2 gst-levy and collection

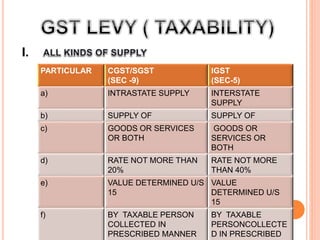

- 1. PARTICULAR CGST/SGST (SEC -9) IGST (SEC-5) a) INTRASTATE SUPPLY INTERSTATE SUPPLY b) SUPPLY OF SUPPLY OF c) GOODS OR SERVICES OR BOTH GOODS OR SERVICES OR BOTH d) RATE NOT MORE THAN 20% RATE NOT MORE THAN 40% e) VALUE DETERMINED U/S 15 VALUE DETERMINED U/S 15 f) BY TAXABLE PERSON COLLECTED IN PRESCRIBED MANNER BY TAXABLE PERSONCOLLECTE D IN PRESCRIBED I.

- 2. II. III. IV.

- 3. INTER-STATE VS INTRA-STATE SUPPLIES ( SEC7-) IGST Location of supplier and place of supply In the same state Different state or UT Intrastate supply Interstate Import of goods and services And Export of goods and services

- 4. PLACE OF SUPPLY OF GOODS Section 10(1)(a) When supply involves movement of goods Location of goods at the time at which movement terminates for delivery to recipient Section 10(1)(b) When goods supplied on direction of the third person Section 10(1)(c) When supply does not involves movement of goods Principal place of business of the third person(i.e., address in Registration certificate Location of goods at the time of delivery to the recipient Section 10(1)(d) When goods are assembled or installed Place of installation or assembly Section 10(1)(e) When goods supplied on board a conveyance e.g. vessel, aircraft , train, vehicle etc. Location at which such goods are taken on board Section 10(2) When place of supply can not be determined in above sub sections Place of supply shall be determined in such manner as may be prescribed

- 5. PLACE OF SUPPLY OF GOODS IN CASE OF IMPORT OR EXPORT Section 11(a) When goods are imported into India Location of the importer Section 11(b) When goods are exported from India location outside India

- 6. PLACE OF SUPPLY OF SERVICES- GENERAL RULE B2B (Registered) B2C (Unregistered) Location of such person Recipient address available No address available Location of such recipient Location of such supplier

- 7. Supply of Goods / services/RCM Time of supply Taxability of taxable person Rate of tax Valuation of supply Location of supply & location of supplier Tax payments Intrastate Interstate Check your taxability Different State

- 8. Section 12(3) Immovable property Section 12(4) Restaurant &performance related Section 12(5) Training &performance appraisal Section 12(6) Venue based service Location of property / boat vessel Location where the services are actually performed Registered recipient: location of recipient Unregistered recipient: place of performance Venue of event/ Park Location PLACE OF SUPPLY OF SERVICES- SPECIAL CASES

- 9. Section 12(7) Organization of event, art, culture etc Section 12(8) Transportation of goods including by mail or courier Section 12(9) Passenger transport Section 12(10) Services on board conveyance Registered recipient: Location of recipient Unregistered recipient :Venue of event Registered recipient: Location of recipient Unregistered recipient: Location where goods are handover for transportation Registered recipient: place of registered recipie Unregistered recipient: place where passenger embarks on the conveyance for continuous journey First schedule point of departure of that conveyance

- 10. Section 12(11) Telecommunicatio n services Services of fixed line postpaid Prepaid Section 12(12) Banking and other financial services Section 12(13) Insurance services Section 12(14) Advertisement Services to government etc •Location of installation of fixed line, cable etc. •Location of billing address of recipient •Location where prepaid payment is received •Location of recipients in supplier’s records (if not available, location of supplier) Registered recipient: location of recipient Unregistered recipient: location o recipient in supplies record If Place of supply is in identifiable state then that State , if supply is in more than one state then proportionate Allocation amongst state

- 11. PLACE OF SUPPLY OF SERVICES WHERE LOCATION OF SUPPLIER OR RECIPIENT IS OUTSIDE INDIA Performance based Services : Sec 13(13) a) Services on goods made physically available by the recipient b) Services requiring physically presence of individual Location Where services actually performed Services directly in relation to an immovable property. Sec13(4) Location of immovable property Services by way of admission to organizing an event etc. and ancillary services Place where event is actually held Services referred in sub sec 3,4,5 supplied in more than one location including taxable territory TT Where greatest proportion of service done Services referred in sub sec-3,4,5 or 6 when supplied in more than one state.sec ds13(7) Proportionate allocations amongst states based on contract or on some reasonable basis

- 12. Banking services to account holders, intermediary services ,hiring of means of transport(other than aircraft &vessel) up to 1month. Sec 13(8) Transportation of goods (other than by way of mail/courier. Sec13(9) Passenger transportation service Sec13(10) Service provided on board a conveyance.Sec 13(11) Location of supplier Place of destination of goods Place where passenger embark on the conveyance First schedule point of departure of that conveyance for that journey Online information and data base access or retrieval services. Sec.13(12) Location of recipient To prevent double taxation/non taxation, or for the uniform application of rules, CG Has power to notify services/circumstances. Sec.13(13) Place of effective use and enjoyment of a service

- 13. where supply involves movement of goods Example-1 : A distributor in West Bengal procures LED lights from a wholesaler in Gujarat on FOR basis. The terms of the contract requires the carrier to be arranged by the supplier and the supply will be complete only if the goods reach the destination safely. Here, the movement of goods is made by the supplier. So, the location where the movement terminates i.e. West Bengal will be the place of supply where goods are delivered by supplier to a recipient or any other person Example-2 : A wholesaler in Jharkhand asks a manufacturer in Maharashtra to directly deliver paper reams to a retailer in Gujarat. Here, there will be two supplies that will be deemed to have taken place. Here First supply will be the supply between the manufacturer in Maharashtra and wholesaler in Jharkhand for which the place of supply will be Jharkhand. The second will be the supply between the wholesaler in Jharkhand and the retailer in Gujarat for which the place of supply will be Gujarat. Example-3 : An agent in Kolkata procures an order from a dealer in New Delhi for delivery to his principal at Mumbai. Since, the goods are delivered on direction of a third person (agent in Kolkata), the first supply will be the principal place of business of the agent i.e. Kolkata. The second supply will be between the agent in Kolkata and the principal in Mumbai for which the place of supply will be Mumbai. where supply doesnot involve movement of goods Example-4 : Mr. A situated in Delhi enters into a contract with Mr. B situated in Karnataka for sale of goods on ex- works basis where point of delivery is factory of Mr. A. Here the place of supply will be Delhi ( factory of Mr. A) where movement of goods for delivery terminates. Here the supply will be treated at Delhi, even though goods Subsequently move to Karnataka. Example-5 ' Suppose Mr. A (Delhi) has hired a machine from Mr. B ( Haryana ). Subsequently Mr. A has offered Mr. 8 to buy the machinery. Here the location of goods will be Delhi as it does not involves any movement of goods.

- 14. Where goods are assembled or installed at site Example-6 A modular furniture manufacturer in Mumbai sends its personnel to a client based at Kolkata. The furniture is brought in dismantled form to the office at Kolkata and assembled at the client's place. Here, the place of supply will be Kolkata as it is the place of assembly/ installation. Where the goods are supplied on board a conveyance, such as a vessel, an aircraft, a train or motor vehicle Example-7 A flight from Guwahati to Mumbai goes via Kolkata. Some merchandise is served to passengers on a chargeable basis within the flight. The merchandise is taken on board at Kolkata and is served in between the journey from Kolkata to Mumbai. The place of supply will be Kolkata where the merchandise has been taken on board.

- 15. Immovable property related services Example-8 X Ltd. hires and expert to determine the standard room rent for each of its hotel located in Kolkata, Mumbai and Chennai. The expert charges Rs. 150000. The place of supply in this case will be Kolkata, Mumbai and Chennai and Value of supply will be Rs. 50000 each (Assume equal service supplied). Restaurant & performance based service Example-9 A hair cutting saloon is a very famous saloon in Goa. Film actor comes to Goa for hair cutting. The services of hair cutting is provided in Goa. Therefore place of provision of service will be Goa irrespective of location of person coming for saloon services . Training and performance appraisal services Example-10 Mr. A is providing training on GST to corporate houses in the country. He provides training to ABC Ltd. (Place of business is Maharashtra). However training is actually conducted at GOA. Though training is done at GOA but place of supply will be Maharashtra. If ABC Ltd. is not registered then place of supply will be GOA. Event based services Example-11 A Ltd. (based in West Bengal), is an event management company and organizes conferences / events / program across the country. B Ltd. (based in Maharashtra),hires A Ltd. to organize a conference in Jaipur. If B Ltd. is a registered then place of supply will be Maharashtra otherwise Jaipur. If B Ltd. requires A Ltd. to organize the program at Singapore then place of supply will be Maharashtra.

- 16. Transportation of goods including by mail or courier Example-12 X Ltd. (based in Uttar Pradesh) is a transportation company and provides service to Y Ltd. (based in Mumbai) for transportation of material from Uttar Pradesh to Madhya Pradesh. If Y Ltd. is registered then place of supply will be Maharashtra otherwise UP. Passenger Transportation services Example-13 X Ltd. (Gujarat) has a fleet of buses and provides passenger transportation service. ABC Ltd. (MP) hires X Ltd. for transportation of its employee through its buses from Mumbai to Goa. If ABC Ltd. is registered the place of supply will be MP otherwise Mumbai. Service on board a conveyance Example-14 A Rajdhani train originated from Delhi to Chennai .The food is loaded at Agra . Here the place of provision of service will be first point of departure i.e. Delhi .

- 17. Telecommunication services Example-15 In case of fixed telephone lines, the telephone instrument is installed at the premises of recipient. Similarly the set-up box or dish antenna is installed at the premises of recipient. These equipment are fixed in position for the purpose of receiving the services. Therefore if these equipment are installed at the residence say in Mumbai then place of supply will be Mumbai. Example-16 A telephone service provider is located in Delhi has a postpaid subscriber located in Delhi. Here service provider has billing address of service receiver at Delhi. Since the Service provider and receiver both are located in Delhi ,CGST and SGST will be charged. But suppose subscriber has shifted to Gurgaon without any information to telephone Company still, the company will continue to charge the CGST and SGST. Example-17 M/s Airtel ( Haryana) sells the recharge voucher to its selling agent (across the India) who in turn sells the voucher to final consumer. The place of supply of voucher will be the location of selling agent as per the records of the M/s Airtel. Banking & Financial Service including stock broking Example-18 Mr. A (Rajasthan) goes to Shimla and takes a DD at HDFC Bank, Shimla. Here the place of supply will be Rajasthan if the DD is made through account, otherwise Shimla.

- 18. Insurance Service Example-19 Mr. A (Jaipur) shifted to Mumbai where he takes his Insurance for his car from ICICI Lombard Insurance Company there. While shifting to Mumbai he has not informed to the insurance company for change of address . Here the place of supply will be Jaipur as per the records of Insurance Company. But if he has updated the address in the records of insurance company then the place of supply will be Mumbai. Example-20 A company M/S XYZ ltd, is registered at Gurgaon has three other offices at Delhi, Noida and Agra. For stock in trade on all these three offices it has got insurance from United India Insurance Co ltd.(Mumbai). Here the place of supply will be Gurgaon, where the XYZ ltd is registered . Place of assets has no relevance in determining the place of supply of service. Advertisement services to CG, SG, Statutory body or a local authority Example-21 A company say M/S ABC advertisement company ltd. is hired by a Government for the promotion of "Beti Bachao Beti Paro ho ". For this purpose Government has asked the company to put 100 hoarding in UP, 100 in MP and So In Uttarakhand. The contract also mentioned-the consideration payable for each of the states. Hence the value of supply in each State will be as per contract. In case the contract does not mention about the allocation for each of the states, then the value of hoarding will be determined on some reasonable basis. The number of hoarding in each states will be the reasonable basis.

- 19. Performance based services – Any one of Supplier or recipient outside india Example-22 An engineering firm located in India deputes its engineers to undertake repairs at Power Plant in Bhutan. The POP will be Bhutan i.e. the place of service actually performed. Example-23 Maintenance of information technology software installed in the computer located in Mumbai and service of maintenance of this software are provided by a company located in USA. The company provides the services on 24X7 basis through electronic media i.e. computer. Since in this case, the software is located in Mumbai the POP will be Mumbai. Example-24 An actor located in Mumbai requiring fitness services of Mr. X from USA in Mumbai. The POP will be Mumbai. Example-25 A company located in Afghanistan, sent a machine for repairs in India and after repairing it is sent back to Afghanistan .In this case place of provision will be of recipient i.e.. Afghanistan subject to fulfilment of all condition. and proviso of Section 10(3) provides that place of supply of service in case of services provided in respect of goods that are temporarily imported to India for repairs and are exported after repair without put to use in India will not be governed by section 10(3) Therefore "provision of subsection (2) will apply and the place of provision of service would be location of recipient. Following conditions must be satisfied:- Services shall be rendered in respect of goods temporarily imported into India. Services shall be for repairs After repair goods must be exported without being put to use. If the above conditions are satisfied GST will not be payable on services of repairs provided by the supplier. Here it is mentioned that section does not provides the time limit within which goods are to be exported after import. Therefore goods can be exported any time after repairs.

- 20. Service directly in relation to an immovable property Example-26 Mr. A an architect, located in Mumbai, contracted for his service, to design the landscaping of a particular resort in Dubai. The POP will be Dubai i.e. location of immovable property. Service by way of admission of events/ cultural/ artistic/ sporting/ scientific/ educational/ entertainment events/ including supply of services in relation to conference / exhibition/ sponsorship & ancillary services Example-27 Management school located in USA organizes a road show in Mumbai for prospective student. Any service provided by the event manager' or right to entry (participation fees for prospective students) will be taxable in India i.e. Mumbai. When supplied in more than one location including taxable territory Example-28 A coaching institute organizes a study tour to UK, US and India for 10 days and out of this 7 days are spent in UK and US. In respect of India it is performed 2 days in Mumbai and 1 day in Delhi. Even though 7 days of service has been performed in the non-taxable territory, yet as per this rule service deemed to have been performed in India and entire value of service will be liable to GST. When supplied in more than one state or UT Example-29 In continuation of the above example, if there is an agreement for performing the coaching in India and the agreement may provide the charges which are payable for holding the event in each of the state. If so provided the value of service for holding the event shall be determined based upon the value indicated in the agreement. If not then reasonable basis is required to be adopted for determination of value of service. Reasonable basis in this case is proportion of the days spent in the Mumbai and Delhi.

- 21. Specified services including intermediary services Example-30 Yes Bank is having 1000 branches in all over India and registered centrally at Mumbai. Mr. Y located outside India opens a bank a/c in Delhi branch of Yes Bank and gets services from it. The place of provision of service will be Delhi. Example-31 Mr. X (India) engaged in selling the tour conducted by M/s Y (USA). M/S. Y has provided to Mr. X with pamphlet which assist him to selling the tour. Mr. X is therefore engaged in facilitating the supply of services of tour to customer. Therefore, he will be considered as intermediary and the place of service shall - be India where Mr. X is located. Example-32 A call centre in Haryana hires 25 Tata sumo from Delhi for 25 days. Here as per this rule POP will be Delhi. If hired for 35 days POP will be Haryana. Transportation of goods other than by way of mail or courier Example-33 Mr. X (Gujarat) imported goods from Mr. Y (USA)with the service of shipping Co in USA. The Shipping Co. (Service Provider) is in non-taxable territory and Mr. X being in taxable territory in Gujarat. Here POP will be destination of goods i.e. Gujarat Transportation of passenger Example-34 To travel on Delhi - London - Delhi (a) If single ticket is issued with halt on either side will be covered in continuous journey and the place of provision of service shall be Delhi. (b)If separate ticket is issued and he stays in London for some time and embark at London then place of provision of service shall be London. Service on board a conveyance Example-35 In a flight from Delhi-Jammu-Mumbai, Video entertainment was provided in the Jammu - Mumbai leg. In this case the POP of this service will be Delhi (starting point of conveyance) which is in TT so taxable.

- 22. Invoice Time limit for issue of Tax invoice Supply of Goods Before or at the time of (a) removal of goods for supply to the recipient, where the supply involves movement of goods delivery of goods or making available thereof to the recipient, in any other case (b) Supply of service Before or after the provision of service but within a period prescribed in this behalf Continuous supply of Before or at the time each such statement is issued or, as the case may be, goods (where each such payment is received successive statements of accounts or successive payments are involved) Supply of goods sent or Before or at the time when it becomes known that the supply has taken taken on approval or place or six months from the date of removal, whichever is earlier sale or return or similar terms

- 23. Invoice Time limit for issue of Tax invoice Continuous of services supply (a) due date of payment is ascertainable from the contract - before or after the payment is liable to be made recipient but within a period prescribed in this whether or not any payment has been received supplier of the service by the behalf by the (b) been received by the supplier of the contract - before or after each such time service from the when the supplier of service receives the payment but within a period prescribed in this behalf payment is linked to the completion of an event - before or after the time of completion of that event but within a period prescribed in this behalf supply of services ceases under a contract before the completion of the supply - at the time when the supply ceases and such invoice shall be issued to the extent of the supply effected before such cessation (c) (d)

- 24. Question Amount a) Value of import under customs valuation 100000 b) Value of invoice as per supplier 90000 c) BCD Rate @10% d) IGST @ 18% I Bill of entry for importer customs valuation 1,00,000 Add: BCD@ 10% 10,000 1,10,000 Add: IGST @ 18% 19,800 1,29,800 II Invoice of manufacturers to wholesaler Intrastate Supply value 1,50,000 Add:CGST @9% 13,500 Add:SGST @9% 13,500 1,77,000 III CST payable by manufacturer Particulars SGST CGST Output tax 13,500 13,500 ITC 6,300 13,500 Tax payable 7,200 Answer