Solution for voucher entry problem

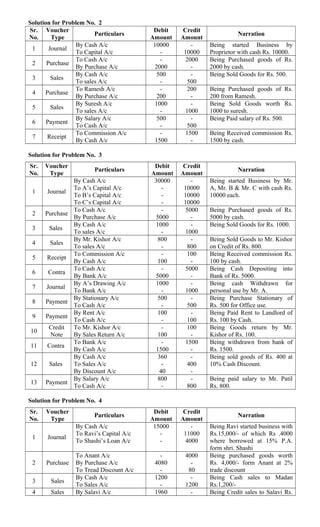

- 1. Solution for Problem No. 2 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Journal By Cash A/c To Capital A/c 10000 - - 10000 Being started Business by Proprietor with cash Rs. 10000. 2 Purchase To Cash A/c By Purchase A/c - 2000 2000 - Being Purchased goods of Rs. 2000 by cash. 3 Sales By Cash A/c To sales A/c 500 - - 500 Being Sold Goods for Rs. 500. 4 Purchase To Ramesh A/c By Purchase A/c - 200 200 - Being Purchased goods of Rs. 200 from Ramesh. 5 Sales By Suresh A/c To sales A/c 1000 - - 1000 Being Sold Goods worth Rs. 1000 to suresh. 6 Payment By Salary A/c To Cash A/c 500 - - 500 Being Paid salary of Rs. 500. 7 Receipt To Commission A/c By Cash A/c - 1500 1500 - Being Received commission Rs. 1500 by cash. Solution for Problem No. 3 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Journal By Cash A/c To A’s Capital A/c To B’s Capital A/c To C’s Capital A/c 30000 - - - - 10000 10000 10000 Being started Business by Mr. A, Mr. B & Mr. C with cash Rs. 10000 each. 2 Purchase To Cash A/c By Purchase A/c - 5000 5000 - Being Purchased goods of Rs. 5000 by cash. 3 Sales By Cash A/c To sales A/c 1000 - - 1000 Being Sold Goods for Rs. 1000. 4 Sales By Mr. Kishor A/c To sales A/c 800 - - 800 Being Sold Goods to Mr. Kishor on Credit of Rs. 800. 5 Receipt To Commission A/c By Cash A/c - 100 100 - Being Received commission Rs. 100 by cash. 6 Contra To Cash A/c By Bank A/c - 5000 5000 - Being Cash Depositing into Bank of Rs. 5000. 7 Journal By A’s Drawing A/c To Bank A/c 1000 - - 1000 Being cash Withdrawn for personal use by Mr. A. 8 Payment By Stationary A/c To Cash A/c 500 - - 500 Being Purchase Stationary of Rs. 500 for Office use. 9 Payment By Rent A/c To Cash A/c 100 - - 100 Being Paid Rent to Landlord of Rs. 100 by Cash. 10 Credit Note To Mr. Kishor A/c By Sales Return A/c - 100 100 - Being Goods return by Mr. Kishor of Rs. 100. 11 Contra To Bank A/c By Cash A/c - 1500 1500 - Being withdrawn from bank of Rs. 1500. 12 Sales By Cash A/c To Sales A/c By Discount A/c 360 - 40 - 400 - Being sold goods of Rs. 400 at 10% Cash Discount. 13 Payment By Salary A/c To Cash A/c 800 - - 800 Being paid salary to Mr. Patil Rs. 800. Solution for Problem No. 4 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Journal By Cash A/c To Ravi’s Capital A/c To Shashi’s Loan A/c 15000 - - - 11000 4000 Being Ravi started business with Rs.15,000/- of which Rs .4000 where borrowed at 15% P.A. form shri. Shashi 2 Purchase To Anant A/c By Purchase A/c To Tread Discount A/c - 4080 - 4000 - 80 Being purchased goods worth Rs. 4,000/- form Anant at 2% trade discount 3 Sales By Cash A/c To Sales A/c 1200 - - 1200 Being Cash sales to Madan Rs.1,200/- 4 Sales By Salavi A/c 1960 - Being Credit sales to Salavi Rs.

- 2. To Sales A/c By Tread Discount A/c - 40 2000 - 2,000/- less trade discount 2 % 5 Payment By Anant A/c To Cash A/c To Discount A/c 1960 - - - 1950 10 Being Paid cash Rs. 1,950/- to Anant and received discount of Rs. 10/- 6 Receipt To Salavi A/c By Cash A/c By Discount A/c - 1950 10 1960 - - Being received Rs.1,950/- form Salavi in full settlement of his dues. 7 Debit Note By Anant A/c To Purchase Return A/c 100 - - 100 Being returned goods of the price of Rs. 100/- to Anant. 8 Contra To Cash A/c By Bank A/c - 5000 5000 - Being deposit into bank Rs. 5,000/- 9 Payment By Anant A/c To Bank A/c 1000 - - 1000 Being issue a cheque for Rs.1,000/- to Anant on account. 10 Purchase To Anant A/c By Purchase A/c - 2000 2000 - Being Purchased goods of Rs. 2,000/- form Anant. 11 Sales By Ratan A/c To Sales A/c 1250 - - 1250 Being Sold goods costing Rs. 1,000/- at 25% Profit to Ratan. 12 Receipt To Ratan A/c By Cash A/c By Discount A/c - 395 5 400 - - Being received a cheque for Rs.395/ - form Ratan and he was allowed discount Rs.5/ -. 13 Credit Note To Ratan A/c By sales Return A/c - 50 50 - Being Ratan returned goods of Rs. 50/ -. 14 Payment By Interest on Loan A/c To Cash A/c 50 - - 50 Being paid interest on loan Rs. 50/- to Shashi. 15 Payment By Salary A/c To Cash A/c To Bank A/c 2000 - - - 800 1200 Being Paid salaries Rs. 2,000/ - out of which Rs. 1,200/ - Paid by cheque. 16 Contra To Cash A/c By Bank A/c - 500 500 - Being deposit into bank Rs. 500/- 17 Payment By Office Rent A/c To Bank A/c 300 - - 300 Being paid office rent by cheque Rs. 300/ -. Solution for Problem No. 5 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Journal By Cash A/c By Furniture a/c To Nitin’s Capital A/c 5000 1000 - - - 6000 Being Nitin started business with cash Rs. 5,000/ - and furniture of Rs. 1,000/ - 2 Payment To Cash A/c By Stationary A/c - 120 120 - Being purchase stationary of Rs.120/ - . 3 Purchase To Vijay A/c By Purchase A/c To Tread Discount A/c - 2100 - 2000 - 100 Being Bought goods form Vijay worth Rs. 2,000/ - at 5% trade discount. 4 Purchase To S.Ram A/c By Purchase A/c - 1500 1500 - Being Purchase Goods from S. Ram Rs. 1,500/ - 5 Debit Note By Vijay A/c To Purchase Return A/c 95 - - 95 Being returned goods of Rs. 95/ - to Vijay 6 Purchase To Vijay A/c By Purchase A/c - 95 95 - Being Received goods form Vijay in exchange of those returned on 6th April. 7 Sales By Cash A/c To Sales A/c 1000 - - 1000 Being cash sales Rs. 1000/- 8 Sales By D. Narayan A/c To Sales A/c 500 - - 500 Being Nitin sold goods to D. Narayan of Rs.500 9 Sales By Ratan A/c To Sales A/c By Tread Discount A/c 768 - 32 - 800 - Being sold goods to Ratan of Rs 800 less tread discount Rs 32. 10 Journal By Drawing A/c To Purchase A/c To Cash A/c 150 - - - 50 100 Being proprietor took for private use goods of Rs. 50/- & Cash Rs. 100/- 11 Credit Note To D. Narayan A/c By Sales Return A/c - 50 50 - Being received goods return from D. Narayan of Rs. 50/- 12 Credit To Ratan A/c - 40 Being received goods return

- 3. Note By Sales Return A/c 40 - from Ratan of Rs. 40/- (i.e. cost Rs.50/- less tread Discount 4%) 13 Payment By S Ram A/c To Cash A/c 900 - - 900 Being Paid cash Rs.900/- to Ram. Debit Note By S Ram A/c To Purchase Return A/c 100 - - 100 Being returned goods of Rs.100/-to S Ram 14 Payment To Cash A/c By Stationary A/c - 500 500 - Being purchase a stationary from M/s. Kishor & Co Rs. 500/- on cash. 15 Payment By S Ram A/c To Cash A/c 200 - - 200 Being Paid cash Rs. 200/- to Madhav on behalf of S. Ram according to his instruction 16 Receipt To D. Narayan A/c By Rent A/c By Cash A/c - 150 300 450 - - Being D. Narayan paid office Rent of Nitin Rs. 150/- and balance due from him in cash. Solution for Problem No. 6 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Payment By Salary A/c To Cash A/c 200 - - 200 Being Paid office salary Rs. 200/-. 2 Payment By wages A/c To Cash A/c 50 - - 50 Being Paid wages Rs. 50/-. 3 Sales By Cash A/c To Sales A/c 400 - - 400 Being Sold goods Rs 1000/- of which Rs. 400/- received in cash and Remaining amount by cheque. Sales By Bank A/c To Sales A/c 600 - - 600 4 Purchase To Bhosale A/c By Purchase A/c To Discount A/c - 6000 - 5700 - 300 Being bought goods worth Rs. 6,000/- from Bhosle A/c at 5% Trade discount. 5 Payment By Salary A/c To Cash A/c 800 - - 800 Being Paid salary of Rs 800/-. 6 Receipt To Bhave A/c By Cash A/c - 1500 1500 - Being Received from Bhave Rs. 1500/- 7 Purchase To Cash A/c By Purchase A/c - 500 500 - Being Purchased goods of Rs 500/- from Narendra on cash. 8 Receipt To Commission A/c By Cash A/c - 40 40 - Being Received Commission Rs.40/-. 9 Sales By Cash A/c To Sales A/c By Discount A/c 3933 - 567 - 4500 - Being sold goods of Rs 4500/- at 5% trade discount and give another cash discount of 8%. 10 Payment By Salary A/c To Cash A/c 200 - - 200 Being Paid office salary Rs. 200/-. 11 Payment By Wages A/c To Cash A/c 30 - - 30 Being Paid wages Rs. 30/-. 12 Sales By Bhave A/c To Sales A/c By Discount A/c 1960 - 40 - 2000 - Being Sold goods to Bhave Rs. 2,000/- at 2% trade discount. 13 Contra To Cash A/c By Bank A/c - 1000 1000 - Being Withdrew from Bank Rs 1,000/- for office use and Rs 500/- for self use. Journal By Drawing A/c To Cash A/c 500 - - 500 14 Payment By Salary A/c To Cash A/c 200 - - 200 Being Paid office salary Rs. 200/- 15 Payment By General Exp. A/c To Cash A/c 200 - - 200 Being Paid general exp. 200/-. 16 Payment By Wages A/c To Cash A/c 10 - - 10 Being Paid wages Rs 10/-. 17 Payment By Salary A/c To Cash A/c 1000 - - 1000 Being Paid salary Rs. 1000/-. 18 Payment By Wages A/c To Cash A/c 15 - - 15 Being Paid wages Rs. 15/-. 19 Payment By Bhosale A/c To Cash A/c 5000 - - 5000 Being Paid to Bhosle Rs. 5,000/-. 20 Debit By Narendra A/c 150 - Being Return goods to Narendra

- 4. Note To Purchase Return A/c - 150 worth Rs. 150/- 21 Debit Note By Bhosale A/c To Purchase Return A/c 100 - - 100 Being Return goods to Bhosle of Rs. 100/- 22 Contra To Cash A/c By Bank A/c - 1000 1000 - Being Deposited cash Rs. 1000/- in to bank 23 Payment By Wages A/c To Cash A/c 40 - - 40 Being Paid wages Rs. 40/-. 24 Sales By Cash A/c To sales A/c By Discount A/c 1960 - 40 - 2000 - Being Sold goods of Rs. 2,000/- at 2% cash Discount. 25 Journal By Drawing A/c To Cash A/c 500 - - 500 Being Goods worth Rs. 500/- withdrawn for personal use. 26 Sales By Cash A/c To Sales A/c 200 - - 200 Being Cash sales Rs 200/- 27 Payment By Commission A/c To Cash A/c 250 - - 250 Being Paid commission Rs 250/- 28 Receipt To commission A/c By Cash A/c - 500 500 - Being Received commission Rs. 500/- Solution for Problem No. 7 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Payment By Salary A/c To Cash A/c 5000 - - 5000 Being Paid Salary Rs. 5000/- to office Staff 2 Purchase To Sashtri A/c By Purchase A/c - 10000 10000 - Being Good purchased from Shastri at Rs 10,000/- 3 Sales By Cash A/c To Sales A/c 5000 - - 5000 Being Goods sold at Rs. 5,000/- 4 Payment By Wife Loan A/c To Cash A/c 1000 - - 1000 Being Paid wife's Loan Rs 1,000/- in cash 5 Sales By Ashok A/c To Sales A/c 8000 - - 8000 Being Goods sold to Ashok of Rs. 8,000/- of which 5,000/- paid immediately Receipt To Ashok A/c By Cash A/c - 5000 5000 - 6 Sales By Sashtri A/c To Sales A/c 5000 - - 5000 Being Goods sold to Shastri of Rs. 5,000/-. He paid Rs. 1,000/- immediately and give a cheque of Rs 3,000Receipt To Sashtri A/c By Cash A/c By Bank A/c - 3000 1000 4000 - - 7 Purchase To Kulkarni A/c By Purchase A/c - 8000 8000 - Being Goods purchase from Kulkarni of Rs. 8,000/- 8 Journal By Free sample A/c To Purchase A/c 500 - - 500 Being Goods distributed as a free sample of Rs. 500/-. 9 Sales By Ashok A/c To Sales A/c 5000 - - 5000 Being Goods sold to Ashok of Rs 5,000 10 Payment By Wife’s Loan A/c To State Bank A/c 500 - - 500 Being Paid wife's loan Rs 500/- by cheque of State Bank 11 Receipt To Ashok A/c By Bank A/c - 2000 2000 - Being Received cheque from Ashok Rs. 2,000/- 12 Credit Note To Ashok A/c By Sales Return A/c - 2000 2000 - Being Goods return from Ashok of Rs. 2,000/- 13 Payment By Tata Co. Shares A/c To Cash A/c 5000 - - 5000 Being Bought a shares of Rs. 5,000/- of Tata & Co 14 Debit Note By Patil A/c To Purchase Return A/c 3000 - - 3000 Being Goods return to Patil of Rs. 3,000/-. 15 Receipt To Dividend 10% A/c By Cash A/c - 500 500 - Being Dividend received on shares at 10% 16 Payment By Wife’s Loan A/c To Cash A/c 500 - - 500 Being Paid wife's loan Rs. 500/- cash 17 Receipt To Ashok A/c By Bank A/c - 2000 2000 - Being Ashok gives a cheque of Rs. 2,000/- 18 Payment By Loan on Building A/c To Cash A/c 5000 - - 5000 Being Paid a Loan installation for Loan on Bld. Rs. 5,000/- 19 Payment By Kulkarni A/c 4000 - Being Give a cheque of Rs

- 5. To Bank A/c - 4000 4,000/- to Kulkarni 20 Payment By Outstanding Exp. A/c To Cash A/c 10000 - - 10000 Being Outstanding exp. were paid in cash Rs 10,000/- 21 Journal By Goods Lost by Fire A/c To Purchase A/c 2000 - - 2000 Being Goods lost by fire of Rs. 2,000/- 22 Sales By Cash A/c To sales A/c 8000 - - 8000 Being Sold goods of Rs 8,000/- in cash 23 Receipt To Commission A/c By Cash A/c - 5000 5000 - Being Commission received from Tata Co Rs. 5,000 24 Payment By wages A/c To Cash A/c 500 - - 500 Being Wages paid Rs 500/- on cash. 25 Purchase To Cash A/c By Furniture A/c - 2000 2000 - Being Purchase a furniture of Rs 2,000/- 26 Payment By Telephone A/c To Cash A/c 1400 - - 1400 Being Paid Telephone Bill Rs. 1400/-. 27 Payment By wages A/c To Cash A/c 150 - - 150 Being Paid wages Rs 150/- in cash. 28 Sales By Cash A/c To sales A/c 10000 - - 10000 Being Sold goods worth Rs. 10,000/- 29 Purchase To Cash A/c By Computer A/c - 30000 30000 - Being Purchased a computer of Rs. 30,000/- for office use 30 Journal By Drawing A/c To Furniture A/c 1000 - - 1000 Being Mr. A took furniture of Rs. 1,000/- for personal use. 31 Journal To Drawing A/c By Cash A/c 500 - - 500 Being Mr. C withdraw cash Rs 500 for to pay his LIC Premium. 32 Receipt To Insurance Compensation By Cash A/c - 1000 1000 - Being Received a compensation of Rs. 1,000/- form Insurance Co for goods lost by fire. 33 Payment By Gold Loan A/c No 22/8 To Cash A/c 1000 - - 1000 Being Paid Installment of Gold loan a/c No. 22/8 Rs. 1000/- 34 Payment By Gold Loan A/c No 22/10 To Cash A/c 1000 - - 1000 Being Paid Installment of Gold loan a/c No. 22/10 Rs. 1000/- 35 Journal By Shah A/c To Bad Debts A/c 1000 - - 1000 Being The amt of Shaha is provide a Bad debts (i.e. Rs.1000/-) 36 Contra To Bank Current A/c By Bank Saving A/c - 8000 8000 - Being Cash transfer from Current a/c to saving a/c Rs 8,000/- 37 Journal By Sashtri A/c To Bad Debts A/c 1500 - - 1500 Being Make a provision for RDD of Rs 1500/- 38 Journal By Depreciation A/c To Building A/c 3750 - - 3750 Being provide a depreciation @ 15% on Building for half year 39 Journal By Depreciation A/c To Furniture A/c 250 - - 250 Being Provide a depreciation @ 10% on furniture for half year. 40 Journal By Depreciation A/c To Computer A/c 1800 - - 1800 Being Provide a depreciation @ 12% on computer for half year Solution for Problem No. 8 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Journal By Cash A/c By furniture A/c To Ratan Loan A/c To capital A/c 3000 400 - - - - 1000 2400 Being Commenced business with cash Rs. 3000/- (of which 1000/- Borrowed from Ratan A/c) and Furniture Rs. 400/- 2 Purchase To Kanchan A/c By Purchase A/c - 760 760 - Being Purchased goods from Kanchan Rs. 760/- 3 Sales By Kanak A/c To Sales A/c 440 - - 440 Being Sold goods to Kanak costing Rs. 440/- 4 Purchase To Cash A/c By Purchase A/c - 500 500 - Being Cash Purchased Rs. 500/- 5 Sales To Cash A/c By Sales A/c - 100 100 - Being Cash Sales Rs 100/- 6 Purchase To Mr. Bali A/c By Purchase A/c - 500 500 - Being Purchased Goods from Mr. Bali Rs 500/- 7 Debit Note By Kanchan A/c To Purchase Return A/c 50 - - 50 Being Returned to Kanchan goods worth Rs. 50/-

- 6. 8 Purchase To Cash A/c By Office Furniture A/c - 100 100 - Being Purchased Office Furniture for Rs 100/- 9 Payment By Kanchan A/c To Cash A/c 710 - - 710 Being Paid to Kanchan Rs. 710/- 10 Sales By Kanak A/c To Sales A/c 490 - - 490 Being Invoiced goods to Kanak Rs. 490/- 11 Receipt To Kanak A/c By Cash A/c - 400 400 - Being Kanak Paid Cash Rs. 400/- And Returned goods of Rs 40/-Credit Note To Kanak A/c By sales Return A/c - 40 40 - 12 Purchase To Kanchan A/c By Purchase A/c - 300 300 - Being Purchased goods from Kanchan Rs. 300/- 13 Debit Note To Kanchan A/c By Purchase Return A/c - 110 110 - Being Returned Damaged goods to Kanchan Rs 60/- and to ball Rs. 50/- 14 Payment By Salary A/c To Cash A/c 1000 - - 1000 Being Paid office Salary Rs 1000/- 15 Sales By Kant A/c To Sales A/c 100 - - 100 Being Sold Goods to Kant Rs. 100/- 16 Receipt To Kant A/c By Cash A/c - 10 10 - Being Received Cash Rs 10/- From Kant 17 Journal By Rent A/c To Kant A/c 100 - - 100 Being Kant, who owes us Rs. 100/- pays rent Rs 100/- to our landlord on our behalf 18 Payment By Kanchan A/c To Cash A/c 75 - - 75 Being We paid Rs. 75/- To Pandit, on instruction from our creditors Kanchan on this behalf 19 Journal By Depreciate A/c To Furniture A/c 25 - - 25 Being Depreciate 5% on furniture Journal By RDD A/c To Sundry Debtors A/c 600 - - 600 Being Make Reserve for bad debts 5% on sundry debtors Solution for Problem No. 9 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Journal By Cash A/c By Furniture A/c By Building A/c To Capital A/c 25000 20000 155000 - - - - 200000 Being Business started with cash Rs. 25,000/- , Furniture Rs 20,000/-, Building 1,55,000 2 Purchase To Cash A/c By Purchase A/c - 10000 10000 - Being Goods Purchased from Mr. X for cash Rs 10000/- 3 Sales By Cash A/c To Sales A/c 15000 - - 15000 Being Sold Goods to Mr. Y for cash Rs 15000/- 4 Purchase To Mandar A/c By Purchase A/c - 5000 5000 - Being Goods purchased from Mandar on credit Rs 5000/- 5 Sales By Sanjay A/c To Sales A/c 7000 - - 7000 Being Goods sold to Sanjay on credit Rs. 7000/- 6 Purchase To Cash A/c By Machinery A/c - 10000 10000 - Being Purchased machinery for cash Rs. 10000/- 7 Contra To Cash A/c By Bank of India A/c - 5000 5000 - Being Opened a Bank A/c in Bank of India with depositing Rs. 5000/- 8 Journal By Cash A/c To Janata Bank A/c 25000 - - 25000 Being Taken a loan from Janata Bank Rs. 25000/- 9 Purchase To Mr. X A/c By Purchase A/c - 10000 10000 - Being Goods purchased from Mr. X on credit 10,000/- 10 Sales By Mr. Y A/c To Sales A/c 15000 - - 15000 Being Goods sold to Mr. Y on credit Rs. 15000/- 11 Journal By Bills Receivable A/c To Mr. Y A/c 15000 - - 15000 Being Received Bills receivables from Mr. Y Rs 15000/- 12 Journal By Mr. X A/c To Bills Payable A/c 10000 - - 10000 Being Issued Bills payables To Mr. X Rs. 10000/- 13 Debit By Mandar A/c 1000 - Being Returned goods to

- 7. Note To Purchase Return A/c - 1000 Mandar Rs. 1000/- 14 Credit Note To Sanjay A/c By Sales Return A/c - 2000 2000 - Being Received goods returned from Sanjay Rs. 2000/- 15 Contra To Bank A/c By Cash A/c - 2000 2000 - Being Withdrawn from bank Rs 2000/- 16 Payment By Salary A/c By Wages A/c To Cash A/c 4000 200 - - - 4200 Being Paid Salary Rs 4000/- & Wages Rs 200/- in cash 17 Receipt To Commission A/c By Cash A/c - 3000 3000 - Being Received commission Rs. 3000/- in cash 18 Payment By Electricity Charges A/c To Bank A/c 1000 - - 1000 Being Paid Electricity Charges by Cheque Rs. 1000/- Solution for Problem No. 10 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Contra To Bank of India A/c By Bank of Maharashtra A/c - 5000 5000 - Being Rs 5000 is transferred from Bank of India Current account to Bank of Maharashtra cash credit account, by an advice to bank of India 2 Contra To Bank of India A/c To Cash A/c By Bank of Maharashtara - - 3500 2000 1500 - Being A cheque of Rs 2000/- issued from Bank of India And Rs 1500/- in cash (total Rs 3500) Deposited in Bank of Maharashtra cash credit account. 3 Payment By Dolphin Services A/c To Bank of India A/c 450 - - 450 Being Paid "Dolphin Service" courier charges by cheque Rs.450/(ch. no 50221) 4 Payment By Salary A/c To Bank of India A/c 200 - - 200 Being Paid salary Rs. 200/- by cheque 5 Payment By Generator Charges A/c To Bank of India A/c 800 - - 800 Being Monthly Generator Charges for Rs.800/- paid to Mohan by cheque 6 Receipt To Commission A/c By Bank of India A/c - 1000 1000 - Being Received commission of Rs. 1000/- by cheque 7 Contra To Bank of India A/c By Cash A/c - 2000 2000 - Being Withdrawn from Bank of India Rs.2000/- 8 Purchase To Bank of India A/c By Furniture A/c - 5000 5000 - Being Purchased Furniture of Rs.5000/- & payment made by cheque of Bank of India (ch.no. 56774) 9 Journal By Bank of India A/c To Printer A/c 5000 - - 5000 Being Sold printer of Rs.5000/- to M/s B. L Traders & payment made by cheque of Bank of India (ch no. 56789) 10 Receipt To Lokmanya A/c By Bank of India A/c - 4500 4500 - Being Received a cheque of Rs.4500/-from M/s Lokmanya Book Depot & Deposited in to Bank of India (Ch No 123433) 11 Payment By National Finance A/c To Bank of India A/c 10000 - - 10000 Being Issued a cheque of Rs. 10000/- in the name of "National Finance" (Ch.No.443389, Bank of India)

- 8. Solution for Problem No. 11 Sr. No. Voucher Type Particulars Debit Amount Credit Amount Narration 1 Purchase To Kulkarni A/c By Purchase A/c - 1000 1000 - Being Purchased goods of Rs 1000 from Shri. Kulkarni, Solapur 2 Purchase To Cash A/c By Purchase A/c - 800 800 - Being Purchased goods of Rs. 800 for cash from Shri. Sawant 3 Purchase To Aram Furniture A/c By Furniture A/c - 900 900 - Being Purchased furniture for office use from Aram Furniture Works Worth Rs. 900 on Credit 4 Purchase To Shinde A/c By Purchase A/c To Discount A/c - 1100 - 1045 - 55 Being Purchased goods of Rs. 1100 at trade discount of 5% from Shri. Shinde 5 Purchase To Vikram Furniture A/c By Furniture A/c - 2000 2000 - Being Purchased furniture for Computer use from Vikram Furniture Works worth Rs 2000/- on Credit 6 Purchase To Sawant A/c By Purchase A/c - 1500 1500 - BeingPurchase goodsof Rs.1500 for credit from Shri. Sawant 7 Purchase To Rawat Brothers A/c By Purchase A/c - 3500 3500 - Being Purchased goods of Rs. 3500/- for credit from Shri. Rawat Brothers 8 Purchase To Doshi Traders A/c By Purchase A/c - 4500 4500 - Being Purchased goods of Rs. 4500/- for credit from M/s Doshi Traders 9 Sales By Solankar A/c To Sales A/c By Discount A/c 1425 - 75 - 1500 - Being Sold goods worth Rs. 1500 to Solanki at 5% trade discount 10 Sales By Cash A/c To Sales A/c 1000 - - 1000 Being Sold goods of Rs. 1000/- for cash to Kulkarni 11 Sales By Solanki A/c To Sales A/c 1500 - - 1500 Being Sold goods of Rs. 1500/- to solanki of Ichalkaranji 12 Journal By Kulkarrni A/c By Typewriter A/c 1800 - - 1800 Being Sold old Typewriter to Kulkarui of Rs.1800/- on Credit 13 Journal By Deshpande A/c To Furniture A/c 1500 - - 1500 Being Sold old furniture to Deshpande for Rs 1500/- on credit 14 Journal By Cash A/c To Old Machinery A/c 5500 - - 5500 Being Sold old Machinery of Rs. 5500 to cash to Mr. Kulkarni 15 Journal By Mr. Raut A/c To Old Printer A/c 1500 - - 1500 Being Sold Old Printer of Rs 1500/- for Credit to Mr. Raut 16 Debit Note By Kulkarni A/c To Purchase Return A/c 150 - - 150 Being Returned goods of Rs 150 to Kulkarni of Solapur 17 Debit Note By Shinde A/c To Purchase Return A/c 100 - - 100 Being Returned goods of Rs. 100/- to shinde 18 Credit Note To Solanki A/c By Sales Return A/c - 150 150 - Being Received goods of Rs 150/- returned by Solanki of Ichalkaranji. 19 Credit Note To Deshpande A/c By Sales Return A/c - 350 350 - Being Received goods of Rs. 350/- returned by Deshpanade 20 Debit Note By Vikram Furniture A/c To Purchase Return A/c 175 - - 175 Being Returned goods of Rs. 175/- to Vikram Furniture Works 21 Debit Note By Rawat Brothers A/c To Purchase Return A/c 100 - - 100 Being Returned goods of Rs 100/- to Shri Rawat Brothers 22 Debit Note By Sawant A/c To Purchase Return A/c 500 - - 500 Being Returned goods of Rs. 500/- to Shri Sawant 23 Credit Note To Mr.Raut A/c By Sales Return A/c - 200 200 - Being Received goods of Rs. 200/- returned by Mr. Raut 24 Debit Note By Doshi Traders A/c To Purchase Return A/c 500 - - 500 Being Returned defective goods of Rs. 500 to M/s Doshi Traders