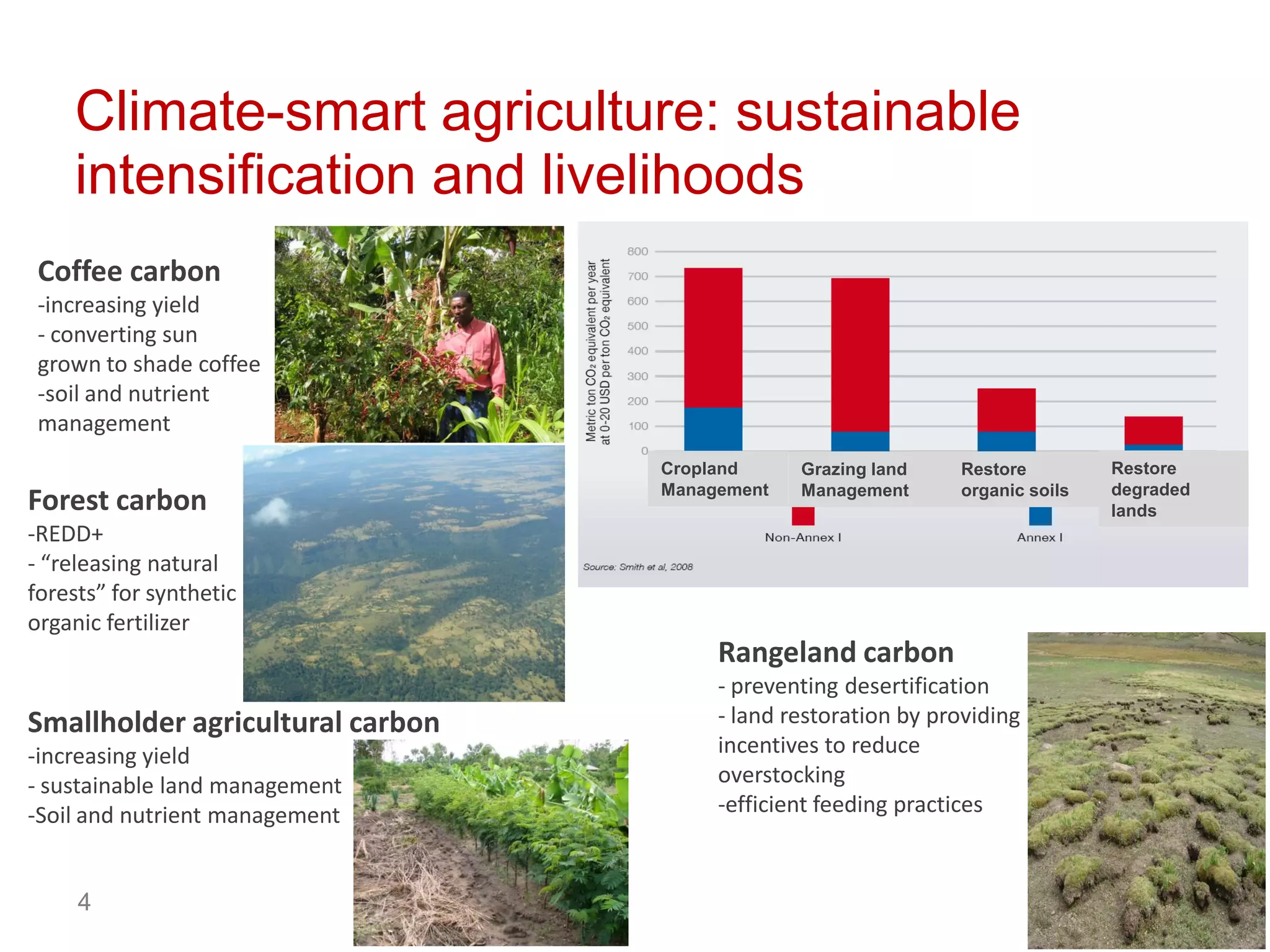

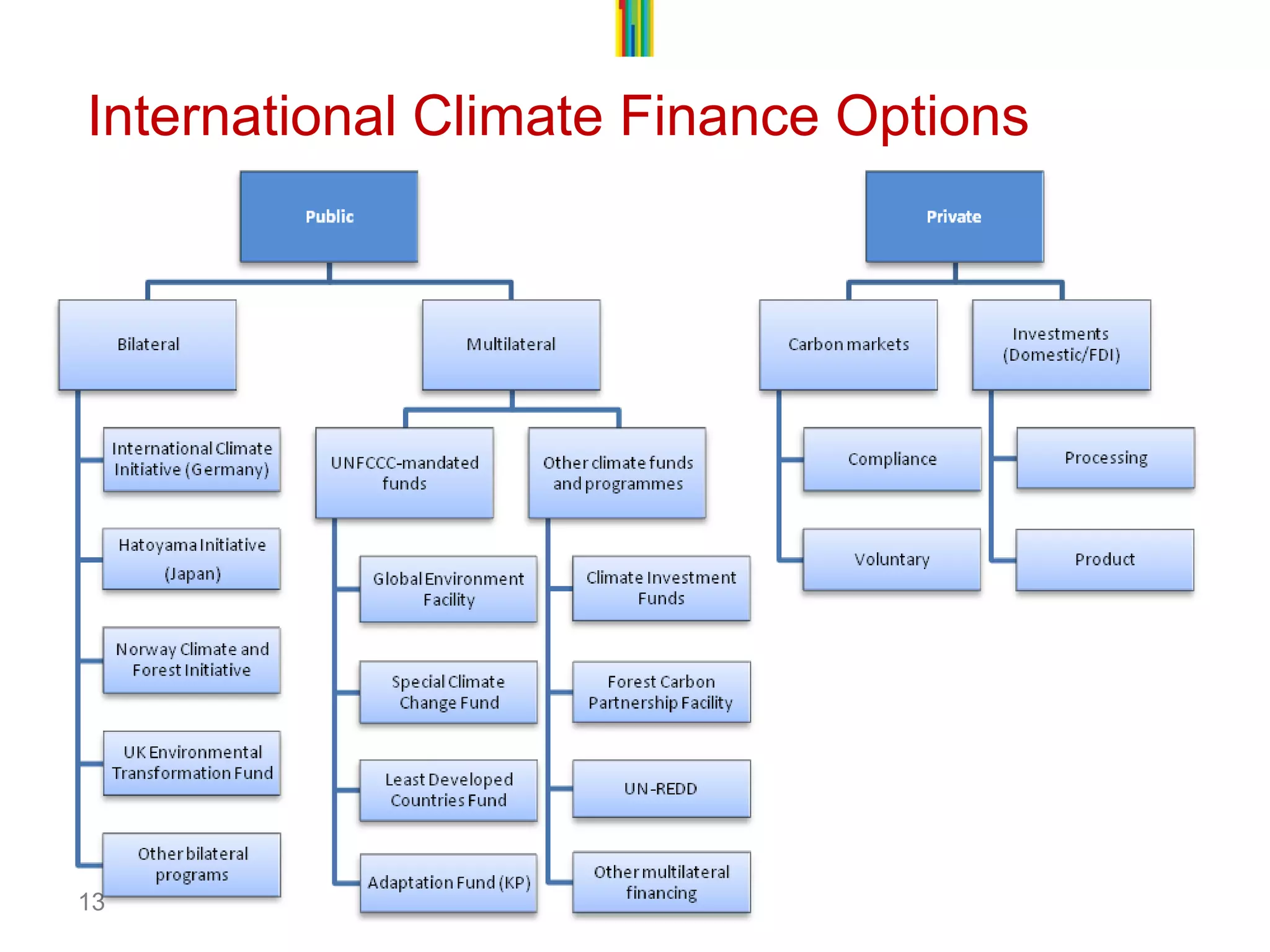

The document discusses the importance of climate-smart agriculture for smallholder farmers, focusing on sustainable practices that address food security, climate change, and resilience. It emphasizes the need to overcome financial, social, and technical barriers to implement climate-smart practices, while highlighting the role of climate finance in providing direct incentives and investment opportunities. The implementation of climate finance is described in three phases, aiming to scale up sustainable agricultural practices through private capital and supportive public finance.