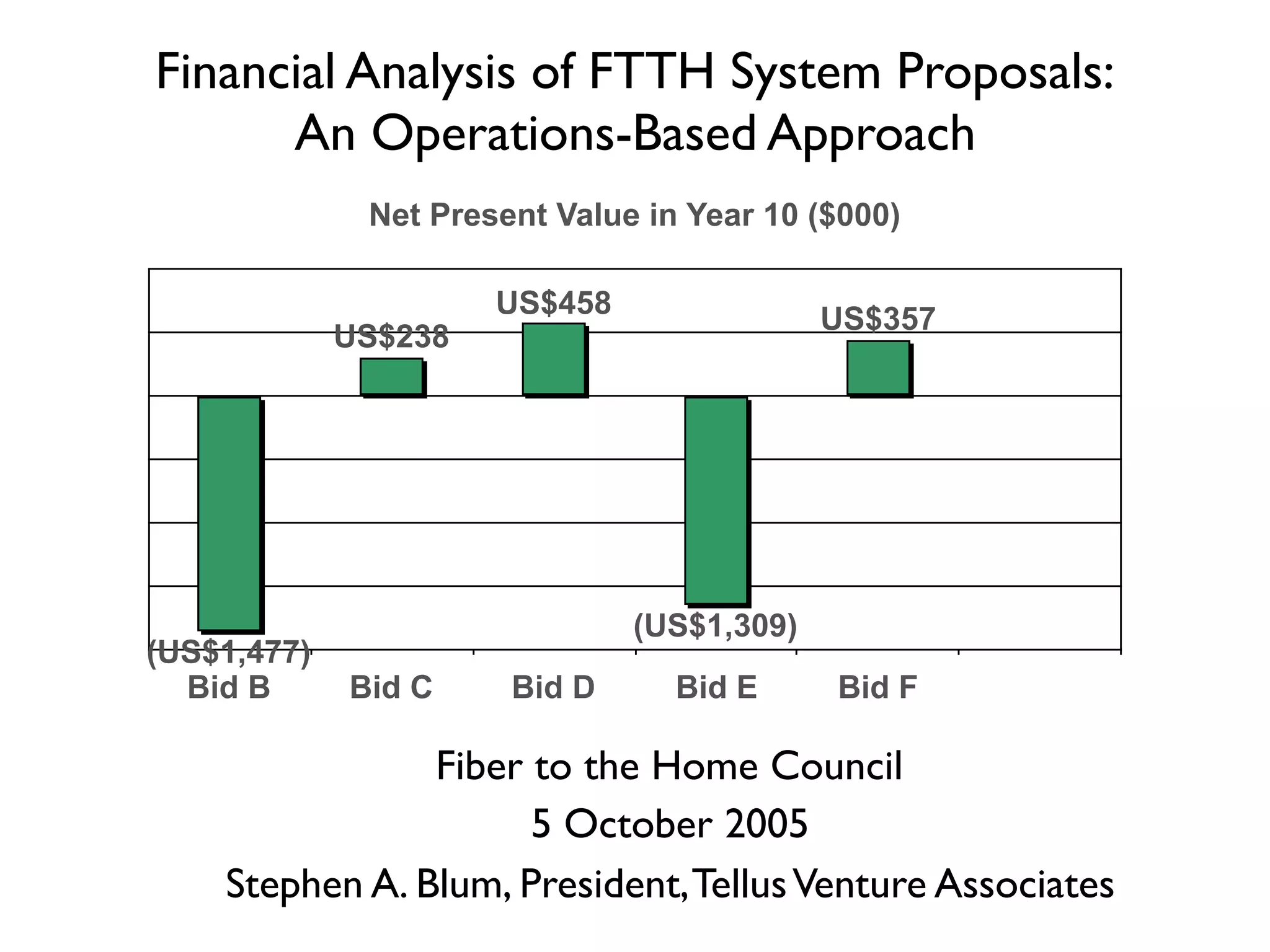

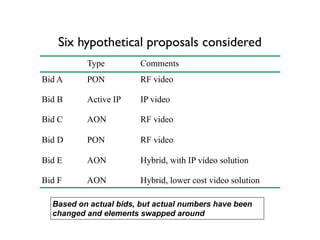

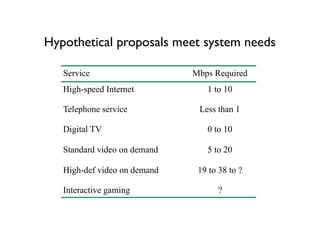

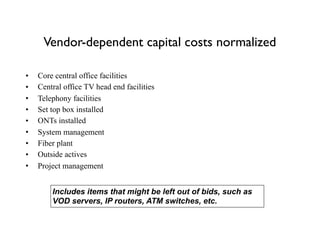

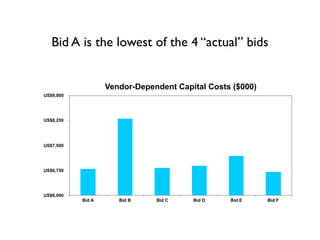

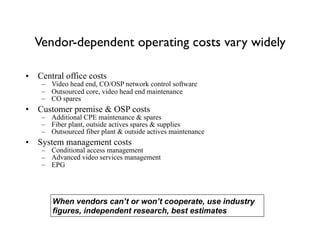

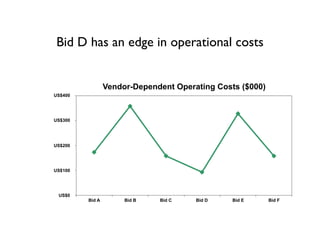

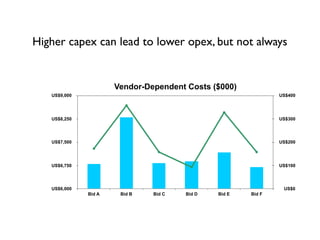

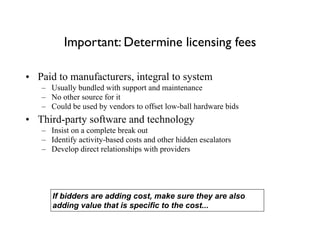

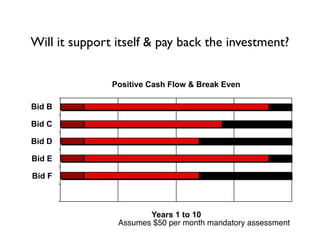

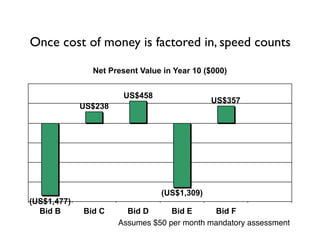

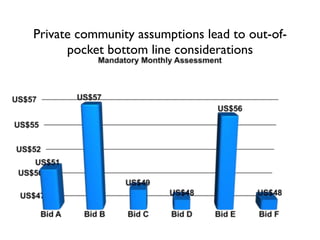

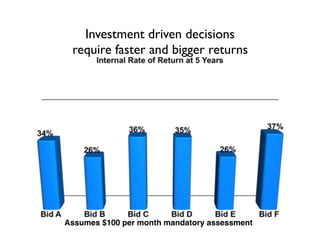

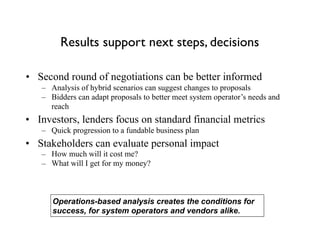

The document provides a financial analysis of various fiber-to-the-home (FTTH) system proposals, emphasizing the importance of comparing both capital and operating costs for accurate evaluations. It discusses vendor-dependent and independent costs, assumptions for revenue generation, and the need for clear financial metrics to support decision-making. The analysis aims to guide system operators in negotiations and funding strategies based on their specific operational needs and financial expectations.