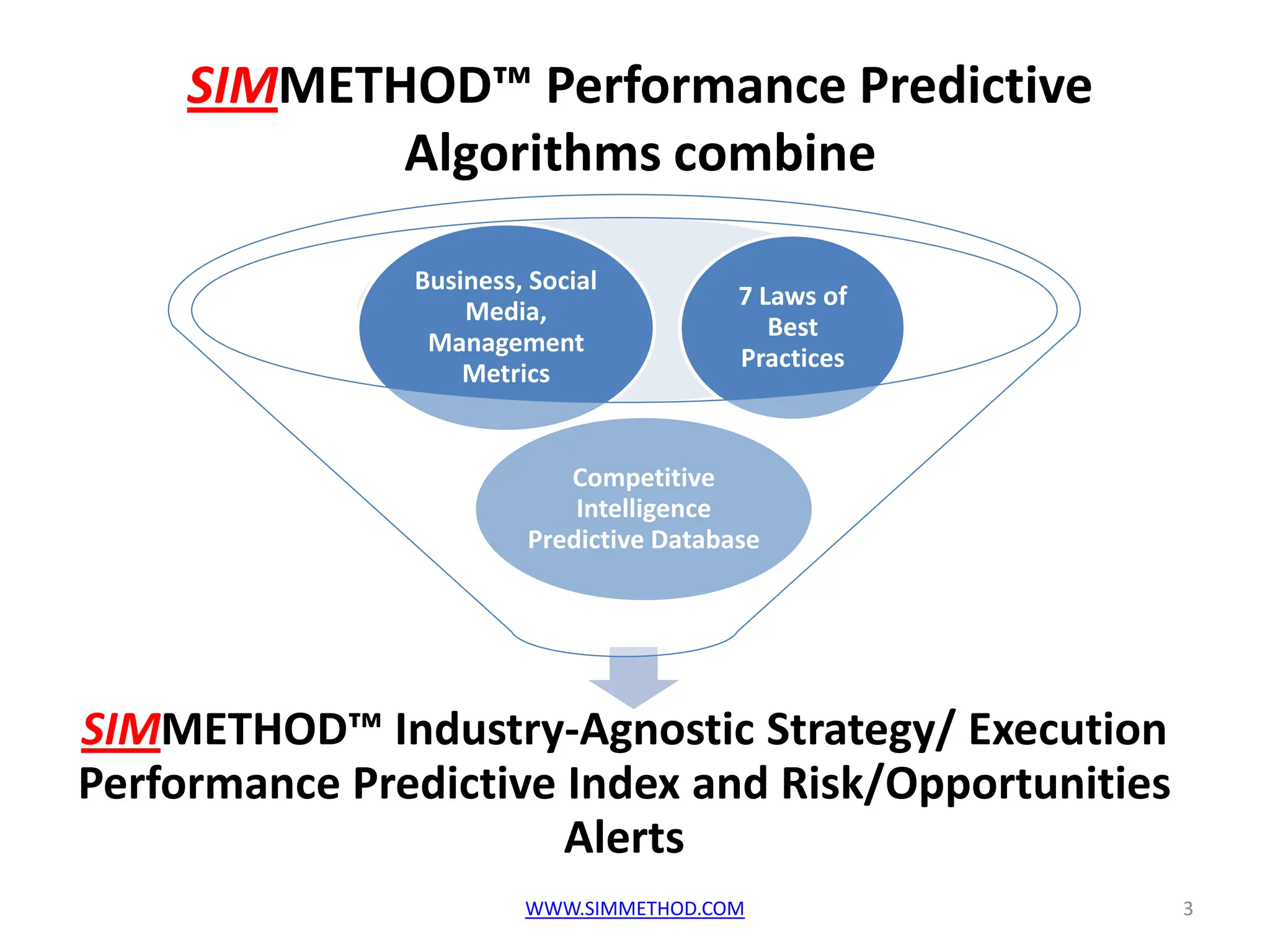

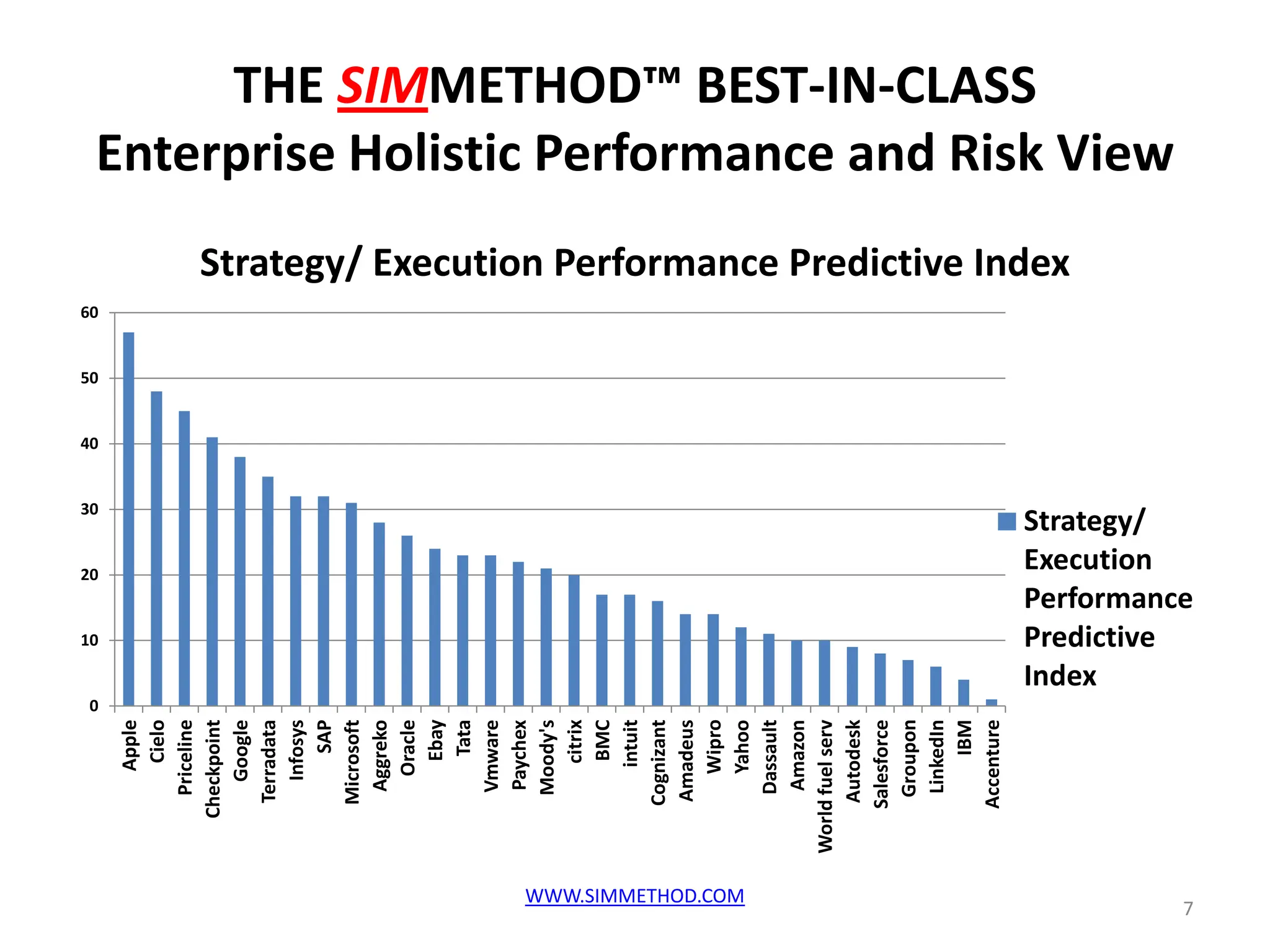

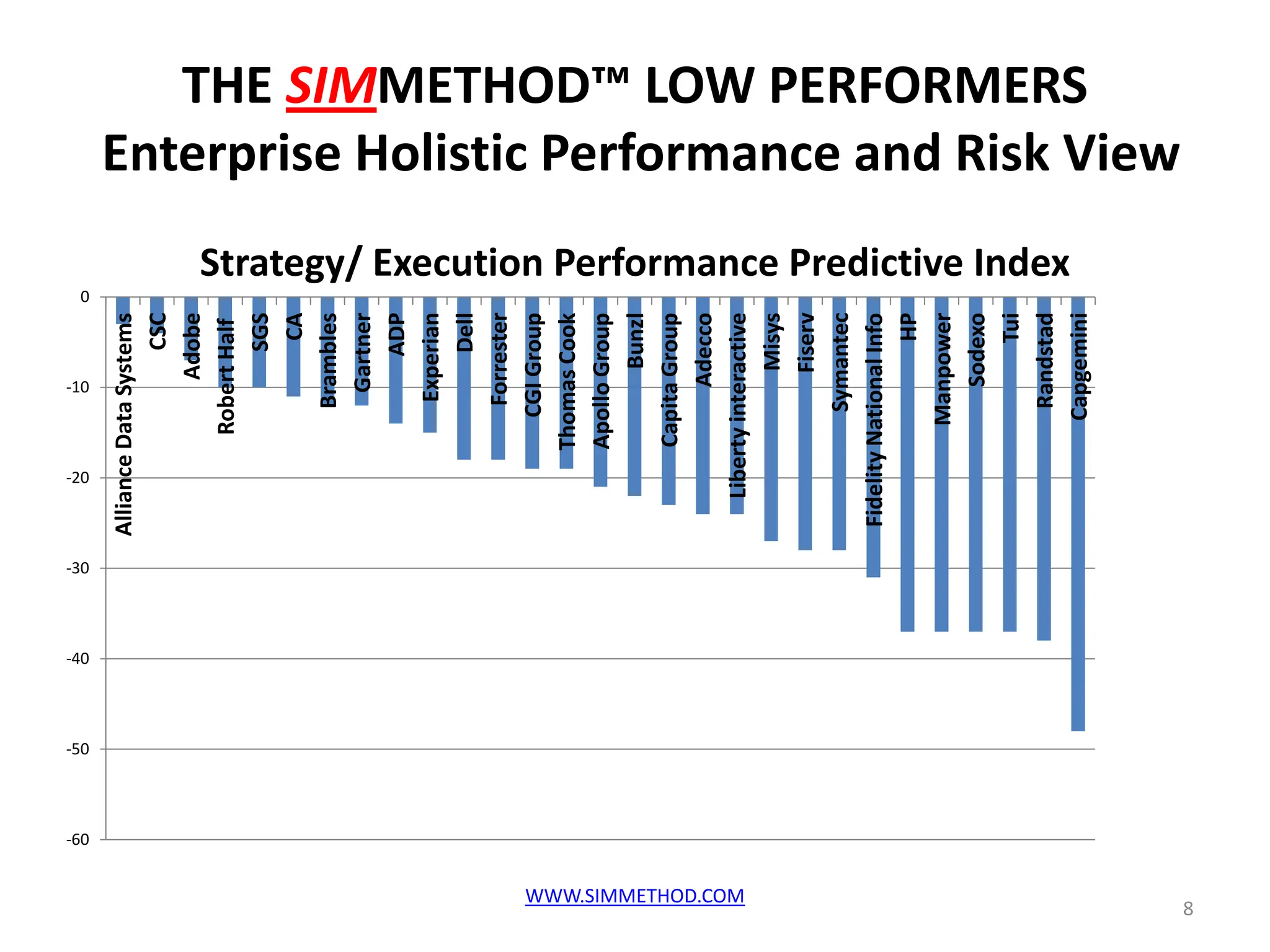

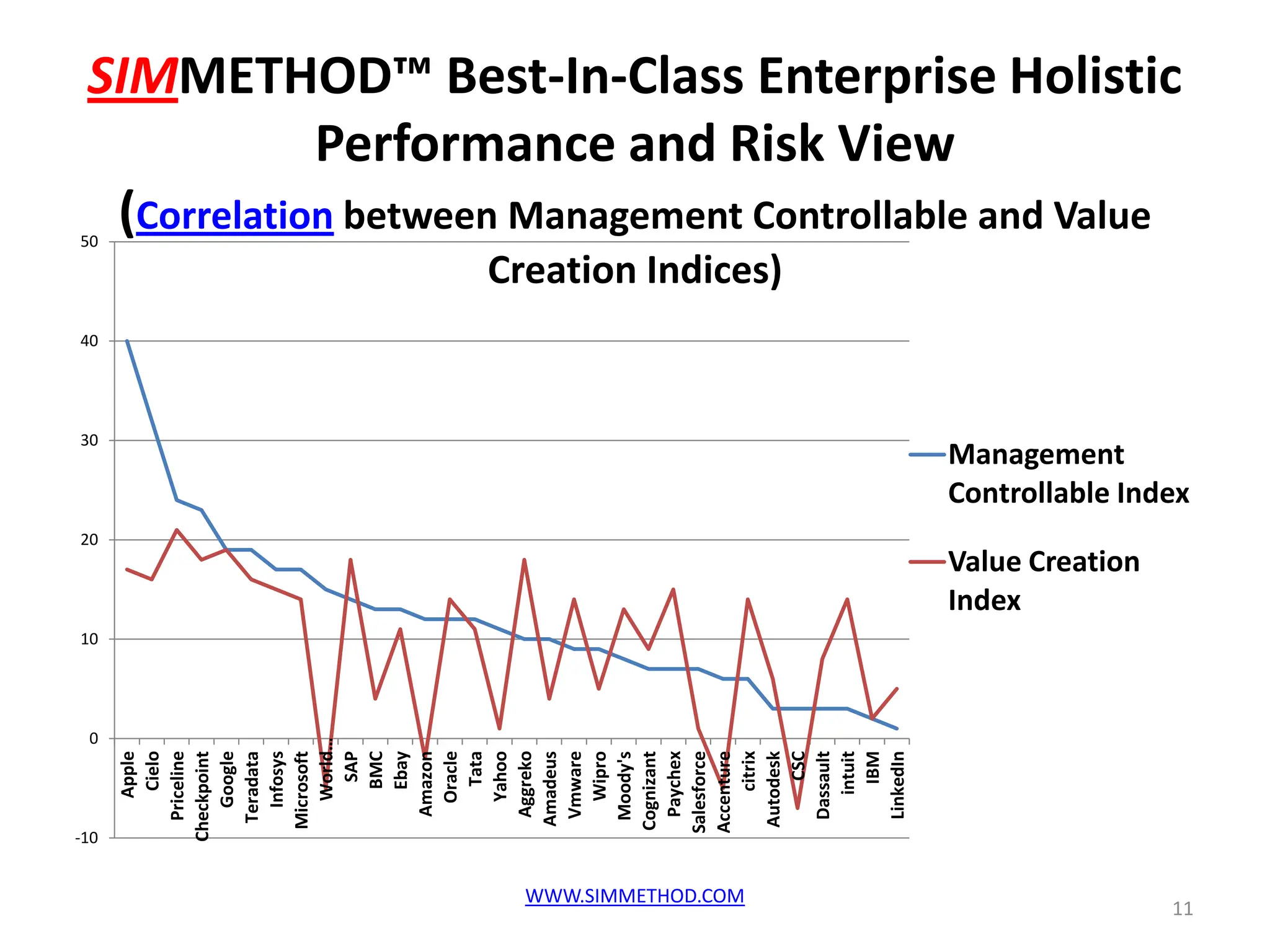

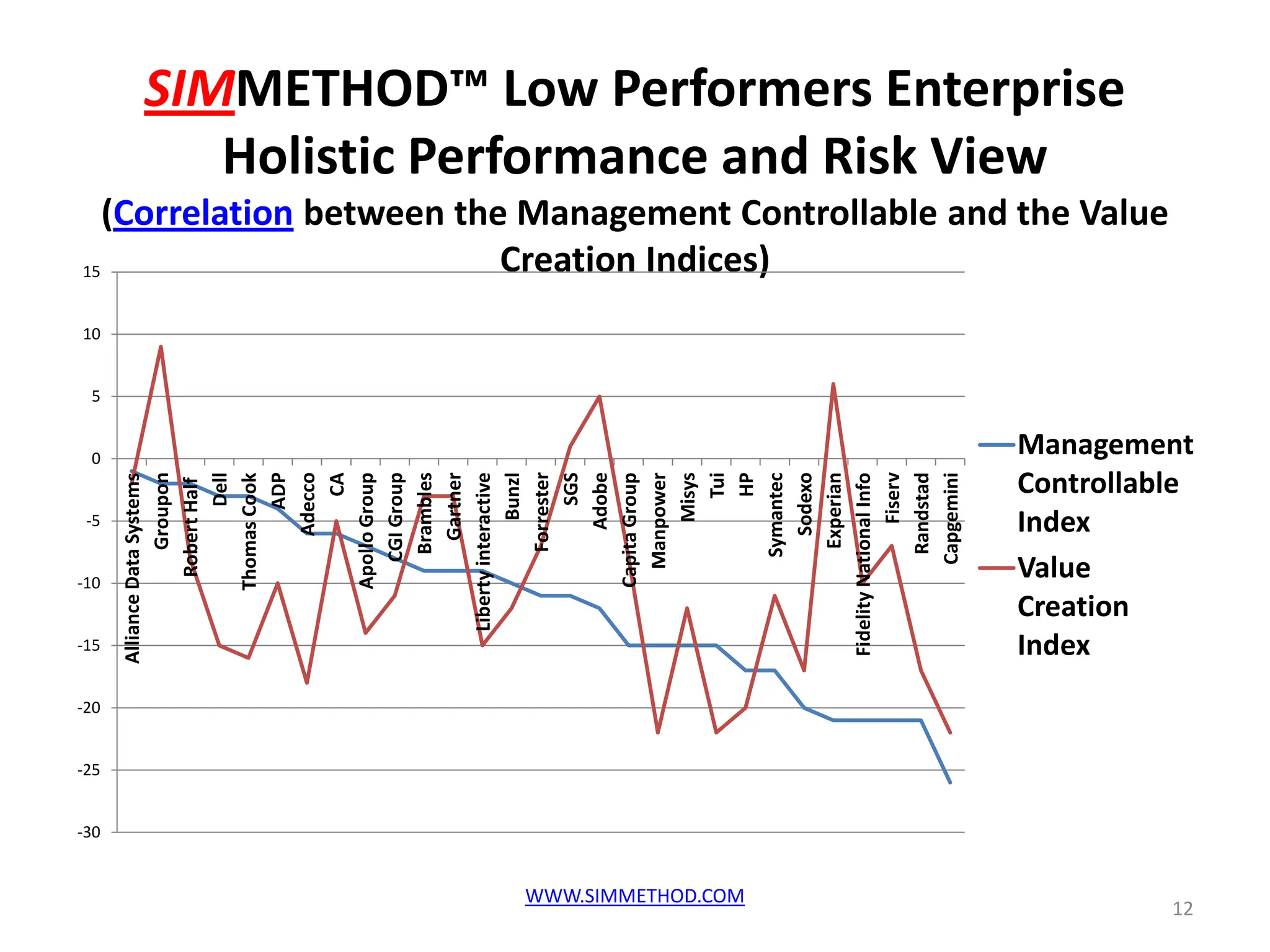

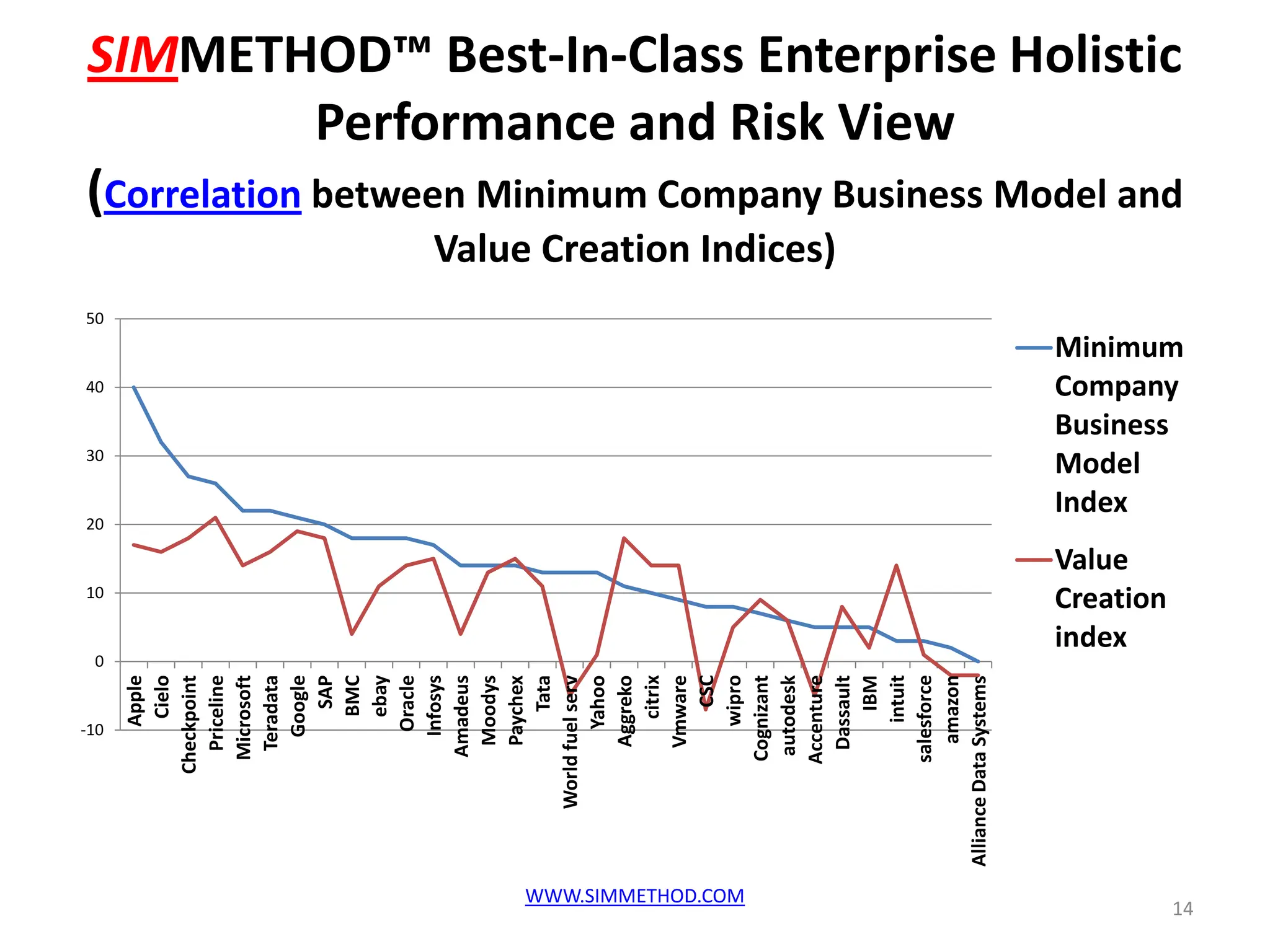

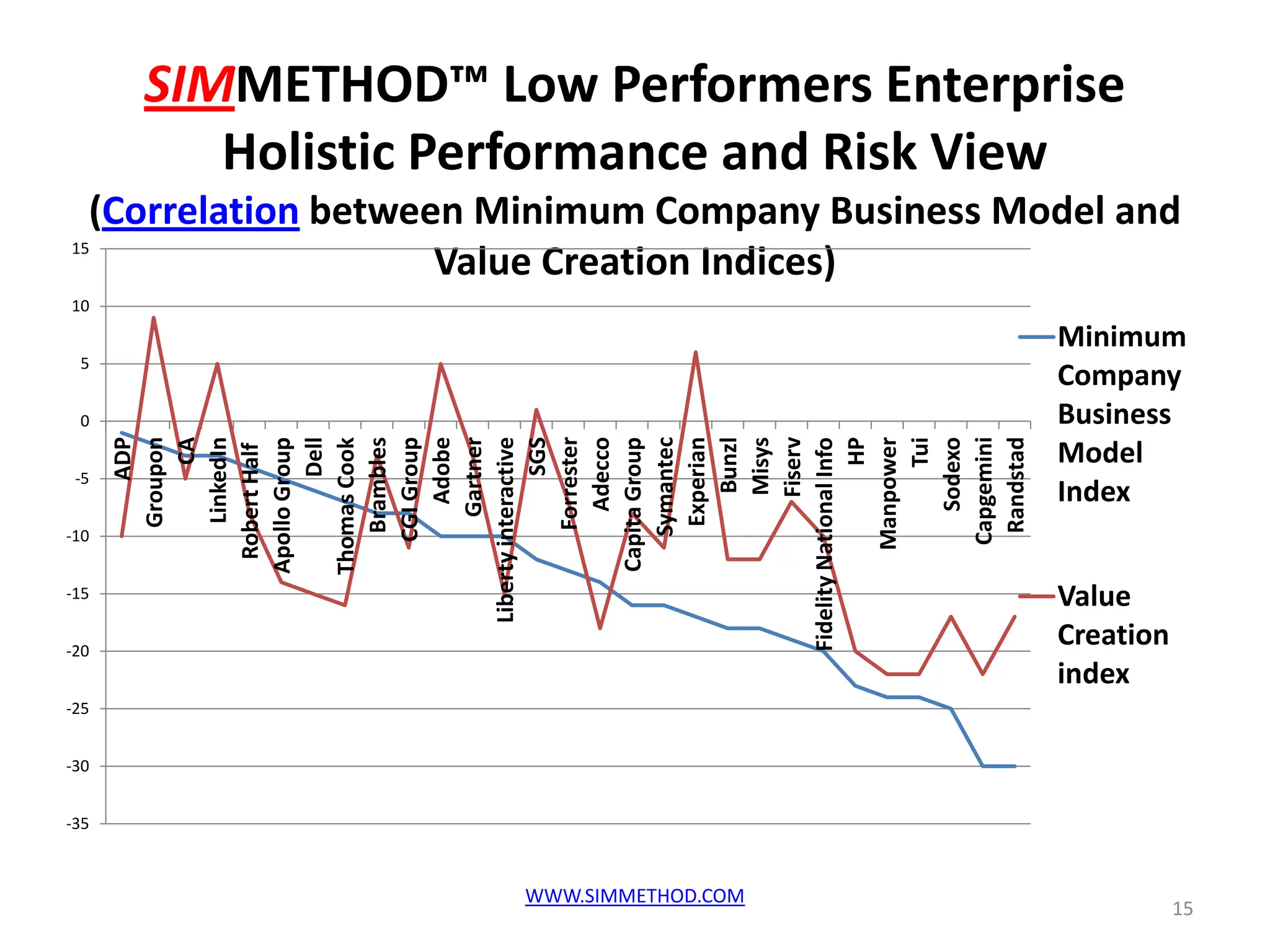

Industry agnostic indicators, unlike industry specific ones, extend the line of vision to the entire value-chain and provide the opportunity to analyze and correlate 1000’s of unrelated business metrics across every business sector in order to:

- Identify previously undetected strengths and weaknesses in specific areas of the business in relation to current and future competitors and threats and opportunities coming from outside your industry.

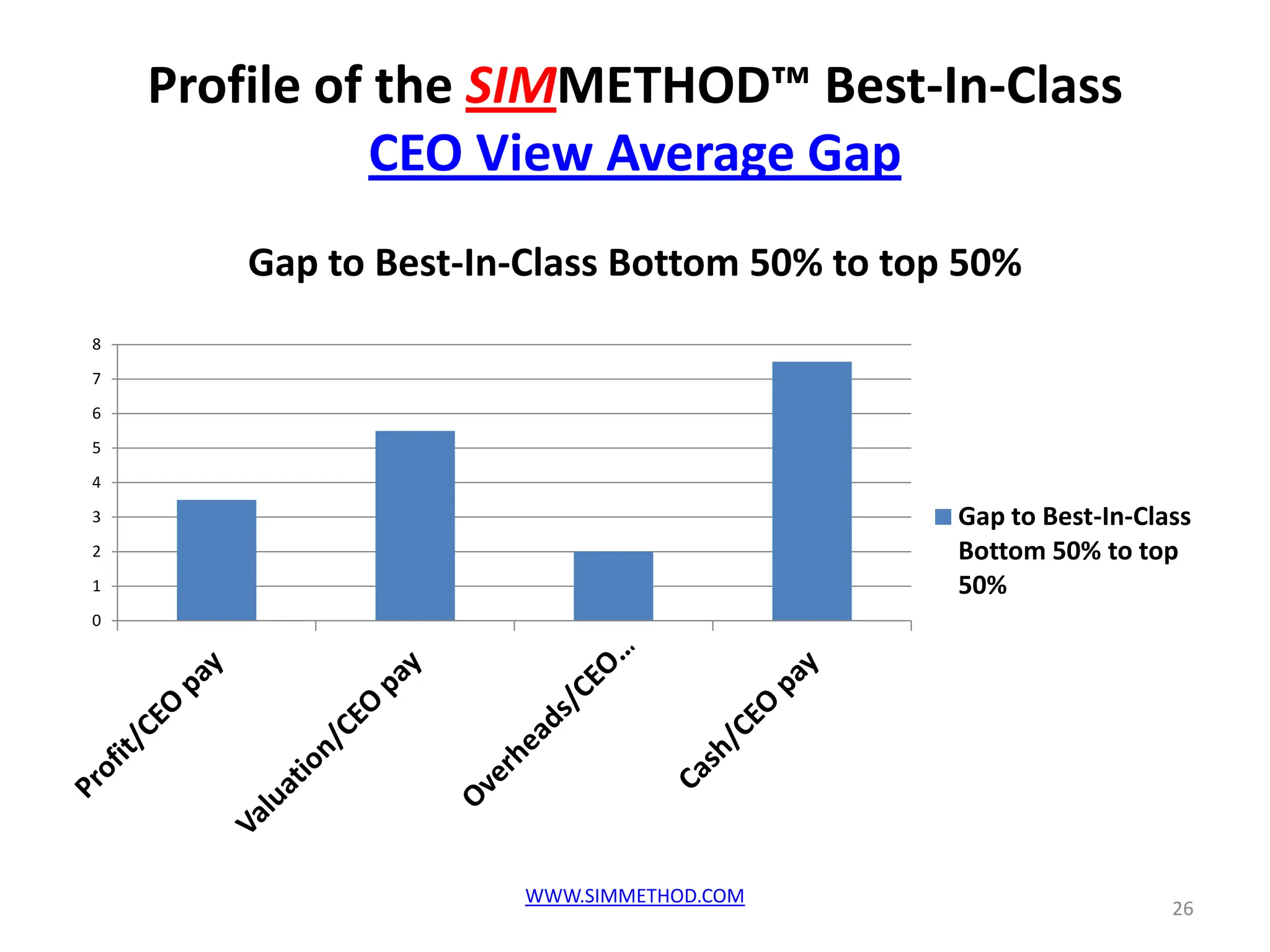

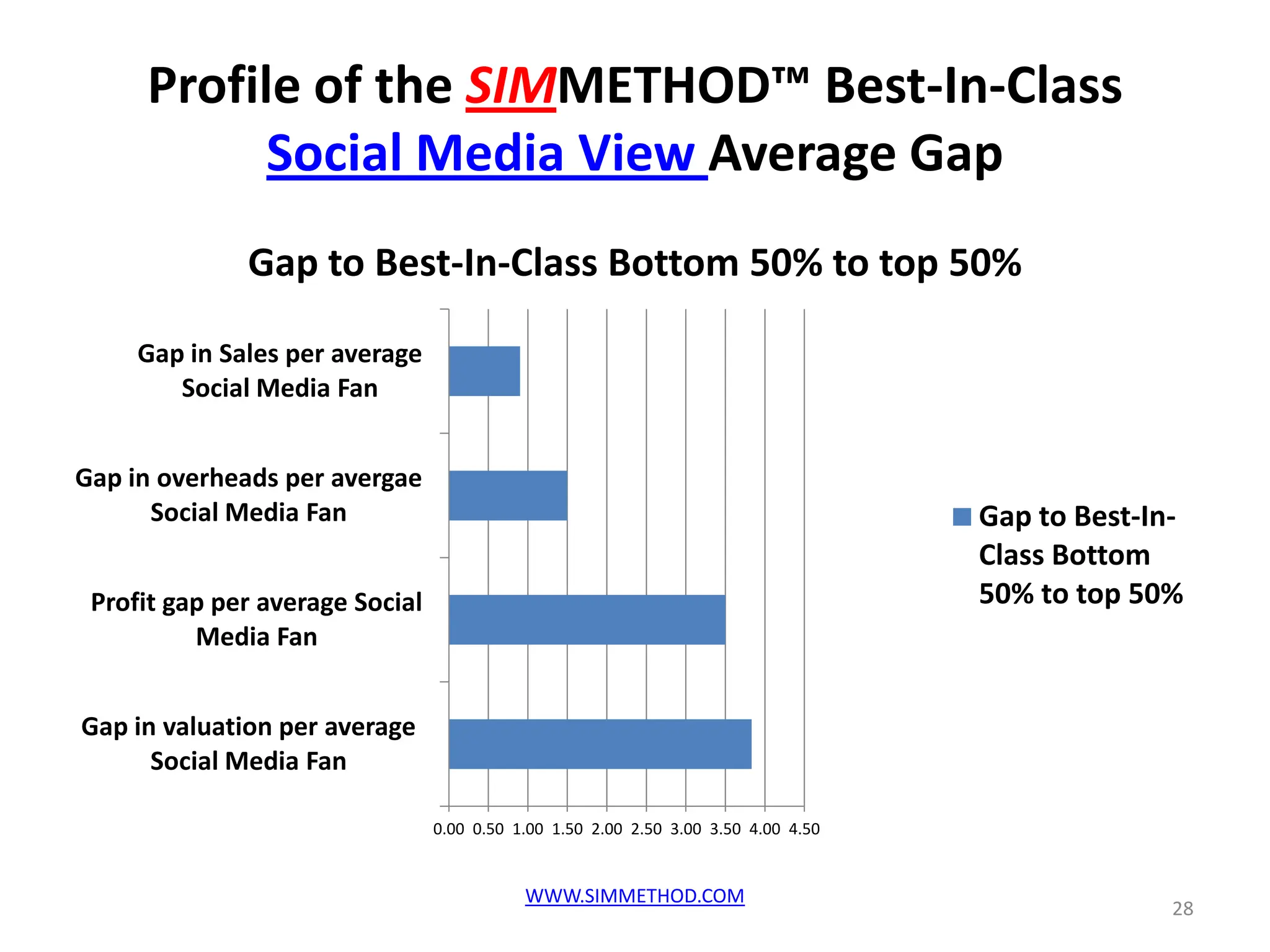

- Identify the Best-In-Class companies and teams in any industry in order to study, adapt and incorporate their Best Practices and

- Enable value-chain partners to collaborate, reduce their risk and improve their performance via shared performance and risk indicators.