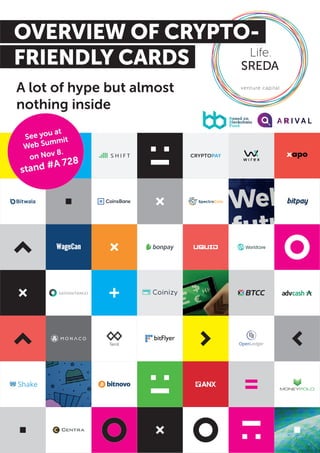

All 25 Crypto-Friendly Bank Cards

- 1. A lot of hype but almost nothing inside OVERVIEW OF CRYPTO- FRIENDLY CARDS See you at Web Summit on Nov 8. stand #A 728

- 2. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside Most cards are issued on the platform of the Gibraltar payment company WaveCrest Holdings, the second largest issuer is the US Metropolitan Commercial Bank. New partners coming to the market – Wirecard and MatchMove. Whatever the difference is in the description of projects - the capabilities of the cards are 99% identical. In fact, you issue a bank debit/prepaid Visa/Mastercard and give a fairly simple mobile application where you can track your transactions and make simple transfers. If compared with neo-banks in fintech – functionality is at the 3-5 years old level. The only exception - they work with crypto-currencies. The key parameters of the cards are approximately the same for all of them: 1-3 curren- cies (USD, EUR, GBP), $10-20 for issuance of a card, $10-15 annual maintenance fee, lifetime limit is about $1000 unless account verified, verification requires ID and proof of address, even if verified maximum limit on withdrawing cash is about $2000. From the point of view of working with crypto-currencies – most projects work only with bitcoins. Few also allow ether, litecoin, dash and other altcoins. Most of them – available only for citizens of the European Union, several projects - for US residents. Earlier there were less strict loyal conditions and the cards had been issued for residents of other countries, but now Visa and Mastercard have prohibited the issuance of such cards for non-EU and non-US residents. Most of crypto-friendly cards issued on Visa (and structured in Hong Kong). All existing cards are for retail customers use - there are no solutions for small and medium businesses. Limits on card spending are such that they are suitable for buying coffees, shopping for T-shirts and jeans, but for more serious purposes – no. In the past, you had to go to an exchange, and sell your cryptocurrency for a USD. After that, you moved your fiat currency into your bank account and maybe convert is into a national fiat currency. And only then, finally, could you spend it. Crypto debit cards, instead of pulling funds from your bank account, pull them from a cryptocurrency wallet. Cryptocurrency debit cards are out from different startups, and are growing in number. Are crypto-friendly debit cards the real deal? Altogether, there are over 30 blockchain-based debit cards out on the payments market. “Since cryptocurrency is a form of digital currency, a crypto-debit card could simply link to your crypto bank account much like a traditional debit card” explains Evan Tarver, an investments analyst at FitSmallBusiness.com. With the number of crypto-debit cards rising, along with the number of cryptocurrency users skyrocketing (the cryptocurrency market cap is up 800% through the end of August, 2017, with bitcoin accounting for half of the growth), the industry aim is to get consumers comfortable with cryptos as “real money.” Unsurprising, none of these cards seem to have caught on beyond a handful of hyper- niche users. The primary reason is likely that there is no real advantage to using them. Spending is the challenge. With more than 900 cryptocur- rencies out there, access to opportunities for earning, trading and investing them has not been a problem. The challenge now is how to spend them in the real world. The new thing, however, is that we can now use crypto debit cards - a bridge between the crypto world and the bank-card point-of- sale world that everyone is familiar with. Crypto debit cards are frictionless for beginners. They’re trying to make crypto mainstream for regular consumers. Unfortunately, very few merchants – either online or offline – accept bitcoin payments directly, which may make it difficult to spend bitcoin and altcoins for the foreseeable future. Crypto debit cards work just like any other debit card at the point of sale or ATM. Instead of drawing from a bank account, however, the card draws from a cryptocurrency wallet. When you make a purchase with a crypto debit card, only the amount of cryptocurrency you need is sold for fiat currency. That fiat currency is then sent to the merchant in a seamless process you aren’t even aware of. “When you buy something online or use a point-of- service purchase, you simply use your debit card the regular way. The only difference is that you pay with your cryptocurrency rather than with actual cash.” Here it should be noted that often it does not work technically at all: a start-up that launches such a card, makes a deposit at the partner bank where it operates, and the partner bank writes off custom- er transactions from this deposit (but the mutual settle- ment of the start-up with the client conversions for these transactions occur later). And the deposits of these start-ups from partner banks are not so big - which suggests that the number of customers and turnover they have so far very small. In fact - it’s just fashionable additional cards in the purse for geeks and other trendy early adopters, and not a full replacement of the main bank cards. Points of sale that accept the payment of a crypto (usually more for additional PR than for a real increase in business) is very small. And partner banks for such start-ups are not yet ready to take on the risk of funding such transactions at their own expense. 02

- 3. 03 Name Daily withdrawal limit BV - before verification AV - after verification Limit w/o verification PriceType Cryptos Wallet/ Exchange 1 Shift Card Xapo Uquid Cryptopay Wirex SHAKE Bitwala CoinsBank SpectroCoin BitPay Wagecan ANX BonPay ADV Cash Worldcore SatoshiTango Debit Card Bitnovo Coinizy MoneyPolo BTCC BITCOIN CARD $200-500 $N/A $400 $2,000 $400 $2,000 $400 $2,000 $400 $2,000 $400 $2,000 $400 $2,000 $400 $2,000 $400 $2,000 $N/A $3,000 $100 $2,000 $ N/A $2,000 $400 $2,000 $ N/A $3,000 $ N/A $4,000 $750 $5,000 $2,500 unlimited $1,500 $1,500 $1,000 $1,000 $1,000 $800 $1,000 $1,000 $ 1,000 $ 1,000 $ 2,500 $2,500 $1,000 $0 $0 $1,000 $2,500 $2,500 $10,00 $20,00 $16,99 $15,00 $15,00 $17,00 $8,00 $8,00 $20,00 $15,00 $10,00 $15,40 $15,00 $4,99 $20,00 $15,00 $0,00 $13,00 Already on the market Coming soon Coinbase XAPO Uquid wallet Cryptopay Bitcoin wallet Wirex wallet Shakepay Bitwala Bitcoin Wallet CoinsBank SpectroCoin BitPay Wallet Wagecan wallet ANX Vault Bonpay Wallet ADV e-wallet BTCC 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 MONACO TENX BITFLYER OCASH CENTRA CRYPTO $400 $2000 $1,000 $1,000 $7,500 $1000 $15,00TENX Bitflyer OpenLedger 21 22 23 24 25 Key crypto-friendly cards Markets US Europe Europe Europe Europe Europe Europe Europe Europe US, Europe Europe Europe Europe Europe 130+ countries* 130 countries* 50 countries* Argentina Europe* * according to the company website / information Analysis provided by: Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 4. 04 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside TRADITIONAL BANKS HATE CRYPTO Various banks around the world are not too happy about people buying bitcoin. We have seen multiple banks close customer accounts because of this activity. This is not a positive development by any means. It now seems TD Bank is actually trying to block bitcoin purchases as well, although the company is mainly performing routine checks by the looks of things. It is never good to see banks call up customers and ask them why they want to buy bitcoin. In some cases, users will buy bitcoin and suddenly see their preferred payment method declined. One user claims that his TD Bank credit card was “blocked” while buying bitcoin and the bank had no intention of allowing him to do exactly that. This is yet another story in the growing list of banks meddling with people’s cryptocurrency affairs. This may only be a matter of time, though, as it seems the bank is actively cracking down on cryptocurrency activity right now. This is not a positive development. When the individual called the TD Bank card services hotline, the person responding to the call confirmed the institution does not support bitcoin, nor does it “deal with the kind of business”. In such instances, there is very little reason to argue with bank staff, as they will not undo their decisions just because you may have some valid arguments. PNC Bank also prevents users from buying bitcoin through a bank account, which is anything but a smart business decision. This also highlights how people never control their money when it is stored in a bank account. Instead, they are at the mercy of financial institutions that will determine how one can spend the money they are holding on one’s behalf. It is evident this legacy system needs to be replaced sooner rather than later.

- 5. 05 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside The PNC bank recently threatened one of their custom- ers for purchasing bitcoin. The bank wanted to shut down the customer’s account. He elaborated on the situation in a Reddit post, saying the bank started by asking him questions about recent bitcoin purchases. The banker wanted to know why he was purchasing bitcoin. The bank seemed to be concerned about him buying and owning the digital currency. They goaded him about his purchase and pried into his business. “I told him I wouldn’t answer, he then asked ‘What are you going to do with the bitcoin?’ I again told him I wouldn’t answer.” The conversation escalated to the level of threats. The banker went on to tell him that their security team would “exit the relationship” with him if he did not provide them with information. He provided them with information, because he appears to not want to close his account and change banks. This story crops up as more news emerges of bankers and well known investors voice concerns about bitcoin and cryptocurrency. They are usually calling it a fraud as with the case of Jamie Dimon. Barclays closed down student’s account after his dealings in bitcoin: Charles Bartlett, a 17-year-old student and aspiring entrepreneur, is still waiting for an explanation after being “sacked” by his bank earlier this year. Unfortunately, his is not an isolated case. A small number of people, estimated to be in the low thousands each year, are told that their bank has made a “commer- cial decision” to close their account. Banks tend to offer no explanation and customers who ask for one are brushed off. British banks are shunning companies that handle cryptocurrencies, forcing many to open accounts in Gibraltar, Poland and Bulgaria and prompt- ing some to question the UK’s ambitions to be a global hub for the fast-growing fintech sector. Traditional banks are steering clear of the sector, fearing it is riddled with criminals and fraudsters. ‘Nobody will give us a bank account in the UK,’ said James Godfrey, head of capital markets at BlockEx, a platform for trading digital assets including cryptocurrencies. He said Metro Bank TRADITIONAL BANKS HATE CRYPTO recently shut its UK account, forcing it to rely on a Bulgarian lender to keep trading. Mr Godfrey said the disruption had prompted BlockEx to consider moving to a more welcoming location, such as Toronto. ‘Having [Bank of England governor] Mark Carney standing at the front of the shop and saying ‘raa, raa, fintech’ just doesn’t do it for me.’ Michael Hudson, chief executive of the bitcoin investment firm Bitstocks, said: “It is almost an impossibility to get a UK bank account. We bank in Gibraltar and Poland — the two jurisdictions that are most stable.” Iqbal Gandham, UK head of eToro, a social trading firm that has handled more than $1bn of crypto- currency trades for clients since adding the asset class to its platform this year, said: ‘The moment you mention crypto to a bank, it’s like you are a drug dealer.’ Banks are too scared of the regulator to open accounts for crypto trading businesses. Meanwhile, the regulator is unhappy with the banks for not opening accounts, according to the FT “The Financial Conduct Authority is worried that banks’ reluctance to open accounts for some fintechs is hurting competition after it hampered several start-ups entering its sandbox to test their business models under its supervision. ‘We are concerned that denying certain customers bank accounts on a wholesale basis causes significant barriers to entry and could lead to poor competition in certain markets,’ the regulator said.” Maybe the Financial Conduct Authority could adopt the common-sense approach, sit down with the banks and work something out. Anson Zeall, the head of Singapore’s Cryptocurrency and Blockchain Industry Association, or Access, said his organization had heard from 10 companies which had encountered problems with their banking relationships in Singapore. The banks didn’t give a reason for their action, Zeall added. Chia Hock Lai, president of the Singapore Fintech Association, said some of his organi- zation’s members also experienced account closures.

- 6. 06 NEW RULES BY VISA AND MASTERCARD Life has become a lot harder for people who enjoy using cryptocurrency debit cards. A few months ago, Visa announced it would suspend all crypto debit cards outside of the European Economic Area (EEA). It now turns out Master- card will be doing the exact same thing. This is bad news for a lot of people outside of Europe who want to use these prepaid cards. Existing cards will remain active for three more months, after which point they will be blocked automati- cally. Unfortunately, this also will affect crypto- currency startups looking to issue such cards on a global scale. Considering that a lot of compa- nies rely on a third-party service provider for their debit cards, things are not looking all that great for the sector. It seems that situation will be coming to an end, especially where the non-EEA user base is concerned. Earlier four bitcoin Visa debit cards have suspended service of non-European residents due to Visa’s new licensing restrictions. China-based BTCC and Germany-based Bitwala have joined Xapo and Shakepay to stop debit card service to users who reside outside of the Visa European payment network. Recently, Mastercard announced that it’s opening up access to a blockchain-based business-to-business (B2B) payment service under a new option called the “Mastercard Blockchain API.” “Mastercard’s blockchain solution provides a new way for consumers, businesses and banks to transact and is key to the company’s strategy to provide payment solutions that meet every need of financial institutions and their end-customers,” the company said in a press statement. This move comes as a bit of a surprise, as Mastercard previously issued a blanket rejection of bitcoin. Like IBM, Mastercard is also targeting cross-bor- der payments between businesses as the primary purpose for its blockchain, which can only be used by invitation. For one, businesses could cut costs by using the blockchain to send cross-border payments, which usually pass through several foreign banks on their way overseas, racking up fees along the way. Mastercard’s blockchain, however, could cut out those middlemen and connect a purchas- er’s bank directly to that of the supplier, remit- ting the payment more efficiently and possibly faster. But consumers won’t be able to pay with the Mastercard blockchain instead of plastic, at least not anytime soon. While cryptocurrencies typically offer users anonymous transactions, payment networks and financial institutions are required to follow know-your-customer rules to prevent money laundering and funding for criminal activity. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 7. 07 EXISTING CRYPTO-CARDS Many other players we affected as well. Advcash, for example, has already informed customers that it cannot offer plastic and virtual cards to users in countries outside the EEA. Advcash is a small company residing in Belize – an area of lax regulations and oversight. This online platform lets users order virtual and physical debit cards, and balances can be topped up with bitcoin, among other payment methods. In June 2016, one user has noticed strange account activity, as his account was emptied. A Reddit user mentioned how his Advcash card was apparently cloned. Several dozen ATM withdrawals were noted on his account, all denominated in Rupiah. Considering how he claims the card was barely used it remains a mystery as to how users obtained these details. According to the report, the Advcash customer support told the user how he could file a chargeback procedure. The catch is, every transaction would be subject to a US$35 fee, and may take p to 90 days to complete. With 29 fraudulent withdrawals, this would result in paying US$1,015 in fees on a sum of US$4,685. While the Advcash team is not to blame for the card cloning itself, the company was unable to stop the fraudster from withdrawing the remaining balance on the card. They never detected fraudulent transactions, nor did they undertake any effort to block further transactions. To top it all off, the chargeback fees for fraudulent transactions are almost high enough to force users to say “forget about it, let them steal my money.” Later, on July 11 2016, Advcash has reached out to The Merkle with the following statement: “(1) We are trying to return money back to the customer and for this we are working with Compliance Officer of the card issuer and I’m awaiting for his reply tomorrow. (2) We don’t take 35$ for each transaction, it’s mistake of our customer service representative and she will be fired from her position after end of July. We will take 35$ to review overall fraud case of the customer.” (3) The company would also like to point out the issue of “card cloning” lies with the card issuer, rather than the company. ADVCASH advcash.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 8. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside In 2014, the bitcoin storage company Xapo announced a Mastercard tied to digital currency wallets, but the credit card giant immediately disavowed the partnership. Since then, Xapo has created a bitcoin-backed debit card that works with Visa. Xapo was one of the first to issue a bitcoin debit card linked to their bitcoin wallet system. But the launch was plagued with issues such as the card not being branded, the wrong currency card being sent to the wrong jurisdiction and so on. However most of these issues have been overcome and the Xapo card and wallet system provide a decent way for using your bitcoin in any merchant you wish. Debit Card and Xapo Wallet are perfectly aligned. Add funds to your wallet and the card is ready for use. The Xapo Card works just like any other debit card, but instead of drawing funds from your bank account, it debits purchases directly from your Xapo main wallet. You can use the card for online purchases, to shop at your local store, or at ATMs. XAPO notifies you of each purchase so you can keep track of your spending Xapo has told its customers that they will soon have to pay the network fees for outbound transactions from their accounts. When a user broadcasts a bitcoin transaction (or one for any other digital currency), they attach a fee that acts as an incentive for miners to include that transaction in their next block. The higher the fee, the more likely a miner will want to include it, as they’ll collect any associated fees should their block be accepted by the wider network. According to an email sent to users by Xapo, they’ll now be responsible for this fee, though the startup clarified that any transfers between Xapo accounts won’t incur this charge. It cited growing network activity as the major factor behind the policy shift. bitcoin wallet provider Xapo said it has received condi- tional approval from Switzerland’s financial market watchdog to operate in the country in a regulatory breakthrough for companies that provide safekeeping for the virtual currency. The approval depended on several factors, including membership of a “self-regula- tory organization,” but added that the company was optimistic of meeting the conditions and being able to serve non-U.S. customers from Switzerland. Olga Feldmeier, a former managing partner of Xapo who coordinated the Swiss licensing process for the compa- ny, told Reuters that Xapo had been designated a financial intermediary, meaning it will not require a costly banking license. Switzerland’s cabinet in Novem- ber proposed new light-touch regulations for fintech companies aimed at bolstering business and competi- tiveness. The proposals include a fintech license, granted by FINMA, for institutions which are restricted to taking deposits of up to 100 million Swiss francs ($99.9 million) and do not lend. XAPO xapo.com 08

- 9. 09 For the same reasons Uquid Prepaid Card is only available to existing registered Uquid customers who are European residents. bitcoin Debit Card allows you to pay, simply and securely, in person, online, over the phone or through the mail. UQUID account help you loading money into your card, keep track of your spending and balance. You can top-up Uquid cards with various cryptocurrencies, including bitcoin, ethereum, ethereum classic and zcash. Users can also top up their cards with Paysafecard or bank transfers. Uquid tries to offer regular debit card experience to customers. Wherever you use bitcoin debit card, you are protected. If, for example, you book a holiday with an airline or travel agent that becomes insolvent, you'll get your money back. Similarly, if you order something that is not delivered, not as described, or arrives faulty or damaged, you’ll receive a full refund It's a safe, secure way to pay It's more versatile than cash, you can easily use bitcoin Debit Card everyday, everywhere, for everything. Initially your limit will $1000. After reaching this limit you will have to upgrade your card by providing additional personal information. Company understands and even advices a way around this limitation: AML Program not allows us to give uncheck ID customer unlimited with only 1 card. But you can have more than 1 card to reach unlimited. you need new email for each card because Visa not allow you to create multi card with same email. We do not want our client card got blocked by them. Some characteristics of the card are not so convenient. For instance, once a user deposits bitcoin funds from a crypto wallet into their Uquid account, it gets exchanged into fiat currency for spending. However, once the bitcoin is transferred there is no way to move or transfer funds back into cryptocurrency. A user has to keep funds in for card use or has a bank wire option to transfer the USD, GBP or EUR to the user’s bank account. Also some customers complain about painful log-in procedure, poor English, unresponsive customer service, harder than most bitcoin debit card providers to move money between bitcoin and fiat currencies. UQUID uquid.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 10. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside Another card from Argentina, the SatoshiTango card also requires full financial identification. It was available in most countries, excepting the United States but with new regulation from Visa and Mastercard – these times are gone. In 2016 when Buenos Aires local government mandated all banks to stop processing Uber charges in their credit cards because they consider it an illegal app (even that it's not, since a federal level law guarantees its business) all local Visa, Mastercard, American Express cards were blocked. Uber started to charge from abroad to jump the blockade, but Uber international charges were later blocked too. Now practically all local credit and debit cards are not working. This made Uber difficult to use for Argentinians, and at this moment only tourists and locals with cards from abroad were able to use can. Also, since Uber is process- ing the charges outside the country, the blockade is global, and Argentinians are not able of using Uber not only in other Argentinian states, but in the whole world (you have to call the bank and tell them you are travel- ling to use it, many started to call lying saying they were travelling even that they were in Buenos Aires using Uber, which resulted in banks doing checks before enabling Uber for any caller). SatoshiTango had entered the agreement with Uber to make it possible to use their bitcoin debit cards with their service. Since bitcoin is the perfect solution for this. Matias Bari, CEO of bitcoin debit card provider Satoshi- Tango, saw a marked increase in card use by Uber because of the company’s trouble with the authorities: “We had an important increase in the amount of prepaid cards issued since Uber announced the possibility to pay with them. Until July 31st, more than 200 people have linked their debit cards to Uber. And we keep receiving queries about that functionality. Many people asking if the card really works with Uber. We are constantly trying to add new payment methods, so we don’t limit our platform to bitcoin users only.” Still despite the widespread perception that Argentina has emerged as the leading bitcoin market in Latin America, the country still poses a significant challenge for entrepreneurs given its lack of regulatory clarity and history of capital controls. And Argentina's entrepreneurs were seeking ways to bring the benefits of bitcoin to the market SATOSHITANGO satoshitango.com Matias Bari keep trying to build a Coinbase for the country's bitcoin users. In 2016 explained that the usual identification requirements are still in place, though are less stringent than those required by banks. As Bari said to CoinTelegraph: “To open an account at Satoshi- Tango you need to verify your identity with a proof of ID and a proof of address. We need to apply the proper KYC and AML policies to comply with international regulations. You don’t need the same level of verification than bank account holders but you can’t request a prepaid card or even buy and sell bitcoins without letting us know who you are.” 10

- 11. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside The Shakepay brought to you by the team behind Shake Labs of Montreal Canada. The ShakePay card is one of the early adopters in a growing field of directly Dash-en- abled debit cards. It’s a streamlined, simple card that works surprisingly well for how basic it looks. Virtual card for online payments: a 16-digit virtual card number will allow you to make transactions online where Visa cards are accepted, basically everywhere. Plastic card for everything else: a chip & pin plastic Visa card is available for all point of sale transactions, ATM withdrawals, and online orders. Both Xapo and Shakepay have been asked to halt their services to non-EU residents. Users in regions outside of the EU will soon see their accounts deactivated and their cards becoming unusable. All of this is thanks to Visa forcing the hand of card issuers and service providers. Right now, the deadline to suspend these services and associated cards is October 15, 2017. That means customers of both Xapo and Shakepay have until that date to use their cryptocurrency debit cards before they become invalid. While this is a very troublesome devel- opment that will make a lot of people unhappy, there is nothing else to do but play by Visa’s rules right now. After all, as the card issuer, it makes the rules for all other companies. It is highly likely some alternatives will be found, but for now, there has been no official confirma- tion just yet. Shake is a mobile app which lets you pay for items at any retail location supporting contactless payment with NFC (Near Field Communication). These days almost any point of sale terminal supports contactless payments either via NFC or RFID. Unlike its competitors, Android Pay and Apple Pay, Shake uses bitcoin as its underlying currency and lets users top up their Shake wallet using bitcoin. There is a 1% bitcoin to fiat exchange fee which is shared before loading any money on the card, and there is a 3% fee when a card is used in a foreign transaction (i.e. USD card used for an EUR transaction). SHAKEPAY shakepay.co 11

- 12. 12 Shift card wasn’t the first bitcoin debit card in the world, but this was the first U.S. bitcoin debit card and the first one that works with your Coinbase account. Coinbase has partnered with Shift Payments back in 2015. Company supports Coinbase and Dwolla accounts. You can connect your Coinbase and Dwolla existing accounts and spend immediately and directly, every- where Visa is accepted. The Shift Card works like any debit card today. You can choose a first source of funding, a second one, etc. For instance, you can tell Shift to spend your bitcoins first, and to use your Dwolla account as a backup once your Coinbase hot wallet is empty. You can see your transaction history in the app as well. The Shift Card goal is to enable users to spend funds from any store of value he/she controls. The team wants to enable users to connect everything from bank, airline mile, and alternative currency accounts to their Shift Card. When you use your Shift debit card to make a purchase, the equivalent value of bitcoin (based on the current spot price of bitcoin on Coinbase) will be debited from your Coinbase bitcoin wallet. For certain transactions, like gas purchases and dinner bills, Shift will debit more than the purchase amount, and will refund you the remainder when the final payment amount is settled. And as any other wallet The Shift app allows you to check account balances and transaction details. Easily add & edit account information for quick selection at time of payment. If you live in US, you can get your Shift Card by complet- ing the verification. Coinbase and Shift are currently working through legal and regulatory matters to offer the service in other markets. SHIFT CARD shiftpayments.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 13. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside The launch of own bitcoin debit card was also the initial idea of UK-based financial solutions provider Spectro Finance. The company came up with this idea probably earlier than anyone else in the market, in 2013. However, the first two years of the company’s activity were dedicated to something different: implementing two separate projects. The first of them is Spectro Coin, a bitcoin exchange with a Blockchain-based wallet and risk-free merchant solution: the exchange service which allows integrating bitcoin in any business with 25 000 EUR no-fee limits. The second one is SpectroCard - a virtual Mastercard-based prepaid card, which is claimed to be one of the most flexible and cheapest payment card solutions for European market. Spectro Сoin debit card was introduced two years later, in early 2015; by now, the company managed to issue more than 20,000 cards for more than 120 countries. Being quite a flexible solution, the card is accepted anywhere where Visa and Mastercard are supported; so, users can withdraw and spend their funds in millions of ATMs, websites and shops across the globe. Besides of bitcoin, SpectroCoin card provides support of dollars, euros, and pounds; also, one of key advantages of the card is instant funding, so owners don’t have to exchange bitcoins in advance. The prices of both virtual and physical cards are signifi- cantly lower than the market average ($0,5/$9 against $3/$15). As for loading fee, SpectroCoin doesn’t take any, it also offers lower exchange rate. The bitcoin conglomerate has added support for Namecoin, Dash, Ripple, Ethereum, Litecoin and many other popular altcoin. Effective March 2017, SpectroCoin debit card holders can add balances with the aforemen- tioned altcoins. They can also use the same funds to top-up their mobile phones, buy gift vouchers, and trade. SPECTROCOIN CARD spectrocoin.com Since its launch some 3 years back, Spectro- Coin had the vision to become the one-stop shop for all services related to newly emerging cryptocurrencies. These cards are powered by Visa and Mastercard, meaning that they can be used across the globe as the substitute of standard fiat debit cards. SpectroCoin Debit Card can be denominated in either Dollar (USD), Euros (EUR) and Pounds (GBP), accord- ing to the holders’ choice. It has high deposit and withdrawal limit. In order to receive funds your card need to be verified. The e-wallet and exchange are supported in more than 150 countries and offer more than 20 methods for depositing and withdrawing funds, which consists of bank transfers and credit cards. The bitcoin debit card is funded instantly with bitcoin, so no need to exchange the cryptocur- rency in advance of payment. The Visa and plastic cards can be used at any ATM around the world, the denominated base currencies are USD, EUR and GBP. They also provide an option for business owners to switch to bitcoin payment for operations. Spectrocoin offers company cards as a solution for those who are one step ahead in the digital world. In order to verify the users themselves, they must provide a valid passport or ID card and a utility bill. The AML policy provides details on the documents, but has no information on how much the process itself takes if everything goes well. Unverified users may also use Spectrocoin services. SpectroCoin offers over 20 ways to buy and sell bitcoins. For most of our services profile verification is not required, however, in order to take the full advantage of the wide selection of bitcoin purchase and withdrawal methods that we provide, we advise you to verify your account. 13

- 14. Cryptopay is one of the oldest and most established Visa bitcoin debit card with over 23,000 issued. The Crypto- Pay bitcoin Debit Card offers users the ability to top up from their Cryptopay bitcoin wallet. The card has the standard sets of fees for foreign and domestic ATM withdrawals and loading fee for pushing your funds into dollars on the card. The Cryptopay card is a prepaid card you can top up instantly by converting funds from your Cryptopay bitcoin account to fiat. It can be used anywhere regular prepaid cards are accepted. You can order a EUR, USD and GBP debit card. Prepaid Card has standard features: low commission, free delivery, both chip & pin and virtual cards are available. The company is registered in London and operates through MyChoice (WaveCrest) Visa. The card ships globally except for the United States, India & Algeria. Using Cryptopay card is easy and fast way to cash-out your bitcoins. Convert your bitcoins whenever you need them, easily through Cryptopay mobile or web app. Your CryptoPay account has a bitcoin wallet with an address that you can send bitcoins to later transfer to your card. The bitcoins aren’t exchanged directly when you pay for something, instead you have to do it beforehand. So, for example, you load up your card with €100 and then you use the card to buy stuff until you need to fill up the card again with more money. This has advantages and disadvantages. The biggest advantage is that you can exchange your bitcoins for EUR, USD or GBP at a time when the exchange rate is really good, you have full control over that. From users reporting their experience of using the card clear that in most cases the card works, but sometimes issues arise: “What worked? Google (for buying Android apps for example), Amazon (both digital and physical goods), PayPal, Stripe and lots of small online stores. What didn’t work? Apple (so you won’t buy macOS or iOS apps with it), Sony’s Playstation Store, MediaMarkt (big German electronics chain, like Best Buy) and a few other smaller online stores. It’s a bit of hit and miss, 90% of the time it will work just fine, 10% of the time the card will be declined because it’s from England. Another issue, is that some companies like Amazon and PayPal will think your card uses Pound Sterling, even if you use a different currency on your card. This is again because the card is issued in England. And they’ll try to get a 3% exchange fee out of you.” CRYPTOPAY cryptopay.me Overview of all crypto-friendly cards: a lot of hype but almost nothing inside 14

- 15. 15 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside Wirex is a London-based bitcoin debit card, mobile banking, and remittance service provider. It is a limited company launched in 2015 with initial funding of around $200K from 93 investors (via crowdfunding). Going by the slogan “Drive Your Money,” Wirex enables the linking of bitcoin wallets to Visa debit cards. Wirex can be accessed through a desktop application or a mobile app. CEO of the company, Pavel Matveev says that launched WIREX with the goal to let users spend bitcoin anywhere where Visa or Mastercard accepted: “when we started about 3 years ago, at the time there were 2 companies which were focusing on bitcoin debit cards (Wirex and Xapo). Initially Wirex started from my pet project. I realized that bitcoin is very good for micro transactions, which are very popular on the internet nowadays in the form of tips on social networks and forums like Reddit. Also, bitcoin is very good for international payments, it’s almost instant and far cheaper, comparing to traditional methods. But crypto currencies have a big problem – it’s poor acceptance, you can’t go to your nearest coffee shop and buy a cup of coffee with bitcoin, so 3 years ago we came up with very elegant solution, it’s bitcon debit card. That is how started Wirex.” Nowadays the Wirex card is a reloadable Visa debit card. Currently virtual and plastic prepaid debit cards available in USD, GBP and EUR with instant loading from your Wirex BitGo-secured bitcoin wallet. Depending on your country, you can add funds by bitcoin deposit, bank transfer, PayPal, or using our digital currency exchange features inside the app. Use your Wirex payment card for in-store purchases, online shopping, and cash withdrawal at the ATM anywhere Visa accepted. The Wirex wallet has an added benefit of allowing altcoin to be held for future conversion to bitcoin. That means that Wirex cardholders can now accept a variety of altcoin payments: ether, litecoin, monero, lisk, ripple, dash, DAO as well as many others. This year Wirex is entering a regional joint venture with Japanese financial group SBI that will deliver a Japanese cryptocurrency payment card. Japan’s SBI Holdings, a major financial services group heavily invested in digital currencies and blockchain technology, is co-launching a joint venture with London-based Wirex called SBI Wirex Asia. The collaboration will see bitcoin startup Wirex make inroads into traditional markets already known to SBI while the Japanese company deepens its foray into establishing ties to the cryptocurrency and blockchain space. With offices in Tokyo and Kiev beyond London, Wirex has already gained a market in Japan as an issuer of bitcoin debit cards. The new joint venture comes after SBI’s participation in a $3 million Series A by Wirex earlier this year in the lead-up to Japanese legislation deeming bitcoin as a legal method of payment in April. A boom in both awareness in adoption of bitcoin has since followed, with an estimated 300,000 Japanese storefronts expected to be equipped to accept the cryptocurren- cy by the end of the year. Japan has also become the world’s largest bitcoin market in recent months follow- ing the closure of several major Chinese exchanges due to regulatory scrutiny in the country. Meanwhile, SBI Holdings is developing its own block- chain-based digital currency that will be tradeable with the Japanese yen, enabling customers to make store payments and peer-to-peer transactions instantly. SBI Wirex Asia will join SBI Ripple Asia as the latest block- chain-centric joint-venture for SBI Holdings. SBI has also launched its own digital currency exchange in Japan and has previously led a record ¥3 billion ($27 million) funding round in Tokyo-based bitFlyer, Japan’s largest bitcoin exchange. WIREX app.wirexapp.com

- 16. 16 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside Founded in March 2015, Bitwala aims to be a one-stop-shop for all kinds of bitcoin-to-fiat billpay solutions. The company received US$910,000 in seed funding April 2015, from KfW Banking Group and the Digital Currency Group, and has been busy developing the service every day since. The service currently supports SEPA payments, but has people from all over the world sending money to Europe. The Bitwala Debit Card can be used at any POS where Visa is accepted, to get cash from ATMs and to make online payments so you can spend bitcoin, dash and steem. Bitwala had announced also that ethereum will also be supported in the near future. Bitwala is known as one of the most affordable bitcoin debit card on the market, both in terms of card price, maintenance and other fees that follow card usage. Bitwala’s product range includes bank transfers, as well as a bitcoin debit card and wallet. According to CEO Jörg von Minckwitz, the company’s mission is to become ‘the first true alternative to a bank account’. Counting more than 15,000 users, Bitwala has attracted funding from prominent investors such as the German Venture Capital firm High-Tech-Gründerfonds. Bitwala is one of the many bitcoin companies issuing cryptocurrency debit cards. Unfortunately, it appears they recently have introduced new limits, which most people are not too happy about. These new changes are the direct result of a new EU regulation amendment proposal. Apparently, the EU wants to make changes to the 4th Money Laundering Directive moving forward. Bitwala is preparing for when these regulations are approved, as that appears to be merely a matter of time. It is evident anonymous payment solutions are on the radar of government officials right now. Companies need to be proactive in this regard, especially if they are linked to bitcoin and cryptocurrency. The bigger question is whether or not further limits will be imposed to verified users. It is certainly possible users may need to submit additional verification in the future. The European Union is not a fan of any anonymous payment tools. Moreover, they aim to further regulate prepaid debit card service providers. Other debit card service providers may be affected by this proposal in the future. BITWALA bitwala.com

- 17. 17 In 2016 in Copenhagen Money 20/20 sponsor Coins- Bank (originally known as Bit-X) announced the launch of its Universal Crypto Solution. The new initiative focused on “next generation blockchain solutions,” and produced new CoinsBank products such as CoinsBank Wallet, Card, Merchant Tools, Exchange, Charts and Mobile App. The company called the initiative a “conflu- ence of both traditional and cryptocurrency ecosys- tems.” The fintech services provider believes that their new products will “help CoinsBank provide an all-in-one gateway for blockchain services.” Newly-appointed Coinsbank CEO Ronny Boesing said: “It is the block- chain, the shared ledger that will power the next generation of fintech solutions. the technology enables anyone to store and transmit information of any kind, directly between individuals” Among others the company proposed the launch wallet and the card. Wallet supports deposit and withdrawal of a wide range of fiat and cryptocurrencies around the clock. The currencies can be converted to different denominations inside the wallet and transferred immedi- ately. User funds on the wallet are stored in cold wallets and they are completely backed by reserves. These cash cards allow users to access their funds in customer accounts, can be used to withdraw money from almost any ATM across the world. In order to ensure faster and flawless transactions, the company has forged strategic partnerships with many international banks and financial institutions. All transactions with CoinsBank cards across the world will be settled in real time in the respective local currency. The company’s cards also offer rewards points for expenses made on it. The card product went live with several card tiers available now, from anonymous virtual cards to (almost) no-limits plastics. The one called a “Named White” card comes at a price (almost a hundred bucks), but it offers by far the best conditions, including a relatively low foreign exchange fee which is great for digital nomads who tend to spend in many different currencies. The card, as most of the BTC cards, is issued by WaveCrest, a white label card provider from Gibraltar so you have to use European address to make an order. Transactions with CoinsBank Debit Card funds convert- ed instantly, so no need to exchange bitcoins in advance. Instant conversion between all supported Crypto and fiat currencies. 4 card types available in USD, EUR and GBP. Also, there is daily cashback bonus for every cent spent on your card. The mobile application for managing your cards. Available for Android and iOS You may order several cards delivered in bulk. Delivery by DHL Express is door-to-door shipment service in the shortest possible timeframe. Virtual cards are available in 5 minutes after the order. Users can spend funds from all accounts: BTC, LTC, USD, EUR, GBP, RUB, CHF, AUD, JPY with automatic conversion on market rates. Users may disable certain accounts for card transactions if needed. Some users report challenges of passing the KYC and getting the PIN for a new cards. “First, my card appeared to be limited with a lifetime turnover limit of $2500 and a daily ATM withdrawal limit of $200. My “Card Level 1” magically jumped to “Card Level 2” after an hour or so, but those are essentially the same; I need “Card Level 3”. Their support got back to me saying “the bank still have to check your documents”, which is very confusing considering I have the highest possible KYC verification level at Coinsbank (which, by the way, is not a bank). KYC verification for the Coinsbank trading account and the card should be in sync. Second, I couldn’t get my PIN code for two days. Supposedly, you can check your PIN anytime on the Coinsbank site, but it was not working. It took the customer support 72 hours to reply. By then the problem has been solved, as their social media guys were quicker and informed their developers who deployed a fix in about 12 hours. Except the fix didn’t work. It took another couple of hours to finally get my PIN”. COINSBANK coinsbank.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 18. Bitpay bitcoin Visa card one of the few available to US as well as to European users. BitPay CEO Stephen Pair states that the company believes that using bitcoin in more ways makes it more valuable. In terms of the fees associated with the card, he expressed how they intentionally wanted loading bitcoin to be free of charge. The fee is linked to particular actions, such as to start the card and for accessing the ATM. James Walpole, BitPay’s marketing lead believes that the card is a useful tool for bitcoin holders to actually use it in cases when they can’t use the currency itself, by quickly moving between bitcoins and USD. Despite being widely described as a bitcoin Visa debit card, the balance is in fact exclusively held in dollar amounts. Users will typically send bitcoin to BitPay, who then will quickly convert the cryptocurrency into dollars. Thus, anyone that owns bitcoin can now have a debit card to use their bitcoins as dollars. BitPay Senior Engineer and project lead Corey Glaze says the Visa Card gives users of the digital currency one of the fastest and easiest ways to acquire liquidity for their bitcoin savings. Topping up is simple and there are no fees on bitcoin top-ups with a max load of up to $10,000 spendable funds per day. Those interested to supplement top-ups can opt to have it reloaded by means of direct deposits from their employer, where the company will send funds directly to the BitPay Visa automatically on each pay period. Bitcoin deposits are credited to the dollar balance in almost an instant, so there’ll be neither waiting nor worrying about the fund transfer to clear prior to cashing out. Overall users report pleasant and simple experience of using the Bitpay debit cards. It definitely uses immediate fiat conversion which is a downside, but basically allows for easy bitcoin sales with a personal debit card in real-time. Purchases are simple and after everyone you got visible access to these transactions on account page. Fees are explained throughout the whole process and are relatively inexpensive and can be avoided. Like many others the BitPay debit card has a $5 per month "dormancy fee". If you don't use the card for 90 days, they will start charging you $5 each month. BITPAY bitpay.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside 18

- 19. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside WageCan is a Taiwanese company that provides blockchain based payment solutions since 2014. The company has been incorporated in Hong Kong. Franky Hu, current Chief Executive Officer at WageCan is one of the founders. As a software architect and a tech geek he has been involved in the bitcoin world since early 2013. The founders realized the market gap that the block- chain payment solutions at the cryptocurrency exchanges are location limited. They rather want to provide services to anyone in the world, without long registration process. The card is specifically marketed to merchants, freelancers, bloggers, international workers, and miners. All of these people receive payments internationally and can benefit from lower fees and lower exchange rates. All WageCan cards operate on top of a major credit card network, and are easy to start using. By piggybacking on the existing banking network, the bitcoin debit cards can be used anywhere regular payment cards are accepted, vastly broadening the business horizons for bitcoiners. To start using the debit card, you simply load it by sending bitcoins to the WageCan debit card account. These coins will be immediately converted to USD or EUR, depending on which card you have. Users can also choose to convert their coins at a later time, allowing them to keep their coins in their wallet. This option allows users to take advantage of bitcoin price fluctuations, and convert when the exchange rate is high, allowing them to get the most out of their coins. WAGECAN wagecan.com 19

- 20. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside ANX International was founded in 2013 by Ken Lo, Dave Chapman and Hugh Madden. Lo now serves as Chief Executive Officer, Chapman serves as Chief Operating Officer, and Madden serves as Chief Technology Officer. In February 2014, the company launched the world's first digital assets physical retail store in Sai Ying Pun, Hong Kong, allowing buyers to walk into the store, pay cash and send digital assets to their virtual wallets instead of buying with credit cards on online exchanges. In March 2014, ANX International announced the launch of digital asset ATMs, which were the first digital asset ATMs in Hong Kong. In July 2014, ANX introduced one of the first digital asset debit cards that can be used worldwide at any merchant that support the respective payment networks. To remedy the situation of digital assets not being widely accepted, ANX merged digital assets with traditional card payments. Users can reload funds to the debit cards with digital assets and the card can then be used for both online and Point of Sale purchases, as well as withdraw- als through the Global AT&T Network. ANX customers load their cards from bitcoin balances (effectively selling bitcoins to ANX) or from any of the 10 international currencies the firm currently supports. The stored currency on the cards, however, is always US dollars. The cards can then to be used at any merchant that accepts debit cards and at regular ATMs to withdraw cash, though, again, all amounts will be debited in USD. Ken Lo, ANX's CEO, said the company believes prepaid cards will play an integral role in a bitcoin consumer's day-to-day financial life. It originated from ANXBTC and is designed for experienced digital assets traders, specializing in Altcoins, Algos and Performance. The order engine delivers pre-scan pricing and users can choose to either fix the quantity of digital assets or fix the price paid for every order. In Feb 2016 ANXPro announced the temporary suspension of bank wire and SEPA deposit services, a matter which has still not been resolved since. Withdrawals should not be affected by this announcement, though, but any company unable to accept payments does not appear to be in a good shape. On February 16th, ANXPro made the announcement regarding the suspension of bank wire and SEPA deposits, affecting users from all over the world. ANX anxpro.com 20

- 21. 21 Founded in 2014, Worldcore, is a payment service provider that allows access to international banking and global transfers regardless of origin, has partnered with BitPay to accept bitcoin payments. Worldcore users can now withdraw funds to bank accounts or prepaid debit cards with minimal fees. Worldcore is owned and operated by EUPSProvider s.r.o., a Czech Republic-li- censed payment institution regulated by the Czech National Bank. Worldcore customers can withdraw U.S. dollars or Euros to any bank accounts or Mastercard or Visa debit cards with minimal fees. These options have found favor among international travelers and emigrants who rely on or send cross-border remittance payments. The company’s portfolio has grown and now serves more than 25000 clients worldwide. Worldcore’s annual transaction volume will exceed 100 million Euros in 2017, according to current statistics for this year, and over 1 million in Euro revenue. The compa- ny’s quarterly growth usually exceeds 25%. Worldcore is also a well-known participant and sponsor of the largest fintech events in Europe like Finovate Europe, Money2020 Europe and the European FinTech Awards. The company’s solutions include debit cards with an industry-leading ATM withdrawal limit of 4,000 Euros per day; virtual debit cards; API for mass payments’ checkout for accepting payments, including cryptocur- rency, on websites; payment card acquiring; and international money transfers to smart invoicing for businesses to create, send and accept payments for invoices issued to their clients. The past May, Worldcore obtained a PCI DSS Level 1 (Payment Card Industry Data Security Standard) certifi- cate, which lets the company enter the card acquiring market and is a guarantee for cardholders that their data is securely protected. The company is also a member of one of the most reputable industry associations in Europe – the Emerging Payments Association. Worldcore is also the world’s first EU payment institution to have implemented voice and facial recognition technologies for authentication of clients, which fully protects clients from fraud. WORLDCORE worldcore.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 22. 22 After its initial establishment in late 2015, Bitnovo quickly cemented itself as a dominant company within Spain’s bitcoin industry. Spain was among the first nations to explore the idea of national cryptocurrencies, launching Spaincoin in 2014 shortly after the Icelandic rollout of Auroracoin. Although the project appears to have been dormant for several years now, Spaincoin saw Spanish officials become one of the first states to promote and encourage cryptocurrency adoption – likely having positive ramifications for the development of the local bitcoin economy. The company initially had released prepaid bitcoin debit cards that can be used to make withdrawals from any Mastercard ATM around the world, and had announced plans for their expansion into the international bitcoin markets. 2017 has been a big year for Bitnovo, with the company’s bitcoin Visa prepaid debit card also being launched in 130 countries. The move signifies Bitnovo’s expansion beyond the Spanish cryptocurrency market and desire to establish itself as a major international brand within the bitcoin payments industry. On 20 September, Bitnovo announced that Spanish residents could now buy bitcoin cards from fifty Carre- four stores across the country. The startup continues its expansion throughout Spain by launching card preload- ed with bitcoins. Spain is the second largest Carrefour market after France, and is present in more than 30 countries. Sales of cards to Carrefour are part of Bitno- vo's launch of more than 4,000 new physical sites in Spain. "By strengthening bitcoin in all corners of the world, we launched a new product" Bitnovo. You can now buy bitcoins at Carrefour, without the need for special documents. Bitnovo bitcoin cards are available for purchase on the store gift card display, along with restaurant coupons, Itunes cards and other retail coupons.” The company says customers can buy the bitcoin cards with cash or credit card. The main competition of Bitnovo is a company called 247 Exchange, which sells bitcoin prepaid vouchers issued by the French company Neosurf. According to the trading platform, customers can buy crypto in many local stores that use the Neosurf prepaid card system. Otherwise, Bitnovo seems to be the only company in Spain to produce bitcoins cards at the moment. In 2015, a startup called Coinay attempted to launch a business based on the same bitcoin card principle, but failed. BITNOVO bitnovo.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside

- 23. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside This year Coinizy started to offer virtual Visa Debit card that you can use to shop on the Internet. In 2015 Coinizy was the first to launch bitcoin to PayPal exchange option to simplify bitcoin to fiat exchanges and withdrawals. While similar money transfers usually, take about 3 or even 14 days for international transfers Coinizy new option delivered money to users PayPal e-wallet in 24 hours. Yannick Losbar, Founder and CEO at Coinizy, explained in the official press release via email: "Up until now, 99% of the bitcoin exchanges only offered the good old wire transfer, when one wanted to withdraw the funds he obtained by converting some bitcoins. This excludes de facto the 2.5bn unbanked people, as well as most of the teenagers, which is very unfortunate since this part of the population could represent the next potential wave of bitcoin adopters." Besides the new bitcoin to PayPal exchange option Coinizy, Vancouver-based financial services platform, offers various withdrawal methods including cryptocurrency exchanges to Okpay e-wallet, Western Union cash delivery and SWIFT bank transfers. The platform also offers virtual and plastic prepaid bitcoin debit cards. COINZIZY coinizy.com 23

- 24. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside BTCC, a major bitcoin exchange and trading platform operator in China, officially launched its first mobile application, “Mobi,” introducing various features and products including Twitter payments and the company’s signature bitcoin-based Visa debit card. With its private blockchain, Mobi allows smartphone users to gain access to over 100 currencies including bitcoin, gold and reserve currencies such as USD, and allows users to instantly convert, store or transfer funds globally to other smartphone users. Mobi accounts are simply linked to users’ mobile numbers and therefore a smartphone is all that is needed to use the app. The main feature of BTCC’s Mobi app is the BTCC bitcoin debit card, which operates just like a normal bitcoin wallet. Funds in the wallet are pegged to the debit card and balance is automatically deducted when users make payments at retail points of sale (POS) that accept Visa or withdraw cash via bank ATMs. It is BTCC’s first initiative to target a global consumer base and expand its services outside of China. Both the Mobi wallet and the debit card are available in 15 languages and can be utilized in any country across the world. Essentially, the launch of the BTCC bitcoin debit card eliminates the necessity of bitcoin ATMs and offers higher liquidity to daily users within China. BTCC’s bitcoin debit cards will allow Chinese users to utilize bitcoin with ease, without undergoing strictly regulated channels to make simple purchases and transfers. More important, in regions wherein bitcoin ATMs or services aren’t available, Chinese bitcoin users will simply be able to cash out their funds via bank ATMs. BTCC’s introduc- tion of bitcoin debit cards to its Chinese user base will position China to compete with Japan, South Korea and the Philippines over the bitcoin ATM and debit card markets. BTCC BITCOIN CARD btcc.com 24

- 25. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside MoneyPolo is a trading name of Mayzus Financial Services Ltd. and has been operating since 2011, but started to issue cards only recently. MoneyPolo recently bought out OK Pay both services can be used in tandem: withdraw funds in your OK Pay wallet into Money Polo and vice versa. The company provides both physical and virtual prepaid cards from Visa and Mastercard: four types of Visa cards with MoneyPolo; Multi-Currency Visa, Virtual Visa, Virtual USD Mastercard and USD Mastercard. As the name suggests, multi-currency supports EUR, USD, GBP, CHF, JPY, AUD, CAD, NOK, DKK, SEK, SGD, HKD, ZAR, NZD and AED. You can move the money from or on your card whenever you like. Once you order a card, it will arrive by post or courier. Virtual Visa Card however, is a perfect solution if you worry about the safety of your private data. Also, unlike ordering regular plastic cards, this virtual card is ready instantly and active for multiple uses. The Virtual USD Mastercard has no transaction nor maintenance fees and should be used for online payments only. You can have up to 3 cards at once, each limited to a maximum balance of $6500. The USD Mastercard however, is the “material” brother of its Virtual Mastercard. This card is tied to a dollar account too, but it has a bigger limit; maximum $25,000 and can be used anywhere. MoneyPolo account/card can be loaded via debit/credit cards, wire transfers, bitcoin, Sibcoin, OKPay, QIWI, Cash transfer (through select outlets in different countries) and Direct Debit. In August 2017 the founder of the company Sergey Mayzus came out publicly to repudiate the claims that he might be linked to the bitcoin exchange BTC-e. Providing more details, he wrote: “MAYZUS Financial Services Ltd. might have had among its clients, through the services of MoneyPolo and OKPAY, legal entities who could be operators of the BTC-E exchange, or private persons who could be owners or employees of the BTC-E exchange, however, all accounts of legal entities or individuals whom we considered as possibly related to the BTC-E exchange, are blocked, which was properly reported to the financial regulatory authorities. In addition, information about these individuals and legal entities was forwarded to the law-enforcement agencies of Great Britain.” MONEYPOLO moneypolo.com 25

- 26. 26 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside The world of cryptocurrency debit cards is getting more competitive. Some new players have emerged with an ICO as of late. COMING SOON...

- 27. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside The Singapore-based startup intends to issue a pre-paid card that will “Take bitcoin Into [the] Real World With Visa.” The company will offer a Visa card tied a digital currency app. This arrangement is intended to let consumers make ordinary purchases at coffee shops and elsewhere using a card backed by bitcoin or other digital assets. I repeat this once more time - do you need a card to buy coffee and t-shirts, or you are waiting for an innovative card that will replace all other cards in your wallet? As of now every crypto card have a huge discrepancy between their plans and reality (perhaps the problem not in them, but in the partner banks where they are launched). TenX is pitching its debit card as an instant converter of multiple digital currencies into fiat money: the dollars, yen and euros that power most everyday commerce. The company said it takes a 2% cut from each transac- tion and has received orders for more than 10,000 cards. While transactions lifetime limit is capped at $1,000 a year, users can apply to increase the limit if they undergo identify verification procedures. For ordinary consumers, a bitcoin-Visa card has an obvious drawback in that it doesn’t offer rewards points like any regular Visa card worth its salt will do. And for merchants, the “2% cut” TenX plans to take is no better than what they must pay out already. The bottom line is TenX, like other firms, might carve out a tiny niche with hardcore bitcoin enthusiasts. Co-founder Julian Hosp said transactions are processed immediately and it doesn’t impose any charges on top of the conversion fee that is set by cryptocurrency exchanges, which typically is 0.15 to 0.2 percent. The card now supports eight digital currencies, including the lesser-known dash and augur, and aims to offer about 11 of them by the end of the year. TenX currently processes about $100,000 of transactions a month. By the end of 2018, it’s targeting $100 million in monthly transactions and a million users. Mati Greenspan, a Israel-based analyst at social trading platform eToro, said: “At the end of the day, it’s going to depend a lot on customer relations. Are they meeting the customers’ expectations? Can somebody else do it better?” TENX tenx.tech In its initial token sale, TenX raised $80 million with about half to be used to expand operations while the rest will provide liquidity for a crypto- currency exchange in the works, said Hosp. The company had previously raised $120,000 from angel investors and $1 million in a seed round led by venture capital firm Fenbushi Capital. TenX isn’t expecting to become profitable in the next two years as it focuses on expanding services. The Paypers interviewed TenX Co-Founder & President Dr. Julian Hosp on the company’s recent initial token sale and the latest news and trends in the cryptocurrency space. “In our first year, we started with four people; at the point of our token sale in June 2017, we were eight people, and now, four months later – October 2017, we have tripled our numbers and we are close to 30 people. Nevertheless, our office has space for 100 people, so we plan to grow even further.” “At the beginning of 2018, we plan to add a new feature, which is the possibility to deposit fiat money (USD, EUR etc.) into your account with the option to get cryptocurrencies instead, all with a click of a button, in your app. We hope to attract more people, that are interested in crypto, but have been put off by seeing how complicat- ed it is to get in.” “The third step is going to happen in mid-2018, when we will make crypto- currencies more stable. Hatching mechanisms are going to be implemented to avoid cryptocur- rencies fluctuations, to the benefit of the users, because these days cryptocurrencies are too volatile.” “Of course, all these plans are based on our business partners as well. We collaborate with Mastercard and Visa’s issuing partners, one in Singapore and one in Europe, and at the moment we are signing up partnerships with two other companies, on plans that we are going to announce soon. Additionally, we are working with several distribution partners and in the future, we plan to do cobranded solutions.” “Additional business plans include getting a banking license for Europe and achieving financial stability over the next couple of years.” Both TenX and MonaCo will be making some significant waves in the coming months, by the look of things. Both TenX and MonaCo are inching closer to releasing their cards and mobile applications. Speaking of TenX, they are looking to get listed on additional exchanges. TenX got listing on Yunbi earlier in October. Gaining a foothold in the Chinese market can do wonders for any debit card-oriented company. Digital payments and non-cash solutions are very popular in China. The TenX debit cards themselves should start arriving by late September of 2017 (as of October 31st, 2017 we were not able to find a live customer with the TenX card, we also tried to request the card through the TenX website and still in the waiting list). 27

- 28. 28 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside MonaCo will take orders for their cards at the end of this month. But before Monaco showed that investors may have bought into a news story suggesting that the digital token was linked with a Visa Inc.-backed payment card, when in fact that deal did not (and does not) exist. A form of digital money known as Monaco gained as much as 695 percent in value since May 17, when its issuing company tweeted that it would offer a Visa Inc.-branded payment card. (Monaco didn’t have a deal with Visa.) Later that month, Monaco put out a press release describing the benefits of its Visa-branded card. (Again, no agreement with Visa.) Monaco is, however, working with a Visa-licensed issuer, Wirecard AG. As far as Visa goes, Monaco is being vetted through the credit-card issuer’s review process, according to spokeswoman Lea Cademenos. Cademenos didn’t say how Monaco’s decision to promote two nonexistent relationships with Visa would affect the review process. Wirecard didn’t return requests for comment. In an Aug. 31 press release, Monaco announced a new mobile application along with plans to debut five different payment cards. There was no mention of Visa. The value of Monaco’s currency dropped 29 percent that day. Marszalek said he and his team are focused on securing a deal with Visa. The company has received 13,000 reservations for Monaco cards, he said. One hungry investor even kicked in $2 million worth of Ethereum, another cryptocurrency, to secure black-card No. 1 from the company. Besides traditional funding sources, Monaco can be funded with bitcoin, Ethereum and other ERC20 tokens. Every time Monaco Card users spend their BTC, ETH or other ERC20 tokens, Monaco will charge a 1% software license fee. MONACO mona.co

- 29. 29 Overview of all crypto-friendly cards: a lot of hype but almost nothing inside BitFlyer, one of Japan’s leading bitcoin exchanges, has started issuing its own Visa-branded payment card, which can be used in both online and offline. Consider- ing that bitcoin and other cryptocurrencies have obtained legal status in Japan this year, it is only logical we would see more products like these being provided to the masses over the coming months and years. What makes the bitFlyer debit card so interesting is its fee structure – or the lack thereof, actually. There is no admission, annual, or usage fee by the looks of things. While it is not uncommon for trading platforms to operate on a 0% fee structure, bringing the same concept to bitcoin debit cards is not straightforward by any means. After all, these cards are usually provided through a third-party service provider which stands to make money from the fees associated with funding the card, processing transactions, and sending text messag- es related to transactions. There are two different types of bitFlyer cards. One is a black prepaid Visa card, whereas the other is a blue prepaid Visa card. There doesn’t appear to be any major difference between the two, other than with the design itself. To sign up for the card, one must have an active bitFlyer account and submit the necessary identity verification documents, which is only to be expected. Users can also withdraw money from ATMs with this card, just like they could with any other payment card. Every card valid for five years and have a monthly charging limit of 120,000 yen (about $1,000). At as now the company will make only 1,000 of these cards available with 500 of each type of card, and cardholders selected at random through a lottery procedure. BITFLYER CARD

- 30. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside Soon to be launched OCASH crypto card will allow token holders to use Stablecoins (SmartCoins), including bitUSD, bitEUR, bitGBP, and Rubles—plus other Open- Ledger tokens such as OBITS, bitcoin, and Ethereum (including ERC20)—to purchase items anywhere. OCASH will thus enable the practical use of a number of tokens. The card for the unbanked and banked alike OCASH will offer millions of users ‘ease of use’ when holding bitUSD on their account. The OCASH payment card is the solution for instant usage anywhere international credit cards are accepted. OCASH, for easy access to FIAT and POS worldwide, instantly OCASH is the connecting entity between all ecosystems on OpenLedger, allowing easy access to FIAT via ATM withdrawals or POS via payment of bills and purchases, whether online or physical. Potentially, all OpenLedger crypto gateways including but not limited to, BTC, ETH, DASH, EOS, NEM, NEO, and WAVES, as well as the native assets such as OCASH, BTS and OBITS are offered a bitUSD market from where they can convert their preferred crypto to bitUSD, for instant conversion to FIAT using the OCASH card. All you need is to hold bitUSD on your OpenLedger account and "swipe your card" to access your FIAT. OCASH ocash.io 30

- 31. Overview of all crypto-friendly cards: a lot of hype but almost nothing inside Music producer and social media star DJ Khaled (born Khaled Mohamed Khaled) is getting into the crypto-pumping business. Khaled is the latest celebrity to become a pitchman for an initial coin offering. Khaled posted a picture of himself posing in a white armchair while grasping a bottle of Cîroc vodka to his Instagram account on Wednesday evening. In his other hand he holds aloft a silver payment card. “I just received my titanium centra debit card. The Centra Card & Centra Wallet app is the ultimate winner in Cryptocurrency debit cards powered by CTR tokens!” Khaled wrote in the caption. Raymond Trapani, chief operating officer of Centra Tech, the startup whose products are featured in the post, told Fortune that Khaled is, an “official brand ambassador and managing partner” of the company. Trapani also said Centra Tech signed pro boxer Floyd Mayweather. Centra Tech plans to become the first Debit Card that is designed for use with compatibility on 8+ major crypto- currencies blockchain assets and solve a global solution to the blockchain currency dilemma that offers a comprehensive rewards program for both token and card holders while giving the ability to spend your cryptocurrency in real time with no exchange fees. The Centra Debit Card enables users to make purchases using their blockchain currency of choice right through the Centra Wallet App. The Centra Card will work anywhere in the world that accepts Visa or Mastercard. CENTRA CRYPTO centra.tech 31

- 32. 32 Bonpay is an initiative of the team of experienced professionals and cryptocurrency enthusiasts, whose ultimate goal is to promote the use of cryptocurrencies. In order to do so, they are working on building a simple, fast and secure system that can be virtually used by anyone, anywhere. Bonpay offers users cards that can increase the conveni- ence of using cryptocurrencies, which might be their biggest selling point. The cards will store bitcoin, Ethereum and Litecoin, and will be used wherever credit or debit cards are accepted. They can be electronic cards on your phone or you can get a plastic Bonpay card that functions just like a regular debit card. The Bonpay card had similar offerings before, but these were saddled with problems that made the cards quite inefficient. The first issue was reliability, with many criticisms of the support they offered. The second problem was with the high fees that came with them. Bonpay is aiming to resolve both problems by offering lower or non-existent fees in most cases. Registering and opening a wallet is free. The company also has big plans for its customer base, so it is not surprising that they are also prioritizing the support offered. In fact, versatility seems to be an area that Bonpay hopes will resonate with the customer. US dollars and euros can be loaded onto the cards, and the funds in your wallet can be kept separate from those on the card. Bonpay also offers the ability to buy digital currency with Paypal, which at the moment is a terrible hassle on p2p exchanges. BONPAY bonpay.com Overview of all crypto-friendly cards: a lot of hype but almost nothing inside