Embed presentation

Downloaded 64 times

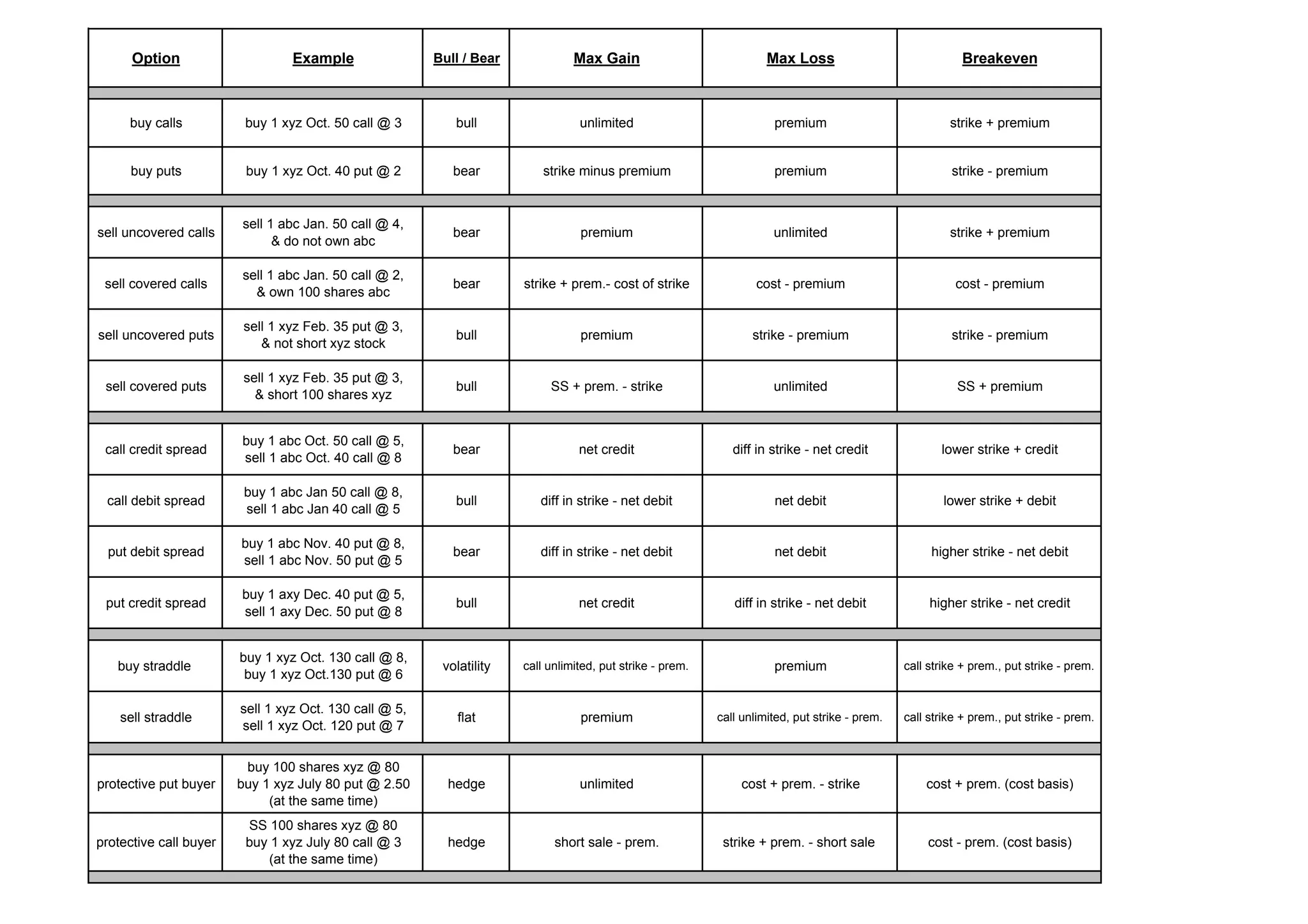

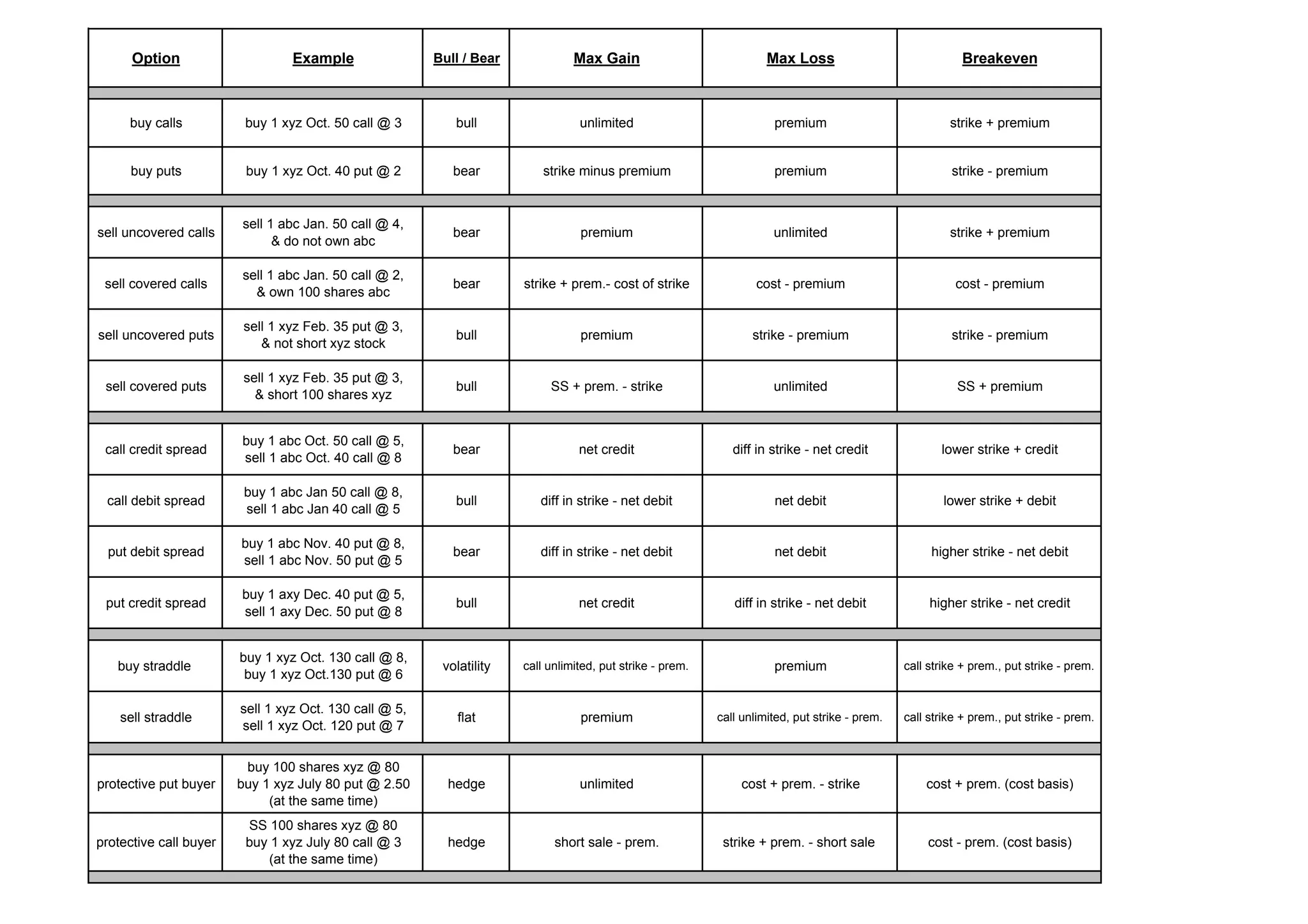

This document outlines various bullish, bearish, and neutral options strategies including their maximum potential gain, maximum possible loss, and breakeven points. It provides examples of buying or selling calls, puts, straddles, spreads, and using options to hedge an existing stock position.