The Boulder Group | Q1 2015 Net Lease Research Report

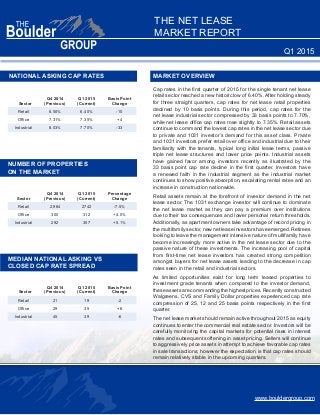

- 1. www.bouldergroup.com THE NET LEASE MARKET REPORT Q1 2015 Q4 2014 Q1 2015 Basis Point Sector (Previous) (Current) Change Retail 6.50% 6.40% -10 Office 7.31% 7.35% +4 Industrial 8.03% 7.70% -33 NUMBER OF PROPERTIES ON THE MARKET Q4 2014 Q1 2015 Percentage Sector (Previous) (Current) Change Retail 2,964 2742 -7.5% Office 300 312 +4.0% Industrial 292 307 +5.1% MEDIAN NATIONAL ASKING VS CLOSED CAP RATE SPREAD MARKET OVERVIEW Cap rates in the first quarter of 2015 for the single tenant net lease retail sector reached a new historic low of 6.40%. After holding steady for three straight quarters, cap rates for net lease retail properties declined by 10 basis points. During this period, cap rates for the net lease industrial sector compressed by 33 basis points to 7.70%, while net lease office cap rates rose slightly to 7.35%. Retail assets continue to command the lowest cap rates in the net lease sector due to private and 1031 investor’s demand for this asset class. Private and 1031 investors prefer retail over office and industrial due to their familiarity with the tenants, typical long initial lease terms, passive triple net lease structures and lower price points. Industrial assets have gained favor among investors recently as illustrated by the 33 basis point cap rate decline in the first quarter. Investors have a renewed faith in the industrial segment as the industrial market continues to show positive absorption, escalating rental rates and an increase in construction nationwide. Retail assets remain at the forefront of investor demand in the net lease sector. The 1031 exchange investor will continue to dominate the net lease market as they can pay a premium over institutions due to their tax consequences and lower personal return thresholds. Additionally, as apartment owners take advantage of record pricing in the multifamily sector, new net lease investors have emerged. Retirees looking to leave the management intensive nature of multifamily have become increasingly more active in the net lease sector due to the passive nature of these investments. The increasing pool of capital from first-time net lease investors has created strong competition amongst buyers for net lease assets leading to the decrease in cap rates seen in the retail and industrial sectors. As limited opportunities exist for long term leased properties to investment grade tenants when compared to the investor demand, theseassetsarecommandingthehighestprices.Recentlyconstructed Walgreens, CVS and Family Dollar properties experienced cap rate compression of 25, 12 and 25 basis points respectively in the first quarter. The net lease market should remain active throughout 2015 as equity continues to enter the commercial real estate sector. Investors will be carefully monitoring the capital markets for potential rises in interest rates and subsequent softening in asset pricing. Sellers will continue to aggressively price assets in attempt to achieve favorable cap rates in sale transactions; however the expectation is that cap rates should remain relatively stable in the upcoming quarters. NATIONAL ASKING CAP RATES Q4 2014 Q1 2015 Basis Point Sector (Previous) (Current) Change Retail 21 19 -2 Office 29 35 +6 Industrial 45 39 -6

- 2. www.bouldergroup.com THE NET LEASE MARKET REPORT Q1 2015 SELECTED SINGLE TENANT SALES COMPARABLES Sale Date Sector Tenant City State Price Price Per SF Cap Rate Lease Term Remaining Feb-15 Retail BJ's Wholesale Tampa FL $16,900,000 $141 6.83% 12 Jan-15 Medical Office Healthsouth Fredericksburg VA $16,529,439 $390 6.64% 8 Jan-15 Retail Walgreens Huntington Beach CA $16,000,000 $1,162 5.13% 21 Mar-15 Retail Kohl's Round Lake Beach IL $12,700,000 $146 5.78% 10 Jan-15 Retail Hobby Lobby Jacksonville NC $7,900,000 $143 6.54% 15 Feb-15 Retail TD Bank Jamaica NY $7,500,000 $1,304 4.84% 10 Jan-15 Retail Walgreens Greeley CO $7,125,000 $483 5.54% 15 Mar-15 Retail Chipotle Brooklyn NY $5,700,000 $1,274 5.26% 14 Feb-15 Retail CVS Weeki Wachee FL $5,100,000 $467 5.20% 25 Jan-15 Retail Tractor Supply Harrisburg PA $4,926,075 $227 6.24% 11 Jan-15 Industrial HVAC Supply, Inc. Denver CO $4,575,000 $78 6.73% 14 Feb-15 Retail Walgreens Milford OH $4,550,000 $312 6.18% 14 Jan-15 Industrial Structus Building Technologies Bend OR $4,500,000 $87 6.67% 7 Feb-15 Retail Bank of America Staten Island NY $4,100,000 $1,108 5.10% 20 NET LEASE CAP RATE TRENDS Retail Office Industrial 6.25% 6.75% 7.25% 7.75% 8.25% 8.75% Q1 2007 Q1 2008 Q1 2009 Q1 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015

- 3. www.bouldergroup.com THE NET LEASE MARKET REPORT Q1 2015 FOR MORE INFORMATION AUTHOR John Feeney | Vice President john@bouldergroup.com Randy Blankstein | President randy@bouldergroup.com Jimmy Goodman | Partner jimmy@bouldergroup.com © 2015. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. Zach Wright | Research Analyst zach@bouldergroup.com CONTRIBUTORS Tenant 2011-2015 2006-2010 2000-2005 Pre 2000 7-Eleven 5.00% 5.25% 5.70% 6.10% Advance Auto Parts 6.00% 6.50% 7.15% 7.75% AutoZone 5.00% 5.26% 6.00% 6.35% Bank of America (GL) 4.00% 4.74% 4.95% 5.90% Chase (GL) 4.00% 4.35% 4.70% 4.70% CVS 5.13% 5.60% 5.80% 6.90% DaVita 5.80% 7.00% 7.65% 8.00% Dollar General 6.50% 7.45% 7.95% 9.50% Family Dollar 7.00% 7.75% 8.00% 9.61% FedEx 6.25% 6.50% 8.00% 9.36% Fresenius 6.00% 7.01% 7.72% 9.75% GSA 7.40% 7.76% 8.40% 9.40% McDonald's (GL) 3.80% 4.20% 4.48% 4.88% O'Reilly Auto Parts 5.75% 5.93% 6.50% 7.00% PNC (GL) 4.30% N/A 5.80% 6.20% Rite Aid 6.00% 6.60% 7.00% 8.13% Walgreens 5.00% 5.50% 5.85% 7.25% Wells Fargo (GL) N/A 4.40% 4.85% 5.00% MEDIAN ASKING CAP RATES BY YEAR BUILT