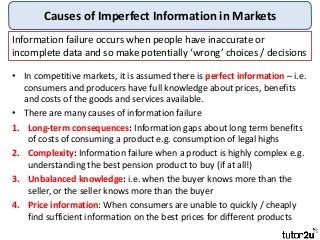

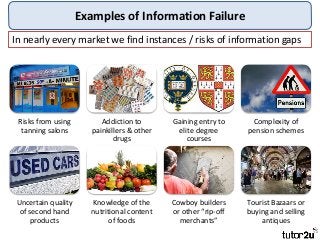

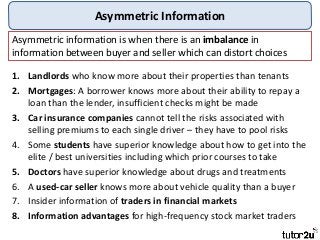

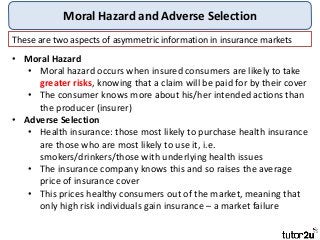

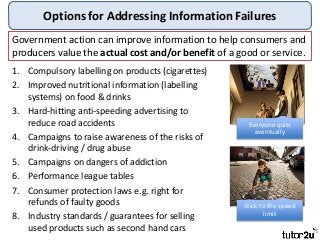

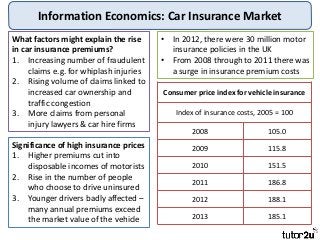

Rather like externalities, it is rare that you will encounter a market where information failure does not exist! The assumption of perfect information in competitive markets is easily dropped when you have covered this topic. The examiners want you to distinguish between symmetric and asymmetric information and also understand how imperfect market information may lead to a misallocation of resources, for example, in decisions over how much to spend on health care, education, pensions, tobacco and alcohol. You should look to link your revision on information failures with the study of merit and de-merit goods and services. This is a topic with loads of real world examples to consider.