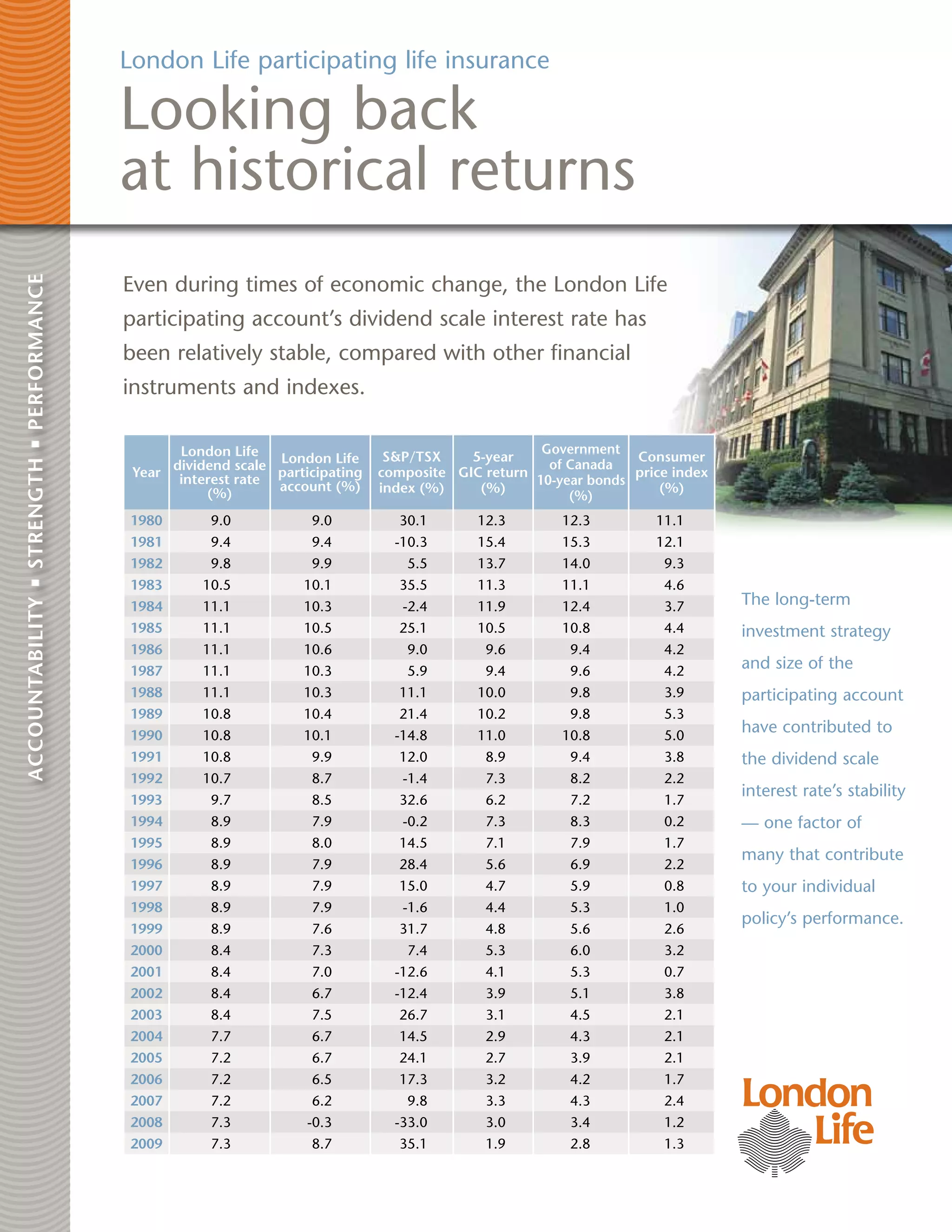

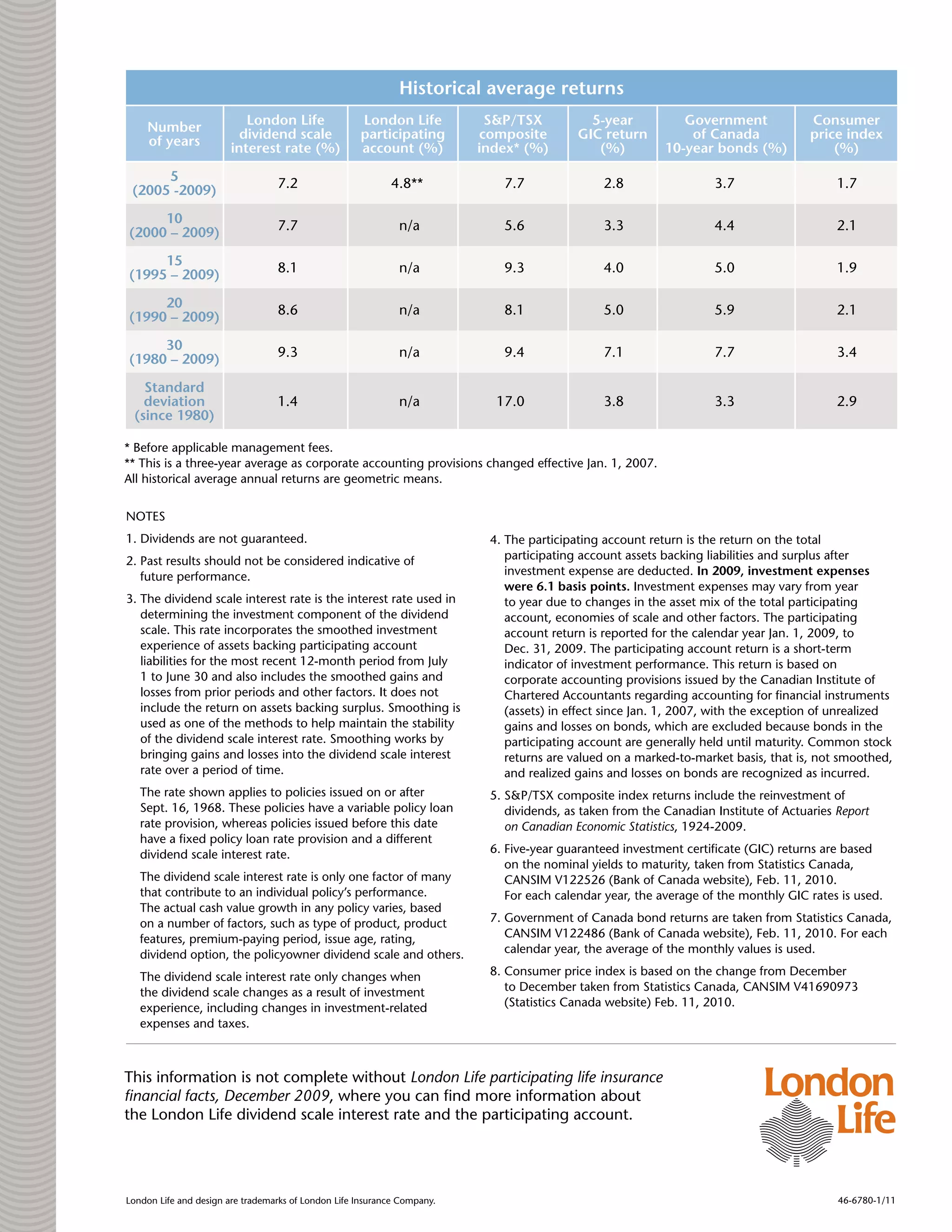

The document compares the historical returns of London Life's participating life insurance account to various other financial indexes from 1980 to 2009. Over the short, medium, and long term, the dividend scale interest rate of the participating account has remained relatively stable compared to indexes like the S&P/TSX Composite and consumer price index, demonstrating the stability provided by the long-term strategy and size of the participating account.