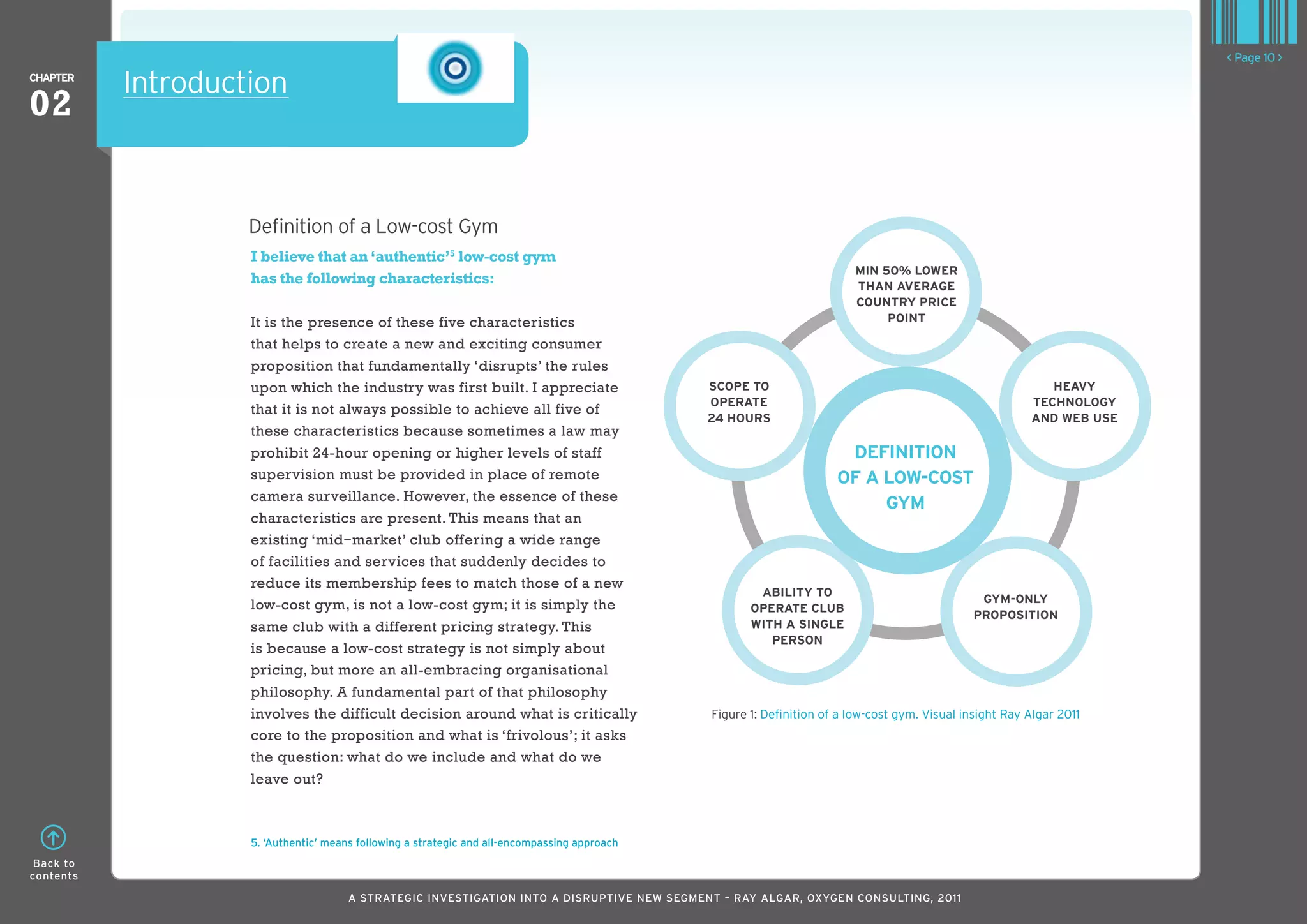

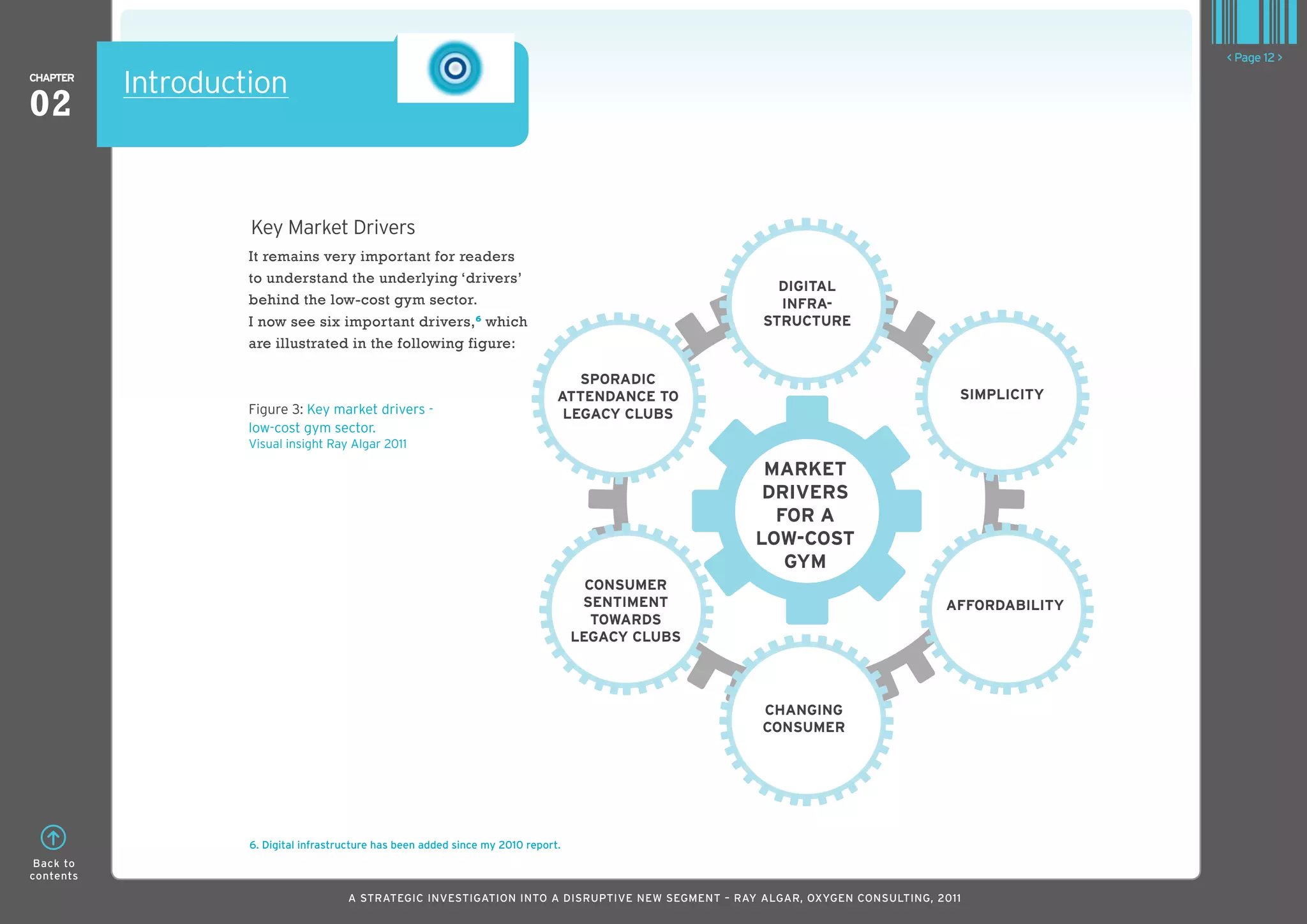

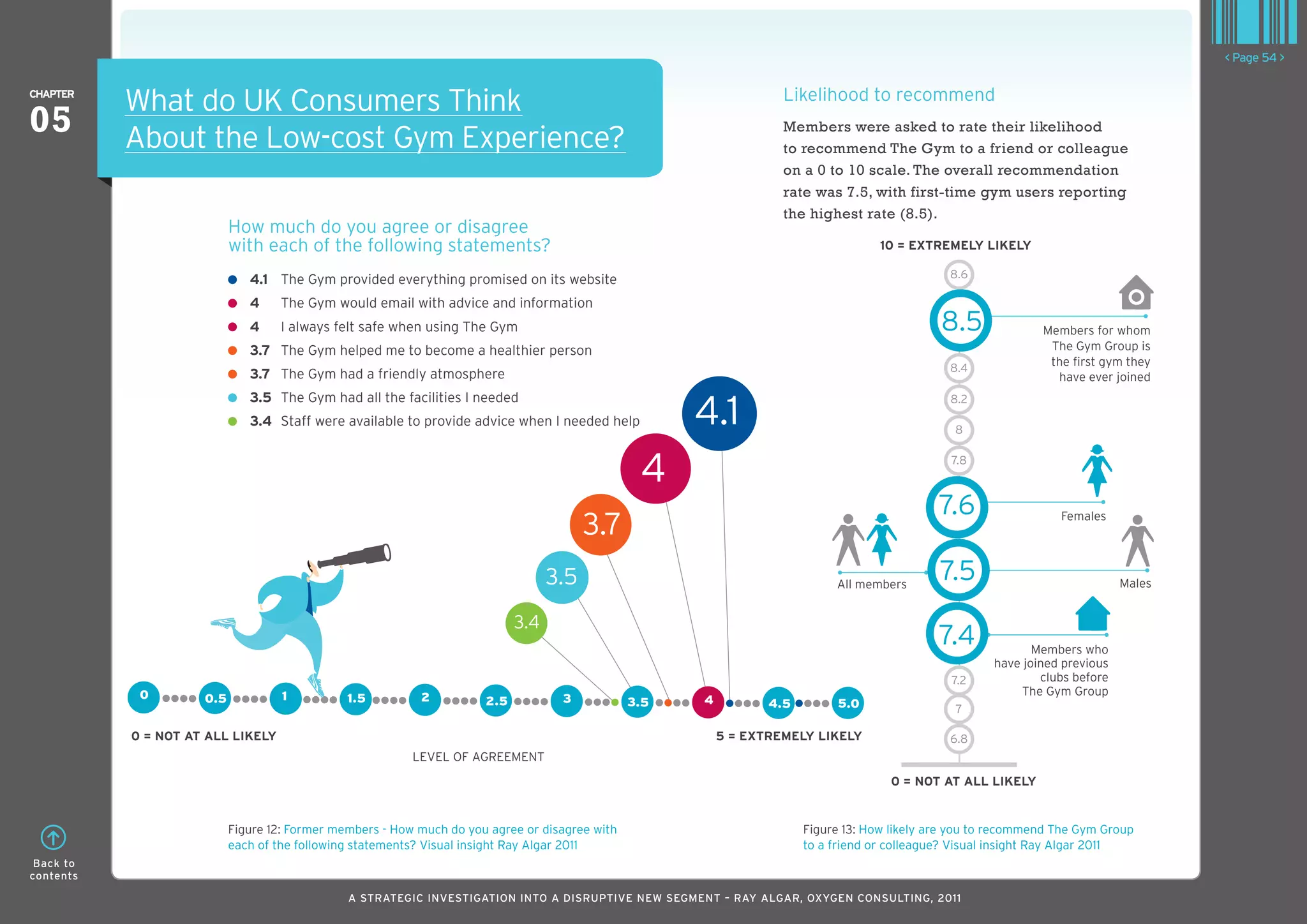

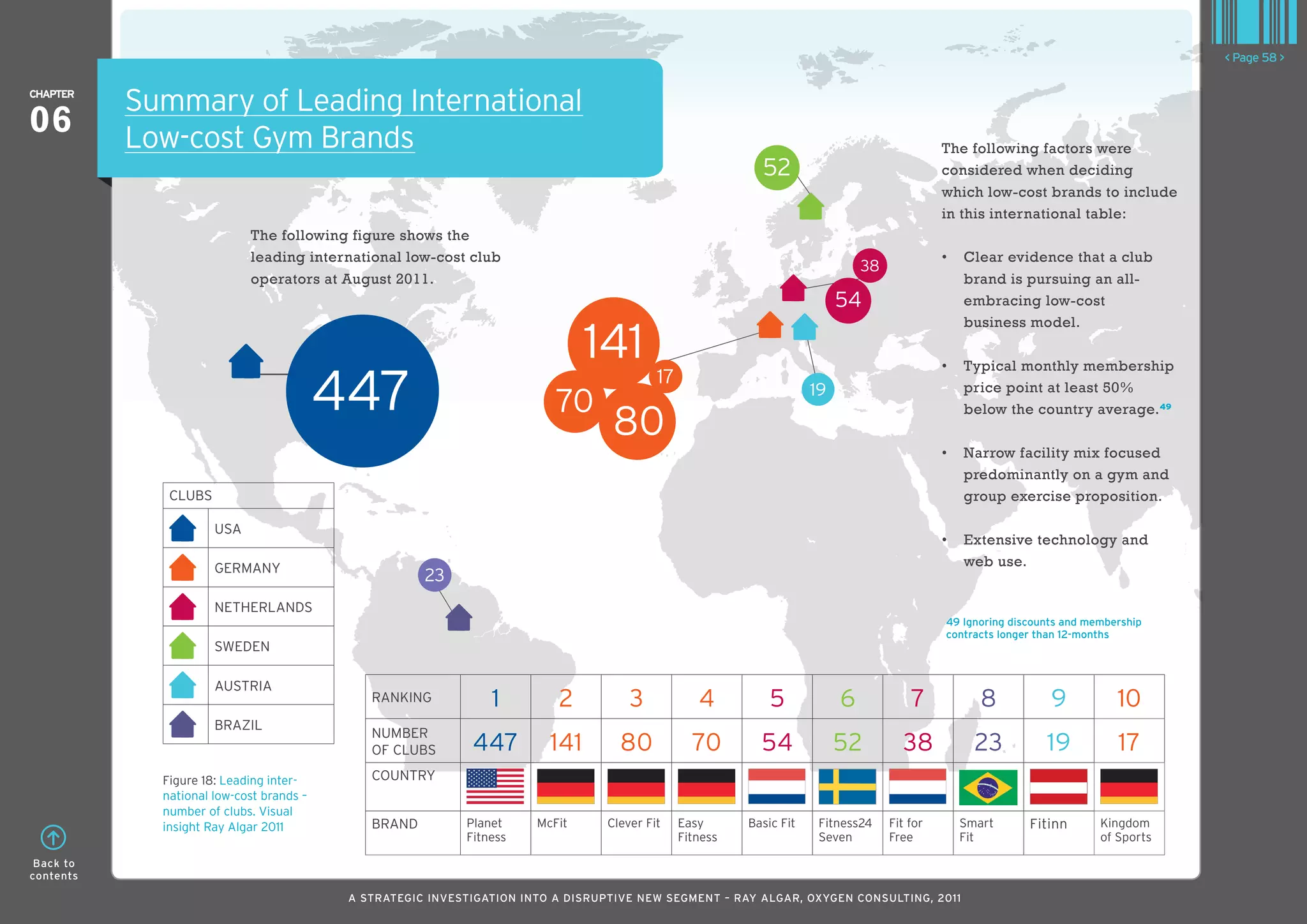

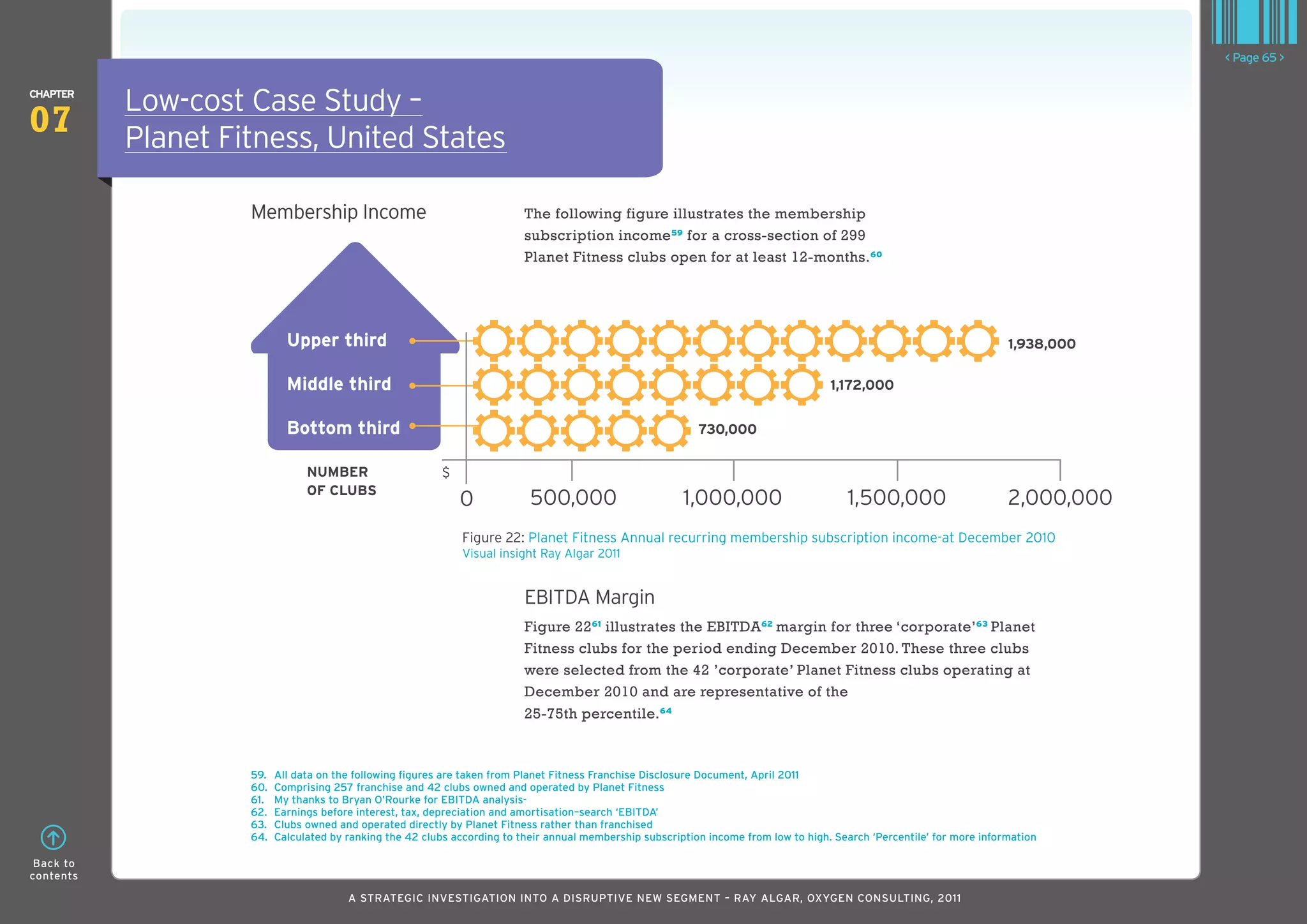

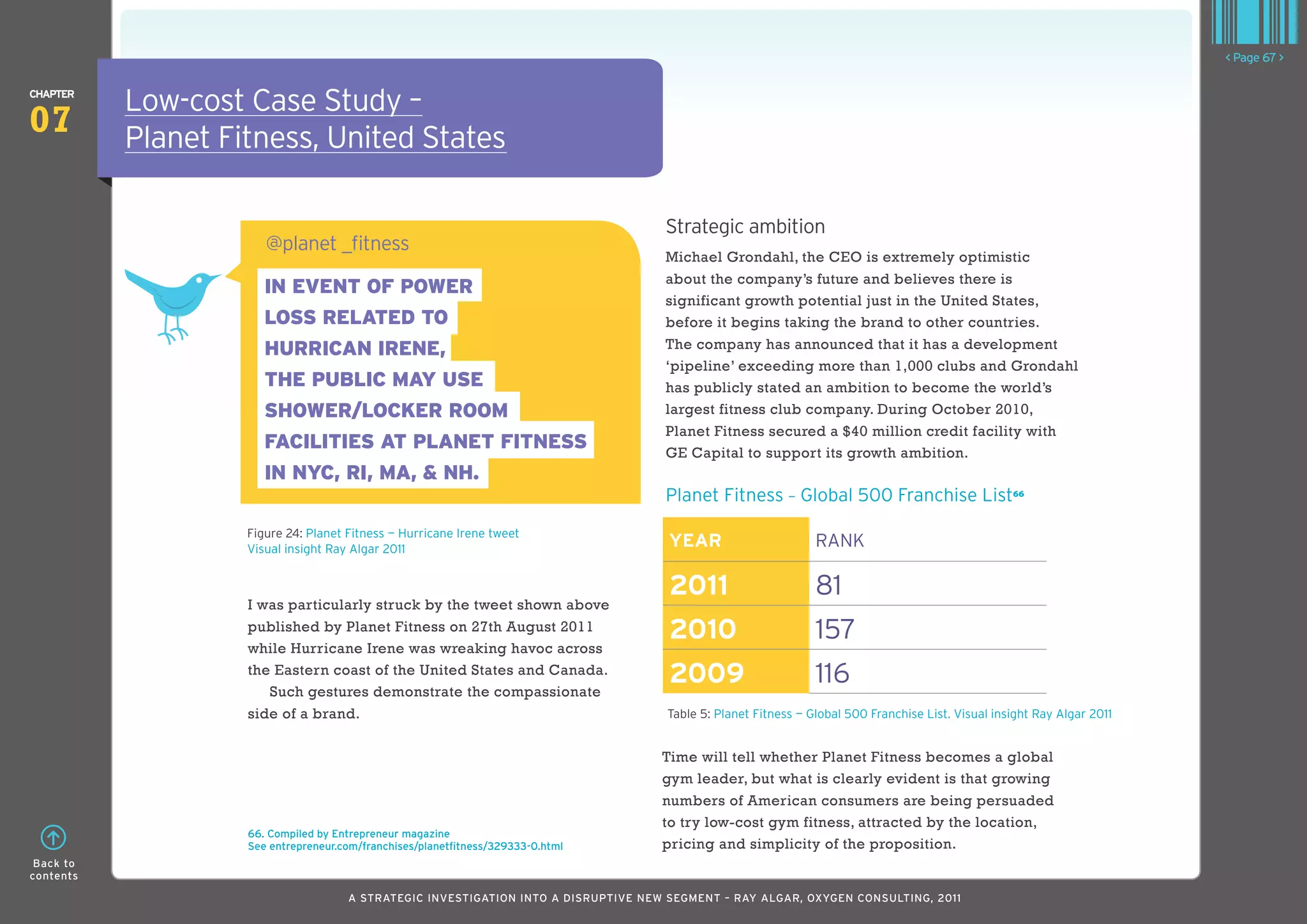

The 2011 global low-cost gym sector report by Ray Algar emphasizes the international emergence of low-cost gyms, drawing on strategic analysis and consumer insights. It explores consumer attitudes towards these gyms and includes interviews with key industry figures, providing a comprehensive view of this disruptive segment. The report also outlines the fundamental characteristics and market drivers of low-cost gyms, highlighting their potential for growth and transformation within the fitness industry.