Islamic Banking and Takaful (IBT) - Exam Notes

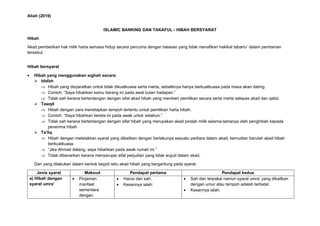

- 1. Aliah (2019) ISLAMIC BANKING DAN TAKAFUL - HIBAH BERSYARAT Hibah Akad pemberikan hak milik harta semasa hidup secara percuma dengan balasan yang tidak menafikan hakikat tabarru’ dalam pemberian tersebut. Hibah bersyarat • Hibah yang menggunakan sighah secara: ➢ Idafah Hibah yang disyaratkan untuk tidak dikuatkuasa serta merta, sebaliknya hanya berkuatkuasa pada masa akan dating. Contoh: “Saya hibahkan kamu barang ini pada awal bulan hadapan.” Tidak sah kerana bertentangan dengan sifat akad hibah yang memberi pemilikan secara serta merta selepas akad dan qabd. ➢ Tawqit Hibah dengan cara menetapkan tempoh tertentu untuk pemilikan harta hibah. Contoh: “Saya hibahkan kereta ini pada awak untuk setahun.” Tidak sah kerana bertentangan dengan sifat hibah yang merupakan akad pindah milik selama-lamanya oleh penghibah kepada penerima hibah. ➢ Ta’liq Hibah dengan meletakkan syarat yang dikaitkan dengan berlakunya sesuatu perkara dalam akad, kemudian barulah akad hibah berkuatkuasa. “Jika Ahmad datang, saya hibahkan pada awak rumah ini.” Tidak dibenarkan kerana menyerupai sifat perjudian yang tidak wujud dalam akad. Dan yang dilakukan dalam bentuk taqyid iaitu akad hibah yang bergantung pada syarat: Jenis syarat Maksud Pendapat pertama Pendapat kedua a) Hibah dengan syarat umra’ • Pinjaman manfaat sementara dengan • Harus dan sah. • Kesannya ialah: • Sah dan terpakai namun syarat umra’ yang dikaitkan dengan umur atau tempoh adalah terbatal. • Kesannya ialah:

- 2. Aliah (2019) meletakkan tempoh umum pada penerima atau pemberi hibah. ➢ Umra’ berkuatkuasa sepanjang hayat penerima hibah; dan ➢ Harta yang dihibah hanya akan kembali kepada pemberi hibah atau waris yang masih hidup setelah penerima hibah meninggal dunia. ➢ Harta menjadi milik penerima hibah serta waris- warisnya tanpa terikat dengan waktu; dan ➢ tanpa perlu dikembalikan. • Mazhah Shafie, Hanafi dan Hanbali: Syarat umra’ adalah sia-sia dan tidak membawa sebarang nilai. ➢ Berdasarkan hadis yang diriwayatkan Abu Hurairah RA dan Jabir RA dengan mafhumnya: “Umra itu diharuskan.” “Rasulullah SAW menyatakan bahawa umra’ adalah milik orang yang diberikan kepadanya.” b) Hibah dengan syarat ruqba • Imam Abu Hanifah: Pemberian hak milik harta kepada orang lain setelah kematian pemberi hibah. • Perbezaan hibah ruqba dan umra’: ➢ Ruqba berkaitan dengan menunggu waktu kematian satu pihak. ➢ Umra’ berkaitan dengan • Sah dan terpakai namun syarat ruqba adalah terbatal. • Kesannya ialah: Harta terus menjadi milik penerima hibah dan dianggap sebagai harta pusaka setelah kematian penerima hibah tersebut. • Al-Zuhri: Hibah dengan syarat ruqba sah diguna pakai sebagai wasiat, dan hukum wasiat adalah terpakai ke atas hibah dengan syarat ruqba. ➢ Berdasarkan hadis yang diriwayatkan oleh Ibn Abbas RA, di mana mafhumnya: “Janganlah kamu melakukan ruqba, sesiapa yang melakukan ruqba terhadap sesuatu, ia membuka jalan perwarisan.” • Sebab pembatalan syarat ruqba: Terdapatnya unsur gharar dalam tempoh masa bagi syarat ruqba. Hibah dengan syarat ruqba dilihat sebagai penangguhan terhadap pemindahan hak milik harta yang dihibah. Ini menunjukkan penghibah telah menta’liqkan pemberian hibahnya dengan perkara yang tidak pasti.

- 3. Aliah (2019) sepanjang hayat umur pemberi atau penerima hibah sebagai ukuran tempoh penerima hibah boleh menggunakan harta hibah. c) Hibah dengan syarat balasan • Hibah dengan syarat balasan bermaksud pemberian hak milik harta yang dikaitkan dengan sesuatu gantian atau alas an. • Mazhab Hanafi kecuali Zufar: Syarat balasan yang dikenakan oleh pemberi hibah dianggap sah dan perlu ditunaikan bagi menjadikan akad tersebut berkuat kuasa. • Mazhab Shafie, Maliki, Hanbali dan Zufar: Akad hibah dengan syarat balasan adalah sah sama ada menyatakan jenis balasan yang perlu ditunaikan atau tidak. Namun, hukum-hukum jual beli seperti hak shufa’ah, khiyar dan ganti rugi adalah terpakai ke atas hibah dengan syarat balasan ini. • Bentuk-bentuk syarat: ➢ Tanggungjawab bagi penerima hibah. ➢ Penerima hibah perlu meninggalkan sesuatu perbuatan seperti tidak pergi ke suatu tempat. ➢ Melunaskan hutang pemberi hibah. Amalan di Malaysia Hibah ruqba • Daud b Idris v Saiyah bt Said dan 9 yang lain

- 4. Aliah (2019) ➢ Fakta kes: Dalam memorandum Encik Daud, hibah akan berlaku sekiranya penerima hibah bersetuju dengan syarat di mana antara syarat tersebut ialah syarat ruqba iaitu harta akan dipindah semula kepada penerima hibah sekiranya penerima hibah meninggal dunia terlebih dahulu. ➢ Diputuskan: Mahkamah berpuas hati bahawa penerima hibah, iaitu defendan yang memohon supaya hibah yang dilakukan beliau, adalah sah. • Rafizah binti Ab Karim dan Kamar bin Ab Karim dan Empat Defendan yang Lain ➢ Fakta: Hibah antara pihak-pihak ini dikaitkan dengan kematian satu pihak. ➢ Diputuskan: Mahkamah merujuk keputusan Majlis Penasihat Syariah Suruhanjaya Sekuriti edisi kedua halaman 141 yang mengharuskan hibah ruqba dalam Pelaksanaan Borang Akuan Hibah untuk transaksi yang melibatkan akaun bersama Tabung Unit Amanah bagi akaun yang dipegang oleh orang Islam. Hibah ruqba yang berlaku melalui dokumen pengisytiharan hibah sah dan terpakai. • Pemberi hibah masih mempunyai kuasa atas harta yang telah dihibahkan dan penerima hibah belum mendapat milikan ke atas korpus harta secara mutlak sehingga berlaku kematian satu pihak, sama ada pemberi hibah atau penerima hibah. Hibah berkuat kuasa selepas kematian pemberi hibah • Rokiah bt Abdul Manap v Nurul Izzah bt Hamzah ➢ HIbah ruqba berkuat kuasa setelah kematian pemberi hibah. • Wan Zanariah bt Wan Ahmad v Zaidi bt Endut ➢ Hakim Syarie mengesahkan hibah yang meletakkan syarat supaya pemberian hibah yang dilakukan berkuat kuasa selepas kematian. Pemberi hibah masih boleh menggunakan manfaat harta hibah • Merupakan amalan di Malaysia namun terdapat syarat: ➢ Tujuan yang dibenarkan: Bagi merealisasikan kemaslahatan yang besar. ➢ Tempoh yang munasabah. Ditentukan oleh mahkamah.

- 5. IBT - Kekuatan dan Kelemahan APKI 2013 • APKI 2013 (Akta Perkhidmatan Kewangan Islam 2013) adalah statut yang memansuhkan akta yang melibatkan kewangan Islam di Malaysia. • Perbezaan pertama ialah dalam definisi takaful. Contoh yang akan digunakan untuk perbandingan ialah AT 1984 (Akta Takaful 1984). Terdapat penambahan dalam definisi 2013 iaitu, “Suatu kumpulan yang sama,” bagi tabung tabarruq atau dana risiko peserta. Definisi 1984 tidak menjelaskan kewujudan tabung atau dana peserta. Oleh itu, definisi 2013 adalah lebih tepat kerana tabung atau dana peserta itu dinyatakan dengan jelas. • Dalam konteks penuntut yang sesuai, APKI 2013 telah menggantikan istilah pihak menuntut wajar dalam AT 1984 dengan istilah baharu iaitu, “penuntut yang sesuai.” Definisi tuntut turut dijelaskan iaitu APKI 2013 telah mamusakkan kategori ibu bapa atau penjaga seorang penama. Ini menunjukkan penambahbaikan yang dilakukan oleh APKI 2013. • Sebelum ini, AT 1984 tidak memberikan peruntukan terperinci mengenai kaedah pembayaran manfaat takaful. Akan tetapi, dengan berkuatkuasanya APKI 2013, kaedah pembayaran manfaat takaful telah disenaraikan secara terperinci dalam Jadual 10 APKI 2013. • Satu lagi perbezaan antara AT 1984 dengan APKI 2013 ialah APKI 2013 memperkenalkan lesen berasingan untuk perniagaan takaful keluarga dan takaful am. Dahulunya, AT 1984 membenarkan pengendali takaful menjalankan kedua-dua perniagaan takaful di bawah satu syarikat yang sama. Kimi, pengendali perlu dua buah syarikat berasingan untuk menjalankan perniagaan takaful keluarga dan am. S 286 APKI 2013 memberikan tempoh lima tahun untuk mematuhi s 16(1) APKI 2013. Kebanyakan pengendali tidak mematuhi s 16(1) APKI buat masa ini kerana tiada garis panduan untuk peralihan kepada satu jenis perniagaan takaful. Ini menunjukkan kelemahan dalam APKI 2013. • Kelemahan APKI 2013 boleh dilihat dalam tadbir urus syarikat. Menerusi s 65(2)f(), jelas terletaknya tanggungjawab kepada para pengarah IKI (Institusi Kewangan Islam) untuk “mengambil kira” dengan sewajarnya keputusan jawatankuasa syariah atas isu syariah. Namun, tiada penerangan selanjutnya bagi maksud “mengambil kira.” Adakah ia bermaksud pengarah IKI tidak wajib mematuhi keputusan jawatankuasa syariah? • Kelemahan kedua dilihat dalam konteks kepentingan boleh lindung takaful. Walaupun konsep tersebut telah dimasukkan dalam APKI 2013, Jadual 8 hanya terpakai untuk perniagaan takaful keluarga sahaja. APKI 2013 tidak menyebut apa-apa mengenai konsep kepentingan boleh lindung takaful untuk perniagaan takaful am. • Dari perspektif syariah, qard adalah kontrak bersifat sukarela. Namun, s 95 APKI 2013 telah menjadikan qard satu tanggungjawab atau liability. Ini dilihat agak tidak menepati semangat kontrak qard. • Peruntukan ini juga dilihat tidak konsistent dengan prinsip takaful kerana ia meletakkan liability kewangan ke atas pemegang saham syarikat takaful sedangkan dalam konsep takaful, para peserta yang bertanggungjawab menyediakan tabungan untuk manfaat bersama secara tolong menolong. • Seterusnya, terdapatnya peruntukan dalam APKI 2013 berkaitan kewajipan pendedahan dan representasi ke atas pihak peserta takaful. Ia adalah selaras dengan kewajipan bercakap benar yang dianjurkan oleh Islam di mana, dari perspektif syariah, penipuan boleh menjejaskan kontrak. • Namun, terdapat kelemahan iaitu dalam konteks hibah bersyarat di bawah APKI 2013. Oleh kerana APKI tidak menjelaskan siapa individu yang layak dinamakan sebagai benefisiari di bawah hibah bersyarat ini, kontrak itu mungkin boleh disalahgunakan untuk menafikan hak waris daripada menerima manfaat takaful. • Dalam APKI 2013, undang-undang telah diperkemaskan dan dilihat lebih menepati kehendak Syariah. Walau bagaimanapun, beberapa kajian lanjut dari sudut Syariah

- 6. perlu dilakukan dalam aspek kepentingan boleh lindung takaful, qard dan pelaksanaan hibah bersyarat dalam pembayaran manfaat takaful.

- 7. IBT - Nota Ringkas Bagi Kes Arab-Malaysian Finance Bhd v Taman Ihsan Jaya Sdn Bhd & Lain-lain Penghakiman ini, yang timbul daripada pengenalan pembiayaan Islam di Malaysia, merupakan pertimbangan terhadap prinsip-prinsip asas yang mentadbir pembiayaan Islam dan had-had bidang kuasa yang dikenakan kepada mahkamah sivil dalam menangani isu- isu ini disebabkan oleh susunan perlembagaan Malaysia. Diputuskan bahawa apabila berurusan dengan kes-kes yang melibatkan kemudahan pembiayaan Islam, mahkamah sivil berfungsi secara tegas sebagai mahkamah sivil dan tidak menjadi Mahkamah Syariah. Fungsi mahkamah sivil, dalam hal ini, adalah untuk memberikan keputusan yang dipertimbangkan secara kehakiman di hadapannya menurut undang-undang dan bukan mengaplikasikan undang-undang Islam seperti ia adalah Mahkamah Syariah. Fungsinya adalah untuk menguji aplikasi konsep Islam dan untuk memastikan bahawa transaksi tersebut di dalam kes-kes di hadapannya tidak melibatkan apa-apa unsur yang tidak dipersetujui di dalam Islam.

- 8. Majlis Penasihat Syariah (MPS) Bank Negara Malaysia ditubuhkan pada tahun 1997 sebagai badan berkuasa tertinggi dalam menentukan perkara-perkara Syariah berhubung dengan kewangan Islam di Malaysia. MPS telah diberikan mandat untuk menentukan hukum Syarak bagi perniagaan perbankan Islam, takaful, kewangan Islam, pembangunan kewangan Islam atau perniagaan lain yang berlandaskan prinsip Syariah yang di bawah kawal seliaan Bank Negara Malaysia. MPS sebagai badan rujukan dan penasihat Bank Negara Malaysia berhubung dengan perkara Syariah juga bertanggungjawab untuk mengesahkan semua produk perbankan Islam dan takaful bagi memastikan produk-produk tersebut mematuhi prinsip Syariah. Selain itu, MPS juga berperanan sebagai penasihat Bank Negara Malaysia berhubung dengan isu-isu berkaitan dengan urus niaga atau urusan kewangan Islam Bank Negara Malaysia dan badan-badan berkaitan yang lain. Berdasarkan peruntukan Akta Bank Negara Malaysia 2009, peranan dan fungsi MPS telah diperkukuh lagi dengan pemberian status badan berautoriti tunggal dalam menentukan perkara-perkara Syariah berhubung dengan perbankan Islam, takaful dan kewangan Islam. Keputusan MPS bukan sahaja terpakai bagi institusi kewangan Islam, malah juga oleh mahkamah dan penimbang tara yang perlu merujuk kepada keputusan MPS untuk setiap prosiding yang berkaitan dengan perniagaan kewangan Islam, dan juga memperakui bahawa keputusan MPS adalah mengikat. MPS dianggotai oleh para ilmuwan Syariah dan pakar kewangan Islam terkemuka, yang mempunyai kelayakan, pengalaman dan pengetahuan yang mendalam dalam pelbagai bidang, khususnya dalam bidang kewangan dan perundangan Islam. MAJLIS PENASIHAT SYARIAH BANK NEGARA MALAYSIA xv

- 9. IBT CHEATSHEET MUDARABAH (DOCUMENT POLICY BNM) CONTRACTING PARTIES CAPITAL OF MUDARABAH PROFIT OF MUDARABAH • Rabbul mal - Capital provider • Mudarib - Entrepreneur • Must be - Natural person/legal entity with legal capacity • Capital ➢ What: Asset provided by rabbul mal to mudarib for mudarabah venture ➢ Conditions: Identifiable, available and accessible for mudarib ➢ Form: Cash or in-kind (similar), including intangible assets • Profit ➢ Profit is value created above capital ➢ It is a fundamental component of mudarabah ➢ Rules: Cannot be fixed in the form of percentage Cannot be pre- determined fixed amount to one party which deprives the profit share of other contracting party Does not have to be guaranteed by mudarib Is shared on a ratio mutually agreed • Legal capacity of a person ➢ Capacity to assume rights and responsibilities ➢ Capacity to give legal effect to his action • Conditions ➢ Possess sound mind ➢ Can distinguish between what is harmful or beneficial to one’s interest • Capital in-kind - Must be valued in monetary terms agreed by contracting parties • Capital in different currency - Must be value based on specific currency agreed by contracting parties • Legal capacity of a legal entity ➢ Eligibility of an entity to acquire rights and assume responsibilities • Debts due to rabbul mal (either from mudarib or third party) ➢ Are unqualified as capital ➢ Are deemed as liability to rabbul mal • PSR (Profit Sharing Ratio) ➢ Determined when entering mudarabah contract ➢ Can be revised Revision must be mutually agreed by rabbul mal and mudarib • Legal capacity governed under ➢ Contracts Act 1950 ➢ Age of Majority 1971 • All remaining capital upon dissolution or termination of mudarabah - Must be returned to rabbul mal • Binding if ➢ The terms and conditions in mudarabah contract are mutually agreed between rabbul mal and mudarib ➢ Does not contravene the shariah • Loss ➢ Borne by rabbul mal up to capital value ➢ Impairement of assets - Not borne by rabbul mal except in case of misconduct, negligence or breach of specified terms ➢ Mudarib must give reasoning for occurrence of loss ➢ In case of multiple rabbul mal - loss shall be born by each rbabul mal proportionate to their capital contribution • Rabbul mal guarantees capital except in case of mudarib’s ➢ Misconduct ➢ Negligence ➢ Breach of specified terms

- 10. Islamic Banking and Takaful Qard • Definition - Payment of money given to someone to benefit from it, and he is to ensure the repayment of equivalent amount. • Legality ➢ Quran, 64:17 - If you loan to Allah, a beautiful loan, He will double it to your (credit) and He will grant you forgiveness: for Allah is most ready to appreciate (service), Most Forbearing. ➢ Ibn Majah, hadith no. 2431 - In the night of journey, I saw on the gate of the Heaven written, reward for sadaqah is ten times and reward for ward is eighteen times. So, I asked the angel how it is possible. The angel replied, “Because a beggar who asked had already had something, but a borrower did not ask for loan unless he was in need.” • Rules and Conditions ➢ Offer and acceptance must be expressed. ➢ No stipulation of repayment more than the principal loan amount. ➢ No combination of qard and exchange contracts - It is unlawful if the lender stipulates that the borrower must purchase something from him, sell something to him or lease his asset. ➢ Writing down the contract is compulsory. The view is deduced from Quranic verse, 2:282. ➢ Having witnesses in qard agreement is highly recommended, to mitigate dispute between parties. • Application ➢ In Islamic banking products qard is commonly used for the current deposite account and saving deposit account. ➢ Some Islamic banks use the principle of wadiah but the modified structure transforms the contract into qard. Hence, the bank receives the deposit as qard. ➢ Qard is also applied by Islamic banks to provide loan facilities such as the overdraft facility and cash withdrawal facility through the use of credit card. ➢ In liquidity management instruments for IFIs, ward is also used as an underlying contract.

- 11. 1 Islamic Banking and Takaful - Takaful 1.0 Concept of Takaful The word takaful comes from the Arabic word kafalah, which means guaranteeing each other or joint guarantee. There are two types of takaful products which are the general and family takaful. The general takaful covers, inter alia, motor policy, fire, MRTT and group policy. On the other hand, family takaful is meant to secure the family conditions from future risks. Takaful is based on the concept of social solidarity1 , cooperation and mutual indemnification.2 It is a pact among a group that agrees to donate to a fund that is used to jointly indemnify covered losses incurred by the members. The operations and the fund are commonly managed by a takaful operator on commercial basis. Islam is not against the concept of insurance itself but against some of the means that are used in conventional insurance. For insurance to be acceptable in Islam, the insurance should avoid the elements of riba (interest), maisir (gambling) and gharar (uncertainty), though the elements of gharar may be forgivable depending on the circumstances. 2.0 Evidence of Legality from Quran, Sunnah and Ijma 2.1 Quran In the Quran, Allah SWT explained that human beings should help each other when they are in danger or need help. The verse in the Quran that illustrate this is Surah Al-Maidah (5):3. 2.2 Prophet’s hadith “Whosoever removes a worldly grief from a mukmin, Allah SWT will take away from him one of the grieves of the 1 Solidarity - Unity or agreement of feeling or action, especially among individuals with a common interest; mutual support within a group. 2 Indemnification - Security against legal liability for one's actions.

- 12. 2 hereafter. Whosoever alleviates a needy person, Allah SWT will alleviate from him both the world and the hereafter.” (Narrated by Abu Hurarira r.a.h) 2.3 Ijma There have been numerous conferences on Islamic insurance held worldwide in which Muslim scholars have unanimously agreed on the validity of insurance practices. Some of those conferences are listed as follows: • The Islamic Fiqh Week held in Damascus from 1st - 6 th April in 1961 • The Seminar held in Morocco on 6th May 1972 which upheld the validity of insurance business with the exception of life insurance business • The Second Conference on Muslim Scholars held in Cairo in 1965 3.0 Law That Governs Takaful Industry In Malaysia There are three levels of regulation of the takaful industry which are premised on local jurisdictions, the standards and guidance notes issued by the IFSB, and the Insurance Core Principles (ICPs) of the International Association of Insurance Supervisors (IAIS). a) Local jurisdiction In Malaysia, the government has passed the Takaful Act 1984 to uphold the legality of takaful. The Act authorises SAC-BNM to supervise and advise takaful operations at national level, and the Shariah advisory committees of respective operators at institutional level. The IFSA 2013 now supersedes3 the Takaful Act 1984 to provide for regulation and supervision of the takaful institutions. 3 Supersedes - Take the place of (a person or thing previously in authority or use); supplant.

- 13. 3 b) IFSB standards The IFSB has issued a number of standards that sets the Shariah, governance and regulatory framework for takaful operators. For example, in December 2009, IFSB-8 was issued to adapt and reinforce takaful internationally so they can stand on level playing field with their conventional counterparts. c) ICPs of the IAIS The IAIS is a voluntary membership organisation of insurance supervisors and regulators from more than 200 jurisdiction in nearly 140 countries. The mission of IAIS is to promote effective supervision of insurance industry to contribute to global financial stability.

- 14. Islamic Banking and Takaful Wadiah • Definition - Wadiah refers to a contract which the owner or his representatives places an asset with another party for custody or safekeeping. The term wadiah came from the verb wadaa which means to deposit. • Parties ➢ Proprietor of the property - Mudi (depositor) ➢ Person entrusted - Mustawda (custodian) ➢ Deposited asset - Wadiah • Legality ➢ Quran, 2:283: If you trust one another, then let him who is trusted fulfill his trust, and let him be conscious of God, his Sustainer. ➢ Abu Dawud, hadith no. 3534: And perform the trust to those who entrusted you and do not betray those who betrayed you. • In the light of evidences from the Quran and Sunnah, all Muslim scholars agree on the permissibility of wadiah. • Types of wadiah ➢ Wadiah yad amanah (safe custody based on trust) Custodian is responsible for safekeeping of asset. Custodian will return asset upon request of depositor. Custodian is not liable for loss and damage of asset except if they arise from misconduct, negligence and breach of specified terms. ➢ Wadiah yad damanah (guaranteed safe custody) This type combines two contracts, safe-keeping and guarantee. It is where custodian guarantees the return of property and agrees to return item upon request. • Conditions of wadiah yad amanah ➢ Custodian has a duty to protect the asset from loss and damage. The custodian will not be responsible expect if the damage arise from his misconduct, negligence or breach of specified terms. ➢ Custodian cannot entrust asset to a third party without consent of depositor. If he does otherwise, custodian will be fully responsible for any loss and damage. ➢ Hiring or lending asset can be done only with the permission of the owner. ➢ Custodian must return asset upon request of depositor. ➢ Custodian and owner of asset can agree to pay charges for wadiah service. • Conditions of wadiah yad damanah ➢ Custodian is entitled to use asset for trading or any other purposes. If the asset is a fungible asset such as money, the wadiah contract will be construed as qard. ➢ Custodian has right to any income derived from utilisation of asset but is liable for any damage or loss. ➢ Custodian at his discretion can give some portion of his income as a gift (hibah) to the depositor. The gift cannot be be in pre-agreed arrangement because this type of wadiah is similar to a load and therefore, the pre-agreed benefit will be regarded as riba. ➢ Custodian must return asset to owner upon request of depositor. • Application ➢ Wadiah yad amanah - Less suitable due to its non-commercial features and restrictions such as non-guaranteed returns and non-utilisation of wadiah asset. ➢ Wadiah yad damanah - Common utilisized to structure various deposit products, namely the savings and current accounts. The bank as custodian will utilise the deposit placed by depositors to give financing or to invest, in which all profits belong to bank. The bank at its own discretion, may give hibah to depositors, on condition that the hibah is not promised upfront and not be a customary practice.

- 15. Aliah (2019) 1 Development of Islamic Finance in Malaysia The development of Islamic finance can be seen in the pre-Islamic period where the inhabitats of Middle East and Arabian peninsula have conducted trade and business partnerships. They have followed certain customary commerical practices and traditions. With the introduction of Islam, they re-evaluated the commercial practices so that they are consistent with Islamic legal principles. During the era of Prophet Muhammad SAW, the doctrine of financial operations are derived from Holy Quran, sunnah or Prophet Muhammad’s SAW examples. To illustrate, Prophet Muhammad SAW, in numerous sayings, has bought credit, taken financing, give npersonal property as security or lien and acted as an agent in mudarabah contract with an investment from Khadijah. Following the passing of Prophet Muhammad SAW in 632 AD, the spread of Islam began, together with its Islamic methods and finance. The first attempts in Islamic finance can be traced to Malaysia and Egypt in the early 1960s. The first institution that was involved in Islamic finance in Malaysia was the Muslim Pilgrim’s Savings Corporation, set up in 1963, to help people to save on a regular basis to pay for their pilgrimage to Makkah. In 1969, this corporation evolved into the Pilgrim’s Management and Fund Board, or Lembaga Tabung Haji. The success of Lembaga Tabung Haji has provided the main impetus for establishing Bank Islam Malaysia Berhad (BIMB) which represents a full-fledged Islamic commercial bank in Malaysia. Below shows the journey of Islamic Finance in Malaysia: 1960s 1980s 1990s 2000s 1. Pilgrims Management and Funboard or Lembaga Urusan dan Tabung Haji, Malaysia 1. Bank Islam Malaysian Berhad 2. Syarikat Takaful Malaysia Berhad 1. Islamic Interbank Money Market (IIMM), Malaysia 2. Bank Muamalat Malaysia Berhad 1. Islamic Financial Services Board (IFSB), Kuala Lumpur 2. International Islamic Liquidity Management Corporation (IILM), Kuala Lumpur Malaysia started with the establishment of one Islamic bank in 1983 to spearhead the introduction of Islamic banking products and services. Takaful was introduced in 1984 to complement Islamic banking operations as it provides amongst other things, coverage for Islamic house mortgages. In addition, Malaysia has also initiated the issuance of Islamic financial instruments by the government and central bank, Bank Negara Malaysia (BN). In order to achieve uniformity of shariah decisions and to advise BNM on shariah issues, the Shariah Advisory Council of BNM (SAC-BNM) was established in May 1997. Its role was enhanced in 2003 when it was accorded the sole authoritative body on Shariah matters pertaining to Islamic banking, takaful and finance. The table below shows Malaysia’s approach in building its Islamic financial system:

- 16. Aliah (2019) 2 1980s 1990s 2000s 2010s Phase I Distinct aspect of Shariah compliance in Islamic financial transactions Phase II Specific regulation allowing establishment of Islamimc windows Phase III Recognition on the dual financing system in Malaysia Phase IV Requiremet to observe end-to-end Shariah compliance by IFIs Malaysia has now evolved into a comprehensive domestic Islamic financial system that is diversified in terms of its institutions, markets and players.

- 17. 1 Islamic Banking and Takaful - Family Takaful and Nomination Family Takaful • Family takaful is an alternative to life insurance that gives protection to beneficiaries of participant financially if any calamity or death happens in the future. • Family takaful distributes takaful benefits in the event of participant’s death. Therefore, the participant is required to name a person as a nominee to receive takaful benefits. Nomination • Process of appointing a person or persons to receive takaful benefits as conferred by takaful participant by certificate, in the event of death of participant. Purpose of nomination • To ensure loved ones are financially protected in case of untimely accident or death of participant. • To ensure the takaful operator to disburse the benefits to the nominated person promptly without the need to wait for distribution orders from court. Status of nominee • The question about the status of nominee is whether he is the sole beneficiary or simply an executor. • Two major views regarding status of nominee: ➢ One view holds that takaful benefits are wealth of the deceased, thus, is part of his estate to be distributed according to faraid, and thus only his legal heirs can be nominated. ➢ The other view holds that the participant can gift the takaful benefits to anybody as a hibah and hence can nominate anybody. Nominee as an executor • Re Ismail bin Rentah ➢ The deceased nominated his daughter to receive his shares in case of his death. ➢ The judge decided that although the daughter was nominated it did not mean that she can enjoy the monetary benefits as those benefits formed part of the estate of the deceased, and hence should be redistributed according to Islamic laws of faraid. ➢ In this case the daughter’s role is that of an executor. • The National Council of Muslim Religious Affairs in Malaysia, Fatwa 1973: “Nominees of the funds in Employees Provident, Post Office Savings Bank, Bank, Insurance, and Cooperative Society are in the position of persons who carry out the will of the deceased or the testator. They can receive the money of the deceased from the sources stated to be divided among the persons who are entitled according to the Muslim Law of Inheritance.” • Takaful Act 1984 does not provide express rule on nomination. S 65(1) of the Act requires the operator to distribute the savings and takaful benefits as predetermined by the participant. “When a participant, in relation to any family solidarity certificate or solidarity certificates, dies and on his death takaful benefits are payable under the certificate or certificates, the operator may make payment to a proper claimant such sum of the solidarity moneys as may be prescribed without the production of any probate or letters of administration and the operator shall be discharged from all liability in respect of the sum paid.”

- 18. 2 • It has been clarified that the ‘proper claimant’ as mentioned by the act is not necessarily the nominee as the act goes on to define proper claimant in Section 65(4): “In this section, “proper claimant” means a person who claims to be entitled to the sum in question as executor of the deceased, or who claims to be entitled to that sum under the relevant law.” • However, Section 167 of the Insurance Act 1996, which applies to the Muslim participant, provides that the nominee in a policy will be treated as a mere executor and not as a sole beneficiary over the benefits of the policy. • Moreover, the benefits over the policy will be regarded as part of the estate of the participant and will also be subject to his (the participant) debts. • Bank Negara Malaysia leaves the status of the nominees up to the Takaful operators, and the majority of the takaful operators in Malaysia prefer to follow the view that the nominee is simply an executor. Nominee as a Sole Beneficiary • While in the Re Ismail bin Rentah (1940) case, it was decided that nominee is simply an executor, in other cases such as Re Man bin Mihat (1965) and Re Bahadun bin Haji Hassan (1974) , the judge ruled that the participant had gifted the benefits to the nominee hence it is his to be enjoyed as the sole beneficiary. • Bank Negara Malaysia’s Sharia Advisory Council issued a resolution saying that the takaful benefits can be given away as Hibah. The resolution gives the final decision up to the takaful operators and goes on to say that the nomination form has to be standardized and the status of the nominee whether as a beneficiary or an executor has to be clearly stated. The participants should be clearly informed of the effect of each option and the eventual distribution of benefits should be based on the contract. Proposed Solution • The resolution of the Sharia Advisory Council seems to offer the best practice for the issue of nomination by leaving it to the Takaful operators and with the requirement of clearly specifying the status of the nominee in the nomination form. However as to the sharia compliance of both these solutions, opinions differ and further research is needed to find a solution which would remove these divergent of opinions.

- 19. Islamic Banking Takaful Family Takaful • A long-term policy, used for children’s education, their pension and compensation for dependants in the event of death and disability, amongst others. • Ranges from 10-30 years. • Operators divide contributions into two parts: ➢ Participant’s account (savings account) ➢ Participant’s special account (tabarruq account) for meeting losses of fellow participants In the event of a loss, the participant will be compensated according to a pre-agreed formula. The clause of tabarruq is incorporated in the contract. • If a participant dies prematurely, his family gets the amount in the participant’s account plus dividends, and the amount in the participant’s special account as if he had continued contributions until the end of the maturity period. • If the participant withdraws from the takaful programme, he will get the amount in the participant’s account only. • Common family takaful products: ➢ Savings and educational plans. ➢ Retirement plans. ➢ Retirement annuities. ➢ Waqf plans and ancillary benefits added to the main plans. Protection for critical illness, disability, accidental death or waiver contribution. Wakalah Model • Contract of agency. • Participants remain the actual owners of the takaful fund and the takaful operators acts as an agent of the participants who manages the fund for a defined fee. • As an agent, the operator is entitled to an agency fee (remuneration) and a performance fee (as commission). • The surplus of participants’ investment funds goes to the participants. • The agency fee rate is fixed annually in advance in consultation with the Shariah committee or the Shariah board of the takaful operator. • The performance fee, which is related to the level of performance, is given as an incentive for good administration and governance of the participants’ fund. • Main issue in pure wakalah model: ➢ The management and shareholders of a takaful operator cannot share in the profits because they merely act as an agent to the participants. ➢ However, they may be entitled to a fee based on their performance in the investment.

- 20. ➢ Therefore, many takaful operators today attempt to adopt a combination of wakalah and mudarabah or a modified wakalah model.

- 21. Vocab 1) Takaful: A type of insurance system devised to comply with the sharia laws, in which money is pooled and invested.