Gresham "Group 150" - July 2011

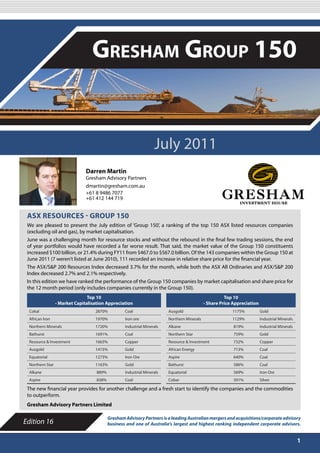

- 1. JULY 2011 Gresham Group 150 July 2011 Darren Martin Gresham Advisory Partners dmartin@gresham.com.au +61 8 9486 7077 +61 412 144 719 ASX RESOURCES - GROUP 150 We are pleased to present the July edition of ‘Group 150’, a ranking of the top 150 ASX listed resources companies (excluding oil and gas), by market capitalisation. June was a challenging month for resource stocks and without the rebound in the final few trading sessions, the end of year portfolios would have recorded a far worse result. That said, the market value of the Group 150 constituents increased $100 billion, or 21.4% during FY11 from $467.0 to $567.0 billion. Of the 143 companies within the Group 150 at June 2011 (7 weren’t listed at June 2010), 111 recorded an increase in relative share price for the financial year. The ASX/S&P 200 Resources Index decreased 3.7% for the month, while both the ASX All Ordinaries and ASX/S&P 200 Index decreased 2.7% and 2.1% respectively. In this edition we have ranked the performance of the Group 150 companies by market capitalisation and share price for the 12 month period (only includes companies currently in the Group 150). Top 10 Top 10 - Market Capitalisation Appreciation - Share Price Appreciation Cokal 2870% Coal Ausgold 1175% Gold African Iron 1970% Iron ore Northern Minerals 1129% Industrial Minerals Northern Minerals 1720% Industrial Minerals Alkane 819% Industrial Minerals Bathurst 1691% Coal Northern Star 759% Gold Resource & Investment 1663% Copper Resource & Investment 732% Copper Ausgold 1415% Gold African Energy 713% Coal Equatorial 1273% Iron Ore Aspire 640% Coal Northern Star 1163% Gold Bathurst 586% Coal Alkane 889% Industrial Minerals Equatorial 569% Iron Ore Aspire 838% Coal Cobar 501% Silver The new financial year provides for another challenge and a fresh start to identify the companies and the commodities to outperform. Gresham Advisory Partners Limited Gresham Advisory Partners is a leading Australian mergers and acquisitions/corporate advisory Edition 16 business and one of Australia’s largest and highest ranking independent corporate advisors. 1

- 2. Group 150 Top 150 asX LisTed resource companies - June By Market Capitalisation Mkt Cap (A$m) % Mkt Cap (A$m) % Jun May Company 30-Jun-11 31-May-11 Change Jun May Company 30-Jun-11 31-May-11 Change 1 1 BHP Billiton Ltd. (ASX:BHP) $239,694.3 $243,791.5 (1.7%) 51 62 Resolute Mining Ltd. (ASX:RSG) $547.1 $526.1 4.0% 2 2 Rio Tinto Ltd. (ASX:RIO) $160,060.8 $157,819.2 1.4% 52 64 Gryphon Minerals Ltd. (ASX:GRY) $542.9 $512.9 5.8% 3 3 Newcrest Mining Ltd. (ASX:NCM) $28,848.2 $30,386.7 (5.1%) 53 59 CuDeco Ltd. (ASX:CDU) $529.3 $596.8 (11.3%) 4 4 Fortescue Metals Group Ltd. (ASX:FMG) $19,770.7 $20,300.0 (2.6%) 54 63 Beadell Resources Ltd (ASX:BDR) $529.2 $525.9 0.6% 5 5 Coal & Allied Industries Ltd. (ASX:CNA) $9,134.7 $9,645.5 (5.3%) 55 52 Discovery Metals Ltd. (ASX:DML) $526.7 $570.4 (7.7%) 6 7 Iluka Resources Ltd. (ASX:ILU) $6,971.8 $6,498.1 7.3% 56 55 Aditya Birla Minerals Limited (ASX:ABY) $477.9 $556.2 (14.1%) 7 6 Equinox Minerals Ltd. (ASX:EQN) $6,895.2 $6,754.5 2.1% 57 56 Guildford Coal Limited (ASX:GUF) $463.2 $545.9 (15.1%) 8 8 Alumina Ltd. (ASX:AWC) $5,148.8 $5,636.8 (8.7%) 58 65 OM Holdings Limited (ASX:OMH) $461.9 $474.5 (2.7%) 9 10 New Hope Corp. Ltd. (ASX:NHC) $4,333.8 $4,400.2 (1.5%) 59 58 Gujarat NRE Coking Coal Limited (ASX:GNM) $426.1 $545.0 (21.8%) 10 9 OZ Minerals Limited (ASX:OZL) $4,274.9 $4,576.1 (6.6%) 60 50 Brockman Resources Limited (ASX:BRM) $419.9 $608.2 (31.0%) 11 11 Riversdale Mining Ltd. (ASX:RIV) $3,959.8 $4,047.8 (2.2%) 61 71 Kagara Ltd (ASX:KZL) $403.9 $418.1 (3.4%) 12 12 Lynas Corporation Limited (ASX:LYC) $3,393.0 $4,035.1 (15.9%) 62 53 Metminco Limited. (ASX:MNC) $402.2 $561.0 (28.3%) 13 13 MacArthur Coal Ltd. (ASX:MCC) $3,307.9 $3,594.9 (8.0%) 63 73 Gold One International Limited (ASX:GDO) $396.3 $411.9 (3.8%) 14 15 Atlas Iron Limited (ASX:AGO) $3,080.9 $3,050.7 1.0% 64 67 Ampella Mining Limited (ASX:AMX) $383.1 $466.9 (17.9%) 15 16 Whitehaven Coal Limited (ASX:WHC) $2,879.0 $2,829.5 1.7% 65 57 Bougainville Copper Ltd. (ASX:BOC) $381.0 $545.4 (30.1%) 16 14 Aquila Resources Ltd. (ASX:AQA) $2,684.2 $3,331.9 (19.4%) 66 66 Cockatoo Coal Limited (ASX:COK) $376.0 $472.5 (20.4%) 17 19 PanAust Limited (ASX:PNA) $2,238.1 $2,403.7 (6.9%) 67 75 Ramelius Resources Ltd. (ASX:RMS) $373.6 $404.2 (7.6%) 18 17 Aquarius Platinum Ltd. (ASX:AQP) $2,209.8 $2,453.8 (9.9%) 68 78 Integra Mining Ltd. (ASX:IGR) $370.3 $399.7 (7.4%) 19 21 Mount Gibson Iron Ltd. (ASX:MGX) $1,991.9 $2,008.2 (0.8%) 69 70 Panoramic Resources Ltd. (ASX:PAN) $362.3 $418.2 (13.4%) 20 22 Extract Resources Ltd. (ASX:EXT) $1,985.5 $1,975.5 0.5% 70 85 Silver Lake Resources Limited (ASX:SLR) $357.8 $322.9 10.8% 21 18 Paladin Energy, Ltd. (ASX:PDN) $1,958.5 $2,448.2 (20.0%) 71 68 Rex Minerals Limited. (ASX:RXM) $354.9 $428.4 (17.2%) 22 20 Aston Resources Limited (ASX:AZT) $1,791.7 $2,028.9 (11.7%) 72 77 Kingsrose Mining Limited (ASX:KRM) $351.4 $400.2 (12.2%) 23 24 Gloucester Coal Ltd. (ASX:GCL) $1,409.2 $1,476.1 (4.5%) 73 60 Summit Resources Ltd. (ASX:SMM) $348.8 $534.1 (34.7%) 24 26 Zimplats Holdings Ltd. (ASX:ZIM) $1,345.5 $1,345.5 0.0% 74 81 Metals X Limited (ASX:MLX) $348.2 $348.2 0.0% 25 23 Medusa Mining Limited (ASX:MML) $1,240.5 $1,639.5 (24.3%) 75 79 Mineral Deposits Ltd. (ASX:MDL) $345.2 $398.0 (13.3%) 26 27 Independence Group NL (ASX:IGO) $1,142.4 $1,234.9 (7.5%) 76 82 Perilya Ltd. (ASX:PEM) $333.6 $344.1 (3.1%) 27 42 Coalspur Mines Limited (ASX:CPL) $1,121.2 $856.9 30.8% 77 69 Murchison Metals Limited (ASX:MMX) $333.5 $427.2 (21.9%) 28 28 Perseus Mining Ltd. (ASX:PRU) $1,115.1 $1,160.3 (3.9%) 78 80 Hunnu Coal Limited (ASX:HUN) $331.7 $363.1 (8.6%) 29 31 Kingsgate Consolidated Limited (ASX:KCN) $1,082.2 $1,060.6 2.0% 79 74 Aspire Mining Limited (ASX:AKM) $307.8 $410.4 (25.0%) 30 33 Regis Resources Limited (ASX:RRL) $1,071.5 $1,017.7 5.3% 80 88 Troy Resources NL (ASX:TRY) $306.2 $318.4 (3.8%) 31 29 Western Areas NL (ASX:WSA) $1,060.4 $1,146.7 (7.5%) 81 86 Tiger Resources Ltd. (ASX:TGS) $301.1 $321.1 (6.2%) 32 32 Sandfire Resources (ASX:SFR) $1,053.2 $1,053.5 (0.0%) 82 83 Elemental Minerals Limited (ASX:ELM) $288.6 $336.7 (14.3%) 33 25 Ivanhoe Australia Limited (ASX:IVA) $1,004.9 $1,376.5 (27.0%) 83 94 BC Iron Limited (ASX:BCI) $287.9 $281.3 2.3% 34 30 Sundance Resources Ltd. (ASX:SDL) $976.1 $1,133.9 (13.9%) 84 76 Moly Mines Ltd. (ASX:MOL) $286.7 $402.2 (28.7%) 35 41 CGA Mining Limited (ASX:CGX) $946.5 $863.2 9.7% 85 106 Greenland Minerals and Energy Ltd (ASX:GGG) $285.0 $232.0 22.8% 36 40 Minara Resources Ltd. (ASX:MRE) $871.2 $865.4 0.7% 86 93 Cape Lambert Resources Limited (ASX:CFE) $278.7 $283.1 (1.6%) 37 34 Mirabela Nickel Ltd. (ASX:MBN) $860.2 $1,007.7 (14.6%) 87 72 Arafura Resources Limited (ASX:ARU) $268.6 $417.7 (35.7%) 38 39 Bandanna Energy Limited (ASX:BND) $794.5 $895.7 (11.3%) 88 84 Saracen Mineral Holdings Limited (ASX:SAR) $263.4 $334.6 (21.3%) 39 37 Energy Resources of Australia Ltd. (ASX:ERA) $782.0 $944.2 (17.2%) 89 105 Straits Resources Limited (ASX:SRQ) $259.7 $232.1 11.9% 40 38 Gindalbie Metals Ltd. (ASX:GBG) $781.2 $898.2 (13.0%) 90 89 Marengo Mining Limited (ASX:MGO) $258.7 $303.5 (14.8%) 41 35 Intrepid Mines Limited (ASX:IAU) $739.5 $989.2 (25.2%) 91 91 Adamus Resources Ltd. (ASX:ADU) $254.6 $295.2 (13.8%) 42 44 Jupiter Mines Ltd. (ASX:JMS) $694.3 $842.6 (17.6%) 92 - Cokal Limited (ASX:CKA) $253.9 $223.4 13.7% 43 43 Bathurst Resources Ltd (ASX:BTU) $684.5 $846.0 (19.1%) 93 87 Catalpa Resources Limited (ASX:CAH) $242.2 $319.6 (24.2%) 44 47 ST Barbara Ltd. (ASX:SBM) $636.6 $636.6 0.0% 94 95 Conquest Mining Limited (ASX:CQT) $242.0 $271.2 (10.8%) 45 124 Kangaroo Resources Limited (ASX:KRL) $635.4 $180.7 251.6% 95 92 Galaxy Resources (ASX:GXY) $240.9 $284.5 (15.3%) 46 46 Grange Resources Limited (ASX:GRR) $605.4 $680.4 (11.0%) 96 101 Focus Minerals Limited (ASX:FML) $240.8 $244.3 (1.4%) 47 48 Northern Iron Limited (ASX:NFE) $594.9 $616.7 (3.5%) 97 102 Equatorial Resources Limited (ASX:EQX) $237.6 $239.6 (0.8%) 48 51 Allied Gold Mining PLC (ASX:ALD) $591.3 $599.3 (1.3%) 98 109 Tanami Gold NL (ASX:TAM) $233.6 $221.8 5.3% 49 54 Alkane Resources Limited (ASX:ALK) $578.4 $556.9 3.9% 99 103 Noble Mineral Resources Ltd. (ASX:NMG) $231.5 $238.4 (2.9%) 50 49 White Energy Company Limited (ASX:WEC) $576.9 $614.8 (6.2%) 100 99 Carabella Resources Limited (ASX:CLR) $230.0 $260.2 (11.6%) Includes ASX Resource companies excluding oil and gas 2

- 3. JULY 2011 Mkt Cap (A$m) % Mkt Cap (A$m) % Jun May Company 30-Jun-11 31-May-11 Change Jun May Company 30-Jun-11 31-May-11 Change 101 104 Exco Resources Ltd. (ASX:EXS) $228.3 $233.5 (2.2%) 126 127 Resource and Investment NL (ASX:RNI) $161.0 $173.2 (7.0%) 102 117 FerrAus Ltd. (ASX:FRS) $225.9 $194.5 16.1% 127 126 Peninsula Energy Limited (ASX:PEN) $154.9 $177.6 (12.8%) 103 98 Flinders Mines Limited. (ASX:FMS) $218.5 $264.0 (17.2%) 128 135 Platinum Australia Limited (ASX:PLA) $153.0 $153.0 0.0% 104 100 Iron Ore Holdings Limited (ASX:IOH) $215.9 $245.8 (12.2%) 129 129 Azumah Resources Ltd (ASX:AZM) $152.1 $166.1 (8.4%) 105 107 Orocobre Limited (ASX:ORE) $212.3 $225.2 (5.7%) 130 120 Red 5 Ltd. (ASX:RED) $147.6 $192.6 (23.4%) 106 96 Nucoal Resources NL (ASX:NCR) $210.2 $268.5 (21.7%) 131 134 Cobar Consolidated Resources Ltd (ASX:CCU) $142.9 $158.2 (9.7%) 107 113 Atlantic Ltd (ASX:ATI) $209.0 $216.2 (3.3%) 132 137 YTC Resources Limited (ASX:YTC) $140.3 $146.4 (4.2%) 108 90 South Boulder Mines Ltd. (ASX:STB) $208.4 $297.1 (29.9%) 133 149 Northern Star Resources Ltd. (ASX:NST) $140.2 $124.9 12.2% 109 111 Hillgrove Resources Ltd. (ASX:HGO) $202.4 $218.3 (7.3%) 134 145 Blackgold International Holdings ltd (ASX:BGG) $138.0 $168.2 (18.0%) 110 114 WPG Resources Ltd (ASX:WPG) $199.4 $201.9 (1.2%) 135 157 Industrial Minerals Corporation Ltd. (ASX:IDM) $136.1 $109.9 23.8% 111 112 Resource Generation Limited (ASX:RES) $197.2 $216.9 (9.1%) 136 154 Territory Resources Limited (ASX:TTY) $132.6 $120.6 10.0% 112 115 Northern Energy Corporation Ltd (ASX:NEC) $196.6 $196.6 0.0% 137 139 Reed Resources Ltd. (ASX:RDR) $132.4 $142.9 (7.3%) 113 128 Astron Ltd. (ASX:ATR) $191.9 $169.0 13.6% 138 130 Altona Mining Limited (ASX:AOH) $132.2 $165.2 (20.0%) 114 119 Gold Road Resources Limited (ASX:GOR) $185.9 $193.3 (3.8%) 139 140 Indo Mines Limited (ASX:IDO) $131.0 $141.4 (7.4%) 115 123 Sylvania Resources Ltd. (ASX:SLP) $185.3 $188.7 (1.8%) 140 142 Robust Resources Limited (ASX:ROL) $128.7 $137.6 (6.5%) 116 61 Sphere Minerals Limited (ASX:SPH) $181.6 $531.2 (65.8%) 141 131 Alcyone Resources Ltd (ASX:AYN) $127.7 $157.9 (19.1%) 117 108 Mincor Resources NL (ASX:MCR) $181.6 $224.7 (19.2%) 142 132 Stanmore Coal Limited (ASX:SMR) $126.9 $157.1 (19.2%) 118 110 African Energy Resources Limited (ASX:AFR) $180.7 $220.7 (18.1%) 143 144 Northern Minerals Limited (ASX:NTU) $126.5 $136.6 (7.4%) 119 116 NKWE Platinum Ltd. (ASX:NKP) $180.6 $196.1 (7.9%) 144 159 Finders Resources Limited (ASX:FND) $119.9 $108.8 10.2% 120 118 Kula Gold Limited (ASX:KGD) $180.2 $193.7 (7.0%) 145 136 Continental Coal Limited (ASX:CCC) $117.7 $151.8 (22.5%) 121 97 Indophil Resources NL (ASX:IRN) $176.8 $266.4 (33.6%) 146 167 African Iron Limited (ASX:AKI) $115.1 $105.5 9.1% 122 122 Deep Yellow Ltd. (ASX:DYL) $169.1 $191.7 (11.8%) 147 147 Papillon Resources Limited (ASX:PIR) $111.8 $127.8 (12.5%) 123 125 Cerro Resources NL (ASX:CJO) $165.2 $179.6 (8.0%) 148 138 Tribune Resources Limited (ASX:TBR) $111.7 $143.4 (22.1%) 124 121 Highlands Pacific Limited (ASX:HIG) $164.7 $192.1 (14.3%) 149 146 IMX Resources Ltd. (ASX:IXR) $110.3 $131.3 (16.0%) 125 143 Ausgold Limited (ASX:AUC) $163.6 $137.1 19.3% 150 158 Rocklands Richfield Limited (ASX:RCI) $109.9 $109.9 0.0% Source: Capital IQ new enTranTs - June eXiTs - June 92 Cokal Limited (ASX:CKA) - database correction Mantra Resources Limited (ASX:MRU) - takeover 135 Industrial Minerals Corporation Ltd. (ASX:IDM) OceanaGold Corporation (ASX:OGC) - primary listing moved to TSX 136 Territory Resources Limited (ASX:TTY) Australasian Resources Ltd (ASX:ARH) 144 Finders Resources Limited (ASX:FND) Pluton Resources Limited (ASX:PLV) 146 African Iron Limited (ASX:AKI) Kentor Gold Limited (ASX:KGL) 150 Rocklands Richfield Limited (ASX:RCI) Minemakers Limited (ASX:MAK) Based on market capitalisation as at 30 June vs 31 May Group 150 Leaders and LaGGers - markeT capiTaLisaTion performance - June Leaders Laggers * Included material placement, acquisition and/or option conversion during month 3

- 4. Group 150 Group 150 markeT capiTaLisaTion +21.4% 567.0 +57.6% Market Valuation (A$b) - Group 150 asX indeX performance - June Group 150 mkT cap - By commodiTy merGer & acquisiTions - announced in June Percent Premium - Premium - Date Value Consideration Target Acquirer Sought 1 Day Prior 1 Month Prior Announced (A$m) Offered (%) (%) (%) 27-Jun-2011 Atlas Iron Limited, SE Pilbara Iron Ore Assets FerrAus Ltd. (ASX:FRS) 78.0 100 - - Cash 26-Jun-2011 FerrAus Ltd. (ASX:FRS) Atlas Iron Limited (ASX:AGO) 214.0 100 34.0 5.9 Equity 19-Jun-2011 Crescent Gold Limited (ASX:CRE) Focus Minerals Limited (ASX:FML) 72.3 100 30.5 23.1 Equity 15-Jun-2011 Conquest Mining Limited (ASX:CQT) Catalpa Resources Limited (ASX:CAH) 305.5 100 13.7 16.3 Equity 9-Jun-2011 Territory Resources Limited (ASX:TTY) Noble Group Ltd. (SGX:N21) 125.3 75 6.4 112.8 Cash Source: Capital IQ Announced Australian Resources (excluding oil and gas) Mergers and Acquisitions >A$10m 4

- 5. JULY 2011 fy 2011 - Top performers wiThin Group 150 Top 20 - Market Capitalisation Appreciation 3000% 2870% 2500% FY 11 Share Price Appreciation 1970% 2000% 1720% 1692% 1663% 1500% 1415% 1273% e 1163% 1000% 889% 838% 802% 773% 752% 707% 643% 638% 560% 533% 480% 500% 415% 0% Top 20 - Share Price Appreciation 1200% 1175% 1129% 1000% 815% FY 11 Market Capitalisation Appreciation 800% 752% 732% 713% 640% 586% 569% 600% 501% 471% 400% 381% 400% e 337% 293% 275% 263% 261% 256% 228% 200% 0% Source: Capital IQ 5

- 6. Group 150 June Group 150 memBers - 12 monTh performance Share Price Performance Market Capitalisation Performance # Company % # Company % # Company % # Company % 1 Ausgold 1175.0% 76 Focus 37.3% 1 Cokal 2869.6% 76 Cockatoo Coal 60.0% 2 Northern Minerals 1128.9% 77 Cape Lambert 36.9% 2 African Iron 1970.1% 77 Allied Gold 57.9% 3 Alkane 814.9% 78 Finders 34.4% 3 Northern Minerals 1720.1% 78 Western Areas 56.1% 4 Northern Star 751.9% 79 Allied Gold 33.3% 4 Bathurst 1691.9% 79 Robust 55.8% 5 Res & Invest. 732.3% 80 Western Plains 33.0% 5 Res & Invest. 1663.4% 80 Fortescue 54.4% 6 African Energy 713.3% 81 Saracen 32.1% 6 Ausgold 1414.8% 81 PanAust 53.1% 7 Aspire 640.3% 82 Azumah 31.7% 7 Equatorial 1273.4% 82 Ampella 51.7% 8 Bathurst 585.6% 83 Northern Iron 29.2% 8 Northern Star 1163.1% 83 Moly Mines 48.6% 9 Equatorial 568.6% 84 Kingsrose 28.5% 9 Alkane 888.7% 84 Northern Iron 48.6% 10 Cobar 501.5% 85 CGA 27.4% 10 Aspire 838.4% 85 Northern Energy 47.2% 11 Gold Road 471.4% 86 Minara 27.3% 11 Gold Road 802.4% 86 FerrAus 42.9% 12 Beadell 400.0% 87 Conquest 25.8% 12 Jupiter Mines 773.3% 87 OZ Minerals 42.7% 13 Elemental 381.4% 88 Rio Tinto 24.5% 13 African Energy 752.4% 88 Troy 42.3% 14 Alcyone 336.6% 89 Ampella 22.2% 14 Cobar 707.3% 89 Kingsrose 40.6% 15 Papillon 292.9% 90 Extract 21.7% 15 Kangaroo 643.4% 90 Flinders 39.6% 16 Cokal 275.0% 91 Whitehaven 21.5% 16 Alcyone 638.2% 91 Bougainville Cop. 38.7% 17 Lynas 263.3% 92 New Hope 21.3% 17 Elemental 560.4% 92 Gloucester 38.4% 18 Iluka 260.9% 93 Orocobre 21.2% 18 Marengo 532.5% 93 Alumina 38.4% 19 Sth Boulder 255.9% 94 Independence 19.8% 19 Altona 479.8% 94 Orocobre 37.1% 20 Ramelius 228.1% 95 Zimplats 19.0% 20 Papillon 415.2% 95 Cape Lambert 37.0% 21 Altona 219.8% 96 Mount Gibson 18.7% 21 Beadell 400.7% 96 Galaxy 35.2% 22 Marengo 217.1% 97 Kagara 17.5% 22 Sth Boulder 368.3% 97 Resolute 32.1% 23 Bandanna 215.3% 98 BHP Billiton 16.3% 23 YTC 338.4% 98 CGA 28.1% 24 Cerro 198.7% 99 FerrAus 16.0% 24 Cerro 321.4% 99 Adamus 27.9% 25 YTC 189.7% 100 Deep Yellow 15.4% 25 Atlantic 277.3% 100 Red 5 25.8% 26 Intrepid 181.2% 101 Highlands Pacific 14.3% 26 Lynas 276.2% 101 Extract 25.6% 27 Regis 177.1% 102 Silver Lake 14.0% 27 Coalspur 268.2% 102 Reed 24.4% 28 Exco 172.9% 103 Perseus 13.9% 28 Bandanna 264.3% 103 Kagara 23.5% 29 Metals X 165.6% 104 Coal & Allied 13.4% 29 Iluka 259.7% 104 Rio Tinto 22.4% 30 Territory 163.2% 105 Adamus 11.8% 30 Intrepid 240.9% 105 Whitehaven 21.5% 31 Sundance 161.5% 106 Resolute 10.9% 31 Indo Mines 234.2% 106 Mount Gibson 19.1% 32 Peninsula 155.2% 107 Robust 9.0% 32 Peninsula 228.2% 107 Zimplats 19.0% 33 Industrial Minerals 140.3% 108 Continental 8.6% 33 Greenland M&E 222.9% 108 New Hope 18.5% 34 Indo Mines 137.5% 109 Newcrest 7.4% 34 Metminco 218.7% 109 IMX Res. 18.0% 35 Aditya Birla 134.6% 110 Grange 5.0% 35 Atlas Iron 208.2% 110 Highlands Pacific 17.4% 36 Coalspur 132.1% 111 IMX Res. 3.7% 36 Tiger 208.2% 111 Perseus 16.1% 37 Gryphon 122.1% 112 Cockatoo Coal 2.5% 37 Gryphon 208.1% 112 Deep Yellow 15.5% 38 Tribune 122.0% 113 Aquila 0.3% 38 Regis 203.3% 113 Mirabela 14.8% 39 Sandfire 120.2% 114 Hillgrove -1.9% 39 Exco 189.4% 114 BHP Billiton 14.4% 40 Tiger 114.3% 115 Brockman -2.7% 40 Ramelius 188.5% 115 Kingsgate 14.3% 41 Jupiter Mines 107.0% 116 Red 5 -4.2% 41 Sundance 177.1% 116 Silver Lake 14.0% 42 Noble 105.3% 117 Tanami Gold -5.4% 42 Noble 176.6% 117 Ivanhoe 13.8% 43 Mineral Deposits 90.9% 118 St Barbara -6.9% 43 Western Plains 168.7% 118 Coal & Allied 13.4% 44 Greenland M&E 86.8% 119 Iron Ore Hold. -7.4% 44 Industrial Minerals 165.8% 119 Minara 13.0% 45 Discovery 85.2% 120 MacArthur -9.7% 45 Metals X 165.6% 120 Iron Ore Hold. 11.5% 46 Rex Minerals 84.8% 121 Sphere Minerals -12.4% 46 Continental 164.5% 121 MacArthur 7.3% 47 Equinox 84.0% 122 Ivanhoe -12.8% 47 Territory 163.6% 122 Gindalbie 6.6% 48 Atlas Iron 76.8% 123 Mirabela -14.2% 48 Resource Gen. 160.8% 123 Aquila 6.0% 49 Arafura 73.8% 124 Kingsgate -15.5% 49 Discovery 157.3% 124 Grange 5.1% 50 BC Iron 73.3% 125 Reed -15.8% 50 Sandfire 150.0% 125 Brockman -0.4% 51 Gold One 71.9% 126 Catalpa -16.3% 51 Rex Minerals 148.2% 126 St Barbara -6.8% 52 Metminco 71.9% 127 Gindalbie -19.3% 52 Aditya Birla 134.6% 127 Catalpa -7.9% 53 Atlantic 71.2% 128 Panoramic -19.7% 53 Hunnu Coal 128.8% 128 Sphere Minerals -12.4% 54 African Iron 70.5% 129 Galaxy -20.3% 54 Equinox 128.7% 129 CuDeco -17.3% 55 Medusa 69.0% 130 Aquarius -20.5% 55 Tribune 122.1% 130 Panoramic -19.0% 56 Kangaroo 68.2% 131 Gloucester -23.2% 56 Arafura 120.0% 131 Aquarius -20.0% 57 Perilya 67.1% 132 Summit -23.6% 57 Independence 112.7% 132 White Energy -21.9% 58 Astron Ltd. 66.5% 133 Paladin -29.8% 58 Stanmore Coal 109.4% 133 Summit -22.6% 59 Rocklands 64.9% 134 CuDeco -31.9% 59 Conquest 107.7% 134 Paladin -23.9% 60 Stanmore Coal 63.1% 135 Gujarat NRE -33.8% 60 BC Iron 94.9% 135 Gujarat NRE -26.3% 61 Resource Gen. 63.0% 136 OM Holdings -37.2% 61 Finders 93.1% 136 Platinum Aust. -29.4% 62 Nucoal 58.5% 137 Platinum Aust. -41.1% 62 Riversdale 87.6% 137 Mineral Deposits -36.0% 63 Western Areas 56.1% 138 White Energy -41.5% 63 Nucoal 74.9% 138 OM Holdings -36.6% 64 Riversdale 55.1% 139 NKWE -49.1% 64 Azumah 73.0% 139 NKWE -48.9% 65 Fortescue 54.1% 140 Mincor -50.1% 65 Gold One 72.5% 140 Mincor -50.0% 66 PanAust 52.3% 141 Indophil -59.1% 66 Newcrest 70.0% 141 Indophil -61.9% 67 Hunnu Coal 52.2% 142 Murchison -61.9% 67 Medusa 69.6% 142 Murchison -61.9% 68 OZ Minerals 49.2% 143 ERA -69.2% 68 Rocklands 68.6% 143 ERA -69.2% 69 Integra 46.7% 144 Astron - 69 Perilya 67.4% 144 Astron - 70 Northern Energy 44.7% 145 Guildford - 70 Focus 64.9% 145 Guildford - 71 Troy 42.0% 146 Straits - 71 Integra 63.3% 146 Straits - 72 Moly Mines 40.6% 147 Carabella - 72 Saracen 63.0% 147 Carabella - 73 Flinders 39.5% 148 Sylvania - 73 Hillgrove 61.7% 148 Sylvania - 74 Bougainville Cop. 38.7% 149 Kula - 74 Astron Ltd. 61.5% 149 Kula - 75 Alumina 38.4% 150 Blackgold - 75 Tanami Gold 61.0% 150 Blackgold - 6

- 7. JULY 2011 Base meTaLs - secTor performance Share Price Performance - June 2011 Copper Nickel Zinc Share Price Performance Share Price Performance - Since 31 December 2010 Share Price Performance Share Price Performance - Since 30 June 2010 Share Price Performance 7

- 8. Group 150 coaL - secTor performance Share Price Performance - June 2011 Share Price Performance Share Price Performance - Since 31 December 2010 Share Price Performance Share Price Performance - Since 30 June 2010 Share Price Performance 8

- 9. JULY 2011 diversified - secTor performance indusTriaL mineraLs - secTor performance Share Price Performance - June 2011 Share Price Performance Share Price Performance Share Price Performance - Since 31 December 2010 Share Price Performance Share Price Performance Share Price Performance - Since 30 June 2010 Share Price Performance Share Price Performance 9

- 10. Group 150 GoLd - secTor performance Share Price Performance - June 2011 Share Price Performance Share Price Performance - Since 31 December 2010 Share Price Performance Share Price Performance - Since 30 June 2010 Share Price Performance 10

- 11. JULY 2011 iron ore - secTor performance Share Price Performance - June 2011 Share Price Performance Share Price Performance - Since 31 December 2010 Share Price Performance Share Price Performance - Since 30 June 2010 Share Price Performance 11

- 12. Group 150 pLaTinum - secTor performance uranium - secTor performance Share Price Performance - June 2011 Share Price Performance Share Price Performance Share Price Performance - Since 31 December 2010 Share Price Performance Share Price Performance Share Price Performance - Since 30 June 2010 Share Price Performance Share Price Performance 12

- 13. JULY 2011 consensus commodiTy price forecasTs - June Gold (US$/oz) Silver (US$/OZ) $2,500 $60 $2,000 $50 $1,500 $1,457 $1,413 $34.69 $40 $32.78 $1,231 $1,159 $29.15 $1,500 $30 $20.00 $19.82 $1,000 $20 $500 $10 $0 $0 Spot 2011 2012 2013 2014 Spot 2011 2012 2013 2014 Copper (US$/lb) Nickel (US$/lb) $6.00 $16.00 $4.28 $4.42 $4.54 $11.57 $5.00 $3.87 $10.63 $10.43 $10.29 $3.71 $12.00 $9.75 $4.00 $3.00 $8.00 $2.00 $4.00 $1.00 $0.00 $0.00 Spot 2011 2012 2013 2014 Spot 2011 2012 2013 2014 Zinc (US$/lb) Lead (US$/lb) $1.50 $2.00 $1.07 $1.08 $1.11 $1.11 $1.09 $1.50 $1.22 $1.17 $1.20 $1.00 $1.12 $1.07 $1.00 $0.50 $0.50 $0.00 $0.00 Spot 2011 2012 2013 2014 Spot 2011 2012 2013 2014 Tin (US$/lb) Uranium (US$/lb) $20.00 $100 $17.50 $13.59 $14.06 $64.50 $63.25 $60.00 $15.00 $11.82 $75 $54.10 $10.36 $53.00 $12.50 $9.07 $10.00 $50 $7.50 $5.00 $25 $2.50 $0.00 $0 Spot 2011 2012 2013 2014 Spot 2011 2012 2013 2014 AUD:USD NYMEX (US$/bbl) $1.25 $1.07 $1.04 $200 $1.00 $0.95 $0.95 $1.00 $150 $108.00 $115.00 $94.83 $98.00 $102.00 $0.75 $100 $0.50 $0.25 $50 $0.00 $0 Spot 2011 2012 2013 2014 Spot 2011 2012 2013 2014 Source: Bloomberg Consensus Estimates - Median / High / Low 13

- 14. recenT resources TransacTions Group 150 Mergers and Acquisitions Mergers and Acquisitions 2010 2009 GRAM 2009 2009 2008 2008 2006 Advised BHP Advised BG Advised Guandong Advised Allied Gold Advised Kalahari Advised Gem Advised IAMGOLD Billiton on its Group on its $1bn Rising on its $216m on its $54m Minerals on its Diamonds on its Corporation on its $204m offer for takeover offer for cornerstone acquisition of $140m proposed $300m acquisition $265m acquisition United Minerals Pure Energy investment in Pan Australian merger with of Kimberley of Gallery Gold. Corporation. Resources Aust. Solomons Gold. Extract Resources. Diamonds. Limited. TakeoverDefence Takeover Defence 2010 2010 2010 2009 2009 2007 2007 Advised Polaris Advised Indophil Advised Advised Energy Advised Brandrill Advised Summit Advised Tethyan on Metals NL on on $545m Centaurus Metals on its $86m Limited on its Resources on its its $220m $178m takeover recommended Resources on its proportional takeover $45m takeover A$1.2bn takeover competing takeover offer by Mineral offer from Zijin $20m merger offer by China offer by Ausdrill by Paladin Energy. offer by Crosby and Resources with Glengarry Guangdong Nuclear Limited. Antogafasta/Barrick. Limited. Resources. Power Group. Strategic Advisory, JointJoint Ventures and Capital Markets Strategic Advisory, Ventures and Capital Markets 2010 2010 2009 2008 2009/08 2008 2008 Advised BHP Introduced Advised BHP Advised Advised Iluka on its Advised Advised Iluka Billiton on its Denham Capital to Billiton on the Bannerman $114m Murchison Metals Resources on its US$116bn iron Trans Tasman disposal of the Resources on its institutional on its joint venture $54m Narama coal ore production Resources resulting Yabulu Nickel financing with placement and with Mitsubishi. divestment to joint venture with in NZ iron sands refinery. Resource Capital $353m accelerated Xstrata. Rio Tinto. investment. Funds. right issue. Gresham Advisory Partners Limited A.B.N. 97 003 344 269 Level 17, 167 Macquarie Street, Level 10, 1 Collins Street, Level 3, 28 The Esplanade, Sydney NSW 2000 Melbourne VIC 3000 Perth WA 6000 Telephone: 61 2 9221 5133 Telephone: 61 3 9664 0300 Telephone: 61 8 9486 7077 Facsimile: 61 2 9221 6814 Facsimile: 61 3 9650 7722 Facsimile: 61 8 9486 7024 Website: www.gresham.com.au Terms and Conditions Information contained in this publication The opinions, advice, recommendations and other information contained in this publication, whether express or implied, are published or made by Gresham Advisory Partners Limited (ABN 88 093 611 413), Australian financial services license (247113), and by its officers and employees (collectively “Gresham Advisory Partners”) in good faith in relation to the facts known to it at the time of preparation. Gresham Advisory Partners has prepared this publication without consideration of the investment objectives, financial situation or particular needs of any individual investor, and you should not rely on the publication for the purpose of making a financial decision. To whom this information is provided This publication is only made available to persons who are wholesale clients within the meaning of section 761G of the Corporations Act 2001. This publication is supplied on the condition that it is not passed on to any person who is a retail client within the meaning of section 761G of the Corporations Act 2001. Disclaimer and limitation of liability To the maximum extent permitted by law, Gresham Advisory Partners will not be liable in any way for any loss or damage suffered by you through use or reliance on this information. Gresham Advisory Partners’ liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Gresham Advisory Partners’ option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. No warranties made as to content Gresham Advisory Partners makes no warranty, express or implied, concerning this publication. The publication provided by us on an “AS IS” basis at your sole risk. Gresham Advisory Partners expressly disclaims, to the maximum extent permitted by law, any implied warranty of merchant- ability or fitness for a particular purpose, including any warranty for the use or the results of the use of the publication with respect to its correctness, quality, accuracy, completeness, or reliability. Copyright Copyright in this publication is owned by Gresham Advisory Partners. You may use the information in this publication for your own personal use, but you must not (without Gresham Advisory Partners’ consent) alter, reproduce or distribute any part of this publication, transmit it to any other person or incorporate the information into any other document. General matters These Terms and Conditions are governed by the law in force in the State of Victoria, and the parties irrevocably submit to the non-exclusive jurisdiction of the courts of Victoria and courts of appeal from them for determining any disputes concerning the Terms and Conditions. If the whole or any part of a provision of these Terms and Conditions are void, unenforceable or illegal in a jurisdiction it is severed for that jurisdiction. The remainder of the Terms and Conditions have full force and effect and the validity or enforceability of that provision in any other jurisdiction is not affected. This clause has no effect if the severance alters the basic nature of the Terms and Conditions or is contrary to public policy. If Gresham Advisory Partners do not act in relation to a breach by you of these Terms and Conditions, this does not waive Gresham Advisory Partners’ right to act with respect to subsequent or similar breaches. 14