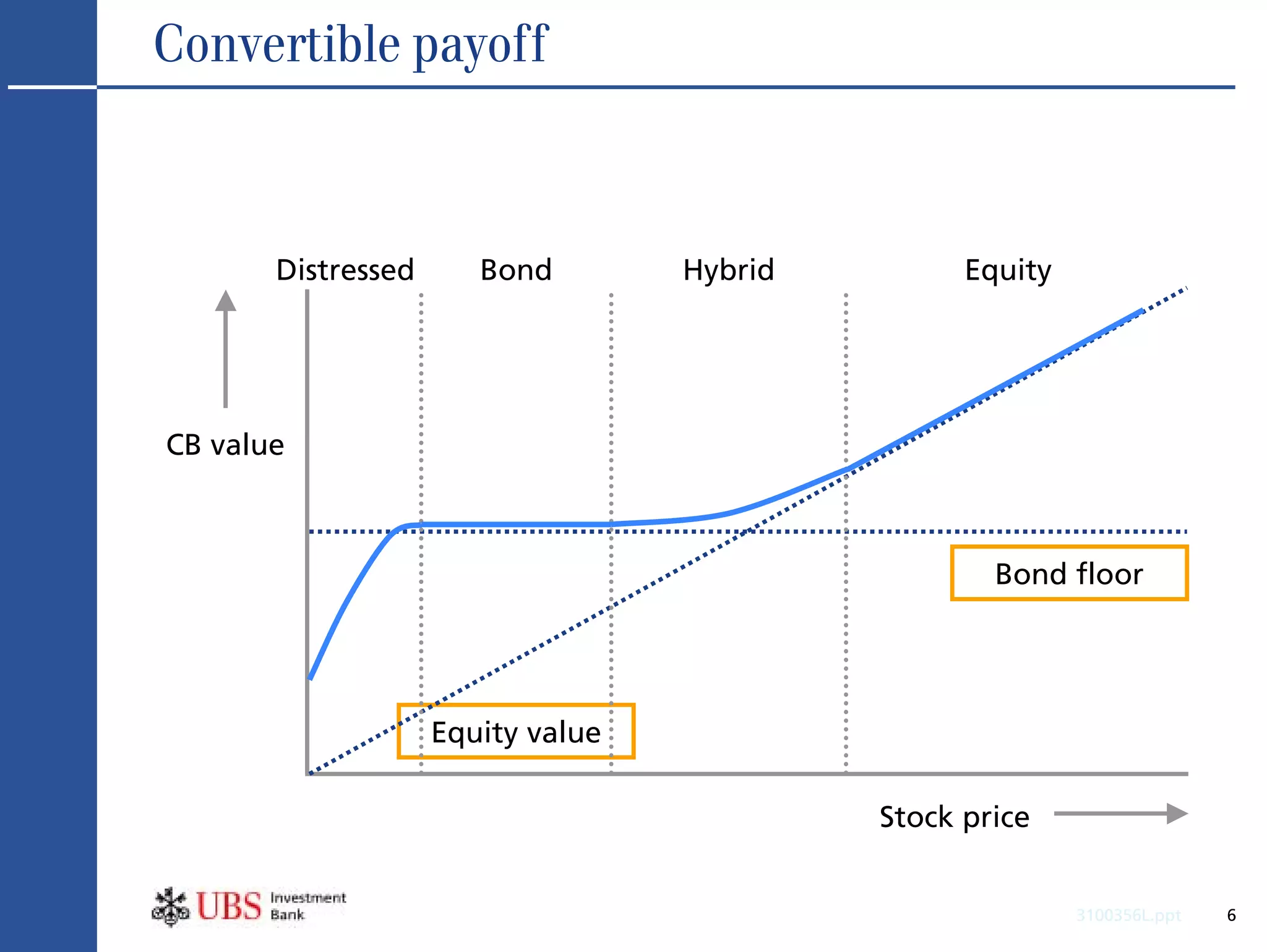

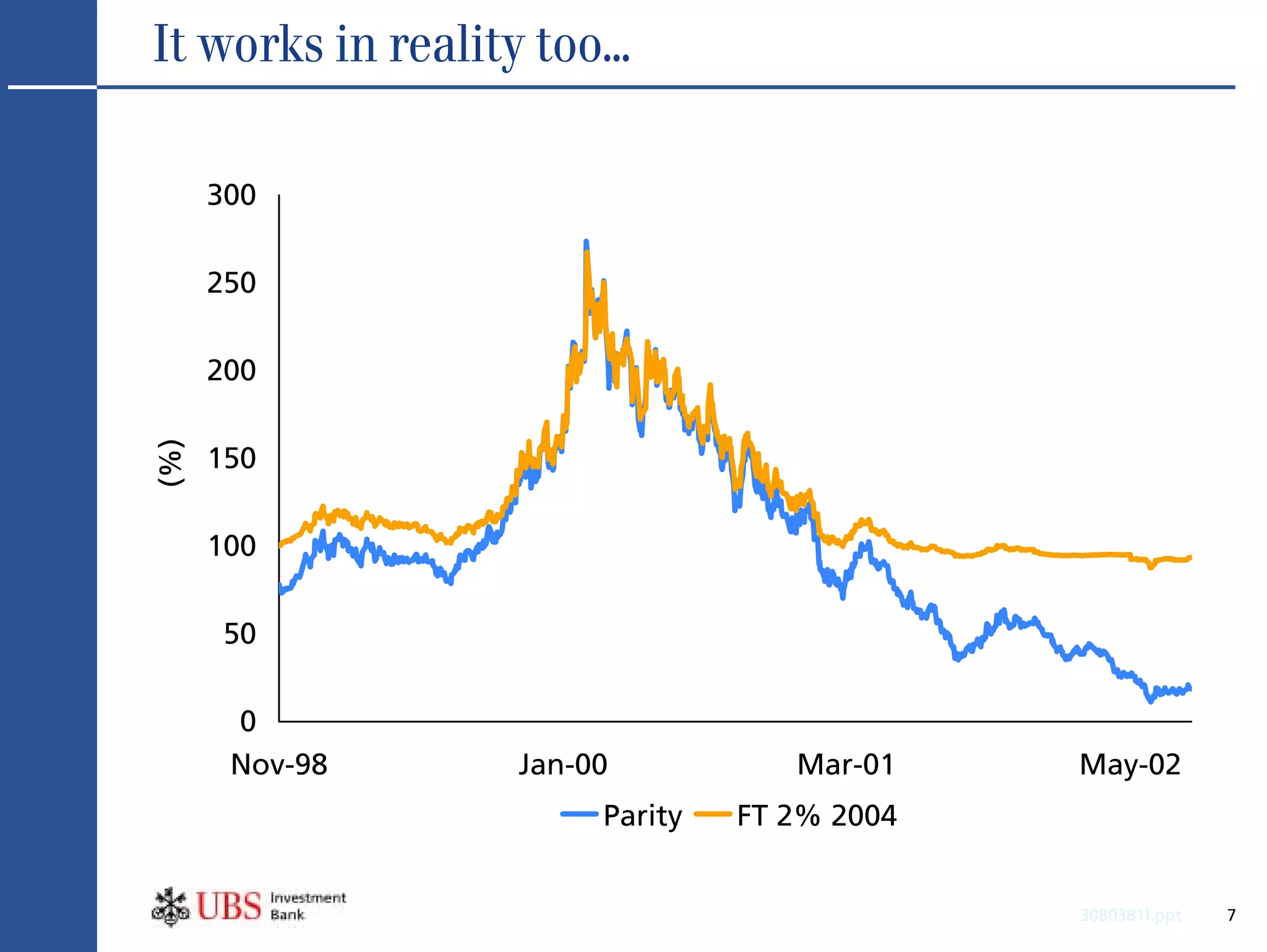

- Convertible bonds take on characteristics of bonds or equities depending on whether the underlying share price rises or falls.

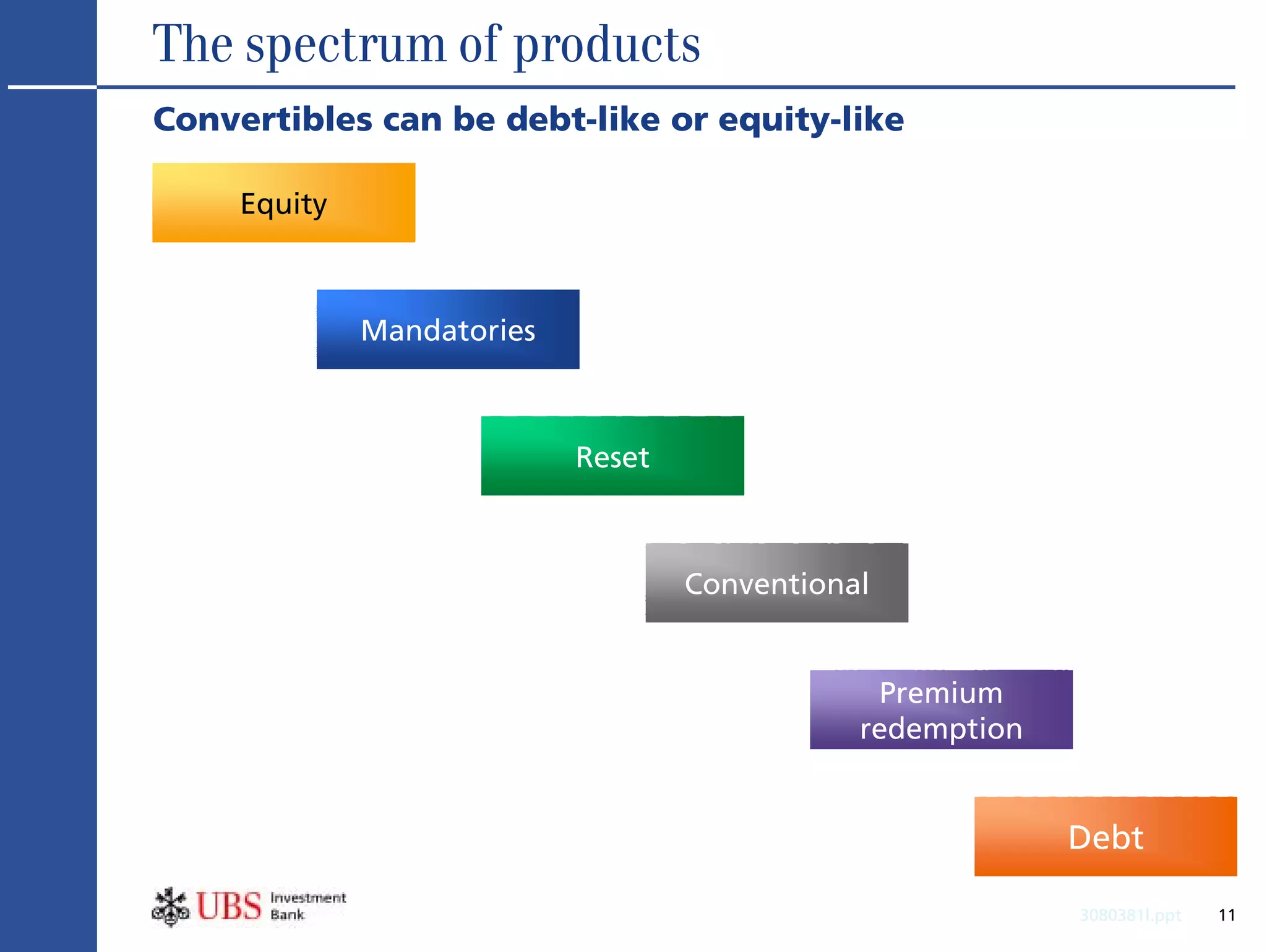

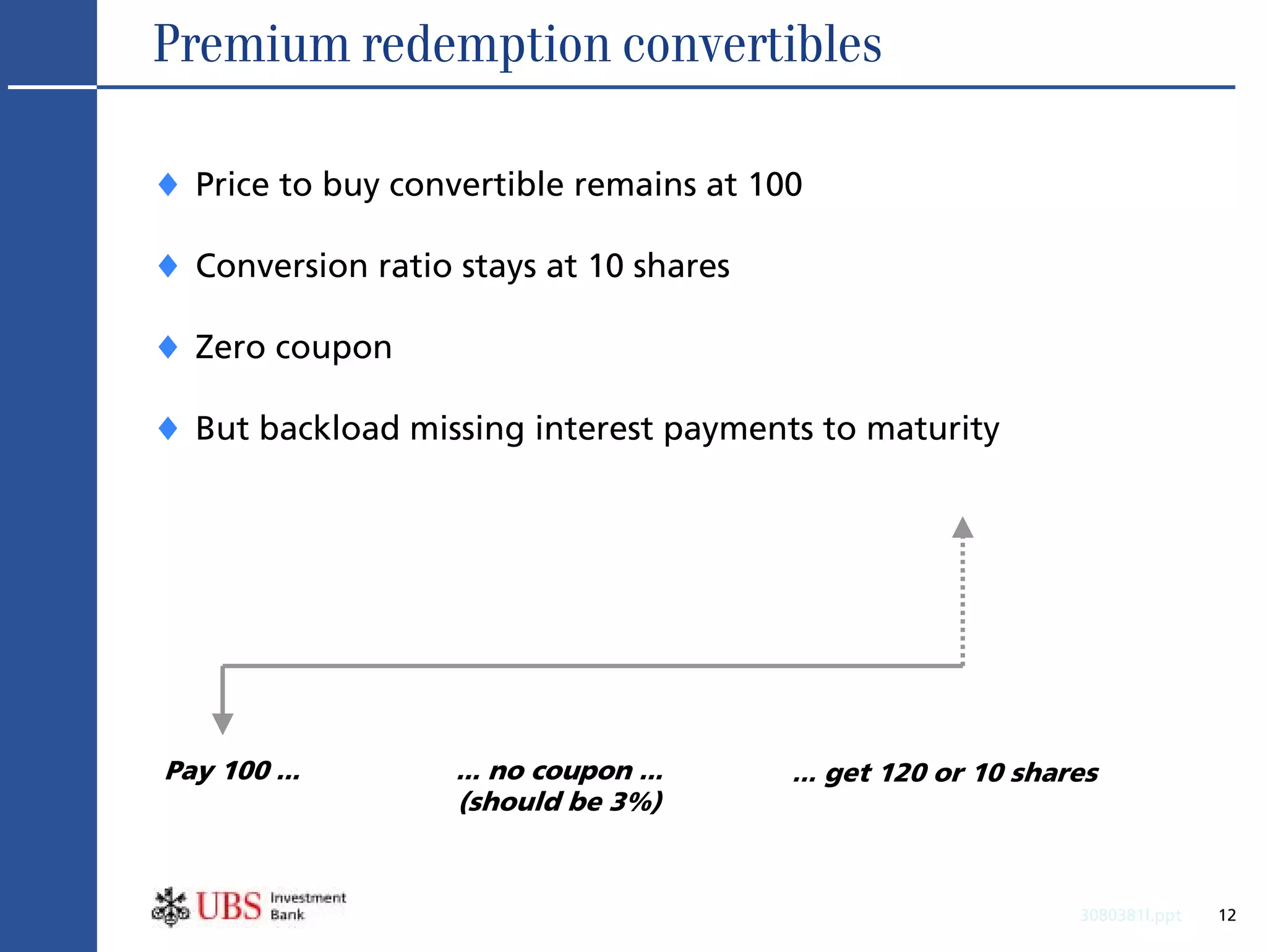

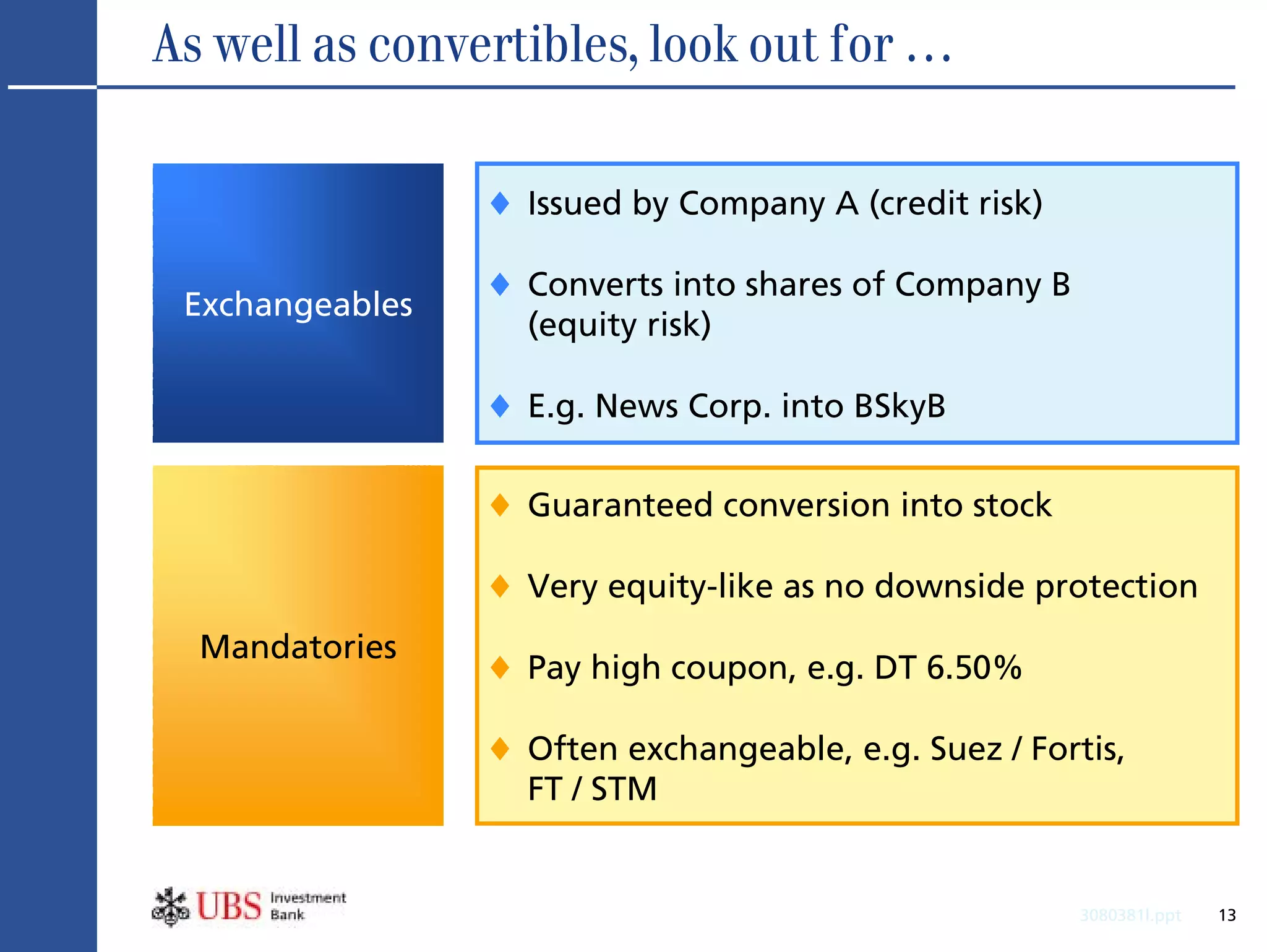

- Various convertible bond structures are discussed, ranging from equity-like to debt-like.