Bandhan

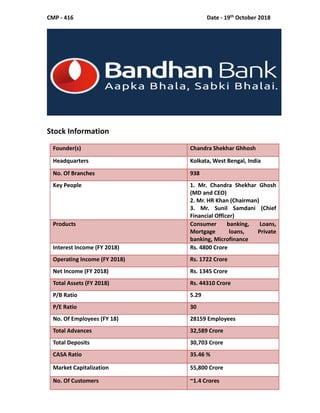

- 1. CMP - 416 Date - 19th October 2018 Stock Information Founder(s) Chandra Shekhar Ghhosh Headquarters Kolkata, West Bengal, India No. Of Branches 938 Key People 1. Mr. Chandra Shekhar Ghosh (MD and CEO) 2. Mr. HR Khan (Chairman) 3. Mr. Sunil Samdani (Chief Financial Officer) Products Consumer banking, Loans, Mortgage loans, Private banking, Microfinance Interest Income (FY 2018) Rs. 4800 Crore Operating Income (FY 2018) Rs. 1722 Crore Net Income (FY 2018) Rs. 1345 Crore Total Assets (FY 2018) Rs. 44310 Crore P/B Ratio 5.29 P/E Ratio 30 No. Of Employees (FY 18) 28159 Employees Total Advances 32,589 Crore Total Deposits 30,703 Crore CASA Ratio 35.46 % Market Capitalization 55,800 Crore No. Of Customers ~1.4 Crores

- 2. About Bandhan Bank Bandhan started as Bandhan Konnagar in 2001 as a non-governmental organisation (NGO) providing microfinance services to socially and economically disadvantaged women in rural West Bengal. Bandhan Financial Services (BFSL) started its microfinance business in 2006. The NGO transferred its microfinance business to BFSL in 2009. Thus, the entire microfinance business was undertaken by BFSL from 2009. Bandhan Bank Ltd. is one of the few financial institutions that have registered a substantial growth in a short span of time. The bank got its banking license in 2014 from RBI for setting up a universal bank. BFSPL was founded under the supervision and support of Mr. Chandra Shekhar Ghosh for offering loans to small businessmen who do not have access to formal banking services. BFSPL has earned a substantial credibility in the last 16 years along with many accolades for having more than 6 million women borrowers and providing financial assistance to small entrepreneurs. Investment Rationale 1. Sailing through Difficulties Bandhan MFI was one of the few institutions to sail through the AP crisis (2011), demonetisation (2016), farm loan waivers, etc. It has demonstrated stellar growth at ~90% CAGR in those 10 years. Even in the last five years, advances grew at 51% CAGR. In bank, AUM has grown from 15,578.4 crore as of FY16 to 32,340 crore as of FY18 while customer base has increased to ~1.37 crore. Micro credit forms 86% of loan book while retail, SME together are still small. Asset quality is strong at 1.2% GNPA ratio. 2. Well Capitalized The bank’s capital adequacy ratio (CAR) as on FY17 was at 26.4% with Tier I capital at 24.8%. With fresh capital from IPO proceeds added to networth and strong profitability in FY18, the CAR strengthened further to 32.7% with Tier improving to 31.5%. The RBI requires a minimum capital adequacy ratio of 13% of a bank's total risk-weighted assets. However, as per new banking licence shareholding norm from RBI, Bandhan Bank’s promoter – Bandhan Financial Holdings is required to reduce its shareholding in the bank to 40% within first three years of commencement of operations, which ends in August 2018. As of March 2018, promoter holding is at ~82.3%. The management has indicated continuous engagement with RBI for an extension of the timeline. Accordingly, the dilution may get an extension of at least two to three years. 3. Robust Financials The bank has a CASA ratio of about ~35%, when compared with other banks and MFI’s, we can conclude that the bank stands at a decent CASA ratio. The bank has GNPA of only 1.26% when compared with industry average of more than 5%. The bank also has an impressive NIM of 10.1%. Also, the Cost/Income Ratio stands at 34.25% which is very low compared to other peers.

- 3. 4. Experienced Board and Managerial Team The management team has a strong track record and significant experience in the microfinance and banking industries. Founder, Managing Director and Chief Executive Officer, Chandra Shekhar Ghosh, has 37 years of experience in the Indian microfinance industry. Throughout his career, Mr Ghosh has been the recipient of numerous accolades for his contributions to the microfinance sector and designation as a Senior Ashoka Fellow. Currently, the Board has 12 Directors comprising one Executive Director & eleven Non-Executive Directors. Within these 11 Non-Executive directors, two are Nominee Directors and eight Independent Directors of which one director is a woman. Risk Factors Limited operating history and fast growing and rapidly evolving business make it difficult to evaluate the bank’s business and future operating results on the basis of the past performance, and future results may not meet or exceed past performance. A substantial portion of bank’s operations are located in East and Northeast India, making the bank vulnerable to risks associated with having geographically concentrated operations. The bank derives a substantial portion of their interest income from loans that are due within one year, and a significant reduction in these short-term loans may result in a corresponding decrease in their interest income. The Bank’s micro finance loan portfolio is not supported by any collateral that could help ensure repayment of the loan, and in the event of non-payment by a borrower of one of these loans, the bank may be unable to collect the unpaid balance. The bank do not own the premises at which their Registered and Corporate Office, branches, ATMs, DSCs and other office premises are located. Reduction in promoter stake to 40% as per RBI norms As per RBI’s new bank licensing guidelines, Bandhan Bank’s promoter – Bandhan Financial Holdings Ltd is required to reduce its shareholding in the bank to 40% within the first three years of commencement of operations, ending in August 2018. As of March 2018, the promoter holding was at ~82.3%. The management has indicated at continuous engagement with the RBI for an extension of the timeline. Rejection of an extension on part of the central bank could entail huge equity supply and thereby substantial dilution in performance parameters. State/ Union Territory Branches DSCs Total Advances East India 55% 51% 59% Northeast India 12% 18% 22% East and Northeast India Total 67% 69% 81%

- 4. Political risk/monsoon risk weigh on MFI business With a substantial proportion of loans towards the lower strata of society wherein dependency on agriculture is high, loan repayment is seen being prone to monsoon. Political activities, including loan waiver, have a substantial impact on credit behavior of borrowers and thereby collection efficiency of micro finance lenders. With India approaching a slew of state elections and general election in the next 6-10 months, the risk of political volatility cannot be ruled out. Therefore, irregularity in monsoon and political volatility in the region with meaningful exposure could impact asset quality as well as profitability. Philosophy Bandhan Bank Services The services offered by Bandhan Bank cover almost every array of financial services such as accounts, loans, deposits, and NRI banking. An explanation of all the services offered by the bank is given here. Accounts: Bandhan Bank offers two basic types of accounts savings account and current account. Both the accounts have a few sub-categories designed for specific individual needs. Savings Account: Savings account at Bandhan Bank offer higher interest rates and greater convenience across a wide network of branches and ATMs. The basic savings accounts offer all the facilities including ATM cum Debit card, shopping, and online fund transfer. However, customers can also choose the other account options in this category such as Premium, Standard, Special, Advantage, and Sanchay. All these accounts are particularly designed for different needs of people depending on their financial capability. The bank offers a 6% interest rate to accounts with balance above Rs. 1 lakh and 4% interest rate for accounts with balance less than Rs. 1 lakh.

- 5. Current Account: These accounts have higher daily withdrawal limits and come with overdraft facility as well. The range of current accounts includes Biz Premium, Biz Standard, Biz Advantage, and Biz Samridhi accounts. Loans: Being a microfinance company from the start, Bandhan Bank understands the rising needs of today’s population and offers loans accordingly. The loan category comprises of a few loans created specifically for your dynamic needs. This category has 5 sub-categories. Retail Loans: The retail loan category includes the common types of loans that are necessary at different stages of life. The types of loans are home loan, vehicle loan, personal loan, loan against property, loan against term deposit, and gold loans. MSME Loans: The bank offers a wide range of MSME loans to start or aid small or medium enterprise. Such loans help to enhance liquidity in businesses and create income generating assets. The MSME category includes: Samriddhi Business Loan: Can be taken as working capital loan or a term loan. The maximum loan can be up to Rs. 25 lakh with a maximum tenure of up to 5 years. Commercial Vehicle Loan: Maximum loan amount of Rs. 10 lakh and a tenure of up to 5 years. Term Loan: The loan amount depends on requirement and due assessment done by Bandhan Bank. The maximum loan tenure is of 7 years. Equipment Loan: Offers a maximum loan amount of Rs. 10 lakh and a maximum tenure of 60 months. Working Capital Loan: This is another loan that is given based on the bank’s assessment. Being a working capital loan, it is repayable on demand. Small Enterprise Loan (SEL): This loan is designed for small enterprises that cannot afford to keep collateral as security and need finance for working capital or income generating activities. This product is specially offered to the people who need both working capital and term/demand loan. The loan amount can range from a minimum of Rs. 1 lakh to a maximum of Rs. 10 lakh. The loan tenure is kept at 3 years with comfortable payment mode that allows individuals to manage the repayment easily. These are composite loans that offer doorstep assistance and simplified documentation. Microloans: These are granted to individuals who want to establish a small business from their home. This product is especially created for women who want to start a co-owned/co-run business. The loan amount can start from Rs. 1,000 and can go up to Rs. 1 lakh depending on the specific scheme. The schemes that come under this head are Suchna, Suraksha, Srishti, and Sushiksha. Agri Loans: As the name suggests, Agri Loans are created for farmers who want to build quality farms producing superior quality crops. This product helps farmers organise and optimise farming and other allied operations. The maximum loan amount available under the several schemes under this head can go up a maximum of Rs. 10 lakh. The schemes include Kisan Credit Card, Agri Allied and Equipment Loan.

- 6. Deposits: Term deposits offered by Bandhan Bank can be utilised for various needs and future plans. The deposits offered by Bandhan Bank include FDs and RD. The several types of FDs available are FD Premium, FD Standard, FD Tax-Saver, FD Advantage and FD Dhan Samriddhi. The minimum deposit amount for FDs starts from Rs. 1,000 which goes up to a maximum of Rs. 1 crore for FD Premium. The bank offers a maximum interest rate of 7.40% per annum for regular customers and 7.90% interest rate per annum for senior citizens. NRI Banking: NRI banking from Bandhan Bank includes world-class services and benefits for non-residents. This allows NRIs to invest and take benefit of the several savings and time deposit schemes offered by the bank. Non-Resident Ordinary (NRO) and Non-Resident External (NRE) account is available for NRIs for opening savings and deposit accounts. This section of the services is handled by experienced banking professionals. The bank is committed to delivering efficient, transparent and customer-friendly services that offer maximum benefits to this group of customers. Product Portfolio 1. Savings Account Premium MAB 1,00,000 (Every Service Complimentary) Advantage MAB 25,000 Standard MAB 10,000 Sanchay MAB 2,000 (Only for Rural Areas) Special MAB 5,000 (For Differently abled) Others - 2. Current Account Biz Premium MAB 1,00,000 Biz Advantage MAB 25,000 Biz Standard MAB 5,000 Other - 3. Loans Home Loans Loan Against Property Two Wheeler Loans Loan against TD Personal Loan Gold Loan

- 7. 4. MSME Loans - >10,00,000 Working Capital Loans Term Loans 5. Small Enterprise Loans - 1,00,000 to 10,00,000 6. Micro Loans - <1,50,000 Product(s) Ticket Size Tenure Purpose Suchana 1,000 - 25,000 Upto 1 Year Self-employement Srishti 25,001 - 1,00,000 Upto 2 Year Self-employement Suraksha 1,000 - 10,000 Upto 1 Year Healthcare Sushiksha 1,000 - 10,000 Upto 1 Year Education 7. Agri Loans Kisan Credit Card Equipment Agri-allied 8. Deposits 9. NRI Banking Shareholding Pattern Company Overview Bandhan started as Bandhan Konnagar in 2001 as a non-governmental organisation (NGO) providing microfinance services to socially and economically disadvantaged women in rural West Bengal. Bandhan Financial Services (BFSL) started its microfinance business in 2006. The NGO transferred its microfinance business to BFSL in 2009. Thus, the entire microfinance business was undertaken by BFSL from 2009. Shareholder Holding % Promoter 82.3 Institutional Investors 11.4 Others 6.3

- 8. Bandhan’s performance as NBFC until 2015 On April 9, 2014, RBI granted an in-principle approval to BFSL to set up a scheduled commercial bank in the private sector. Upon receipt of the in-principle approval, BFSL and Bandhan Bank entered into a business transfer agreement to transfer all of BFSL’s existing microfinance business, including all assets, liabilities, accumulated profits and entire infrastructure, along with a wide consumer base to the bank. By the time BFSL transferred its microfinance business to the bank, it was India’s largest microfinance company with AUM of ~ 8309 crore and ~70 lakh customers. With historical strength in the microfinance segment, Bandhan Bank, which began operations on August 23, 2015, is now a commercial bank focused on serving underbanked and underpenetrated markets in India. As can be seen in the above exhibit, Bandhan’s performance before becoming a bank has been superior on all fronts. Loans have increased at 39% CAGR while earnings have risen at 24% CAGR to 430 crore in FY12-15. Asset quality remained stable while return ratios were one of the best in the industry. However, even after becoming a bank, its superior performance has continued. It has started its operations on 23rd August 2015 with 501 branches, 50 ATM’s and 2022 DSC’s (Dedicated Service Centres). As of now, the Bank has 937 branches, 430 ATM’s and 2764 DSC’s. The bank has more than 1.37 crore customers out of which 1.1 crores Micro finance customers and 27 lakhs general banking customers. The bank plans to have 1000 branches and 3000 DSC’s by year end. In terms of area of operations of the bank, east and northeast India (especially West Bengal, Bihar, Assam) are strongholds for the bank with a substantial presence in terms of branches, DSCs, proportion of deposits and advances. As of December 2017, ~65% of branches are in eastern and north-eastern India. In terms of advances, ~80.8% of loans comprises the east and north-eastern regions. However, the bank is focusing on developing a pan-India network to achieve geographical diversification. Accordingly, the bank has increased its footprint to 33 states and union territories from 24 states and union territories at the commencement of banking operations. On the deposit front, the book has grown from zero as of August 23, 2015 to 33869 crore as on FY18, with CASA ratio at ~34.3% and retail-to-deposit ratio at 85.07%. For FY18, net interest income (NII) amounted to | 3032 crore vs. 2404 crore in FY17. The net interest margin (NIM) was at 9.7% for FY18 compared to 10.4% in FY17. FY’12 FY’13 FY’14 FY’15 NII (Rs. Crore) 402 358 535 750 PAT (Rs. Crore) 226 218 294 430 Loans 3103 4097 5801 8309 GNPA % 0.0 0.0 0.7 0.6 RoE % 34.9 27.3 28.3 31.1 RoA % 5.4 4.5 4.8 5

- 9. Business Model Bandhan Bank is a unique business model of high yielding micro finance loan portfolio (94% priority sector fulfilment) and low cost deposit franchise with 35.46% CASA offered in the ambit of a commercial bank. It was the only MFI to receive a universal banking licence from the RBI in 2014 led by Founder, MD and CEO, Chandra Shekhar Ghosh, who has 37 years of experience in the Indian microfinance industry. Bandhan Bank, with 13-14% market share, operates 937 branches and 2,764 dedicated doorstep services centres servicing ~1.37 crore customers in 34 states including Union Territories. East and northeast (West Bengal, Bihar, Assam) are its stronghold. FY18 AUM was at 32340 crore a PAT at 1346 crore. Business Mix Customer Distribution Among all the customers, 72% customers have only single loan, it is a positive sign for the Bank as the loan book is more diversified. In terms of geography, most MFI loans are in rural areas at ~55%. In terms of regions, south dominates the overall loan portfolio outstanding of MFIs with 43% followed by East with 23%. Central and West have a share of 17% and 9%, respectively. North and North East have least portfolio share of 5% and 3%, respectively. Geographical Distribution The bank has 57% of its loan book from its eastern Indian operations consisting of states like West Bengal, Jharkhand, Bihar etc. It has about 43% of Loan book from Rest of India. I find this as little concerning because of concentration of Bank’s loan book in a particular region. Still, the management believes that in the coming years, the bank will diversify its portfolio to a greater extent.

- 10. Geographical Distribution of MFI’s in India In the above picture, we can see that 55% of of MFI loans are disbursed to Rural areas. Bandhan being a rural player has an advantage because it’s majority of disbursement goes to rural areas and it has a huge market in rural areas. Now, when we see zonal wise distribution of MFI loans in India, we can see that Southern region has bulk of MFI loans and North East has only 3% of all MFI loans combined. This is because North east region has vast majority of population with very less or no credit history. Now, As bandhan bank specializes in providing loans to underbanked and underprivileged, I see a huge potential in Bandhan Bank’s loan book growth in North Eastern region.

- 11. Indian Economy Overview It is estimated that Indian economy will grow at 7% for the fiscal year 2018. Banks will play a major role for attaining this level of growth. India’s economy turned in a resilient performance in FY 2017-18 due to strong rebound in the second half of FY 2017-18 on the back of a turnaround in investment demand. This was supported by accelerated manufacturing, rising sales growth, pick-up in capacity utilisation, strong activity in the services sector and record agriculture harvest. Thus because of ample growth in Industrial and Agricultural sector, Bandhan Bank will hugely benefit from the opportunities in these sectors. The performance of India’s banking sector, especially the public-sector banks, remained subdued. The gross non-performing advances (GNPA) ratio for Scheduled Commercial Banks increased from 9.6% to 10.2% between March 2017 and September 2017. But, Bandhan being a private sector bank has very impressive GNPA Ratio of 1.3%. I expect GNPA ratio to remain below 1.75 % in coming few years as most of the loan given by Bandhan bank has to be repaid in less than 1 year, thus risk is low. Industrial sector credit growth picked pace in November 2017 after remaining persistently negative from October 2016 to October 2017. However, the growth of credit to medium scale industry has remained negative since June 2015. But, Small Scale industries has seen a rapid growth. As Bandhan contributes majorly to Small Scale Industry, the loan book is expected to grow at current rate. The provision of funds for re-capitalisation of public sector banks coupled with improved recovery due to speedy resolution under new Bankruptcy law, would enable the Banks to capitalise on the rising demand for credit due to projected higher growth rates in the next two to three years’ time horizon. The Government of India (GoI) has rolled out several initiatives to increase the adoption of digital transactions mainly in the Retail Banking space. The bedrock created by these initiatives is likely to usher in various trends in digital banking. The following trends could become major differentiators in future for India’s banking industry: a) Machine learning and use of chatbots b) Extension of digital coverage to corporate banking and small and medium enterprises (SME) as hitherto digital coverage has mainly been profound in Retail Banking space c) Innovation in digital banking offer cost-effective solutions for including data rich but credit poor customer into mainstream banking d) Bank-Fintech partnership will continue to grow driving down the overall cost of intermediation, and thereby exerting pressure on banks’ profit margins e) Robotic process automation According to a Ministry of Electronics and Information Technology (MeitY) scorecard for 38 banks, Bandhan Bank is among the only 8 banks to have a ‘good’ rating in digital transactions for FY 2017-18.

- 12. Summary of Banking Industry in India The Indian banking system consists of 27 public sector banks, 22 private sector banks, 44 foreign banks, 56 regional rural banks, 1,589 urban cooperative banks and 93,550 rural cooperative banks, in addition to cooperative credit institutions. Bank credit grew at 12.64 per cent year-on-year to Rs 85.511 lakh crore (US$ 1,326.78 billion) on May 11, 2018 from Rs 75.91 lakh crore (US$ 1,131.47) on May 12, 2017. Credit off-take has been surging ahead over the past decade, aided by strong economic growth, rising disposable incomes, increasing consumerism & easier access to credit Strong growth foreseen in in household financial savings. CRISIL Research expects the pace of economic growth to pick up in the medium term, as structural reforms, such as GST and the bankruptcy code, aimed at removing constraints and raising the trend rate of growth. As per the World Bank forecast, the Indian economy is projected to grow at a 7.3% CAGR over the next year and at 7.5% in 2019-2020. Growth in India will be higher than many emerging and developed economies, such as Brazil, Russia and China.

- 13. Strong growth in savings in financial assets Growth in Deposits As of Q3 FY18, total credit extended surged to US$ 1,288.1 billion. Credit to non-food industries increased by 9.53 per cent reaching US$ 1,120.42 billion in January 2018 from US$ 1,022.98 billion during the previous financial year. Demand has grown for both corporate & retail loans; particularly the services, real estate, consumer durables & agriculture allied sectors have led the growth in credit. The digital payments revolution will trigger massive changes in the way credit is disbursed in India. Rising incomes are expected to enhance the need for banking services in rural areas and therefore drive the growth of the sector.

- 14. Post becoming Bank... Out of overall customer base, 72% customers have only single loan. This helps the bank a lot in diversification. Because of Bandhan becoming a bank, Customers are closing their other MFI loans and are maintaining a relationship with Bandhan. 83% of Bandhan’s total loan book consist of Micro Loans. As we have already discussed there are 4 products under Micro Loans category i.e. Suchana, Srishti, Suraksha and Sushiksha. Suchana and Srishti have IRR of >18% Suraksha and Sushiksha have IRR of <18% Now, the high IRR is seen because Bandhan was a microfinance company earlier, but, as now it has become a full-fledged Bank, we may not see such a high IRR in future. Bandhan’s Cost of Capital is ~6.53% Average Savings deposit cost ~5.1% It increased from 5% to 5.1% because of increase in deposits and deposits above Rs. 1,00,000 attract an Interest Rate of 6%. Source - ConCall Transcript Coming to Non-Micro Credit, all Non- Micro Credit are secured and the primary security is Stock. As of now, Bandhan Bank has reported no Related Party transactions. Non-interest Income The bank has two sources of Non-Interest Income, i.e. Processing Fees and Priority Sector Lending Certificates (PSLC). 1. Processing Fees accounted for 100 Crores of revenue in the current quarter. The bank, with low processing fee compared with other banks, still managed to collect a significant portion of revenue from processing fee.

- 15. 2. PSLC - Priority Sector Lending Certificates is a tool for promoting comparative advantages among banks while they meet their priority sector lending obligations in India. "Banks with a comparative advantage in lending to the priority sector should earn priority sector lending certificates [social credits] while those falling short of the target would be required to buy priority sector lending certificates [social credits] The revenue for the FY 18 accounted for Rs. 256 Crore of revenue from PSLC. This Revenue is amortized over 4 quarters. Thus PSLC revenue accounted for Rs. ~65 crore in the last quarter. By mandate, minimum 40% of loan book must consist of Priority Sector Lending which includes sectors like Rural Loan Book, Education, Healthcare etc. Since about 96% of lending of Bandhan Bank is in Priority Sector, it can sell remaining 56% of loan rights to other banks. PSLC represents a significant amount of banks income, also, because of its more focus towards priority sector lending, it will continue to enjoy income from PSLC’s. Quarter Report (Q1 FY19) Analysis In the last Quarter, lending increased by 250 Cr., Y-o-Y Credit growth is about ~52.37%. The profit for the Quarter stands at Rs. 482 Crore compared with profit of Rs. 327 cr for first quarter of last year, translating to growth of 47.58% Deposits at the first quarter of FY 2017 stood at 22439 Crore while in the first quarter of FY 2018, Deposits stood at 30703 Crore which translates to growth of 36.83% CASA increased from 26.33% to 35.46 % in this Quarter. Out of 35.46% CASA, CA contributed 6.75% and SA contributed 28.71%. I believe that the growth in CASA Ratio is very healthy. NIM from last quarter grew from 10% to 10.27% which suggests that the bank has increased its margins. Cost to Income ratio which indicates Operating costs as a percentage of Operating income reduced from 35.65% to 34.25%. Such a low Cost to Income Ratio indicates that the Bank is efficiently managing its operations. Return on Assets increased from 4.40% to 4.49% which again shows an increase in efficiency of company’s Assets. However, the company’s ROE declined significantly from 28.10% to 19.92% but this steep decline is because the IPO which the company has issued earlier this year. Because of the IPO, the denominator, i.e. The total equity increased significantly driving down the ratio. Net NPA increased from 0.58% to 0.64%. However, I don’t see this slight increase in NPA as an alarming issue. This increase in Net NPA may be because the company has expanded its operations.

- 16. The company has added 7 Lakh new customers in this quarter. Out of 7 Lakhs, 4 Lakh customer are Micro credit customers and 3 Lakh customer are General Banking customer. The Bank, since its inception in 2015 has been adding customers at a rapid pace, which has driven the growth significantly. Recent RBI Sanctions On 28th September 2018, RBI imposed sanctions on Bandhan Bank, stopped Branch expansion and froze CEO’s compensation for non compliance of promoter holding rules. According to RBI, a Bank’s promoter can hold maximum of 40% stake in a Bank. If the stake is more than 40%, promoter will have to dilute the stake in 3 years from the date of commencement of Bank. This date was due on 23rd August, 2018. Due to failure of promoter to follow the above RBI guidelines, RBI imposed the sanctions. However, after imposing the sanctions, the promoter conducted a conference call assuring investors that in spite of sanctions on branch expansion, it would not hurt the growth of the bank. The bank will continue to grow at current levels due to growth in “same branch customer growth” The promoter justified the statement by saying that currently Bandhan’s branches on an average have 3000 customers, whereas in an established bank, average branch has about 25000 customers. So, there’s still a lot of scope for “same branch customer growth” Now, on being asked about the options available to bank to reduce the stake to 40%, the management replied that there are plenty of options available for bank to reduce the promoter’s stake, including secondary sale, inorganic growth, etc. However, the promoter did not say how exactly will it reduce the stake to 40%. He concluded by saying “We are trying to satisfy the compliance as early as possible.”. Post this, on Monday, 1st October, 2018 opening, the share price of Bandhan Bank fell 113 points to ~450 rupees. I believe that this price fall was mostly due to investor panic. I believe that this correction makes the share more attractive as it is now available at a lower price multiples. Quarter Report (Q2 FY19) Analysis Net Interest Income (NII) for the quarter grew by 55.6% at 1078 crore as against 693 crore in the corresponding quarter of the previous year Non-interest income grew by 3.1% at 230 crore for the quarter ended September 30, 2018 against 223 crore in the corresponding quarter of the previous year Operating Profit for the quarter increased by 46.9% at 874 crore against 595 crore in the corresponding quarter of the previous year Net Profit for the quarter grew by 47.4% at 488 crore against 331 crore in the corresponding quarter of the previous year

- 17. Net Interest Margin (NIM) for the current quarter stands at 10.3% against 9.3% in the corresponding quarter of the previous year and 9.7% for FY 2017-18 CASA ratio at 36.9% of total deposit, compared to 28.2% in the corresponding period last year CASA grew 69.8% Y-o-Y at 12,176 crore compared to 7,170 crore Total Advances increased by 50.9% at 33,373 crore as on September 30, 2018 against 22,111 crore as on September 30, 2017 Total Deposits grew by 29.6% as on September 30, 2018 is at 32,959 crore as compared to 25,442 crore on September 30, 2017. Gross NPAs as on 30 September 2018 at 1.3% against 1.3% as on 30 June 2018 and 1.4% as on 30 September, 2017 Strong deposit franchisee in short span, high CASA offers low CoF Bandhan Bank has focused on building a strong deposit base and has grown from zero as of August 23, 2015, to 33,869 crore in FY18. Current and savings account deposit (CASA) was at 11,617 crore, constituting 34.3% of deposits. CASA provides stable low-cost funding with CoF now at 6.7%. Financial Trends Gross AUM growth to continue strong at 38%

- 18. Strength in Net Income and PAT to continue Margin trends hover around 9% Asset Quality Trends

- 19. Financials Balance Sheet Mar 18 Mar 17 Mar 16 12 mths 12 mths 12 mths EQUITIES AND LIABILITIES SHAREHOLDER'S FUNDS Equity Share Capital 1,192.80 1,095.14 1,095.14 Preference Share Capital 0.00 0.00 0.00 Total Share Capital 1,192.80 1,095.14 1,095.14 Revaluation Reserve 0.00 0.00 0.00 Reserves and Surplus 8,189.14 3,351.31 2,239.36 Total Reserves and Surplus 8,189.14 3,351.31 2,239.36 Money Against Share Warrants 0.00 0.00 0.00 Employees Stock Options 0.00 0.00 0.00 Total ShareHolders Funds 9,381.95 4,446.46 3,334.50 Equity Share Application Money 0.00 0.00 0.00 Preference Share Application Money 0.00 0.00 0.00 Share Capital Suspense 0.00 0.00 0.00 Deposits 33,869.00 23,228.66 12,088.75 Borrowings 285.00 1,028.94 3,051.65 Other Liabilities and Provisions 774.11 1,532.04 1,281.60 Total Capital and Liabilities 44,310.06 30,236.09 19,756.50 ASSETS Cash and Balances with Reserve Bank of India 2,837.07 6,012.07 810.29 Balances with Banks Money at Call and Short Notice 2,673.52 1,352.93 2,363.11 Investments 8,371.94 5,516.49 3,758.03 Advances 29,713.04 16,839.08 12,437.55 Fixed Assets 238.13 251.79 237.23 Other Assets 476.37 263.74 150.29 Total Assets 44,310.06 30,236.09 19,756.50

- 20. Profit and Loss Cash Flow Statement Mar 18 Mar 17 Mar 16 Net Profit/Loss Before Extraordinary Items And Tax 2,055.90 1,704.47 413.51 Net Cash Flow From Operating Activities -2,593.77 8,885.21 6,953.65 Net Cash Used In Investing Activities -2,241.63 -2,670.92 -3,718.24 Net Cash Used From Financing Activities 2,846.00 -2,022.71 -3,722.64 Net Inc/Dec In Cash And Cash Equivalents -1,989.40 4,191.59 2,773.14 Cash And Cash Equivalents Begin of Year 7,364.73 3,173.15 400.01 Cash And Cash Equivalents End Of Year 5,375.33 7,364.74 3,173.15 Mar 18 Mar 17 Mar 16 INCOME Interest / Discount on Advances / Bills 3,823.60 3,121.42 1,282.79 Income from Investments 490.02 428.05 131.20 Interest on Balance with RBI and Other Inter-Bank funds 141.61 79.03 56.67 Others 347.06 280.21 110.71 Total Interest Earned 4,802.30 3,908.71 1,581.36 Other Income 706.18 411.41 149.89 Total Income 5,508.48 4,320.12 1,731.25 EXPENDITURE Interest Expended 1,770.06 1,505.21 648.53 Payments to and Provisions for Employees 687.98 545.57 325.08 Depreciation 85.92 66.85 35.77 Operating Expenses (excludes Employee Cost & Depreciation) 534.41 409.58 255.07 Total Operating Expenses 1,308.31 1,022.01 615.92 Provision Towards Income Tax 777.58 625.18 169.54 Provision Towards Deferred Tax -67.24 -32.66 -31.28 Other Provisions and Contingencies 374.21 88.44 53.30 Total Provisions and Contingencies 1,084.55 680.96 191.56 Total Expenditure 4,162.92 3,208.17 1,456.01 Net Profit / Loss for The Year 1,345.56 1,111.95 275.25 Net Profit / Loss After EI & Prior Year Items 1,345.56 1,111.95 275.25 Profit / Loss Brought Forward 1,048.43 215.38 0.58 Transferred on Amalgamation 0.00 0.00 0.00 Total Profit / Loss available for Appropriations 2,393.99 1,327.33 275.82

- 21. Peer Comparision Peer Company P/B CASA% NNPA% GNPA% NIM HDFC Bank 4.97 43.50 0.40 1.30 4.04 Equitas Small Finance 2.60 5.00 1.80 3.53 5.99 Ujjivan 1.85 3.70 0.70 3.60 9.45 Kotak Bank 5.80 51.00 0.98 2.00 3.94 AU Small Finance 7.86 32.00 1.30 2.00 5.20 SBI 1.23 45.70 5.73 10.91 2.47 Bharat Fin 4.92 - 0.10 4.10 7.86 IDFC Bank 0.85 11.80 1.69 3.31 1.60 Bandhan Bank 5.29 35.46 0.64 1.26 10.10 Average 4.12 - 1.48 3.56 - Peer Company ROE ROA CAR C/I P/E HDFC Bank 18.43 1.86 14.80 41.00 28.00 Equitas Small Finance 7.64 1.78 35.51 65.00 130.00 Ujjivan 0.48 0.15 23.04 67.05 - Kotak Bank 13.50 2.00 18.20 61.35 53.76 AU Small Finance 13.76 2.04 19.31 56.65 59.05 SBI -2.16 -0.12 12.60 60.13 - Bharat Fin 17.00 4.15 33.20 50.40 23.12 IDFC Bank 6.38 0.81 18.00 58.11 20.55 Bandhan Bank 19.92 4.49 32.61 34.25 30 Average 10.5 1.82 - - 40

- 22. Outlook Bandhan Bank is trading at above average Price multiples when compared with peers. However, we feel that it commands premium because of :- Bandhan Bank has lesser NPA’s when compared with it’s peers. It has more ROE and ROA ratio when compared with other Banks and MFI’s in the peer. It has highest NIM when compared with it’s peers. AUM has grown at a CAGR of 44% over last 2 years and it is expected to grow at at least 38% for the upcoming 3 years. This robust growth in AUM also supports the premium demanded by the company. NII has grown at a CAGR of 80% over last 2 years. Even if we consider half the growth rate, a 40% growth in AUM is also impressive. PAT of the company has grown at a CAGR of 121% over last 2 years. Again, even at conservative growth in PAT over upcoming years, the Bank seems to have decent PAT margins. On the deposit front, the book has grown from zero as of August 23, 2015 to 33869 crore as on FY18. Conclusion Bandhan , a Bank with high and sustainable Return on Equity and Return on Assets metrics, Low Non-Performing assets, higher NIM, decent CASA ratio, low Cost to Income Ratio, seems to be a good investment opportunity. At this point of time, I believe that the fundamentals of the company will improve even as the bank moves into a mature stage of operations. I believe Bandhan remains a strong compounding story with a play on vast rural opportunity, with best-in-class return metrics and strong operating efficiency. Bandhan will continue to trade at premium valuations as investors acknowledge the structural growth opportunity and sustainability of return metrics.

- 23. Source(s) https://www.bandhanbank.com/pdf/Annual-Report-FY-17-18.pdf https://www.bandhanbank.com/pdf/Earnings-Call-Trascript-BandhanBank-Q1-FY-201 8-19.pdf https://www.ibef.org/industry/banking-india.aspx https://www.mckinsey.com/featured-insights/india/mastering-the-new-realities-of-in dias-banking-sector https://economictimes.indiatimes.com/bandhan-bank-ltd/quarterly/companyid-6766 5.cms https://www.livemint.com/Money/rG4AeI1cDItQNSVtuVxdiN/Bandhan-Bank-posts-4 75-rise-in-Q1-net-profit.html https://www.goldmansachs.com/worldwide/india/ipo/bandhan-bank-drhp.pdf Disclaimer No recommendations are given for the company discussed in the report. Any valuation discussed in the report is solely for informational reasons and not to be taken as investment recommendation. I do not hold any shares of the company, neither I am beneficiary to any of the shares of the company. Please consult your Financial Adviser, or do your own due diligence before making any Investment decision. Authored By - NIKHIL BHAUWALA nikhilbhauwala@yahoo.com Guided By - Mr. JIMIT ZAVERI - Mr. TEJAS JARIWALA Research Head - Mr. TEJAS JARIWALA