Subprime Underwriting Matrix, 100% LTV down to 580 FICO

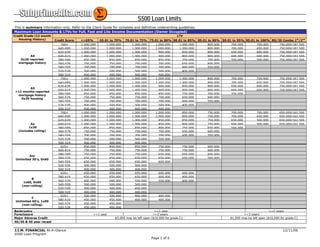

- 1. S500 Loan Limits This is summary information only. Refer to the Client Guide for complete and definitive underwriting guidelines. Maximum Loan Amounts & LTVs for Full, Fast and Lite Income Documentation (Owner Occupied) Credit Grade (12 month LTV Housing History) Credit Score <=65% 65.01 to 70% 70.01 to 75% 75.01 to 80% 80.01 to 85% 85.01 to 90% 90.01 to 95% 95.01 to 100% 80/20 Combo 1st /2nd 700+ 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 800,000 700,000 700,000 750,000/187,500 640-699 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 800,000 700,000 650,000 750,000/187,500 620-639 1,000,000 1,000,000 1,000,000 900,000 850,000 800,000 650,000 600,000 750,000/187,500 600-619 1,000,000 1,000,000 1,000,000 900,000 800,000 800,000 600,000 600,000 750,000/187,500 580-599 850,000 850,000 850,000 850,000 750,000 700,000 550,000 500,000 750,000/187,500 560-579 750,000 750,000 750,000 700,000 650,000 600,000 540-559 700,000 700,000 700,000 700,000 600,000 550,000 520-539 500,000 500,000 500,000 500,000 400,000 A4 0x30 reported mortgage history 500-519 400,000 400,000 400,000 400,000 700+ 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 800,000 700,000 700,000 750,000/187,500 640-699 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 800,000 700,000 650,000 750,000/187,500 620-639 1,000,000 1,000,000 1,000,000 900,000 850,000 800,000 650,000 600,000 750,000/187,500 600-619 1,000,000 1,000,000 1,000,000 900,000 800,000 800,000 600,000 600,000 750,000/187,500 580-599 850,000 850,000 850,000 850,000 750,000 700,000 550,000 560-579 750,000 750,000 750,000 700,000 650,000 600,000 540-559 700,000 700,000 700,000 700,000 600,000 550,000 520-539 500,000 500,000 500,000 500,000 400,000 A5 <12 months reported mortgage history 0x30 housing 500-519 400,000 400,000 400,000 400,000 700+ 1,000,000 1,000,000 1,000,000 1,000,000 850,000 750,000 700,000 700,000 650,000/162,500 640-699 1,000,000 1,000,000 1,000,000 1,000,000 850,000 750,000 700,000 650,000 650,000/162,500 620-639 1,000,000 1,000,000 1,000,000 850,000 850,000 750,000 650,000 500,000 650,000/162,500 600-619 1,000,000 1,000,000 1,000,000 850,000 800,000 750,000 600,000 500,000 650,000/162,500 580-599 850,000 850,000 850,000 800,000 750,000 650,000 550,000 560-579 750,000 750,000 750,000 700,000 650,000 600,000 540-559 700,000 700,000 700,000 700,000 600,000 550,000 520-539 500,000 500,000 500,000 500,000 Ax 1x30 (includes rolling) 500-519 400,000 400,000 400,000 620+ 850,000 850,000 850,000 750,000 750,000 600,000 600-619 750,000 750,000 750,000 750,000 750,000 600,000 580-599 750,000 750,000 750,000 650,000 650,000 600,000 560-579 650,000 650,000 650,000 650,000 650,000 500,000 540-559 650,000 650,000 650,000 600,000 520-539 500,000 500,000 500,000 Am Unlimited 30's, 0x60 500-519 400,000 400,000 400,000 620+ 650,000 650,000 650,000 600,000 600,000 580-619 650,000 650,000 650,000 600,000 400,000 560-579 600,000 600,000 550,000 550,000 400,000 540-559 500,000 500,000 500,000 520-539 500,000 500,000 450,000 B 1x60, 0x90 (non-rolling) 500-519 400,000 400,000 400,000 620+ 500,000 500,000 400,000 400,000 580-619 450,000 450,000 400,000 400,000 540-579 450,000 450,000 C Unlimited 60's, 1x90 (non-rolling) 520-539 450,000 400,000 Bankruptcy >=1 year >=2 years Foreclosure >=1 year >=2 years >=3 years Major Adverse Credit $5,000 may be left open ($10,000 for grade C) $1,500 may be left open ($10,000 for grade C) 40/30 & 40 year recast J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Loan Program Page 1 of 6

- 2. S500 Loan Limits Housing Payment History for Full, Fast and Lite Income Documentation (Owner Occupied) LTV <=65% LTV 65.01 to 70% 70.01 to 75% 75.01 to 80% 80.01 to 85% 85.01 to 90% 90.01 to 95% 95.01 to 100% 80/20 Combo Borrowers without 12 month reported mortgage history • Requires Institutional Verification of housing, private verification of housing, or 12 months canceled checks • If documentation of housing indicates late or missing payments, the credit grade is downgraded according to the number and severity of the late/missing payments • Credit scores >=600, require Institutional Verification of Housing, Private Verification of Housing, or 12 months canceled checks • Credit scores <600, require Institutional Verification of Housing or 12 months canceled checks • If documentation of housing indicates late or missing payments, the credit grade is downgraded according to the number and severity of the late/missing payments A5 Rent Free/Lives with Relatives/owns free and clear or cannot document Maximum LTV/CLTV of 90% Not eligible Maximum CLTV by Credit Score for Full, Lite and Fast Income Documentation (Owner Occupied) Credit Grade Credit Score Max CLTV A4, A5, Ax, Am 100% B, C 580+ 95% All Grades 560-579 95% All Grades 500-559 90% J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Loan Program Page 2 of 6

- 3. S500 Loan Limits Maximum Loan Amounts & LTVs for Stated Income Documentation (Owner Occupied) Credit Grade LTV (12 month Housing History) Credit Score <=55% 55.01 to 60% 60.01 to 65% 65.01 to 70% 70.01 to 75% 75.01 to 80% 80.01 to 85% 85.01 to 90% 90.01 to 95% 95.01 to 100% 80/20 Combo 1st /2nd 640+ 650,000 650,000 650,000 650,000 650,000 650,000 500,000 400,000 400,000 400,000 400,000/100,000 620-639 650,000 650,000 650,000 650,000 650,000 650,000 500,000 400,000 400,000 600-619 500,000 500,000 500,000 500,000 500,000 500,000 500,000 400,000 400,000 580-599 500,000 500,000 500,000 500,000 500,000 500,000 400,000 400,000 400,000 560-579 500,000 500,000 500,000 500,000 400,000 400,000 400,000 540-559 350,000 350,000 350,000 350,000 350,000 300,000 520-539 300,000 300,000 300,000 A4 0x30 reported mortgage history 500-519 250,000 250,000 250,000 640+ 650,000 650,000 650,000 650,000 650,000 650,000 500,000 400,000 400,000 400,000 400,000/100,000 620-639 650,000 650,000 650,000 650,000 650,000 650,000 500,000 400,000 400,000 600-619 500,000 500,000 500,000 500,000 500,000 500,000 500,000 400,000 580-599 500,000 500,000 500,000 500,000 500,000 500,000 400,000 560-579 400,000 400,000 400,000 400,000 400,000 400,000 400,000 540-559 350,000 350,000 350,000 350,000 350,000 300,000 520-539 300,000 300,000 300,000 A5 <12 months reported mortgage history 0x30 housing 500-519 250,000 250,000 250,000 640+ 500,000 500,000 500,000 500,000 500,000 500,000 400,000 400,000 400,000 620-639 500,000 500,000 500,000 500,000 500,000 500,000 400,000 400,000 560-619 400,000 400,000 400,000 400,000 400,000 400,000 400,000 540-559 350,000 350,000 350,000 350,000 350,000 300,000 520-539 300,000 300,000 300,000 Ax 1x30 (includes rolling) 500-519 250,000 250,000 250,000 620+ 500,000 500,000 500,000 500,000 500,000 500,000 400,000 580-619 400,000 400,000 400,000 400,000 400,000 400,000 400,000 560-579 350,000 350,000 350,000 350,000 350,000 300,000 540-559 300,000 300,000 300,000 Am Unlimited 30's, 0x60 500-539 250,000 250,000 250,000 560+ 350,000 350,000 350,000 350,000 300,000B 1x60, 0x90 (non-rolling) 520-559 300,000 300,000 300,000 C Unlimited 60's, 1x90 (non-rolling) 520+ 250,000 250,000 250,000 Bankruptcy >=1 year >=2 years Foreclosure >=1 year >=2 ears >=3 years Major Adverse Credit $5,000 may be left open ($10,000 for grade C) $1,500 may be left open ($10,000 for grade C) 40/30 & 40 year recast N/A J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Loan Program Page 3 of 6

- 4. S500 Loan Limits Maximum LTVs for Stated Income Documentation (Owner Occupied) LTV <=55% 55.01 to 60% 60.01 to 65% 65.01 to 70% 70.01 to 75% 75.01 to 80% 80.01 to 85% 85.01 to 90% 90.01 to 95% 95.01 to 100% 80/20 Combo Borrowers without 12 month reported mortgage history • Requires Institutional Verification of Housing, Private Verification of Housing, or 12 months canceled checks • If documentation of housing indicates late or missing payments, the credit grade is downgraded according to the number and severity of the late/missing payments A5 Rent Free/Lives with Relatives/owns free and clear or cannot document Maximum LTV/CLTV of 90% Not eligible Maximum CLTV by Credit Score for Stated Income Documentation (Owner Occupied) Credit Grade Credit Score Maximum CLTV A4, A5, Ax 600+ 100% Am, B, C 600+ 95% A4 580-599 95% A5, Ax, Am, B, C 580-599 90% All Grades 560-579 85% All Grades 500-559 80% J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Loan Program Page 4 of 6

- 5. 50.01 to 55.01 to 60.01 to 65.01 to 70.01 to 75.01 to 80.01 to 55% 60% 65% 70% 75% 80% 85% S500 Loan Limits Maximum Loan Amounts & LTVs for Full, Fast and Lite Income Documentation (Non-owner Occupied) LTV Credit Grade (12 month Housing History) Credit Score <=50% A4 580-599 400,000 400,000 400,000 400,000 400,000 400,000 400,000 400,000 0x30 reported mortgage 560-579 350,000 350,000 350,000 350,000 350,000 350,000 350,000 350,000 history 540-559 300,000 300,000 300,000 300,000 300,000 300,000 300,000 520-539 300,000 300,000 300,000 300,000 A5 600+ 500,000 500,000 500,000 500,000 500,000 500,000 500,000 400,000 <12 months reported 580-599 400,000 400,000 400,000 400,000 400,000 400,000 400,000 400,000 mortgage history 560-579 350,000 350,000 350,000 350,000 350,000 350,000 350,000 350,000 0x30 housing 540-559 300,000 300,000 300,000 300,000 300,000 300,000 300,000 580+ 400,000 400,000 400,000 400,000 400,000 400,000 400,000 400,000 Ax 560-579 350,000 350,000 350,000 350,000 350,000 350,000 350,000 1x30 (includes rolling) 540-559 300,000 300,000 300,000 300,000 300,000 300,000 300,000 520-539 300,000 300,000 300,000 300,000 620+ 400,000 400,000 400,000 400,000 400,000 400,000 400,000 400,000 Am 580-619 350,000 350,000 350,000 350,000 350,000 350,000 350,000 Unlimited 30's 560-579 300,000 300,000 300,000 300,000 300,000 300,000 300,000 0x60 540-559 300,000 300,000 300,000 300,000 520-539 300,000 300,000 300,000 300,000 B 560+ 300,000 300,000 300,000 300,000 300,000 300,000 1x60, 0x90 (non-rolling) 540-559 300,000 300,000 300,000 300,000 C 560+ 300,000 300,000 300,000 300,000 Unlimited 60's, 1x90 (non-rolling) 540-559 300,000 300,000 300,000 Bankruptcy >=1 year >=2 years Foreclosure >=2 years >=3 years Major Adverse Credit $1,500 may be left open ($10,000 for grade C) Minimum Loan Amount $50,000 Housing Payment History Borrower without 12 months mortgage history Lives rent free/lives with relatives/owns • Requires Institutional Verification of Rent or 12 months canceled checks • If documentation of housing indicates late or missing payments, the credit grade is downgraded according to the number and severity of the late/missing payments free and clear or cannot document Not eligible CLTVs Secondary Financing Not eligible 40/30 Balloon, 40 Year Recast Not eligible J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Loan Program Page 5 of 6

- 6. S500 Loan Limits Maximum Loan Amounts & LTVs for Stated Income Documentation (Non-owner Occupied) LTVCredit Grade (12 month Housing History) Credit Score <=50% 50.01-55% 55.01-60% 60.01-65% 65.01-70% 70.01-75% 75.01-80% 580+ 350,000 350,000 350,000 350,000 350,000 350,000 350,000 560-579 250,000 250,000 250,000 250,000 250,000 250,000 A4 0x30 reported mortgage history 520-559 250,000 250,000 250,000 250,000 580+ 350,000 350,000 350,000 350,000 350,000 350,000 350,000 560-579 250,000 250,000 250,000 250,000 250,000 250,000 A5 <12 months reported mortgage history; 0x30 housing 540-559 250,000 250,000 250,000 250,000 560+ 250,000 250,000 250,000 250,000 250,000 250,000 Ax 1x30 (includes rolling) 520-559 250,000 250,000 250,000 250,000 580+ 250,000 250,000 250,000 250,000 250,000 250,000 560-579 250,000 250,000 250,000 250,000 250,000Am Unlimited 30's, 0x60 520-559 200,000 200,000 200,000 200,000 560+ 250,000 250,000 250,000 250,000 B 1x60, 0x90 540-559 200,000 200,000 200,000 200,000 Bankruptcy >=1 year Foreclosure >=2 years >=3 years Major Adverse Credit $1,500 may be left open Minimum Loan Amount $50,000 Housing Payment History Borrower without 12 months mortgage history • Requires Institutional Verification of Rent or 12 months canceled checks • If documentation of housing indicates late or missing payments, the credit grade is downgraded according to the number and severity of the late/missing payments Rent free/lives with relatives/owns free and clear or cannot document Not eligible CLTVs Secondary Financing not eligible 40/30 Balloon, 40 Year Recast Not eligible J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Loan Program Page 6 of 6

- 7. Documentation Requirements Income Type Full Lite Fast Stated • Paystub(s) showing most recent 30-days YTD income • W-2 forms for most recent 2 years or • Written VOE • Paystub(s) showing most recent 30-days YTD income • W-2 forms for most recent year or • Written VOE • Paystub(s) showing most recent 30-days YTD income • W-2 forms for most recent year or • Written VOE Additional requirement for B & C: Verbal VOE 5 days prior to closing. Additional requirement for B & C: Verbal VOE 5 days prior to closing. Additional requirement for B & C: Verbal VOE 5 days prior to closing. Bonus or overtime income: Averaged over most recent 2 years unless declining, then past 12 months will be averaged Bonus or overtime income: Not used for qualifying. Bonus or overtime income: Averaged over most recent year. Tips or gratuity income: Averaged over most recent 2 years unless declining, then past 12 months will be averaged. Tips or gratuity income: Not used for qualifying. Tips or gratuity income: Averaged over most recent year. Wage Earner Commission income: Averaged over most recent 2 years using personal tax returns & deducting non-reimbursed business expenses as reported on IRS Form 2106. If declining in most recent tax year lower income is used Commission income: Not used for qualifying. Commission income: Averaged over most recent year using personal tax returns & deducting non-reimbursed business expenses as reported on IRS Form 2106. • Income must be stated on the application • Credit grades A4, A5 and Ax only • Minimum 580 Credit Score • Verbal VOE required • Owner occupied, primary residence or second/vacation home • Signed and dated IRS Forms 4506 or 4506-T authorizing the Client or its assigns to obtain income information S500 Income Documentation This is summary information only. Refer to the Client Guide for complete and definitive underwriting guidelines. J.I.M. FINANCIAL At-A-Glance 03/13/06 S500/Credit Gap Income Documentation Page 1 of 3

- 8. S500 Income Documentation Documentation Requirements Income Type Full Lite Fast Stated Self-Employed • Personal tax returns with all schedules for most recent 2 years • Business tax returns with all schedules for most recent 2 years • Proof of existence of business (business license or confirmation through phone directory listing) for most recent 2 years or • Personal bank statements for most recent 2 years and proof of existence of business (business license or confirmation through phone directory listing) for most recent 2 years with conditions as required for self-employed income Additional requirement: If >120 days since filing tax return, a signed & dated P&L is required. Not available • Personal tax return with all schedules for most recent year • Business tax returns with all schedules for most recent year • Proof of existence of business (business license or confirmation through phone directory listing) for most recent 2 years or • Personal bank statements for most recent year with conditions as required for self-employed income Additional requirement: If >120 days since filing tax return, a signed & dated P&L is required. • Income must be stated on the application • Verification of the existence of the Borrower’s business through evidence of a business license and confirmation of a phone directory listing. If a license is not required for the business, a signed confirmation of business is required by Borrower’s accountant or other CPA • Signed and dated IRS Forms 4506 or 4506-T authorizing the Client and/or its assigns to obtain income information Fixed Income One of the following is required: • W-2P Form for most recent 2 years • Award Letter or Court Order and evidence of receipt • 1099 Forms for most recent 2 years • Personal tax returns with all schedules for most recent 2 years • Copy of divorce stipulation and decree or Court Order Not available One of the following is required: • Most recent W-2P Form • Award Letter or Court Order and evidence of receipt • 1099 Form for most recent year • Personal tax return with all schedules for most recent year • Copy of divorce stipulation and decree or Court Order Not available Rental Income • Current annual lease • Schedule E for most recent 2 years or • Operating Income Statement Not available • Current annual lease • Schedule E for most recent year or • Operating Income Statement Income stated on the 1003 Interest and Dividend Income • Personal tax returns with Schedules B for most recent 2 years • Proof of assets to support the interest or dividend income Not available • Personal tax return with Schedules B for most recent year • Proof of assets to support the interest or dividend income Not available J.I.M. FINANCIAL At-A-Glance 03/13/06 S500/Credit Gap Income Documentation Page 2 of 3

- 9. S500 Income Documentation Documentation Requirements Income Type Full Lite Fast Stated Trust Income Trust Agreement or Trustee’s Statement and one of the following: • Personal tax returns with all schedules for most recent 2 years • K-1 Schedule for most recent 2 years • 1041 Fiduciary tax returns for most recent 2 years Not available Trust Agreement or Trustee’s Statement and one of the following: • Personal tax returns with all schedules for most recent year • K-1 Schedule for most recent year • 1041 Fiduciary tax returns for most recent year Not available Note Income Copy of Note and one of the following: • Tax returns with all schedules for most recent 2 years • Bank statements showing Note income deposited for most recent 2 years Not available Copy of Note and one of the following: • Tax returns with all schedules for most recent year • Bank statements showing Note income deposited for most recent year Not available Inherited and Guaranteed Income • Award Letter • Personal tax returns with all schedules for most recent 2 years Not available • Award Letter • Personal tax returns with all schedules for most recent year Not available Temporary Disability Income • Insurance Award Letter • Letter from Borrower’s employer Not available • Insurance Award Letter • Letter from Borrower’s employer Not available Seasonal Unemployment Compensation • Personal tax returns with all schedules for most recent 2 years Not available • Personal tax return with all schedules for most recent year • Letter from the Borrower’s employer Not available J.I.M. FINANCIAL At-A-Glance 03/13/06 S500/Credit Gap Income Documentation Page 3 of 3

- 10. S500 Underwriting Criteria This is summary information only. Refer to the Client Guide for complete and definitive underwriting guidelines. Owner Occupied and Second/Vacation Owner Occupied Full, Lite, Fast and Stated Income Documentation, All Property Types Full, Lite, Fast and Stated LTV Percentages <=65 65.01-70 70.01-75 75.01-80 80.01-85 85.01-90 90.01-95 95.01-100 J.I.M. FINANCIAL 80/20 Credit DTI e Maximum DTI 50%; DTI up to 55% allowed with 2 months reserves or $1,500 residual income e For the 40 Year Recast and 40/30 Balloon Features, DTI cannot exceed 50% Residual Income No Minimum $1,500 No Minimum Reserves None Required e None required for Full, Lite or Fast e Stated requires 2 months Trade Lines All credit grades require a Credit Score based on: e A minimum two year credit history e At least one trade (derogatory or non-derogatory) reported in the past six months e A minimum number of non-derogatory trade lines based on credit grade and income documentation type: o Full, Lite & Fast – minimum 3 non-derogatory trade lines o Stated – minimum 5 non-derogatory trade lines Seller Concessions Maximum of 6% non recurring Temporary Buy Downs Not eligible Adverse Credit Collection accounts, charge-off accounts, judgments, liens, delinquent property taxes, repossessions, garnishments and accounts currently 90 days or more delinquent are considered Major Adverse Credit. e Medical accounts that are collection or charge-offs will not be required to be paid. Aggregate totals exceeding the CLTV limits for the loan transaction will be reviewed on a case-by-case basis e All property, State, and IRS tax liens, regardless of seasoning, are required to be paid whether or not they currently affect title. No payment plans or subordination allowed. Property tax liens on other properties will be considered Major Adverse Credit. Federal tax liens older than ten years are not required to be paid unless the title company requires payoff. e Adverse accounts > 24 months that do not affect title will not be considered in grade determination and are not required to be paid e Cumulative adverse accounts and all non-medical adverse credit <24 months seasoned, must be paid off if it exceeds amounts listed below: o For LTV <=90%, $5,000 may be left open provided it does not affect title o For LTV >90%, $1,500 may be left open provided it does not affect title o For C grade, $10,000 may be left open provided it does not affect title Borrower Eligibility US Citizen Borrower without 12 months reported mortgage history Permanent resident alien Non-permanent resident alien Maximum LTV/CLTV 90%. No cash-out permitted. Not eligible Non-occupant co-borrower Not eligible Foreign National Not eligible Transaction Types Purchase Mortgage Rate/Term Refinance Mortgage Cash Out Refinance Mortgage e Maximum Cash out of $150,000 (cash-in-hand may be the greater of $50,000 or 30% of Loan Amount) e For credit grade C, no cash-in-hand allowed unless derogatory and revolving debt is paid off. e No cash-out permitted for non-permanent resident aliens. Construction/Permanent Mortgage Not eligible Contract for Deed/Land Contract See Chapter 3B, Contract for Deed/Land Contract Section for more information. Not eligible Lease with option to Purchase Not eligible J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Underwriting Criteria Page 1 of 4

- 11. S500 Underwriting Criteria Owner Occupied and Second/Vacation Owner Occupied Full, Lite, Fast and Stated Income Documentation, All Property Types Full, Lite, Fast and Stated LTV Percentages <=65 65.01-70 70.01-75 75.01-80 80.01-85 85.01-90 90.01-95 95.01-100 J.I.M. FINANCIAL 80/20 Property Types Single Family 1 -2 units (attached or detached) Second/vacation limited to 1 unit only PUD Modularized, Panelized, Pre-cut Home Single Family 3-4 units Second/vacation not eligible. Maximum LTV/CLTV 90% Not eligible Condominium unlimited stories Must meet J.I.M. FINANCIAL Class II or III warranties Rural property Maximum LTV/CLTV of 90% Not eligible Mixed Use properties e Reduce LTV/CLTV 15%, Max Loan amount of $500,000 or maximum allowed for credit grade. e Full, Lite & Fast: Max LTV/CLTV 85% (after reduction) e Stated: Max LTV/CLTV 80% (after reduction) Not eligible Occupancy Second/Vacation Restricted to 1 unit only. 2-4 units are not eligible. Not eligible Loan Amount Minimum Properties with a loan amount less than $50,000 have a maximum LTV/CLTV of 60% Minimum $20,000 loan amount for 2nd mortgage (or as specified by State law) Secondary Financing 10%-20% LTV allowed on simultaneous 2nd Lien Stated Income Requirements Wage Earners Minimum of 580 Credit Score; Grades A4, A5, Ax only (1x30 housing history or better) Self-Employed Rental Income Interest Only Transaction Types Purchase mortgage, rate/term refinance mortgage, or cash-out refinance mortgage. Credit Grades e A4 0x30 reported mortgage Delinquency in past 12 months e A5 0x30 unreported housing and/or <12 months reported mortgage history e Ax 1x30 mortgage/rental history in past 12 months, rolling lates allowed, no more than 30 days down at closing Minimum Credit Score e Full, Fast, Lite: 580 e Stated Income: 640 Occupancy e Owner Occupied, Primary Residence only Property Types e Single family 1 -2 units attached or detached e PUD e Modular homes, Panelized homes, Pre-cut homes e Condominiums, unlimited stories with Class II or Class III Warranties Term e Standard IO term is 5 years DTI e Maximum DTI is 45% e 45.01% to 50% DTI allowed with 2 months reserves or $1,500 residual income 40/30 Balloon, 40 Year Recast e Not allowed on 2nd liens e For the 40 Year Recast and 40/30 Balloon Features, maximum 50% DTI e Not allowed on Interest Only feature J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Underwriting Criteria Page 2 of 4

- 12. S500 Underwriting Criteria Non-Owner Occupied Full, Lite, Fast, and Stated Income Documentation, All Property Types LTV Percentages <=50 50.01-60 60.01-65 65.01-70 70.01-75 75.01-80 80.01-85 Credit DTI Maximum of 50%; up to 55% allowed with 2 months reserves or $1,500 residual income Residual Income Minimum $1,500 Reserves e None required Trade Lines All credit grades require a Credit Score based on: e A minimum two year credit history e At least one trade (derogatory or non-derogatory) reported in the past six months e A minimum number of non-derogatory trade lines based on credit grade and income documentation type: o Full, Lite & Fast – minimum 3 non-derogatory trade lines o Stated – minimum 5 non-derogatory trade lines Seller Concessions Maximum of 3% non-recurring Temporary Buy Downs Not eligible Adverse Credit Collection accounts, charge-off accounts, judgments, liens, delinquent property taxes, repossessions, garnishments and accounts currently 90 days or more delinquent are considered Major Adverse Credit. e Medical accounts that are collection or charge-offs will not be required to be paid. Aggregate totals exceeding the CLTV limits for the loan transaction will be reviewed on a case-by-case basis e All property, State, and IRS tax liens, regardless of seasoning, are required to be paid whether or not they currently affect title. No payment plans or subordination allowed. Property tax liens on other properties will be considered Major Adverse Credit. Federal tax liens older than ten years are not required to be paid unless the title company requires payoff. e Adverse accounts > 24 months old that do not affect title will not be considered in grade determination and are not required to be paid e Cumulative adverse accounts and all non-medical adverse credit < 24 months seasoned, must be paid off if it exceeds $1,500 ($1,500 may be left open provided it does not affect title) Borrower Eligibility US Citizen Borrower without 12 months reported mortgage history Permanent resident alien Non-permanent resident alien Not eligible Non-occupant co-borrower Not eligible Foreign National Not eligible Transaction Types Purchase Mortgage Rate/Term Refinance Mortgage Cash Out Refinance Mortgage e Maximum Cash out of $150,000 (cash-in-hand may be greater of $50,000 or 30% of loan amount) e For credit grade C, no cash-in-hand allowed unless derogatory and revolving debt is paid off Construction/Permanent Mortgage Not eligible Contract for Deed/Land Contract Not eligible Lease with option to Purchase Not eligible J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Underwriting Criteria Page 3 of 4

- 13. S500 Underwriting Criteria Non-Owner Occupied Full, Lite, Fast, and Stated Income Documentation, All Property Types LTV Percentages <=50 50.01-60 60.01-65 65.01-70 70.01-75 75.01-80 80.01-85 Property Types Single Family 1 -2 units (attached or detached) PUD Modularized, Panelized, Pre-cut Home Single Family 3-4 units Maximum LTV 75% Not eligible Condominium unlimited stories Must meet J.I.M. FINANCIAL Class II or III warranties Rural property Not eligible Mixed Use properties Not eligible Loan Amount Minimum $50,000 Secondary Financing Secondary Financing is not eligible Stated Income Requirements Stated Wage Earners Not eligible Self-Employed Interest Only Not eligible 40/30 Balloon, 40 Year Recast Not eligible J.I.M. FINANCIAL At-A-Glance 12/11/06 S500 Underwriting Criteria Page 4 of 4