Exam #3 ReviewChapter 10· Balance of payment statements · .docx

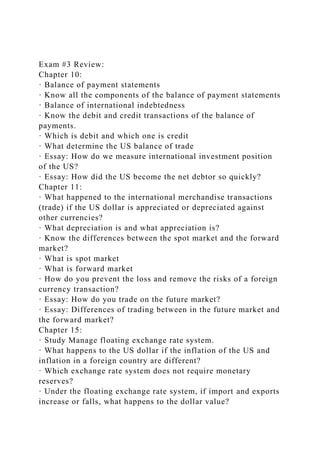

- 1. Exam #3 Review: Chapter 10: · Balance of payment statements · Know all the components of the balance of payment statements · Balance of international indebtedness · Know the debit and credit transactions of the balance of payments. · Which is debit and which one is credit · What determine the US balance of trade · Essay: How do we measure international investment position of the US? · Essay: How did the US become the net debtor so quickly? Chapter 11: · What happened to the international merchandise transactions (trade) if the US dollar is appreciated or depreciated against other currencies? · What depreciation is and what appreciation is? · Know the differences between the spot market and the forward market? · What is spot market · What is forward market · How do you prevent the loss and remove the risks of a foreign currency transaction? · Essay: How do you trade on the future market? · Essay: Differences of trading between in the future market and the forward market? Chapter 15: · Study Manage floating exchange rate system. · What happens to the US dollar if the inflation of the US and inflation in a foreign country are different? · Which exchange rate system does not require monetary reserves? · Under the floating exchange rate system, if import and exports increase or falls, what happens to the dollar value?

- 2. · What happens to the balance of trade when the currency is appreciated or depreciated? · Essay: difference between current pect and adjustable pect exchange rate. Bonus question about the video that wi will finished on monday. ECO-358: Assignment 4, Article Analysis 1. Please read the attached article several times and highlight its main points and/or arguments. If you need additional research to write your analysis of this article, please do so and cite your sources appropriately and make up a reference page at the end of your assignment to list sources (APA format is required). 2. Choose 7 concepts and/or theories from our textbook to use as guidance and foundation to analyze the article. These concepts and theories can be from any chapter of the textbook. You should choose concepts and theories that are broad/big/important enough so you can write a lot about them with information from the article. Simple definitions don’t have much to write, don’t choose them. 3. Your paper must include an article summary (very short one, just 1 paragraph), a body, and a brief conclusion. Please show me how the article contents relate to the concepts/theories you choose or vice versa. Each concept/theory has to be underlined and also has textbook page number reference on your paper. The minimum length is 5 double space pages, excluding title and reference pages. 4. Your paper has to be in APA format and style. Visit Doane College writing center, or read APA guide posted on BB for guidance on APA writing. There are many requirements on APA format. Here are some most basic and essential ones you must

- 3. have on your paper: cover page, reference page, running head, page number, quotation, correct font, size, and style…Make sure you have someone proofread your paper before you submit. 5. You should use formal language and style on this assignment. If you don’t like the attached article, you may choose your own article with my approval a week before assignment 4 deadline. Only articles from recognized magazines or peer review journals will be accepted. The article has to be long enough for you to write. Due date is on Schedule. Email me right away if you have questions. I’m looking for college level papers. Happy writing! WHAT INTERACTIONS BETWEEN FINANCIAL GLOBALIZATION AND INSTABILITY?—GROWTH IN DEVELOPING COUNTRIES BRAHIM GAIES1, STEPHANE GOUTTE2* and KHALED GUESMI3 1IPAG Lab, IPAG Business School, Paris, France 2University Paris 8, LED, France and Paris Business School, PSB, Paris, France 3IPAG Lab, IPAG Business School, Paris, France and Telfer School of Management, University of Ottawa, Canada Abstract: This paper tests the effects of the impact of financial globalization on economic growth,

- 4. examining its interaction with financial instability for a sample of 72 developing countries over the period 1972–2011, using dynamic panel estimator ‘two-step Generalized Method of Moments’ (two-step system GMM). The main results of the paper are the following: (i) financial instability and indebtedness-globalization decrease growth; (ii) financial globalization and investment-globalization increase growth; (iii) indebtedness-globalization increases the effect of financial instability on growth; (iv) investment-globalization decreases the effect of financial instability on growth; and (vi) financial globalization decreases the effect of financial instability on growth. These results are robust in a set of tests consisting of the insertion of alternative variables of financial instability, the inclusion of new control variables, inter alia an indicator of banking crises, using different time periods, and changing of the composition of the sample. © 2018 John Wiley & Sons, Ltd. Keywords: financial globalization; GMM system; spillover effects; growth; financial instability; interaction variables JEL Classification: C23; C26; E44; F21; F36 1 INTRODUCTION The main purpose of this article is to determine the impact of financial globalization on economic growth in developing countries, examining its interaction with financial *Correspondence to: Stephane Goutte, University Paris 8, LED, France and Paris Business School, PSB, Paris, France.

- 5. E-mail: [email protected] © 2018 John Wiley & Sons, Ltd. Journal of International Development J. Int. Dev. 31, 39–79 (2019) Published online 11 September 2018 in Wiley Online Library (wileyonlinelibrary.com) DOI: 10.1002/jid.3391 http://orcid.org/0000-0002-5206-866X http://crossmark.crossref.org/dialog/?doi=10.1002%2Fjid.3391 &domain=pdf&date_stamp=2018-09-11 instability. There are two conflicting positions on the empirical effects of financial globalization. On the one hand, the proponents of financial liberalization attribute the economic take- off of emerging countries to the expansion of their financial markets and to the mobilization of significant foreign savings that finance the investment and expansion of technology transfer linked to financial globalization (Quinn, 1997; Bekaert, Harvey, & Lundblad, 2011; De Nicolo & Juvenal, 2014; Agrawal, 2015). On the other hand, the opponents of this point of view attribute the economic difficulties of certain developing countries with regard to indebtedness, negative growth and crises, to a large extent to their adherence to the free worldwide circulation of capital (Rodrik, 1998; Mougani, 2012; Gehringer, 2013). More specifically, the UNCTAD (2012) goes as far as to speak of ‘the paradox of finance-driven globalization’, in

- 6. which the external financial globalization has not kept its theoretical promises—namely, better worldwide mobilization and allocation of savings for faster convergence of developing countries and a better share and diversification of the risks of cost reduction of capital at the international level (McKinnon, 1973; Shaw, 1973). Thus, the absence of empirical consensus regarding the question (Obstfeld, 2009) renders as complex to verify it as to refute a more important involvement of developing countries in the process of financial globalization. In search of an answer to this problem, a new point of view on the subject has emerged. It assumes that to a larger extent than the direct effects, financial globalization leads to spillover effects (indirect effects) that impact indirectly on economic growth and that by acting primarily in the development of domestic financial system (Masten, Coricelli, & Masten, 2008; Estrada, Park, & Ramayandi, 2015 Ahmed, 2016; Trabelsi & Cherif, 2017). In contrast, another new literature does not exclude the possibility of financial globalization entailing indirect negative effects and underestimated the macroeconomic constraints attributed to it in the last century, in particular after financial crises (Rodrik & Subramanian, 2009; Joyce, 2011; Lane & McQuade, 2014). As a matter of fact, if financial opening promotes the irregular financial development of a developing country, it can act as an amplifier of financial instability and of its

- 7. potential mischiefs in relation to growth (Guillaumont & Kpodar, 2006; Loayza & Rancière, 2006; Eggoh, 2010). In this context, the foreign capital flows injected into the receiving financial system can have a procyclic role, amplifying the negative impact of financial instability on growth (Aghion, Bacchetta, & Banerjee, 2004; Caballé, Jarque, & Michetti, 2006). That is how financial globalization may catalyse financial instability, which in turn may constrain growth in developing countries because their regulatory systems are less mature than those of developed countries. The result is a decline in investment, production and international trade. Considering all these controversies, three questions are worth being raised in the case of developing countries: (i) What is the direct effect of financial globalization on growth? (ii) What is the direct effect of financial instability on growth? (iii) What is the spillover (indirect) effect of financial globalization via the impact of financial instability on growth? In order to find possible answers to these questions, firstly, we study the direct impacts of investment-globalization [stocks of external assets and liabilities, foreign direct investment (FDI) plus portfolio equity], indebtedness- globalization (stocks of external assets and liabilities, debt) and financial globalization (investment-globalization plus indebtedness-globalization) on economic growth. Secondly, we

- 8. examine the direct impact 40 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid of financial instability (in the sense of an irregularity of financial development, and not only in terms of crisis) on growth. Thirdly, we analyse the indirect impacts (spillover effects) of financial globalization, investment-globalization and indebtedness-globalization on growth through its interaction with financial instability. Through our study, we find four main results. In the first place, financial instability has a negative effect on economic growth. Second, not only does investment-globalization have a direct positive effect on growth but also has an additional spillover and positive effect, reducing the negative impact of financial instability. Furthermore, in contrast, not only does indebtedness-globalization have a direct negative effect on growth but also has a spillover and negative effect, increasing the negative impact of financial instability on growth. Lastly, in sum, financial globalization (investment- globalization plus indebtedness-globalization) positively influences growth directly and collaterally through its interaction with financial instability. Our study makes three main contributions to the literature. First, it goes beyond the

- 9. recent literature on the tripartite relationship between financial globalization, financial development and economic growth in developing countries (Estrada et al., 2015; Ahmed, 2016; Trabelsi & Cherif, 2017). In fact, this literature does not take into account the effect of the irregularity of financial development, namely, financial instability. In the second place, we complement the previous empirical analyses focused on the effects of financial instability on growth (Guillaumont & Kpodar, 2006; Loayza & Rancière, 2006; Eggoh, 2010). These analyses neglected the interaction between financial globalization and financial instability. Thirdly, we give an empirical view to the theoretical modelling of financial instability in small open economies (Aghion et al., 2004; Caballé et al., 2006). The following sections of the article will be organized as follows. Section 2 constitutes a literature review; Section 3 describes the data used, while Section 4 discusses the methodology and the results. Section 5 presents the conclusions drawn. 2 LITERATURE REVIEW 2.1 Financial Globalization and Growth Overall, academic work treating the tandem of financial globalization and economic growth can be classified in three big groups. The first group represents those studies that

- 10. prove that financial globalization has a direct positive effect on economic growth. The second group includes investigations that have shown that financial globalization has a mitigating effect on growth.1 The last group comprises research inquiries that have underscored the direct negative or insignificant effect on economic growth. For the first group, Quinn (1997) was one of the first economists to demonstrate without ambiguity a direct and net positive relationship between financial opening and economic growth. The sample studied by the author, comprising a period from 1958 to 1989, consisted of 64 developed and developing countries. In order to examine the nature of the relationship between financial opening through portfolio investment and economic growth, Bekaert, Harvey, and Lundblad (2005) studied 95 developed and developing countries during the 1This means that the impact of financial globalization on economic growth is indirect and/or depends on the nature of the financial opening (foreign direct investment, portfolio investments, debts, foreign aids, …). Growth: Financial Globalization, Instability 41 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid period 1980–1997. Their conclusion is that an opening of the equity market increases GDP per capita by an annual average of 1 per cent. More recently,

- 11. Bekaert et al. (2011) analysed the effects of financial globalization (opening of capital accounts and of the equity market) in a panel of 96 developed and developing countries between 1980 and 2006. The authors demonstrate the robustness of the impact of financial opening both on growth and on total factor productivity. Furthermore, using a sample comprising 48 emerging and developing countries, De Nicolo and Juvenal (2014) highlight the fact that financial globalization and financial integration increase economic growth stabilize and develop the real sphere of the economy. According to the authors, this positive effect is even more important in a context of good institutional quality and governance. Lastly, the paper by Agrawal (2015) studies the nature of the relationship between FDI and economic growth in the BRICS economies between 1989 and 2012. The empirical methodology used is panel data co-integration and causality analysis. The results from Agrawal (2015) confirm that FDI and economic growth are co-integrated in the panel countries and the causality test highlights the long- term causality between these two variables. In the second group, Masten et al. (2008) examine the effect on economic growth of financial opening and financial development, separately and in interaction, in 31 European economies between 1996 and 2004. The authors show that financial development is a necessary condition for the sample countries to absorb foreign capital flows and to harness their benefits. Indirectly, this condition forces open countries to develop their domestic financial

- 12. systems. Recently, Estrada et al. (2015) found that financial development increases economic growth in developing countries but that this effect is lower in developed ones. Conversely, the authors argue that the direct positive impact of financial globalization on output is stronger in advanced economies than in less developed economies. They conclude that the financial systems are more efficient to allocate foreign savings in developed countries than in developing economies. However, this conclusion does not exclude the positive effect of financial globalization on financial development. The analysis is conducted through 108 countries from 1977 to 2011 in the period 1984–2007 using the Generalized Method of Moments (GMM) estimator using panel data. In a more recent article, Ahmed (2016) studies the direct and indirect impact of financial globalization on economic growth through the channel of financial development. For the sample of 30 countries of sub-Saharan Africa, his calculations underscore that between 1976 and 2010, financial opening has not increased direct growth through the classic channel of capital accumulation but through the development of the sample countries’ domestic financial systems. Lastly, Trabelsi and Cherif (2017) examined the impact of financial globalization on financial development in 90 high-income and middle-income countries during the period 1980–2009. Their empirical analysis based on cross-sectional and dynamic panel (GMM method) highlights that the positive effect on financial sector and output growth of

- 13. freeing cross-border financial transactions depends on the same institutional prerequisites. Furthermore, according to Kose, Prasad, Rogoff, and Wei (2006), in the case that the effect of financial globalization on economic growth is mitigated, this means that not all types of globalization are beneficial to growth. Even though several studies prove the positive effect of FDI and portfolio investments, several other studies affirm the negative effect of foreign debts. In this sense, Neto and Veiga (2013) conclude in the light of their results that FDI is beneficial to developing countries and that it is elemental for the governments of these countries to track the typology of the capital that they exchange in order to profit from financial globalization, particularly given that foreign debts do not seem to increase the corresponding GDP. The study by Neto and Veiga (2013) is 42 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid based on a large sample of 139 countries examined during the period 1970–2009. Agbloyor, Abor, Adjasi, and Yawson (2014) investigated the relationship between private capital flows (FDI, portfolio investment and debts) and economic growth between 1990 and 2007 for a panel of 14 African countries.

- 14. Using the technique of instrumental variables and the GMM method, Agbloyor et al. (2014) draw two main conclusions. The first is that the three types of flow have a negative impact on economic growth in the countries in question. The second is a nuance of the first: it stipulates that those countries that have a developed financial market are able to transform this negative effect into a positive impact. In the last group, the groundbreaking study by Alesina, Grilli, and Milesi-Ferretti (1994) is one of the earliest to be cited. The authors conclude that the financial opening can neither increase nor decrease growth, looking at 20 countries of the Organization for Economic Cooperation and Development between 1950 and 1989. This is confirmed 1 year later by Grilli and Milesi-Ferretti (1995) in a sample of 61 countries and in a period spanning from 1966 to 1989 and then by Rodrik (1998) for 100 developed and developing countries in the course of the period 1975–1989. Mougani (2012) examines a sample of 34 African countries between 1976 and 2009, looking at the specifications that explain growth through a combination of economic and institutional control variables, as well as two variables of interest, which reflect the financial opening: private financial flows and FDI. In line with the other results, the author reveals a positive impact of financial opening on growth when the calculations are conducted in time series. For GMM estimations, this effect is robust neither in open economies nor

- 15. in closed ones, which leads the author to refute the hypothesis of a positive correlation between financial globalization and growth, notably regarding the superiority of the GMM method when it comes to relevance (as a result of the potential biases of endogeneity, which are linked to the Ordinary Least Squares (OLS) method). Lastly, in a study conducted with a dynamic panel consisting of 26 countries of the European Union between 1990 and 2007 using the difference GMM and GMM system, Gehringer (2013) finds that financial liberalization has a positive impact on economic growth, global productivity and investment. The result is obtained by the author using a de jure measure of financial opening, which is not the case with the de facto measure. Indeed, Gehringer (2013) puts forward that it is the political aspect of financial opening—namely, the external financial liberalization—and not its quantitative reality (financial globalization), which promotes economic growth. In sum, this literature review supports the non-existence of empirical consensus on the effect of financial globalization on growth. This absence of consensus can explain the diversity of indicators of financial globalization, of samples and of periods studied, as well as the multiplicity of modelization techniques, and of types of financial globalization. This being said, recent studies underscore the general tendency to consider the indirect (spillover) effects of financial globalization. Additionally, the

- 16. global effects—direct and/or indirect—of financial opening are more robust in the long term with de facto measures and dynamic panel data models, as well as with interaction variables and the GMM method. Moreover, it is more convenient to demonstrate a direct and/or indirect positive effect of financial globalization through FDI and portfolio investment on growth than of financial globalization through foreign debt. Lastly, it has to be noted that the new tendency of empirical literature is to focus on the indirect positive effects of financial globalization (development of the financial system, improvements in governance) and it relatively neglects the indirect negative effects that the latter could have on economic Growth: Financial Globalization, Instability 43 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid growth. This motivates our study of the triplet relationship between financial globalization, financial instability and growth. 2.2 Financial Instability and Growth As supported by Hnatkovska and Loayza (2005) and Rancière, Tornell, and Westermann (2008), macroeconomic fluctuations are either of the ‘normal’ or the ‘crisis’ type. The first are more repetitive in frequency and more long lasting. The

- 17. second are more ample and shorter in duration. According to Cariolle and Goujon (2015), macroeconomic instability constitutes the normal fluctuations of macroeconomic variables. It is traditionally measured by the deviation of the distribution of a variable around its mean (absolute deviation or standard deviation of the growth rate of a variable) or a trend (residual of an econometric regression), which then represents the equilibrium value. By analogue means, financial instability reflects the normal fluctuations of financial development and is distinct from financial crises. More precisely, it can be considered as an irregularity of financial development—namely, repetitive fluctuations and long-lasting financial development, which are propagating in the long term. Consequently, financial instability can be measured by the deviation of the distribution of the financial development variables around their means—absolute or standard deviation—or the trends—residual (Guillaumont & Kpodar, 2006; Loayza & Rancière, 2006; Eggoh, 2010). Furthermore, Aghion et al. (2004) examined in their theoretical study the phenomenon of financial instability in a context of free capital circulation. The authors modelled a dynamic small open economy model with tradeable goods produced with capital and a country-specific factor. In this model, the firms are subject to credit constraint in order to finance their projects, without the possibility of a leverage effect. The dynamic of the

- 18. model is the following. In a first movement, the rise in investment produces a rise in production and in the most important profits. The increase of profits permits the firms to have more credit (they are considered to be more solvent). While the foreign capital flows amplify this trend and lead to an investment boom, the investment boom increases the demand and so the price of the country specific factor of production. This mechanism promotes inflation and generates subsequently a reversed movement, namely, a decrease in profits, a reduced solvency of firms, credit crunch, a contraction of investment and a fall in production. In consequence, this movement reestablishes the first phase of investment boom and price decline of the specific factor of production (the factor of production is henceforth less commonly used due to the fall in investment in the second phase). This dynamic supports the conclusion on the endogenous character of financial instability, whose effects are catalysed by the access to foreign capital flows, according to Aghion et al. (2004). In this sense, a crisis would constitute an extreme case in terms of the brutality and magnitude of movements of instability. Aghion et al. (2004) further add that if the financial system was highly developed, this instability would be of less importance, because the firms would still be able to obtain financing for their investments despite the fall in profits of the second movement. This is possible due to the diversity of financial institutions and the plurality of the domestic and foreign financial sources in these

- 19. economies. Caballé et al. (2006) have drawn the same conclusions as Aghion et al. (2004) from a dynamic model of a small open economy. They have insisted on the endogeneity of financial instability and on the catalysing role that foreign debts have in the development of instability. 44 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid Concerning the effects of financial instability on growth, three papers have empirically examined this relationship, namely, Loayza and Rancière (2006), Guillaumont and Kpodar (2006) and Eggoh (2010). As a starting point, Loayza and Rancière (2006) investigate the inter-linking between financial development and economic growth in a sample of 75 developed and developing countries in the period 1960–2004. The results of their calculations drive them to conclude that financial development has a positive effect on economic growth in the long term. However, in the short term, this effect is negative. These two authors explain this result by the means of financial stability, which they measure by the recurrence of financial crises and by the instability of the indicator of financial development. Just like Loayza and Rancière (2006), Guillaumont and Kpodar (2006) study financial instability as a collateral phenomenon to

- 20. financial development that influences the process of economic growth. The main results that they find for a sample of 120 developing countries indicate that financial development is one of the factors that explains financial instability in an inflationary context. It acts negatively on growth among others, by reducing the positive impact of financial development on the latter, but without offsetting it completely. In a more recent study, Eggoh (2010) estimates a growth model in cross section, and in a second step in panel data, which simultaneously integrates indicators of financial development and of financial instability as variables of interest for a hybrid sample of 75 developed and developing countries in the period 1960–2004. The deductions of Eggoh (2010) agree with those of Guillaumont and Kpodar (2006). 3 DATA To quantify the links between financial globalization, financial instability and economic growth in developing countries, we are basing our study on an unbalanced panel of 72 countries among low-income and middle-income countries according to the World Bank classification.2 As is now standard in growth regression literature (see, e.g. Loayza and Rancière, 2006; Aghion, Bacchetta, Rancière, & Rogoff, 2009; Neto & Veiga, 2013; Ahmed, 2016), we construct our panel data set by transforming our time series data between 1972 and 2011 into a 5-year average.3 This method is used to eliminate

- 21. business-cycle fluctuations in order to focus on long-term growth effects (Temple, 1999). It is also useful to capture considerable variation and is less noisy compared with annual rates (Bhargava, Jamison, Lau, & Murray, 2001). We consider a standard growth regression model, as is traditionally implemented in literature (see, e.g. Barro & Sala-I- Martin, 2004). The dependent variable is the growth rate of the real GDP per capita (GDPPCG). It is explained by the indicators of financial globalization, of financial instability and of control variables.4 2The World Bank considers that a country is low-income if its GNI per capita is lower than or equal to US$935. A country is considered to have lower average income if its GNI per capita is no less than US$936 and no more than US$3705; a country has a higher average income if its GNI per capita is between US$3706 and US$11 455; and a country is at higher income if its GNI per capita exceeds US$11 456 (http://data.worldbank.org/about/country- classifications/country-and-lending-groups). 3The transformation results in eight non-overlapping sub- periods: 1972–1976, 1977–1981, 1982–1986, 1987– 1991, 1992–1996, 1997–2001, 2002–2006 and 2007–2011. The variables of financial instability are calculated in terms of standard deviation and absolute deviation over 5 years. 4Variables and sources are described in Table A12. Summary statistics can be found in Table A13; correlation coefficients are in Table A14. Growth: Financial Globalization, Instability 45 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019)

- 22. DOI: 10.1002/jid http://data.worldbank.org/about/country-classifications/country- and-lending-groups http://data.worldbank.org/about/country-classifications/country- and-lending-groups 3.1 Indicators of Financial Globalization Our indicators of financial globalization are extracted from the database of Lane and Milesi-Ferretti (2007), updated in 2011 (the last update). OPGLG is the indicator of financial globalization. It constitutes the growth rate of total stocks of external FDI, portfolio equity and debt, assets and liabilities. INVOPGLG is the indicator of investment-globalization. It is the growth rate of total stocks of external FDI and portfolio equity, assets and liabilities. OPENDEB is the indicator of indebtedness- globalization. It is the growth rate of total stocks of external debt, assets and liabilities. The use of these indicators is recommended by Kose et al. (2006). The authors stress that it is more beneficial to use this kind of indicator (de facto measure), because the latter account for the reality of the impact of financial globalization rather than the degree of liberalization of the capital account (de jure measure). Moreover, Baltagi, Demetriades, and Law (2009) argue that the endogeneity bias is more important for de jure indicators, reflecting a policy choice of financial opening, than de facto indicators of financial

- 23. globalization. 3.2 Indicators of Financial Instability The indicators of financial instability are INBANK and INLIQ. INBANK constitutes the 5- year average absolute deviation of the growth rate of deposit money bank assets to total bank assets (deposit money plus central). INLIQ is the 5-year average absolute deviation of the growth rate of liquid liabilities to the GDP. These two indicators of financial instability are calculated with the use of the formula Vx1 ¼ 1 5 ∑ 5 t¼1 gxt � gx �� ��. VX1 constitutes the measure of financial instability INBANK or INLIQ, considering that gxt is the growth rate of deposit money bank assets to (deposit money + central) bank assets (BANK) or the growth rate of liquid liabilities to GDP (LIQ), taken from the database of Beck and Demirgüç-Kunt (2009), updated in April 2013. Since the pioneering work of King and Levine (1992), LIQ reflects the size of a financial system and its depth, and BANK indicates the importance of commercial banks in the economy in relation to the central

- 24. bank (Sahay et al., 2015). 3.3 Control Variables The control variables are extracted from the World Bank database. These are lagged real GDP per capita (L.GDPPC), trade openness (TRADE), education (EDU), terms-of-trade growth (TERM) and government size (GOV). They are selected in accordance with several studies on the phenomenon of economic growth, because they have been proven robust, namely, by Sala-I-Martin (1997), Barro and Sala-I- Martin (2004) and Sala-I- Martin, Doppelhofer, and Miller (2004). These variables are also used by the recent empirical literature on financial globalization and financial development (see, e.g. Aghion et al., 2009; Neto & Veiga, 2013; Estrada et al., 2015; Ahmed, 2016; Trabelsi & Cherif, 2017). 46 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid 4 EMPIRICAL ANALYSIS 4.1 Estimated Models We examine the direct effect on growth of financial globalization and financial instability measures. Then we look at the impact of interaction between

- 25. these measures of growth. More specifically, we test two models: Equation (1) tests the direct effect and Equation (2) tests the indirect (spillover) effect. ΔYit ¼ α0 þ γY it�1 þ α1 int1it þ α2int2it þ β 0 X it þ μi þ λt þ εit (1) ΔY it ¼ α0 þ γYit�1 þ α1int2it þ α2 int1it� int2itð Þ þ β 0 X it þ μi þ λt þ εit; (2) where ΔYit = Yit – Yit�1 is the growth rate of real GDP per capita (GDPPCG); Yit�1 is the lagged real GDP per capita (L.GDPPC); int1it represents the indicators of financial globalization (OPGLG or INVOPGLG or OPENDEB); int2it represents the indicators of financial instability (INBANK or INLIQ); int1it * int2it represents an interaction term between financial globalization measures and financial instability measures; Xit regroups the set of control variables (TRADE, EDU, TERM and GOV); α0 is a constant; μi is the country-specific effect; λt is the time-specific effect; and εit is the error term. According to Equation (2), the marginal effect of financial instability of growth is obtained through calculation of the partial derivative of the growth rate of the real GDP per capita on the indicator of financial instability, which reads as follows: d ΔYð Þit

- 26. d int2ð Þit ¼ α1 þ α2 int1it: (3) If α1 and α2 are both positive (negative), the financial instability measures have a positive (negative) effect on economic growth, and financial globalization measures amplify this impact. If α1 > 0 and α2 < 0, the financial instability measures have a positive effect on economic growth, although the financial globalization measures reduce this impact; if α1 < 0 and α2 > 0, the financial instability measures have a negative effect on economic growth, although the financial globalization measures reduce this impact. 4.2 Estimation Method We use the GMM5 system dynamic panel data estimator developed in Arellano and Bond (1991), Arellano and Bover (1995) and Blundell and Bond (1998), and we compute 5The use of the Generalized Method of Moments (GMM) system method constitutes a strong point of the empirical investigations based on the dynamic panel data, because of its superiority to traditionally employed methods (e.g. OLS, Generalized Least Squares (GLS), Quasi Least Squares (QLS), within estimator and between estimator) because it provides the advantage of controlling the endogeneity of explanatory variables, such as the lagged dependent variable, generating internal instruments (Arellano & Bond, 1991; Arellano & Bover, 1995; Blundell & Bond, 1998; Roodman, 2009a, 2009b).

- 27. Growth: Financial Globalization, Instability 47 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid robust two-step6 standard errors by following the methodology proposed by Windmeijer (2005).7 This method permits us to resolve the potential problem of endogeneity of explanatory variables. Moreover, in our models, the explanatory variables, including the initial level of real GDP per capita, are of a macroeconomic and institutional nature, hence constituting a risk of evoking inverse causality with growth. These variables may not be fully exogenous, and causality may run in both directions. This method also allows us to resolve the potential bias related to possible correlation between country- fixed effects and the explanatory variables. In addition, the individual dimension of our panel—which is relatively larger than its temporal dimension (small T, large N)—justifies the choice of the GMM system estimator in two stages (Roodman, 2009a, 2009b). The GMM system estimator is used in the most recent panel studies on the financial globalization and financial development (see, e.g. Aghion et al., 2009; Neto & Veiga, 2013; Estrada et al., 2015; Ahmed, 2016; Trabelsi & Cherif, 2017). The validity of the GMM system estimator

- 28. is conditioned upon the exogeneity of the instruments (Hansen test of over-identifying restrictions: Hansen test) (Hansen, 1982), as well as no autocorrelation of errors of order 2 (Arellano–Bond test: AR2) (Arellano & Bond, 1991; Arellano & Bover, 1995; Blundell & Bond, 1998). All of these tests confirm the validity of our estimates. 4.3 Basic Results In Table 1, the coefficients of the indicators of financial instability (INBANK and INLIQ) are statistically significant and negative in all of the regressions (1), (2), (3), (4), (5) and (6). This leads us to conclude that the direct impact of financial instability on growth is negative. Also, this result confirms the conclusions of the theoretical models of Aghion et al. (2004) and Caballé et al. (2006) that demonstrate the negative impact of financial instability on firm profits and investment. The coefficients linked to the indicator of financial globalization (OPGLG) being positive in regressions (1) and (4) bear witness to the positive direct impact of financial globalization on growth. The same observation in regressions (2) and (5) applies to the indicator of investment-globalization (INVOPGLG). Also, as can be observed in regressions (3) and (6), the negativity of the coefficients related to the measure of indebtedness-globalization (OPENDEB) indicates that this type of globalization decreases the real GDP per capita growth. The beneficial effect

- 29. of investment- globalization can be explained by the crowding effect between domestic and foreign 6A first estimation revolves around the hypothesis of the absence of an errors’ correlation and the homoscedasticity of errors. In a second step of the calculation, the vector of residuals derived from this first estimation is used to assess a variance–covariance matrix of errors in a convergent manner. At this second stage, the hypothesis of the absence of the errors’ correlation and of the homoscedasticity of errors is being verified. This leads to the GMM estimator that is being assessed in two stages, which is more efficient than the GMM estimator assessed in one step, especially for the GMM system (Roodman, 2009a, 2009b). 7All of our regressions are estimated with Stata 12, in which the GMM system method is preprogrammed (commands: xtabond2 and twostep robust). Additionally, we base the writing of our commands in relation to our assessments on the recommendations of Roodman (2009a, 2009b) and Newey and Windmeijer (2009), including application of the correction by Windmeijer (2005). Through the use of Stata 12, the command collapse guarantees a small number of instruments which does not exceed the number of observations, enabling us to assess the model in an unbiased manner, which potentially prevents the problem of instrument proliferation (Roodman, 2009a, 2009b). Indeed, with a number of instruments that is too large and surpasses the number of observations, the endogenous variables can be overrepresented through their instruments, evoking the risk of a persisting problem of endogeneity. 48 B. Gaies et al.

- 30. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le 1 . F in an ci al g lo b al iz at io n , fi n an ci al in st ab

- 61. ca nt at 1 p er ce nt . Growth: Financial Globalization, Instability 49 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid investment, as well as a technology transfer (see, e.g. Borensztein, De Gregorio, & Lee, 1998). On the other hand, the negative direct effect of indebtedness-globalization may go back to the potential indebtedness problems—especially repayment of debt—related to this type of globalization (see, e.g. Obstfeld, 1998; Broner, Martin, & Ventura, 2010). Furthermore, the negativity of the coefficient’s sign of lagged GDP per capital (L. GDPPC) is in line with teachings about the conditional- convergence framework. The positive sign of the coefficient of trade openness (TRADE) corresponds with fundamental theses of classical international trade theory. The negative sign

- 62. of the coefficient of the indicator of government size (GOV) is also in line with public choice theory. The indicators of education (EDU) and the terms-of-trade growth (TERM) appear little explanatory with regard to growth of the real GDP per capita in the countries of our sample between 1972 and 2011. According to Table 2, the coefficients of the terms of interaction between financial globalization and financial instability (INLIQ × OPGLG and INBANK × OPGLG) are positive in regressions (1) and (4). In consequence, the marginal negative effect of financial instability on growth decreases with a higher level of financial globalization. More precisely, the positive impact of the latter on the real GDP per capita counterbalances the negative effect of instability. Hence, it seems that financial globalization also allows a spillover (indirect) positive effect on growth. This effect may be the decrease of financial instability’s harmful effect on growth in developing countries. On the other hand, and still according to Table 2, the terms of interaction between investment-globalization and financial instability (INBANK × INVOPGLG and INLIQ × INVOPGLG) also have coefficients with a positive sign, suggesting that investment-globalization decreases financial instability’s harmful effect on economic growth. It hence indirectly and positively influences economic

- 63. growth. Conversely, the interaction terms between indebtedness-globalization and financial instability (INBANK × OPENDEB and INLIQ × OPENDEB) show a coefficient with a negative sign. This means that the negative impact of financial instability on real GDP per capita growth is amplified by a stronger indebtedness-globalization. This type of globalization allows an indirect negative effect on growth, increasing the harmful effect of financial instability. The negative spillover effect of indebtedness- globalization on growth via financial instability confirms the conclusions of the theoretical models by Aghion et al. (2004) and Caballé et al. (2006). Let us recall that these models show the robust theoretical relationship between the movements of foreign capital flows—especially debt flows—and credit instability. In addition, a number of studies proved that the foreign debt flows are often synonymous with agency problems, risks and crises in the domestic financial system (see, e.g. Rodrik & Subramanian, 2009; Joyce, 2011; Lane & McQuade, 2014). Besides, the literature on spillover effects of financial globalization attributes the development of the domestic financial system to foreign investment flows rather than foreign debt flows (see, e.g. Kose et al. (2006)). On this basis, we can explain the positive spillover effect of investment-globalization on growth via financial instability as follows: It is because investment- globalization indirectly promotes financial development that it lowers the negative

- 64. effect of financial instability on growth. Moreover, as is the case for the regressions of Table 1, the signs of the coefficients of those control variables are significant, consistent with basic economics theories. 50 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le 2 . F in an ci al g lo ba li za ti o n

- 97. Growth: Financial Globalization, Instability 51 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid 4.4 Robustness Test We subject our main empirical findings to a set of tests to validate their robustness. These tests consist of the insertion of alternative variables of financial instability, the inclusion of new control variables, inter alia an indicator of banking crises, using different time periods, and changing the composition of the basic sample. 4.4.1 Alternative variables of financial instability We have calculated two other alternative indicators of financial instability, taking the indicators of financial development (LIQ and BANK). INBANKR and INLIQR constitute the 5-year average absolute value of residual εt. They are calculated in the following formula: Vx2 ¼ 1 5 ∑ 5 t¼1 εtj j; (4)

- 98. where VX2 constitutes the measure of financial instability INBANK or INLIQ and εt is the pooled OLS estimated residual of the following regression: xt ¼ a þ bxt�1 þ ct þ εt; (5) where x is BANK or LIQ, a is a constant and t is the time. This regression is estimated separately for every country in the sample. Table A1 presents the results of the estimates run on Model 1 through the introduction of new alternative variables of financial instability (INBANKR and INLIQR). It shows the negative impact of financial instability on real GDP growth per capita. The indicators of financial globalization and of investment-globalization (OPGLG and INVOPGLG) have positive coefficients. This confirms their positive impact on economic growth. However, the coefficients linked to the indicator of indebtedness- globalization (OPENDEB) are negative in Table A1. This type of globalization has a harmful effect on the growth of the real GDP. These results and the ensuing interpretations confirm those in Table 1. Also, the control variables keep the same signs and almost the same significance as those of the estimates in Table 1. The results in Table A2 equally confirm those in Table 2. The coefficients of the terms of interaction between the variables of financial instability and financial globalization, as well as investment-globalization (INLIQR × OPGLG, INBANKR × OPGLG, INBANKR × INVOPGLG and INLIQR × INVOPGLG), bear

- 99. positive signs. In contrast, the coefficients of the terms of interaction between the variables of financial instability and indebtedness-globalization (INLIQR × OPENDEB and INBANKR × OPENDEB) are negative. Consequently, the two main conclusions drawn from our estimates on the basis of Model 2 regarding Table 2 are consolidated at this point. The first constitutes the spillover (indirect) positive impact of financial globalization and investment- globalization on growth via the decrease in the harmful effect of financial instability. The second conclusion is that indebtedness-globalization increases this effect and lowers the GDP growth per capita. Furthermore, the coefficients of control variables keep the signs and the significances of the estimates in Table 2. According to Tables A1 and A2, it has to be noted that the replacement of the indicators of financial instability with other variables has not significantly undermined the stability of our baseline estimates. That being said, what happens if we insert the variables of financial 52 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid instability from a different calculation method and from a new indicator of financial development?

- 100. We consider the two following indicators of financial development: the financial system deposits to the GDP (DEV) and deposit money bank assets to the GDP (DEBA). Thereafter, we calculate8 the indicators of financial instability INDEV and INDEBA. Firstly, INDEV is the 5-year standard deviation of the log- difference of DEV. It is calculated in the following formula: INDEV ¼ ffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi ffiffiffiffi ∑ 5 t¼1 gxt � gx � �2 ; s (6) where gxt is the log-difference of DEV, extracted from the database of Beck and Demirgüç- Kunt (2009), updated in April 2013. Secondly, INDEBA is the 5-year standard deviation of value of residual εt. It is calculated in the following formula:

- 101. INDEBA ¼ ffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi ∑ 5 t¼1 1 5 εt2; s (7) where εt is the pooled OLS estimated residual of the following regression: xt ¼ a þ bxt�1 þ ct þ εt; (8) where x is DEBA, extracted from the database of Beck and Demirgüç-Kunt (2009), updated in April 2013, a is a constant and t is the time. This regression is estimated separately for every country in the sample. Tables A3 and A4 also confirm our main empirical findings. The signs of the coefficients associated with the variables of financial globalization and the alternative indicators of financial instability, as well as those of interaction terms, support the fact that financial globalization and investment-globalization positively and significantly affect growth directly and indirectly. In contrast, indebtedness- globalization seems to be harmful to the latter, directly as well as indirectly.

- 102. 4.4.2 Adding control variables In Table A5, we have kept Models 1 and 2, adding three new control variables. They are the banking crisis dummy (CRISIS), the population growth (POPG) and the political rights indicator of Freedom House (POL). Eichengreen, Gullapalli, and Panizza (2011) support that financial opening develops the financial system but generates financial crises. In consequence, the resumption of our main empirical results, after controlling the variable of the banking crises and of other variables, risks causing a decrease in the significance of the coefficients of financial instability’s variables and the terms of interaction. However, Table A5 highlights the opposite. It confirms our main empirical findings after adding new variables. Moreover, this supports our distinction between financial crisis and financial 8These calculation methods are equally used to measure macroeconomic instability in general, just like the other exposed methods. For more detail, see Cariolle and Goujon (2015). Growth: Financial Globalization, Instability 53 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid instability. Indeed, the impact of financial instability on growth has not been nullified by the presence of the indicator of crisis, which is significant.

- 103. Thus, financial instability can trigger a crisis, but it is important not to amalgamate the two. 4.4.3 Changing of the estimation period In order to see if the results stay valid in other temporal horizons, we estimate again Models 1 and 2 for the three following sub-periods: 1972–2001 and 2007–2011, 1972– 2007 and then 1972–2001. In a first step, we have eliminated the data related to the sub- period of 2002–2006. In this sub-period, the process of financial globalization saw a worldwide boom since 1972 (International Monetary Fund, 2012). In a second step, we have considered the sub-period 1972–2007 in isolation. Indeed, in contrast to the sub- period of 2002–2006, the sub-period of 2007–2011 corresponds to a sharp decline in the exchange of financial flows (International Monetary Fund, 2012) after the international financial crisis in 2008. In a third step, we have eliminated the sub-period 2002–2011. This sub-period presents two strong movements of acceleration and deceleration of the phenomenon of financial globalization. From Tables A6, A7, A8, the stability of our conclusions for the investigated different time periods becomes obvious. The signs and the coefficients’ significance associated with the variables of financial globalization, financial instability and the terms of interaction are consistent with those in Table 1 and 2 for the periods 1972–2001 and 2007–2011, 1972–2007 and 1972–2001. 4.4.4 Changing of the composition of the sample

- 104. Tables A9 and A10 highlight that our main results are stable and significant, once again, after the successively elimination of two subgroups of our basic sample. The first subgroup (subgroup 1) includes the countries that belong to the three ‘continents’ according to the World Bank classifications, namely, East Asia and Pacific, Europe and Central Asia, and South Asia. The second subgroup eliminated (subgroup 2) includes the countries that belong to the category of Latin America and the Caribbean, also according to the World Bank classifications. Similarly, Table A11 confirms our main empirical findings after excluding the data of five countries to our basic sample: Egypt, Pakistan, India, Indonesia and the Philippines. We have removed these countries, because they are classified as emerging markets by Morgan Stanley Capital International 2018 indices. 5 CONCLUSION AND POLICY RECOMMENDATIONS This article examines the effect on long-term growth of financial globalization and financial instability, independently and in interaction for a panel of 72 developing countries in the period 1972–2011. Two dynamic panel models are estimated through the GMM system. The calculations have proved to be robust in a series of tests consisting of the insertion of alternative variables of financial instability, the inclusion of new control variables, inter alia an indicator of banking crises, using different time periods, and

- 105. changing the composition of the sample. We obtain four main results. In the first place, financial instability has a negative effect on economic growth. Second, not only does investment-globalization have a direct positive effect on growth but also has an additional spillover and positive effect, reducing the negative impact of financial instability. Furthermore, in contrast, not only does indebtedness-globalization have a direct 54 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid negative effect on growth but also has a spillover and negative effect, increasing the negative impact of financial instability on growth. Lastly, in sum, financial globalization (investment-globalization plus indebtedness-globalization) positively influences growth directly and collaterally through its interaction with financial instability. In the light of these findings, it seems that investment- globalization is more interesting for developing countries than indebtedness- globalization. The latter risks being counterproductive to the financing of a country’s economy. This emphasizes the importance of evoking the potential utility of a regulation in the sense of a control

- 106. on foreign capital apart from portfolio investments and FDIs. This is not an easy thing to do for at least two reasons. First of all, the least developed countries generally need foreign debts in order to finance at least their short-term development because of the insufficiency of domestic savings being mobilized for this purpose. Consequently, even if this type of opening harms their growth in the long run, it is often a ‘necessary evil’ in the short and medium term. Secondly, indebtedness- globalization is easier to implement in developing countries than investment- globalization. Indeed, because of the weakness of their financial risk management system and the relative uncertainty of their institutional and politico-economic framework, for these countries, it often is more difficult to attract foreign investments than foreign debts. Moreover, financial development constitutes a condition that is necessary but insufficient for the financing of these countries’ growth. The regularity of the financing is crucial to long-term economic growth, because its absence can be counterproductive. To achieve this regularity, the liberalization of the financial sphere must be supervised and accompanied by institutional reforms, especially regarding property rights, legal system and anti-corruption measures. The foreign investments may be advancing these reforms (for more details, see, e.g. Mishkin, 2009). REFERENCES

- 107. Agbloyor EK, Abor JY, Adjasi CKD, Yawson A. 2014. Private capital flows and economic growth in Africa: the role of domestic financial markets. Journal of International Financial Markets Institutions and Money 30: 137–152. Aghion P, Bacchetta P, Banerjee A. 2004. Financial development and the instability of open economies. Journal of Monetary Economics 51(6): 1077–1106. Aghion P, Bacchetta P, Rancière R, Rogoff K. 2009. Exchange rate volatility and productivity growth: the role of financial development. Journal of Monetary Economics 56(4): 494–513. Agrawal G. 2015. Foreign direct investment and economic growth in BRICS economies: a panel data analysis. Journal of Economics, Business and Management 3(4): 421–424. Ahmed DA. 2016. Integration of financial markets, financial development and growth: is Africa different? Journal of International Financial Markets Institutions and Money 42(C): 43–59. Alesina, A., Grilli, V., Milesi-Ferretti, GM. 1994. The political economy of capital controls. Center for Economic Policy Research Discussion Paper 793. Arellano M, Bond S. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58(2): 277–297. Arellano M, Bover O. 1995. Another look at the instrumental- variable estimation of error-

- 108. components models. Journal of Econometrics 68(1): 29–52. Baltagi BH, Demetriades P, Law SH. 2009. Financial development and openness: evidence from panel data. Journal of Development Economics 89(2): 285–296. Growth: Financial Globalization, Instability 55 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid Barro RJ, Sala-I-Martin X. 2004, 2004. Economic Growth, second edition. MIT Press: Cambridge, MA. Beck, T., Demirgüç-Kunt, A. 2009. Financial institutions and markets across countries and over time: data and analysis. World Bank Policy Research Working Paper 4943. Bekaert G, Harvey C, Lundblad C. 2005. Does financial liberalization spur growth? Journal of Financial Economics 77(1): 3–55. Bekaert G, Harvey C, Lundblad C. 2011. Financial openness and productivity. World Development 39(1): 1–19. Bhargava A, Jamison D, Lau L, Murray C. 2001. Modeling the effects of health on economic growth. Journal of Health Economics 20(3): 423–440. Blundell R, Bond S. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87(1): 115–143.

- 109. Borensztein E, De Gregorio J, Lee JW. 1998. How does foreign direct investment affect economic growth? Journal of International Economics 45(1): 115–135. Broner F, Martin A, Ventura J. 2010. Sovereign risk and secondary markets. The American Economic Review 100(4): 1523–1555. Caballé J, Jarque X, Michetti E. 2006. Chaotic dynamics in credit constrained emerging economies. Journal of Economic Dynamics and Control 30(8): 1261–1275. Cariolle J, Goujon M. 2015. Measuring macroeconomic instability: a critical survey illustrated with exports series. Journal of Economic Surveys 29(1): 1–26. Eggoh JC. 2010. Développement financier, instabilité financière et croissance économique: Un réexamen de la relation. Région et Développement 32: 9–29. Eichengreen B, Gullapalli R, Panizza U. 2011. Capital account liberalization, financial development and industry growth: a synthetic view. Journal of International Money and Finance 30(6): 1090–1106. Estrada, GB., Park, D., Ramayandi, A. (2015). Financial development, financial openness, and economic growth. ADB Economic Working Papers Series No. 442, Asian Development Bank, Philippines. Gehringer A. 2013. Growth, productivity and capital accumulation: the effects of financial liberalization in the case of European integration. International

- 110. Review of Economics and Finance 25: 291–309. Grilli V, Milesi-Ferretti GM. 1995. Economic effects and structural determinants of capital controls. IMF Staff Papers 42(3): 517–551. Guillaumont S, Kpodar R. 2006. Développement financier, instabilité financière et croissance économique. Économie et Prévision 174: 87–111. Hansen LP. 1982. Large sample properties of generalized method of moment estimators. Econometrica 50(4): 1029–1054. Hnatkovska V, Loayza N. 2005. Volatility and growth. In Managing Economic Volatility and Crises, Aizenman J, Pinto B (eds). Cambridge University Press: Cambridge; 65–100. International Monetary Fund. 2012. The Liberalization and Management of Capital Flows: An Institutional View. International Monetary Fund: Washington, DC November. Joyce J. 2011. Financial globalization and banking crises in emerging markets. Open Economies Review 22(5): 875–895. King, R., Levine, R., 1992. Financial indicators and growth in a cross-section of countries. World Bank Policy Research Working Papers 819. Kose, MA., Prasad, ES., Rogoff, K., Wei, SJ. 2006. Financial globalization: a reappraisal. IMF Working Paper 06/189.

- 111. Lane PR, McQuade P. 2014. Domestic credit growth and international capital flows. The Scandinavian Journal of Economics 116(1): 218–252. 56 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid Lane PR, Milesi-Ferretti GM. 2007. The external wealth of nations Mark II: revised and extended estimates of foreign assets and liabilities, 1970–2004. Journal of International Economics 73(2): 223–250. Loayza N, Rancière R. 2006. Financial development, financial fragility, and growth. Journal of Money, Credit, and Banking 38(4): 1051–1076. Masten A, Coricelli F, Masten I. 2008. Non-linear growth effects of financial development: does financial integration matter? Journal of International Money and Finance 2(2): 295–313. McKinnon RI. 1973. Money and Capital in Economic Development. Brookings Institution: Washington D.C. Mishkin FS. 2009. Globalization and financial development. Journal of Development Economics 89(2): 164–169. Mougani, G. 2012. An analysis of the impact of financial integration on economic activity and

- 112. macroeconomic volatility in Africa within the financial globalization context. African Development Bank Group Working Paper 144. Neto DG, Veiga FJ. 2013. Financial globalization, convergence and growth: the role of foreign direct investment. Journal of International Money and Finance 37: 161–186. Newey WK, Windmeijer F. 2009. Generalized method of moments with many weak moment conditions. Econometrica 77(3): 687–719. De Nicolo G, Juvenal L. 2014. Finance, growth, and stability: lessons from the crisis. Journal of Financial Stability 10: 65–75. Obstfeld, M. (1998). The global capital market: benefactor or menace? NBER Working Papers 6559. Obstfeld M. 2009. International finance and growth in developing countries: what have we learned? IMF Staff Papers 56(1): 63–111. Quinn D. 1997. The correlates of changes in international financial regulation. American Political Science Review 91(3): 531–551. Rancière R, Tornell A, Westermann F. 2008. Systemic crises and growth. Quarterly Journal of Economics 123(1): 359–406. Rodrik D. 1998. Who Needs Capital-Account Convertibility? Essays in International Finance 207. Princeton University: Princeton, New Jersey. Rodrik D, Subramanian A. 2009. Why did financial

- 113. globalization disappoint? IMF Economic Review 56: 112–138. Roodman D. 2009a. A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics 71(1): 135–158. Roodman D. 2009b. How to do xtabond2: an introduction to difference and system GMM in Stata. Stata Journal, StataCorp LP 9(1): 86–136. Sahay, R., Annette Kyobe, Lam Nguyen, Martin Cihk, Adolfo Barajas, Diana Ayala Pena, Ran Bi, 2015. Rethinking Financial Deepening: Stability and Growth in Emerging Markets. IMF Staff Discussion Note. Sala-I-Martin X. 1997. I just ran two million regressions. The American Economic Review 87(2): 178–183. Sala-I-Martin X, Doppelhofer G, Miller RI. 2004. Determinants of long-term growth: a Bayesian averaging of classical estimates (BACE) approach. American Economic Review 94: 813–835. Shaw ES. 1973. Financial Deepening in Economic Development. Oxford University Press: New York. Temple J. 1999. The new growth evidence. Journal of Economic Literature 37(1): 112–156. Trabelsi M, Cherif M. 2017. Capital account liberalization and financial deepening: does the private sector matter? The Quarterly Review of Economics and Finance 64: 141–151.

- 114. UNCTAD, 2012. The paradox of finance-driven globalization. Policy Brief, January 1. Windmeijer F. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126(1): 25–51. Growth: Financial Globalization, Instability 57 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid A. APPENDIX A.1. LIST OF COUNTRY A.1.1. Basic sample (72 countries) Albania, Chad, Georgia, Kiribati, Niger, Sudan, Armenia, Comoros, Ghana, Lesotho, Nigeria, Swaziland, Bangladesh, Rep. Demo of Congo, Guatemala, Liberia, Pakistan Rep., Syria, Belize, Republic of Congo, Guinea, Madagascar, Papua New Guinea, Tajikistan, Benin, Côte d’Ivoire, Guinea-Bissau, Malawi, Paraguay, Tanzania, Bhutan, Djibouti, Guyana, Mali, Philippines, Tonga, Bolivia, Egypt, Haiti, Mauritania, Rwanda, Uganda, Burkina Faso, Salvador, Honduras, Moldova, Samoa, Uzbekistan, Burundi, Eritrea, India, Mongolia, Senegal, Vanuatu, Cambodia, Ethiopia, Indonesia, Mozambique, Sierra Leone, Vietnam, Cameroon, Fiji, Iraq, Nepal, Solomon Islands,

- 115. Zambia Rep., Central African Republic, Gambia, Kenya, Nicaragua, Sri Lanka and Zimbabwe. A.1.2. East Asia and Pacific (12 countries) Cambodia, Fiji, Indonesia, Kiribati, Mongolia, Papua New Guinea, Philippines, Samoa, Solomon Islands, Tonga, Vanuatu and Vietnam. A.1.3. Europe and Central Asia (seven countries) Albania, Armenia, Georgia, Moldova, Tajikistan, Uzbekistan and Belize. A.1.4. South Asia (six countries) Bangladesh, Bhutan, India, Nepal, Pakistan and Sri Lanka. A.1.5. Latin America and The Caribbean (eight countries) Bolivia, El Salvador, Guatemala, Guyana, Haiti, Honduras, Nicaragua and Paraguay. A.1.6. Middle East and North Africa (four countries) Djibouti, Egypt, Iraq and Syrian Arab Republic. A.1.7. Sub-Saharan Africa (35 countries) Benin, Burkina Faso, Burundi, Cameroon, Central African Rep., Chad, Comoros, Congo. Dem. Rep. of, Congo. Republic of, Côte d’Ivoire, Eritrea, Ethiopia, Gambia. The, Ghana, Guinea, Guinea Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Niger, Nigeria, Rwanda, Senegal, Sierra Leone,

- 116. Sudan, Swaziland, Tanzania, Uganda, Zambia and Zimbabwe. 58 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A 1 . F in an ci al g lo b al iz at io n , fi n an

- 152. p er ce nt . Growth: Financial Globalization, Instability 59 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A 2 . F in an ci al g lo b al iz at io n

- 186. . * * * M ea n si g n ifi ca nt at 1 p er ce nt . 60 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A

- 219. nt . Growth: Financial Globalization, Instability 61 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A 4 . F in an ci al g lo ba li za ti o n , fi n an ci al

- 253. nt at 1 p er ce nt . 62 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A 5 . F in an ci al g lo b al

- 285. ) Growth: Financial Globalization, Instability 63 © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A 5 . (C o n ti n u ed ) R eg re ss io n (1 )

- 317. nt at 1 p er ce nt . 64 B. Gaies et al. © 2018 John Wiley & Sons, Ltd. J. Int. Dev. 31, 39–79 (2019) DOI: 10.1002/jid T ab le A 6 . F in an ci al g lo ba li