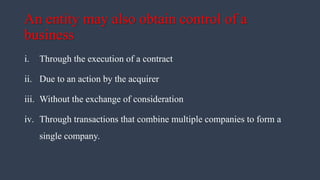

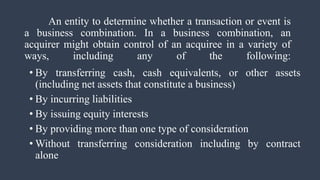

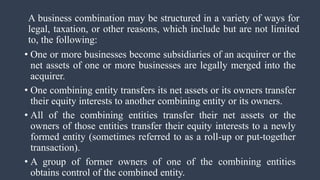

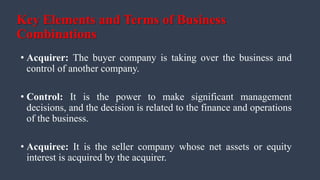

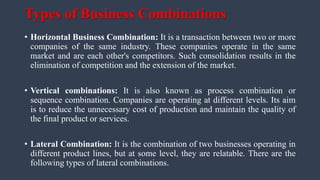

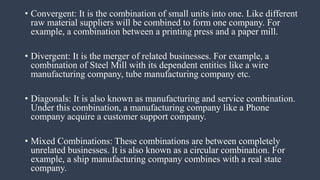

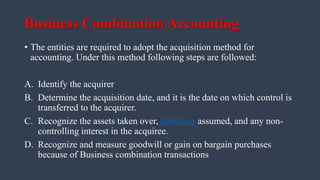

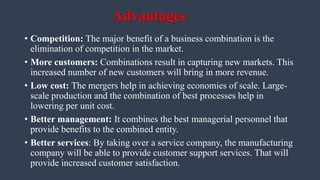

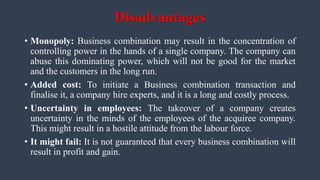

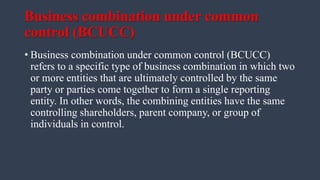

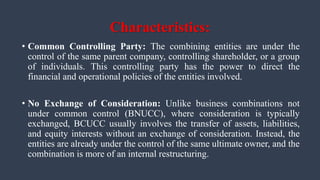

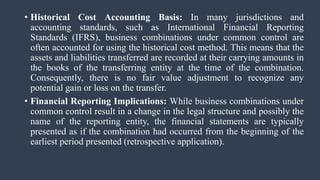

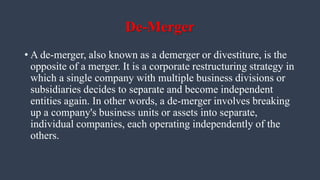

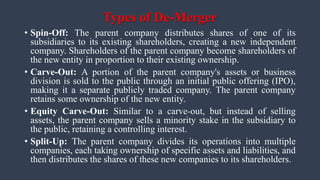

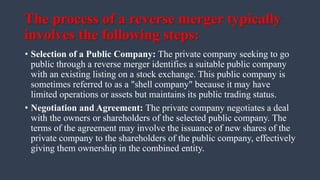

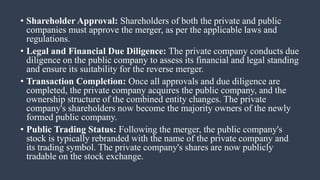

The document provides an overview of business combinations, defining key concepts such as acquirer, acquiree, and types of combinations including horizontal and vertical mergers. It discusses the objectives behind such combinations, advantages like increased market share, and disadvantages such as potential monopolies. Additionally, the text outlines specific transactions like de-mergers and reverse mergers along with their processes and implications.