MSME-PPT-251222.pdf

- 2. Shishu-50000 Kishore- 50000 to 5 Lac Tarun : 5 lac to 10 lac SHG – 20 Lacs Agri allied-10 Lacs TAILOR MADE PMEGP PMSVANIDHI GECL etc., ANY LOAN AMT BUT (CGTMSE COVER) UPTO 2 CR (MFG/SER) UPTO 1 CR (TRADE)

- 3. MSME INTERNATIONALMSME DAY – 27th June “Simplified Common Appraisal Memorandum for MSMEs” Loans upto Rs 10 lacs -NF 1042 Loans above Rs. 10 lakhs to Rs. 1 Crore -NF 1028 Loans above Rs. 1 Crore to Rs. 5 Crore -NF 1029 Loans above Rs. 5 Cr to Rs. 25 Cr –NF 1023 Above Rs. 25.00 Crore - Long Format adopted by the Bank MSME sector provides Employment :120 million people. MSM enterprises 63.4 million Contribute to 45% of the industrial production of the country and 48% of the total exports. MSMEs contribute 6.11% of the manufacturing GDP and 24.63% of the GDP from service activities AND 33.4% of India’s manufacturing output. 94% of MSMEs are unregistered with a large number in the unorganized sector

- 4. 4 Based on Iinvestment in P & M OR Equipment Does not exceed T/O DOES NOT EXCEED 1 CRORE MICRO 5 CRORES 10 CRORES SMALL 50 CRORES 50 CRORES MEDIUM 250 CRORES Any person who intends to establish a MSME may file Udyam Registration online in the Udyam Registration portal, based on self-declaration with no requirement to upload documents, papers, certificates or proof MFG ( INVESTMETN IN P & M) SERVICE (INVEST IN EQUIPMENT MULIPLY WITH 5

- 5. Calculation of investment in Plant and Machinery or equipment:- ➢ Linked to the IT Return of the previous years filed under the Income Tax Act, 1961 ➢ If new enterprise, where no prior ITR is available, the investment will be based on self-declaration of the promoter of the enterprise and such relaxation shall end after the 31st March of FY in which it files its first ITR. ➢ Online form for URC captures depreciated cost as on 31st March each year of the relevant previous year. Therefore, the value of P & M or Equipment for all purposes shall mean the Written Down Value (WDV) as at the end of the FY as defined in the IT Act and not cost of acquisition or original price, ➢ Cost of certain items specified as per section 7 of the Act (Cost of pollution control, Research and development, Industrial safety devices, Tools, Jigs, Dies, Mould etc.,) shall be excluded from the calculation of the amount of investment in P & M

- 6. Calculation of turnover Exports of goods or services or both, shall be excluded for the purposes of classification of MSME Information as regards T/O & Exports T/O for an enterprise shall be linked to the IT Act or Central Goods and ServicesAct (CGST Act) and the GSTIN. T/O related figures of such enterprise which do not have PAN will be considered on self-declaration basis for a period upto 31st March, 2021 and thereafter, PAN and GSTIN shall be mandatory. The exemption from the requirement of having GSTIN shall be as per the provisions of the Central Goods and Services Tax Act, 2017

- 7. URC Registration process ➢ Registration portal : Udyam Registration portal. ➢ NO fee for filing Udyam Registration. ➢ Aadhaar number shall be required for Udyam Registration. ➢ iv. The Aadhaar number shall be of the proprietor in the case of a proprietorship firm, of the managing partner in the case of a partnership firm and of a karta in the case of a Hindu Undivided Family (HUF). ➢ PAN shall be mandatory. ➢ vi. In case of a Company or a LLP or a Cooperative Society or a Society or a Trust, the organisation or its authorised signatory shall provide its GSTIN and PAN along with its Aadhaar number. ➢ No enterprise shall file more than one URC: Provided that any number of activities including manufacturing or service or both may be specified or added in one Udyam Registration. ➢ Whoever intentionally misrepresents or attempts to suppress the self- declared facts and figures appearing in the Udyam Registration or updation process shall be liable to such penalty as specified under section 27 of the Act ➢ Registration of existing enterprises: Existing Entrepreneurs Memorandum (EM) Part II and Udyog Aadhar Memorandum (UAMs) of the MSMEs obtained till June 30, 2020 shall remain valid till June 30, 2O22, ➢ Udyam Registration of PM SVANidhi beneficiaries is not mandatory (MoHUA),

- 8. TARGETS FOR LENDING TO MSME SECTOR BY DOMESTIC COMMERCIAL BANKS Priority Sector (which include MSME sector) constitute 40 % of ANBC or CEOBE (H) MICRO ENERPROSES TAGER IS 7.5 % of ANBC or CEOBE (higher) As per recommendations of the Prime Minister's Task Force on MSMEs Achieve a 20% year-on-year growth in credit to Micro and Small Enterprises Achieve 10% annual growth in the number of accounts under Micro Enterprise 60% of the total advances to Micro and Small Enterprises sector as on preceding March 31st Should go to Micro Enterprises ➢ RBI advised to open atleast one specialised branch in each district. ➢ Bank has been permitted to categorise their general banking branches having 60% or more of their advances to MSME sector as a whole.

- 9. INSTITUTIONALFRAMEWORK MSME Wing at HO : Exclusively facilitate growth and expansion of MSME business for the Bank. MSME Wing primarilyconsistsof the following Departments/verticals. ➢ SME Business Unit :Formulating/Renovating policies and strategies and for MSME business growth, taking into account the communications/guidelines received from RBI/Govt. of India/SIDBI/KVIC/CGTMSE/other regulators and In-house Committees of the Bank. ➢ SME Credit Group : Processing of SME proposals falling under HO powers ➢ SME Monitoringand Rehabilitation Centre : Monitoring of NPA slippage of accounts and follow up of same for recovery of dues. ➢ CGTMSE Vertical (At MSME Wing Annex–Manipal : Coverage of Eligible accounts under CGTMSE (NPA Marking, NPA Upgradation, Claim Preferment etc., ➢ MSME Sulabh Monitoring Cell: Performance monitoring of MSME Sulabhs (including Marketing officers linked to such Sulabhs). ➢ Government Sponsored Schemes (MSME) monitoringand Credit Guarantee Cell: Implementation and monitoringof MSME Government sponsored schemes like PMEGP, Stand-Up India, CLCSS, PM-SVANidhi, PMMY etc., including handling of respective portals. ➢ GM’s Secretariat ➢ MSME Section at CO: Primarily responsible for driving MSME growth ➢ General Advances Section at RO: Handle all credit related matters falling under the purview of RO, includingMSME advances ➢ MSME Sulabhs: w.e.f 01.07.2021. 156 MSME Sulabhs : Handle all fresh and enhancement MSMEproposals (Except VSL & GL) beyond cumulative cut off limits of Rs 25 Lakh or branch DOP whicheveris less in case of Small/Medium/Large & VLB branch. ➢ Specialized SME branch

- 10. Issue of Ack of Loan Applications to MSME borrowers : INWARD IN NB139 . Rejection of MSME credit facilities: Concurrence of the NHA. (However, proposals of CAC/MC powers may be rejected by MD &CEO or ED in the absence of MD & CEO) Time Norms for disposal of Applications BY BRANCH: MSME PROPOSALUPTO 5 LACS : 15 DAYS ABOVE 5 LACS : 30 DAYS. Collateral Security GUIDELINES Bank has mandated not to accept collateral security in the case of loans up to Rs.10 lakhs extended to units in the MSE sector & PMEGP . Bank may, on the basis of good track record and financial position of the MSE units, increase the limit to dispense with the collateral requirement for loans up to Rs.25 lakh based on merits. However, obtention of mandatory CGTMSE Cover can be waived for MSME loans above Rs.10 lakhs upto Rs.200 lakhs, when the MSME borrower provides primary security or primary and collateral security put together in the form of land and building/ approved securities with a minimum value of 75% of the sanctioned limit, in addition to the security of assets created out of Bank’s finance

- 11. Delayed payment : In no case, the period agreed upon between the supplier and the buyer shall not exceed 45 days from the date of acceptance or the day of deemed acceptance. (PENALTY : 3 times of Bank Rate COMPOUNDED - monthly) Guidelines of our Bank in respect of enabling mechanism for meeting payment obligations by Large corporates to MSMEs are as under : While sanctioning/renewing credit limits to their large corporate borrowers (i.e. borrowers enjoying WC limits of 10 crore and above from the banking system), Bank to fix separate sub-limits, within the overall limits, specifically for meeting payment obligations in respect of purchases from MSMEs either on cash basis or on bill basis

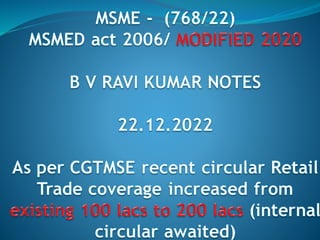

- 12. CREDIT GUARANTEE SCHEMES: Credit Guarantee Scheme is a tool for : i. Widening of credit portfolio ii. Better management of risk iii. Faster recovery of dues iv. Enhancement of profitability CGTMSE :Credit Guarantee Fund Trust Scheme For Micro & Small Industries COVERAGE : FB and/or NFB (single borrower) MS Enterprise for credit facility UPTO Rs. 200 lakh ➢ Retail and Wholesale trade : Rs. 100 lakh ➢ by way of Term loan and/or Working Capital ➢ without any collateral security and/or 3rd party guarantees. ➢ Maximum guarantee coverage limit of Rs. 200 lac per borrower will be based on the O/S credit facilities and the borrowers can avail incremental credit facilitis ➢ Hybrid Security : MLIs will be allowed to obtain collateral security for a part of the credit facility, whereas remaining unsecured part of credit facility, upto a maximum of ₹200 lakh, can be covered under CGTMSE. CGTMSE will, however, have notional second charge on the collateral security. Credit facilities may be extended by more than one bank and/or FI jointly and/or separately to eligible borrower up to a maximum of ₹200 lakh per borrower subject to ceiling amount of individual MLI. Any credit facility which has been sanctioned by the Bank with the interest rate charged as per the RBI guidelines would be eligible for coverage under CGS of CGTMSE

- 13. MLIs can now apply for guarantee cover anytime during the tenure of Loan provided the credit facility was not restructured / Remained in SMA2 status in last 1 year from the date of submission of application. Provided further that, as on the material date: ➢ Credit facility is standard and regular (not SMA) as per RBI guidelines and / or ➢ Business or activity of the borrower has not ceased; and / or ➢ Credit facility has not wholly or partly been utilized for adjustment of any debt deemed bad or doubtful of recovery, without obtaining a prior consent in this regard from the Trust. Credit facilities not eligible under the Scheme ➢ DICGC COVERED ACCOUNTS. ➢ Any credit facility in respect of which risks are additionally covered by Government or by any general insurer or any other person or association of persons carrying on the business of insurance, guarantee or indemnity. ➢ Any Credit facility upto ₹10 lakh to Micro Enterprises covered under MUDRA. ➢ Any credit facility, which does not conform to, or is in any way inconsistent with, the provisions of any law, or with any directives or instructions issued by the Central Government or the RBI. ➢ Any credit facility which has been sanctioned by the lending institution against collateral security and / or 3RD party guarantee.

- 14. GUARNATEE - 236/20 AGF Guarantee cover will commence from the guarantee start date and shall run through the agreed tenure of the term credit in respect of Term loan/Composite credit. Where WC alone is extended to the eligible borrower, the guarantee cover shall be for a period of 5 years or a block of 5 years, keeping maximum period of guarantee cover of 10 years or for such period as may be specified by the trust in this behalf

- 15. CALCULATION OF AGF BY TRUST : TERM LOAN : Outstanding amount as on 31st December WC : Maximum (peak) WC limit availed by the borrower during previous calendar year Additional risk premium : 15% will be charged on the applicable rate to MLIs who exceed the payout threshold limit of 2 times more than thrice in last 5 years. This premium will be applicable for all guarantee accounts irrespective of the sanction date

- 16. COVERGAE PERIOD CGTMSE GUIDELINES : Coverage within the end of subsequent quarter to the quarter in which the credit limit is sanctioned. BANK GUIDELINES : 15 days from the date of sanction Invocation of guarantee NPA MARKING CGTMSE GUIDELINES : NEXT QUARTER END BANK GUIDELIENS : 15TH OF SUBSEQUENT MONTH TO THE MONTH IN WHICH ACCOUNT SLIPS TO NPA. Preferring of claim of eligible NPA accounts under CGTMSE CGTMSE GUIDELINES : Max period is 3 years from the NPA date or lock-in period whichever is later Bank guidelines : within 180 days of NPA date or expiry of lock in period which ever is latter. (18 months from date of issue of guarantee cover OR the date of last disbursement , which ever is later)

- 17. Claim preferment Settlement of 2ND/Final instalment: Settlement of 2nd / final instalment will be considered on conclusion of recovery, irrespective of the sanction date of the credit facility. With regards to conclusion of recovery proceedings, following 4 scenarios as applicable and certified by the concerned authority of the MLI is considered as conclusion of recovery proceedings provided minimum period of 3 years from the date of settlement of first claim has been lapsed. ➢ If legal action is initiated under SARFAESI Act and whatever assets available were sold off and the amount is remitted to the Trust. Also, the borrower is not traceable and the Networth of the Personal Guarantor is not worth pursuing further legal course. ➢ If amount is recovered through sale of assets under SARFAESI and no other assets are available and legal action is taken under any forum such as RRA, Civil Court, Lok Adalat or DRT where there is no further means to recover the money from the borrower and the Networth of the Personal guarantor is significantly eroded. ➢ If no assets are available and the borrower is absconding, and the Networth of the Personal guarantor is significantly eroded. ➢ If no assets are available and the legal action is withdrawn as the borrower is absconding and it may not be worth pursuing legal action. ➢ As per CGTMSE guidelines, the balance 25 % of the guaranteed amount will be paid on conclusion of recovery proceedings by the lending institution or after 3 years of obtention of decree of recovery, whichever is earlier

- 18. Other important CGTMSE guidelines CGTMSE Cover can be waived for loans above Rs.10 lakhs upto Rs.200 lakhs, when the borrower provides primary security or primary and collateral security put together in the form of land and building/ approved securities with a minimum value of 75% of the sanctioned limit, in addition to the security of assets created out of bank’s finance. Guarantee coverage for credit facilities above Rs. 50 lakhs – (internal guidelines) Credit facilities above Rs.50 lakhs under CGTMSE with relaxations in respect of the following Viability Parameters are to be permitted by CM/DM and above authorities upto their delegated powers at Branches/ SME Sulabhs/ROs, with proper substantiation/ justification for the relaxations : a) Current Ratio – 1.25 and above b) Promoter's contribution – minimum 30% of project cost c) Debt Equity Ratio – 2:1 d) Overall DSCR- 1.50 and above. e) Fixed Assets Coverage Ratio(FACR) – 1.4 and above f) Internal Rate of Return – 5% and above from estimated weighted average cost of funds. g) Repayment Period (in respect of TL)– Up to 6 years excluding moratorium period Sanction to be reviewed & confirmed by NHA @ RO/CO before release of loan. MSE units who approach for credit facilities under CGTMSE are to be duly verified through Due Diligence Services of the Rating Agencies for exposures of 10 lacs and above. All proposals above Rs.50.00 lakhs will have to be rated internally and accounts with Risk Rating upto Normal Risk only to be considered for financing

- 19. Credit Guarantee Fund For Micro Units (CGFMU) CGFMU is the Trust Fund set up by GOI , managed by NCGTC as a trustee, with the purpose of guaranteeing payment against default in Micro Loans extended to eligible borrowers by Banks under PMMY. CGFMU guarantees loans to eligible micro units under PMMY upto Rs10 Lac without obtaining any collateral or 3RD party guarantee. CGFMU Covers PMJDY of Rs.10000/- SHISHU category loans, i.e.,upto Rs.50,000 are eligible for CGFMU guarantee cover if ROI charged should not exceed 12% p.a. There is no such cap on ROI for loans granted under “KISHOR” & “TARUN” Credit Guarantee is available on a portfolio basis and not on individual loan basis, i.e., all the eligible loans granted under PMMY shall be centrally covered under CGFMU at HO and branches need not cover the loans individually.

- 20. Credit Guarantee Scheme For Standup India (CGSSI): In order to increase the pace of lending under Standup India Scheme, GOI introduced Credit Guarantee Scheme for Standup India (CGSSI). Brief details of the scheme are, as under: ➢ CGSSI shall be maintained and operated by NCGTC. ➢ CGSSI facilitates Credit Guarantee of all eligible A/CS sanctioned under Stand-up India. ➢ Fund shall cover assistance of over Rs.10.00 Lakhs and upto Rs.100 Lakhs inclusive of WCl extended under Stand Up India scheme to a single eligible borrower without obtaining any collateral or 3RD party guarantee. ➢ Fund shall provide guarantee cover to the extent of ➢ Rs.10 Lakhs and upto Rs.50 Lakhs : 80% of the amount in default for credit facility above, subject to a maximum of Rs.40 Lakhs. ➢ For above Rs.50 lakhs and upto Rs.100 Lakhs : Rs.40 Lakhs ➢ +50% of the balance amt in default above Rs.50 Lakhs subject to Max Rs.65 Lac

- 21. Credit Enhancement Guarantee Scheme For Scheduled Castes (CEGSSC) OBJECTIVE : Promote entrepreneurship among the SC population in India Introduced : Ministry of Social Justice and Empowerment, GOI Implemented by : “Industrial Finance Corporation of India Ltd (IFCI) Brief details of the scheme are, as under: ➢ Scheme aims at guaranteeing the financial assistance extended by the Banks and Financial Institutions to SC entrepreneurs by providing credit guarantee through the CEGSSC. ➢ Envisaged for Small and Medium Enterprises, projects/units being set up, promoted and run by Scheduled Caste entrepreneurs in Manufacturing, Trading and Services Sector. ➢ Primary Sector such as Commercial agriculture, Food processing, Horticulture, Poultry etc. are also eligible ➢ Scheme cover credit to a single eligible borrower by way of WC, TL or Composite Term Loan facilities without any collateral security and/or 3rd party guarantees. ➢ The minimum loan amount can be covered under the scheme is Rs.15 lacs

- 22. Coverage By Export Credit Insurance From Export Credit Guarantee Corporation (ECGC) Pre-shipment Credit: Bank has subscribed to Export Credit Insurance for Banks - ECIB (WTPC), which covers all packing credit advances granted by the Bank excluding advances granted to Government Companies Any company in which not less than 50% of the paid up share capital is held by the Central or any State Government or partly by the Central Govt and partly by one or more State Govt and includes a company which is a subsidiary of a Govt company) Post-shipment credit: Post-shipment credit under Export Credit is covered under Post-Shipment Credit under Export Credit Insurance for Banks (Whole Turnover Post Shipment) [ECIB. (WT-PS)] of ECGC. The premium in respect of ECIB (WT-PS) is borne by the Bank and not to be recovered from exporters. In addition to Whole Turnover Post Shipment Guarantee (ECIB-WTPS), individual Buyer wise Policy to be obtained by the exporter client. However, bank may consider waiver on selective basis,

- 23. FRAMEWORK FOR REVIVAL AND REHABILITATION OF MSMEs Objective : To provide a simpler and faster mechanism to address the stress in the accounts of MSMEs and to facilitate the promotion and development of MSMEs. RBI has issued guidelines on framework of revival and rehabilitation of MSME units having loan limits upto Rs. 25 Crores. The salient features of the framework are as under: ➢ Before a loan account of an MSME turns into a NPA, Banks or creditors should identify incipient stress in the account by creating 3 sub categories under the SMA category as given in the framework. ➢ Any MSME borrower may also voluntarily initiate proceedings under this framework. ➢ Committee approach to be adopted for deciding corrective action plan. ➢ Time Lines have been fixed for taking various decisions under the framework

- 24. Standby Credit for Capital Expenditure of MSMEs Purpose : To meet unforeseen/contingent requirement for acquiring fixed assets like, generator set, balancing equipments, replacement of existing machinery items, moulds, jigs etc, to maintain production and /or to acquire necessary equipments/machinery for modernization of the unit. Term Loans : 25 % of the original value of the existing P & M subject to a maximum of Rs.25 Lakhs, at the time of each renewal of WC limits. Margin : 15 to 25% of the cost of FA to be acquired under the loan. Adhoc Credit Facility EXTRA ROI : 2 % (EXPORTER NO EXTRA ROI) (ADHOC : 2 TIMES IN A FY) MAXIMUM PERIOD OF ADHOC : 90 DAYS

- 25. General Guidelines: (MSME POLICY) Latest 3 YEARS financial statements shall be analysed and carry out the comparison of the financials. In case of any huge deviation the same shall be analysed & justified ABS shall be obtained in respect of Limits above Rs.20 lacs or Turnover of Rs.100 lacs and above per annum and also where audit of balance sheet is mandatory by statute. All documents provided by the CA should mandatorily contain UDIN. Pre and Post sanction inspection Eligible new borrowers as well as existing borrowers having FB or NFB exposure of Rs.5 crore & above from the Bank, shall submit Legal Entity Identifier (LEI) Code (within specified timelines) along with the loan application. In cases of limits are above Rs.5.00 crore, a copy of the passports of the Promoters/ Promoter Directors and Guarantors to be mandatorily obtained

- 26. 577/21 30.08.21 : Renewal of MoU with the following agencies for entrusting Due Diligence Services for MSME : valid upto 02.08.2024 External Due Diligence from such agencies has been made Mandatory for MSME who approachour Bank for the first time seeking credit facilityrequirement of above Rs. 10 lakhs and are eligible to be covered under CGTMSE Agency-soft copy of Report to be given in 3 days Amount Bracket Charges M/s. Brickworks AnalyticsPvt. Ltd.(whollyowned subsidiary of Brickwork Ratings India Pvt Ltd Upto Rs.25 lakhs Rs 6,500 Rs.25 lakhs upto Rs.75 lakhs Rs 8,500 Above Rs.75 Lakhs Rs 10,500 M/s. Acumen Business ConsultancyPvt. Ltd. Upto Rs.2 Crore Rs 5,000 Rs.2 Crore upto Rs.10 Crore Rs 7500 Above Rs.10 Crore Rs 10000/- M/s. SMERA Gradings&Ratings Pvt. Ltd Irrespective of Loan amount Rs 12000/- M/s. Infomerics Analytics and Research Private Limited (14.9.24) Upto Rs.25 lakhs Rs 5,500 Rs.25 lakhs upto Rs.75 lakhs Rs 7,500 Above Rs.75 Lakhs Rs 9,500 M/s. CRIF Solutions Private (610/22) Limited (22.9.24) Up to Rs. 75 Lakhs Rs 3,500 Above 75 lacs Rs 3,750

- 27. CREDIT INFORMATION REPORTS: (i) M/s.TransUnion CIBIL Limited (ii) M/s. Experian Credit Information Company India Private Ltd. (ECICI) (iii) M/s. Equifax Credit Information Services Private Ltd. (ECIS) (iv) M/s. CRIF High Mark Credit Information Services Pvt. Ltd. (CHMCIS MSME Secured loans upto 10 lac: only one CIR to be obtained MSME secured loans above Rs. 10 lakhs : 2 CIR ABOVE 10 lakhs and upto Rs. 10 Cr : One from CIBIL including CMR and another report from any of the CICs

- 28. Page 28 Learning & Development Vertical MSME CMR RATING (10 LACS TO 10 CR) • Applicable to Existing & New MSME loans with aggregate Loan quantum (Present & Proposed) of above Rs.10 lakhs upto Rs.10 crores • CMR measures MSMEs on a rank scale of 1 to 10. • 1 being the best rank and 10 being the worst. • • CMR will be automatically generated along with Commercial Credit Information Report at the time of generating the same (CIBIL RS 500 + CMR 400=RS 900)

- 29. Page 29 Learning & Development Vertical CREDIT RISK RATING (190/20 & 171/20 FOR CIRM) • CRR IS A PRE- SANCTION EXERCISE. • AGGREGATE OF ALL FB AND NFB LIMITS (PRESENT & PROPOSED) OF A BORROWER –DECIDES MODEL • CREDIT RISK RATING PURPOSE : DOP/ROI • INTERNAL RATING SHALL BE ENTERED IN BAM 88 FOR ANY MODEL. • EXTERNAL RATING GRADES HAS TO BE ENTERED IN BAM 89. • Our bank is adopting 4 models under Risk rating. • 1) PORTFOLIO MODEL- Applicable for loans upto2 lakhs & Loans • 2) SMALL VALUE MODEL – ABOVE 2 LACS TO 20 LACS • 3) MANUAL MODEL- ABOVE 20 LACS TO 200 LACS • 4) CIRM – ABOVE 200 LACS • CIRM Hybrid Model (600/2022) : Applicable for the Manufacturing, Trading and Services (wherever balance sheet is available) as under: New Borrower (except Greenfield projects) having exposure above 2 Cr to 5 Cr (irrespective of turnover). Existing borrower having exposure above 2 Cr to 5 Cr (irrespective of T/O)

- 30. ECAI (EXTERNAL CREDIT RATING : 25 CR & ABOVE In case of externally unrated borrowers with exposure Above Rs 25 Crores up to Rs 100 Crores : Additional interest 0.25% . Exposure above Rs 100 Crores : Additional interest of 0.50% shall be charged over and above ROI. Credit Scoring Model To decide the eligibility for availing finance under MSME. ApplicabIlity : MSME applying for loans from our Bank for the first time Exposures upto an aggregate amount of Rs.2 crores). Fetch at least 60% of the marks to become eligible for finance. Rejection of the loan proposals of MSME entrepreneurs who score less than 60% marks shall be done by the NHA. Canara Bank Proposal Rating (CBPR): MSME loans for >= Rs.10 crore (FB + NFB)

- 31. PSB loans in 59minutes : New-age digital lending platform that has been put into operation to apply and get “in Principle Sanction” for Business Loans within 59 minutes without any physical contact with Bank Branch. This web portal is enabled for in principle approval for MSME loans under ➢ MUDRA category and ➢ Other loans upto Rs. 5 Crores within 59 minutes. The Portal reduces TAT. Subsequent to this in-principle approval, the loan is required to be sanctioned & disbursed in 7-8 working days. Tie-Up with Fin-techs : (MSME SUGAM) Bank has entered into tie up arrangements with the Fin Tech Company ‘M/s. Basix Sub-K iTransactions Limited ➢ Source eligible MSE proposals up to and inclusive of Rs.10 LACS in the service areas of the designated Circles/Branches. ➢ Obtain application and other required documents. ➢ Conduct KYC, Due Diligence and credit verification check

- 32. Trade Receivables DiscountingSystem (TReDS): The Scheme facilitating the financing of Trade Receivables of MSMEs from Corporate and other buyers, including Govt. Departments and PSUs through multiple financiers is known as “TRADE RECEIVABLES DISCOUNTING SYSTEM (TReDS)”. Our Bank is on boarded for participating as ‘Financing Bank’ on the TReDS digital platform of M/S .RXIL, M/s.A.TReDS Ltd. (Invoicemart) and M/s.Mynd Solutions (M1xchange) for online discounting of trade receivables by executing Master Agreement with them. Further, Bank has established 2 TReDS Cells i.e. at SMCB BKC Branch-Mumbai and Infantory Road (II) Branch- Bengaluru ECAI Rating of Buyer to be approved for discounting on TReDS platforms shall be ‘A-’ and above for non-constituent type of buyers & BBB and above for constituent type of borrowers. However, ECAI rating in respect of Central/State Govt has been waived off. Bills upto a tenor of 180 days can be quoted for discounting on the platform.

- 33. End to end digitization of Shishu Mudra Loans” for existing customers, as per EASE 3.0 PSB Reforms. End to End (E2E) digitization of Shishu Mudra loans under (STP) mechanism for existing customers of the Bank. Online validation of KYC and Udyam Registration Certificate. Sanction of loans up to Rs 50,000/- based on pre-defined business rule engines. Digital Document Execution (e-stamping and e-signing) by the borrower. System has the following capabilities: KYC validation. URC verification. Eligibility Check based on the set of business rule engines. End to end processing of loan Digital document execution (e- stamping & e-signing)

- 34. “Jansamarth Portal” (also known as National Portal) In this background, the following Credit linked Govt. MSME schemes have been made eligible for routing through the Jansamarth Portal: i. Pradhan Mantri Mudra Yojana (PMMY) ii. Weavers Mudra iii.Stand Up India iv. National Urban Livelihood Mission (NULM).

- 35. Pradhan Mantri Mudra Yojana (PMMY): Pradhan MantriMudra Yojana(PMMY) was launchedon April 8, 2015 by the GOI in order to provide financialsupport primarilyto Micro Enterprises. An overdraft amount Rs 10,000/- sanctioned under PMJDY also classifiedunder MUDRA Maximum loan quantum under PMMY is limited to Rs.10.00 Lakhs. Credit facility is extended by way of TL and/or WC. Collateral Security: Not to accept collateral security in the case of loan up to Rs 10 lakh extended to units in the MSE Sector. CGFMU guarantees micro units under PMMY upto the specified limit of Rs.10.00 Lakhs, without obtaining any collateral or 3rd party guarantee. ix. A separate Scheme Code “75410 – PMMY-MUDRA YOJANA” has been created for opening of loans in CBS under PMMY Category Slab SHISHU Loans upto Rs.50,000/- KISHORE Loans above Rs.50,000/- and upto Rs. 5.00 Lakhs. TARUN Loans above Rs.5.00 Lakhs and upto Rs.10.00 Lakhs

- 36. Stand Up India Scheme (SUI): Scheme was launched with a view to promoteentrepreneurship among SC/ST & Women entrepreneurs. LOAN AMOUNT : Rs.10.00 Lakhs to Rs.1.00 crore ELIGIBGLE : SC OR ST OR/and Women Entrepreneurs FINANCE ONLY TO : New Enterprise(Greenfield Project) in MFG, Tradingand services sector or agriculture allied activitiesand services supporting these. Credit facility : Composite loan (WC+TL) MARGIN : 15% (In cases where the borroweris eligible for Central / State Govt. subsidy, the subsidy amount can be reckoned as margin brought in by the borrower.However in such cases, the borrowershould contribute at least 10% of the project cost as margin.) GUARANTEE: Credit Guarantee Scheme for Stand Up India (CGSSI). Scheme Code : “75430 – STAND UP INDIA SCHEME”

- 37. PM Street Vendor’s AtmaNirbharNidhi (PM SVANidhi)” scheme for Street vendors The Street Vendorswill be eligible to avail a WorkingCapital Demand Loan (WCDL) Ist Tranche : Loan of upto Rs.10, 000/- with tenure of 1 year and repaid in monthly. 2nd Tranche : On timely or early repayment, the vendors are eligible for 2nd tranche loan with minimumloan of Rs 15000/- and maximumloan amount of Rs 20000/- 3rd Tranche : Rs.50,000/- maybe consideredto the eligible beneficiaries,subject to successfulrepayment of the 2nd tranche. Bank shall ensure marking of the 2nd loan as closed, for processingthe 3rd loan. Interest Subsidy : @ 7% for all the loans i.e. 1st, 2nd and 3rd loans. Interest subsidy claims on all loans under the scheme will be paid till March, 2028. Productcode- 711 - to be utilized while opening 1st, 2nd and 3rd tranche of loan ) Scheme code – 104600 (to be utilized while opening 2nd tranche of loan in CBS) 111200 (to be utilized while opening 3rd tranche of loan in CBS Interest Subsidy claimsto be paidon quarterly basis. (June 30, September 30, December 31, and March 31 of each year.) – HO CIR 644/2O22

- 38. Deendayal Antyodaya Yojana - National Urban Livelihood Mission (DAY –NULM) LAUNCHED : GOI - Ministryof Housing and Urban Poverty Alleviation (MoHUPA), OBJECTIVE : Improve the livelihood opportunities for the poor in urban areas Restructured: Existing Swarna Jayanti Shahari RozgarYojana (SJSRY) and launched the NULM in 2013. (AGAIN RENAMED AS DAY-NRLM) IMPLEMENTED : All District headquarters(irrespective of population) and All the cities with population of 1 lakh or more. FOCUS ON : Self Employment Program (SEP)-Providing financial assistance through provision of interest subsidy on loans to support establishment of Individual & Group Enterprises and Self-Help Groups (SHGs) of urban poor ELIGIBLE : Individual enterprise (SEP-I), Group enterprise (SEP-G) and SHG (SEP-SHGs) PRODUCT CODE : 719 -SEP-I, 720-SEP-G and 737-SEP-SHGs SUBSIDY : Difference between 7% p.a. and ROI charged by the bank will be provided to Banks under DAY-NULM. An additional 3% interest subvention will be provided to all Women SHGs (WSHGs) who repay their loan in time

- 39. Prime Minister’s Employment Generation Programme (PMEGP) Administered by : Ministry of MSME . Objective : Generate employment opportunitiesin Rural and urban areas of the country through setting up of new self-employment ventures/projects/micro enterprises. LOAN : Cost of the project : Rs 50 lacs in respect of manufacturing activity & Rs.20 lacs in respect of Service / business activity 2nd PMEGP loan : with subsidy for upgrading the existing units, which are performing well in terms of Turnover, profit making and loan repayment. 2ND LOAN : Manufacturing units : 1 Crore Service/Trading Units : Rs.25.00 lakhs Subsidy of 15%( 20% for NER and Hilly States). Product code: For MSMEs: Term Loan- 727 OCC-2000 For Agriculture: Term Loan – 877 & OCC -261

- 40. WEAVER’S MUDRA SCHEME. IMPLEMENTED : Ministry of Textiles, GOI. Objective : Provide timely and hassle free assistance to weaversto meet their immediate requirements, in the form of WC : Maximum of Rs.2 lacs & TL : Maximum of Rs.50000 within a overall exposureof Rs.2 lacs per Borrower. Government support by way of: Margin Money Assistance- 20% of the PC subject to maximum of Rs.10,000/- per weaver. Interest Subvention –Differencebetween the actual interest charged by Bank and 6% p.a. (Maximum interest subvention shall be capped at 7% p.a –(FOR 3 Years from first disburs) One time guarantee fee & Annual CGTMSE fee for 3 years to be borne by the GOI. Product code: Term Loan- 769 OCC-275

- 41. Partial Risk Sharing Facility (PRSF) Implemented by : SIDBI and supported by World Bank (line with GOI National Mission on EnhancedEnergy Efficiency (NMEEE) which aims to promote Energy efficiency (EE) projects implementedby ESCOs (Energy Service Companies) in the unit premises of Host entities, that offer energy efficiency improvement services with the objectiveof bringing about demonstrableenergy savings. The performanceriskis borne by the ESCO. M/s. SIDBI, provides Credit guarantee of upto 75% of the loans granted by PFI for energy efficiency projects sanctioned under the scheme in the eligible sectors such as MSMEs, Municipalities, Building Discoms and Large Industries.

- 42. Credit Linked Capital Subsidy Scheme (CLCSS & SCLCSS): OBJECTIVE : CLCS Component of CLCS-TU Scheme aims at facilitating technology upgradation by providing capital subsidy to MSE units, on institutional finance (credit) availed by them for modernization of their P & M involved in MFG process and equipment for rendering services. Quantum of capital subsidy :15% (max up to Rs.15 lakh) of eligible investment. Ceiling limit of loan (TO GET SUBSIDY) under CLCS : Rs. 100.00 Lakh. SCLCSS (Special Credit Linked Capital Subsidy Scheme) is implemented whereby the SC/ST MSEs are provided additional 10% subsidy (over disbursement of 15% subsidy under CLCS) under National SC/ST Hub (NSSH). SC/ST MSEs of Service Sector apart from the Manufacturing Sector are also eligible for 25% subsidy under SCLCSS for procurement of equipments w.e.f. 15.11.2021. NSSH Scheme has been made applicable till 31.03.2026. SC/ST MSEs are provided subsidy of 25% (with the overall ceiling of Rs. 25 lakhs on the subsidy - (632/22)

- 43. Zero Defect Zero Effect: ZED is an extensive drive of the GOI to promote “Zero Defect Zero Effect “ practices among MSMEs. All MSMEs registeredwith the UDYAM registrationportal will be eligible to participate in MSME Sustainable (ZED) Certification and avail related benefits/ incentives. Bank has adopted the followingbenefits/ incentives to ZED certified MSMEs under the revamped ZED scheme introduced on 28.04.2022 The financial support, incentives, benefits and other provisionscontained in the scheme as per the ZED guidelines published by the MoMSME, will be valid till 31.03.26 (477/22) ZED Certificationis not mandatory criterion for MSMEs Quality Council of India (QCI), an autonomousbody setup by Ministryof Commerce & Industry, GOI has been appointedas an implementingagency for facilitating, implementation,co-ordination and monitoringof the Scheme MSME Sustainable(ZED) Certificationcan be attainedby eligible MSMEsin 3 Levels after registeringand taking the ZED Pledge: Level 1: BRONZE Certification Level 2: SILVER Level 3: GOLD

- 44. Risk Rating of the Unit (New/Existing) ZED Rating of the MSME unit ROI CONCESSION PROCESSING CHARGES CONCESSION Internal Rating – CNR I to V (Minimal/LR) External Rating – AAA/AA/A Bronze 0.10% 10 % Silver 0.25% 25% Gold 0.50% 50% Internal Rating – CNR VI (NR) External Rating – BBB Bronze 0.10% 10% Silver 0.20% 20% Gold 0.30% 30% Internal Rating – CNR VII (MR-1) External Rating – BBB Bronze ---- --- Silver 0.10% 10% Gold 0.25% 25% External Rating – BB/B & below Bronze No concessions permitted Silver Gold ➢ Sanctioned concessional ROI shall not be stipulated below extant RLLR ➢ Sanctioned concession in processing charges shall not be stipulated more than 75% of the extant processing charges applicable under non-schematic MSME

- 45. Guaranteed Emergency Credit Line(31.03.23 or RS 500000 CR Gua (which ever early) Emergency Credit Line Guarantee Scheme (ECLGS) of GOI was implemented by M/s. NCGTC to extend support to MSME affected by COVID19 pandemic to sustain their business . GECL 1 AMOUNT 20% of their outstanding as on 29.02.2020, with combined outstanding loans across all MLIs up to Rs. 50 crores and DPD upto 60 days as on 29.02.2020 TYPE OF LOAN Working Capital Term Loan REPAYEMENT 36 months with the initial moratorium of 12 months ROI RLLR + 0.60%/MCLR (as applicable) subject to a maxim of 9.25% RF 2.0 following was permitted for GECL 1.0 facilities Additional 1 more year Moratorium i.e. extension of tenor of GECL 1.0 to 5 years i.e. 24 months Moratorium + 36 EMIs. GECL 1.0 (Extension) component of GECL scheme Provide additional support to existing borrowers of GECL 1.0 or new borrowers eligible under GECL 1.0 based on revised reference date of March 31, 2021, for building up current assets, meeting operational liabilities and/or restarting the business in the form of Additional WCTL Facility(FB facility only) 30% of the total credit outstanding (net of support received under GECL 1.0) up to Rs. 50 crore (FB only) as on 29th Feb 2020 or 31st March 2021, whichever is higher

- 46. Guaranteed Emergency Credit Line . GECL 2 ELIGIBILITY Existing borrowers with business activities corresponding to the 26 sectors identified by the Kamath Committee on Resolution Framework in its report dated September 04, 2020, and the Healthcare sector AMOUNT 20% of their outstanding as on 29.02.2020, whose total loan outstanding (FB only) across all MLIs is above Rs 50 Crore and not exceeding Rs.500 crore as on 29.02.2020, with DPD upto 60 days TYPE OF LOAN WCTL facility and / or NFB facility or a mix of the two REPAYEMEN T 5 years from the date of first disbursement of FB facility or first date of utilization of NFB facility, whichever is earlier. ROI RLLR + 0.60%/MCLR (as applicable) subject to a maxim of 9.25% GECL 2.0 (Extension) component of GECL scheme Additional support to existing borrowers of ECLGS 2.0 or new borrowers eligible under ECLGS 2.0 based on revised reference date of March 31, 2021, for building up current assets, meeting operational liabilities and/or restarting the business in the form of WCTL and/or NFB or a mix of two 30% of their total FB credit outstanding (net of support received under GECL 2.0) above Rs. 50 crore and up to Rs. 500 crore as on 29.02.2021 or 31.03.2021 (applicable reference date), subject to borrower meeting all eligibility criteria. REPAYMENT : 6 years including moratorium of 24 months.

- 47. Guaranteed Emergency Credit Line . GECL 3 ELIGIBILITY Hospitality, Travel & Tourism and Leisure & sporting sectors and Civil Aviation sectors (Our existing borrowers (which were classified as standard but not in default for more than 60 days). AMOUNT Upto 40% of their total credit outstanding (FB only) as on 29.02.2020, subject to a cap of Rs. 200 Cr. per borrower (However, entities who have availed upto 20% of their FB credit outstanding as on 29.02.2020 under ECLGS 1.0 or ECLGS 2.0, could get additional financial assistance upto 20% of the total FB credit outstanding as on 29.02.2020.) TYPE OF LOAN WCTL REPAYEMENT 6 years (including moratorium of 2 years on repayment of the principal amount) ROI RLLR + 0.60%/MCLR +0.60 % subject to a maxim of 9.25% GECL 3.0 (Extension) component of GECL scheme Additional support to existing borrowers of GECL 3.0 or new borrowers eligible under GECL 3.0 for building up current assets, meeting operational liabilities and/or restarting the business in the form of Additional WCTL Facility (FB facility only) upto the extent of 50% of their total credit outstanding as on 29.02.2020 or31.03.2021 or 31.01.2022, whichever is higher, subject to a cap of Rs. 200 crore per borrower (Hospitality and related sectors excluding Aviation sector) and Rs 400 crore per borrower (aviation sector) and the borrower meeting all the other eligibility criteria

- 48. Guaranteed Emergency Credit Line . GECL 4 ---CANARA GECL Jeevanrekha ELIGIBILITY Extended to eligible hospitals/nursing homes/clinics/ medical colleges/units having existing credit facilities with any lending institution for setting up low cost oxygen generation plants, involving technologies like Pressure Swing Adsorption for onsite oxygen generation AMOUNT Loans upto Rs. 2 Cr TYPE OF LOAN WCTL REPAYEMENT 5 years from the date of first disbursement of fund based facility including moratorium of 6 months ROI RLLR+0.60% and 1year MCLR+0.15% subject to a max 7.50% PA .

- 49. GECL Claim Preferment in NCGTC portal (39/22) NPA marking:MLIs are required to mark the date on which the account has been classified as NPA within 90 days of the account being classifiedas NPA. Claim Preferment:On submission of this claim, an e-mail shall go to the MLI that their claim has been lodged and NCGTC would initiateaction to approvethe claim request and arrange to pay 75% of the amount in default within 30 days of the claim date provided all requisite documents are submitted and the claim is found to be in order and complete in all respects. This shall be treated as Interim Claim. The MLI shall also furnish details of the recoveries made in the account and after adjusting such recoveries towards default amount relating to first charge and the legal costs incurred by them, remit the balance amount to NCGTC within 30 days, failing which MLI shall be required to pay the recovered amountalong with interest at 2% over and above the prevailing repo rate from the date of recovery to the date of payment Final Claim: On completionof the recovery Proceedings or till decree gets time barred, whichever is earlier, the MLI shall submit its claim for the balance 25% of the amount in default (net of recoveries, if not already remitted as above).

- 50. Credit Guarantee Scheme For Subordinate Debt (CGSSD) : EXTENDED 31.3.23 : Launched by CGTMSE (31.3.23 OR 20,000 crore of guarantee amount) Applicability MSMEs whose accounts have been Standard as on 31.03.2018 and have been in regular operations, Either as standard accounts, or as NPA accounts during financial year 2018-19 and financial year 2019-20. Scheme is valid for MSME Units which are stressed viz., SMA 2 and NPA accounts as on 30.04.2020, which are eligible for restructuring as per RBI guidelines Accounts opened after 01.01.2016 are not eligible LOAN (620/22) 50% of the promoter contribution (equity plus debt) or Rs 75 lakh whichever is lower. Borrowers who had earlier availed 15% of the promoters’ stake are allowed to avail additional 35% of the promoters’ stake, provided the overall max benefits availed under CGSSD does not exceed ₹75 lac security Loan will have 2nd charge of the assets financed under existing facilities for the entire tenor REPAY 10 years. Moratorium of 7 years (Maximum) on the payment of principal. Till the 7th year, only interest will be paid. Principal shall be repaid within a max of 3 years after completion of moratorium GUARANTE 90% guarantee coverage CGTMSE and 10% from concerned promoter Promoters are required to bring in 10% of the sub-debt amount as

- 51. Loan Guarantee Scheme For Covid Affected Sectors (LGSCAS) – 31.3.23 Sanctioned under the same during the period from May 07, 2021 till March 31, 2023 or till guarantees for an amount of Rs. 50,000 crore are issued under the scheme, whichever is earlier (560/22) ELIGIBILI TY Brownfield and Greenfield projects pertaining to setting up of/ modernization/expansion of COVID related healthcare infrastructure and services in the NON-METROPOLITAN areas (i.e. other than Ahmedabad, Bangalore, Chennai, Kolkata, Mumbai, New Delhi, Hyderabad and Pune) under credit guarantee coverage of M/s. NCGTC 75% in case of eligible Greenfield projects in any area & eligible Brownfield projects in aspirational districts and 50% in case of eligible Brownfield projects in areas other than aspirational districts GUA FEE No guarantee fee will be charged by M/s. NCGTC LOAN Rs 100 crore upto Moderate Risk (FB + NFB) ROI 7.95 % FIXED Collateral securities 20% in eligible Greenfield & brownfield projects in aspirational districts 40% in respect of eligible brownfield projects in other districts Last date of first disbursement of loans sanctioned under the scheme shall be within 3 months of sanction of facility (560/22)

- 52. Loan Guarantee Scheme for the Covid Affected Tourism Service Sector (LGSCATSS) 100 % guaranteed facility ELIGIBLE Registered Tourist Guides (recognized/ approved by M/o Tourism and State Govts/ UT Administrations), and Travel & Tourism Stakeholders (i.e. Tour Operators/ Travel Agents/ Tourist Transport Operators)recognized/ approved by the Ministry of Tourism, GOI Can be availed by the eligible beneficiaries, only if there are no outstanding loans covered under ECLGS scheme of NCGTC VALIDITY 31st March,2023, or till guarantees for an amount of Rs.250 cr are issued under the scheme, whichever is earlier. WCTL to finance WC requirements and for discharging of existing liabilities) or Term Loans to finance new asset creation for business purpose like cycles, cameras, laptops, computers, transport vehicles etc. LOAN WCTL – Rs 1 lac to Regd Tourist guides/travel or tourism stakeholders & Upto 10 lacs to our existing borrowers enjoying WC with our Bank. Upto Rs. 25,000 under the stipulated ceiling on declaration basis only. TL upto Rs. 1 lakh to the eligible tourist guides & Upto Rs. 10 lakhs to Travel & Tourism Stakeholders for asset creation ROI Fixed rate 7.95 % Repay 5 years from the date of first disbursement, including moratorium

- 53. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Canara Vyapar Scheme : Purpose : WC requirements of the party and for Purchase of Premisesfor conducting business,equipments, computers, furniture, fixtures, undertakingexpansion, additions, repairsand renovation of businesspremises FB & NFB or combination includingTL : MAX : 10 CRORES Product Code : WC-285 TL-621 Canara Udyog : Provide credit to MSME in Manufacturing Sector and Ancillary Business. LOAN : WC and/or Term Loan : Min: Above Rs. 10 lacs Max: Rs. 10 Cr Margin : 20%

- 54. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Doctor’s Choice : Purpose : To address variouscredit needs of the RegisteredMedical Practitioners practising Indian, Unani, Homeopathic, Allopathic as well as their associatebusiness activities/centres (viz., Clinical/PathologicalLaboratory,Physiotherapy centres, Inhouse Drug/MedicalStores Loan : TL and WC Max loan : 5 crores Product Code : WC- 280 TL – SERVICES- 614 Canara Contractor : For Purchase of brand new equipment/office premisesto the existing and prospective contractors/sub-contractors LOAN : WC (FB/NFB) in the formof running limit (Secured OD), FLC/ILC & BG for WC needs and Term Loan Min: Above Rs. 10 lacs Max: Rs. 10 Cr

- 55. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Canara Smart Professional: Purpose : Credit to MSME professionals for purchase/constructionof office premises /acquisitionof machineries /equipments/furniture/ fixtures, includingexpansionand modernizationof the existing unit Loan : TL and WC (SECURED OD) OR COMPOSITE LOAN Max loan : Rs. 200 lakhs in case of Urban & Metro centers Rs. 50 lakhs in case of other centers Scheme is 81500. MSME Can BEML: purchaseof Earth moving, construction and mining operation equipment from M/S BEML by way of Term Loan LOAN : Term Loan Min: Rs. 20 lakhs Max: Rs. 3OO LACS

- 56. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Canara MSME Expo: Purpose : Loan to exporters in MSME sector for purchase of software/hardware for fashion designing, travellingabroad for business purpose, participation intrade fairs, exhibitions aboard or International TradeFair Loan : TL Max loan : Rs.50 lakhs Scheme is 70870. Canara Caravan: Purchase of brand new vehicles as businessassets/ businesspurpose only. (Two wheelers, Passengercars/vans/Jeeps)Goods carriersare not eligible LOAN : Term Loan QUANTUN : 90% of the “On Road Cost” value OR Average of last 3 years Net Profit Whichever is lower, with a maximum of Rs. 25.00 lakhs “MSME Vahan” scheme is 65570

- 57. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Canara MSE Vijeta (II) Purpose : Credit to meet businessrelated needs including purchase/construction of businesspremises,machinery, equipments, vehicles and WC requirementsof women under MS Enterprisesincluding Retail Trader Loan : TL AND/OR WC QUANTUM : 10 Lacs to Rs. 200 lakhs Scheme is 65590 Mudra Canara Athithi : For purchase of equipments requiredfor setting up of business LOAN : TL AND/OR WC QUANTUN : MAX 10 LACS scheme is - 92200

- 58. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Canara MSME Gold Loan Purpose : Loan to MSME units (Individuals and ProprietorshipFirm only) against Gold Ornaments/ Jewellery held in the name of Individual /Proprietorrespectively, for fund based requirementsfor general businesspurpose & augment WC, acquiring machinery/ equipment/ tools for repairs,renovations etc Loan : Overdraft (OD) or Demand Loan (DL) QUANTUM : MINIMUM : 1 Lac MAX : Rs. 35 lakhs PRODUCT CODE : 215 (OD), 709 (DL) Standby credit for capital expenditure of MSMEs: To meet unforeseen/contingent requirementfor acquiringfixed assets like, generator set, balancingequipments, replacement of existing machinery items, tools, moulds, jigs etc, to maintain production and /or to acquire necessaryequipments/machineryfor modernizationof the unit LOAN : TL QUANTUN : 25 % of the original value of the existing P & M subject to maximumRs.25 Lacs scheme is - 96900

- 59. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Standby term loan scheme for Apparel exports in Small and Medium sectors Purpose : Loan to Export customers havingregular credit limits and havingsatisfactory track record with the Bank for at least past 3 years (under sole banking / multiplebanking arrangements/ consortium arrangements) for Apparel Exports Loan : Stand-by Term Loan QUANTUM : Maximum limit of Rs. 100 lakhs Scheme Code : 97000 Loan scheme for reimbursementof investmentmade in fixed assets by MSMEs : Capital expenses incurredtowards creation/acquisitionof fixed assets (other than L & B) during the immediatelypreceding 6 months maybe reimbursed. LOAN : TL QUANTUN : Rs. 50 lakhs for new machineryand maximumof Rs.15 lacs for 2nd hand machinerywhich is not more than 2 years old fromthe original date of purchase Scheme is - 97100

- 60. MSME PRODUCTS AND SCHEMES APPLICABLE PAN INDIA Loan scheme for providing Risk Capital assistance Purpose : Assistthe deserving MSMEs in the formof quasi equity on need basis. Loan : Term Loan QUANTUM : MinimumRs. 25 lakhs and maximumof Rs. 10 crores Scheme Code : 64600 Laghu Udayami credit card scheme : Loan to meet the WC requirementof Artisans,village industries,micro and small enterprisesincluding tiny units to all existing small borrowers. Eligibility : Borrowersshould have satisfactorydealings with us for the last 3 years LOAN : WC QUANTUN : Rs. 10 lakhs Product : 255

- 61. Area Specific Schemes. Valid till 31.3.2023 Financing ARTHIYAS (Commission Agents) in the State of Punjab & Haryana - Chandigarh & Karnal Circles : SOD – Min : Rs. 10 lacs and Maximum Rs. 200 lacs. Financing Automotive Components Manufacturers –Chennai & Pune Circles : FB & NFB limits with Minimum loan Rs. 25 lakhs and Maximum upto Rs. 50 Crores Canara MSME Textiles scheme - Ahmedabad, Bhopal, Chandigarh, Chennai, Jaipur, Karnal, Madurai, Mumbai, Lucknow, Pune, Kolkata Circles : Rs. 10 lakhs to Rs. 50 Crores (FB/NFB). Financing MSMEs engaged in both Ceramic and Vitrified Tile Industries - Ahmedabad Circle :. Rs. 10 lakhs to Rs. 50 Crores. However, TL component not to exceed Rs.30 Cr . Financing Marble, Granite, Mineral and Mineral Powder Industries - Jaipur Circle : Min Rs. 10 lakhs and Max -Rs. 25 crores for MFG and Rs. 10 Cr for service units. Financing to MSME- Service Enterprises having tie up with M/s Oil India Limited and Oil & Natural Gas Corporation (ONGC) Limited – Guwahati Circle – MAX 2 CR Financing Handloom and Handicraft Industries - Jaipur Circle : Min Rs. 10 lakhs and Max -Rs. 25 crores for MFG and Rs. 10 Cr for service units

- 62. Area Specific Schemes. Valid till 31.3.2023 Indira Gandhi Urban Credit Card scheme – Jaipur Circle : Rs. 50,000/- to Urban street vendors belonging to SC, STs and OBC. Canara Iron and Steel Industries – Bhubaneswar Circle (Sambalpur Region) : Rs. 10 lakhs to Rs. 50 Crores. (However, the maximum quantum of the WC shall not be more than Rs. 25 crores. Financing manufacturing units engaged in Metal Fabrication and casting works – Bhopal (state of Chattisgarh) : Above Rs. 25 lakhs to Rs. 50 Crores Mukhyamantri Udyam Kranti Yojana – Bhopal Circle : Projects ranging from Rs. 1 lakh to Rs. 50 lakhs for manufacturing units and Rs.1 lakh to Rs. 25 lakhs for service units or retail trade businesses for setting up of new units .

- 63. 396/22 : CANARAMSME CAP (CREDIT AGAINST PROPERTY)SCHEME FOR FINANCING MSME Target MSME (Manufacturing/Service) (Excluding Educational /SHG/JLG ) ELIGIBILITY Individuals/Proprietary/Traders/Businessman/Professionals or self employed Partnership firm(other than partnership firms where HUF is partner) Company (excluding NBFC) Min loan ABOVE Rs 10 LACS (FB/NFB) MAX LOAN MANUFACTURING- RS 20 CRORES) & SERVICE - RS 10 CRORES MARGIN WC AND TERM LOAN - 20 % & NFB – 25% Repayment Working Capital (256 AND 261) – Tenable for 12 MONTHS. Term Loan (766 AND 768) - Maximum 10 years including moratorium Valuation Report 1 panel valuer to be obtained for loans extended upto Rs. 2 Cr. and 2 panel valuers for loan extended above Rs.2 Cr (Least value consider) Upto Moderate risk accounts only to be financed Not eligible to be covered under CGTMSE 0.50 % concession to women and NE States concessions not to be extended No liquidity premium is applicable for term loans under the scheme. 50% of the applicable upfront fee/ processing charges. Fresh valuation once in 3 years Submission of Stock Statement and Inspection of stocks : Quarterly STOCK AUDIT : Low & Normal Risk Rated Accounts: Waived upto Rs. 5 Cr Stock audit : Moderate Risk Rated Accounts: Every Year Properties of CLOSE RELATIVES & BROTHER IN LAW/SIS IN LAW/FATH IN LAW/AUGHTER IN LAW can also be accepted

- 64. MSME CAP : SECURITY : L & B AND APPROVED SECURITIES (10 YEARS POSTAL SAVINGS) Urban & Metro Properties 100% of the loan amount for MFG units 125% of the loan amount for service sector units Semi-Urban Properties 125% of the loan amount for MGF units 150% of the loan amount for service sector units VACANT SITES VACANT LAND UPTO 25% OF ACCETABLE SECURITY Select Rural Properties located close to Metro/Urban/Semi Urban centres: At least 150% of the loan for both MFG units and service sector units subject to : Located within 20 kms radius from nearby Metro/Urban city. Located within 10 kms radius from nearby Semi-Urban city Unit should be functioning in that property or used for the said business Approvals relating to conversion as industrial area/commercial land to be available Enforceability of underlying security has to be confirmed Clearance from RO Head CO CAC for proposals falling below RO HEAD CAC Clearance from Circle Head CO CAC for proposals falling RO HEAD CAC & above DOP : Beyond Rs 25.00 Lakh or branch DOP whichever is less (i.e. in case of Small, Medium, Large and VLB branches) shall be handled by MSME Sulabhs. In respect of properties which are less than 1 year old, valuation of the property shall be taken as “Sale deed value” or “Guideline value” whichever is HIGHER Tenanted property shall be avoided

- 65. 396/22 : CANARAMSME CAP – Vacant land may be accepted as security upto a maximum of 25% of the permitted security comfort (in terms of value), provided it has clear demarcation and boundaries with approaching roads & it is Allotted by any government / Statutory body or Acquired by Govt for development of any industrial/residential/ commercial purpose or Entity has been permitted by the Govt / statutory body for acquiring the same for industrial / residential purpose or Land usage change has been permitted by competent authority or it has been taken as collateral security for the proposed facility Valuation of such properties shall be done on following lines 90% of the acquisition cost as per registered sale deed may be considered as cost of land, if acquired within immediate preceding one year. If the land is acquired/ purchased beyond preceding one year, 75% of the Fair Market Value assessed by the Bank’s approved Valuer should be taken as value of the land.

- 66. 91/22 canara MSME CAP scheme – Modificationsin existing ROI Guidelines (Export Credit) PRE-SHIPMENT CREDIT (Including Gold Card Exporters) Upto sanctioned period (including extensions) but not exceeding 270 Days from date of advance.:RLLR + 0.10 % i. Beyond sanctioned period (includingextensions) and upto 360 daysfrom date of advance :ECNOS ii. Beyond 360 daysfrom date of advance, if shipment takes place :ECNOS from the date of advance

- 67. 91/22 : CANARAMSME CAP –Modificationsin existing ROI Guidelines (Export Credit) POST -SHIPMENT CREDIT (Including Gold Card Exporters) a)On Demand Bills i) for Normal Transit Period (NTP) (as specified by FEDAI) :RLLR + 0.10 % ii) Beyond NTP - upto 180 daysfrom the date of advance :RLLR + 1.35 % - from 181st day till date of realisation/crystallization :RLLR + 2.60 % iii) Beyond date of crystallizationtill date of recovery : ECNOS (b) Against Usance bills: Upto NotionalDue Date(NDD) or Actual Due Date whichever is earlier but not exceeding 180 daysfrom the date of advance : RLLR + 0.10 Beyond NDD/Due Date - upto 180 daysfrom the date of advance: RLLR + 1.35 -from 181st day till date of realization/crystallization : RLLR + 2.60 Beyond date of crystallization till dateof recovery : ECNOS

- 68. 618/21 18.09.21 & 543/22 : CANARA GST scheme - Modificationsin scheme guidelines Target Group MSME (Manufacturing/Service) Product 2000 for WC. Scheme 95500 ELIGIBILITY ➢ New customers with minimum business operation of 6 months and existing customers shall be brought under the scheme. ➢ Upto Moderate risk accounts only ➢ GST Return of minimum for the past 6 months. ➢ At least 75% of turnover reflected in GST return should have been routed through the Bank account Minimum loan Rs 10 lacs (WC - FB/NFB) MAX LOAN Rs.10 Crores (543/22) MARGIN NIL Current Ratio: Minimum 1 Assessment : ➢ Maximum of 25% of the annual T/O as per GST Return with NIL Margin ➢ In case of non-availability of preceding 12 months annual GST Return, past 6 months returns shall be considered to arrive annual turnover (2 times of the past 6 months turnover). ➢ Assessment of the WC limit is based on GST return and not based on financial papers ➢ However financial papers to be obtained Collateral 75% of the loan amount –RSA can permit 50 % TO 75% BY CIRCLE HEAD CAC and above (but only MFG units) Proc charges 50% of the applicable processing charges Penal Interest If T/O is between 50% to 74% compared to GST return : 0.25%

- 69. GST : RURAL SECURITY Select Rural Properties located close to Metro/Urban/Semi Urban centres: At least 150% of the loan for both MFG units and service sector units subject to : Located within 20 kms radius from nearby Metro/Urban city. Located within 10 kms radius from nearby Semi-Urban city Unit should be functioning in that property or used for the said business Approvals relating to conversion as industrial area/commercial land to be available Enforceability of underlying security has to be confirmed Clearance from RO Head CO CAC for proposals falling below RO HEAD CAC Clearance from Circle Head CO CAC for proposals falling RO HEAD CAC & above OTHER POINTS : In respect of properties which are less than 1 year old, valuation of the property shall be taken as “Sale deed value” or “Guideline value” whichever is HIGHER Properties of CLOSE RELATIVES & BROTHER IN LAW/SIS IN LAW/FATH IN LAW/AUGHTER IN LAW can also be accepted Fresh valuation once in 3 years TENANTED PROPERTIES MAY BE ACCEPTED NOT ELIGIBLE TO COVER UNDER CGTMSE STOCK STATEMENT : HALF YEARLY STOCK AUDIT : WAIVED INCLUDING TAKE OVER

- 70. 543/22 : CANARAGST– Vacant land maybe accepted as security upto a maximumof 25% of the permitted security comfort(in terms of value), provided it has clear demarcation and boundarieswith approachingroads & it is Allotted by any government / Statutory body or Acquiredby Govt for development of any industrial/residential/commercialpurpose or Entity has been permitted by the Govt / statutorybody for acquiringthe same for industrial/ residential purposeor Land usage change has been permitted by competent authority or it has been taken as collateral security for the proposedfacility However, valuation of such propertiesshall be done on following lines: 90% of the acquisition cost as per registered sale deed maybe consideredas cost of land, if acquired within immediate preceding one year. If the land is acquired/ purchased beyond preceding one year, 75% of the Fair Market Value assessedby the Bank’s approved Valuer should be taken as value of the land. PRUNING DOWN THE LIMIT DUE TO REDUECTION IN T/O IN SUCCEDING YEAR If decrease in succeeding year : limit to bring down to 25% of GST ➢ Gradual reduction may be permitted in max 6 months subject to 50% reduction in limit with IN 3 months. ➢ 2% PENAL INTEREST for overdrawn position on non compliance of above condition beyond the grace period of 3 months

- 71. 92/22 : Canara GST scheme – Modificationsin existing ROI Guidelines (Export Credit)- Reductionin ROI applicableto Export Credit facilities(in INR) under “CANARA GST Scheme PRE-SHIPMENT CREDIT (Including Gold Card Exporters) Upto sanctionedperiod (includingextensions) but not exceeding 270 Daysfrom date of advance.:RLLR + 0.10 %. i. ii. Beyond sanctioned period (including extensions) and upto 360 daysfrom date of advance :ECNOS ii. iii. Beyond 360 days from date of advance, if shipment takes place :ECNOS from the date of advance

- 72. 92/22 : CANARAGST –Modificationsin existing ROI Guidelines(Export Credit) POST -SHIPMENT CREDIT (Including Gold Card Exporters) a)On Demand Bills i) for Normal Transit Period (NTP) (as specified by FEDAI) :RLLR + 0.10 % ii) Beyond NTP - upto 180 daysfrom the date of advance :RLLR + 1.35 % - from 181st day till date of realisation/crystallization :RLLR + 2.60 % iii) Beyond date of crystallizationtill date of recovery : ECNOS (b) Against Usance bills: Upto NotionalDue Date(NDD) or Actual Due Date whichever is earlier but not exceeding 180 daysfrom the date of advance : RLLR + 0.10 Beyond NDD/Due Date - upto 180 daysfrom the date of advance:RLLR + 1.35 -from 181st day till date of realization/crystallization : RLLR + 2.60 Beyond date of crystallization till dateof recovery : ECNOS

- 73. 629/21 22.09.21 : Mandatoryobtention and updation of ‘Udyam Registration Certificate’ details in CBS (under CIM22 option) in respectof all eligible MSMEs – URC detailsof all the eligibleMSMEs for strict adherence and accomplish completionof the same on or before 31.10.2021 679/21 13.10.21 : Weavers Mudra Scheme–Promptand timely sanctioning, claiming of Margin Money subsidy, Interest Subsidy and Guarantee Fees/AnnualService Fees of CGTMSE/CGFMU through online “Handloom Weavers Mudra Portal” MSME proposals upto Rs. 5.00 lakhs is to be sanctioned within 15 days

- 74. 630/21 22.09.21 : MSME SUGAM scheme for lending under Origination Tie-ups Target Group Micro and Small Enterprises (Manufacturing/Service) ELIGIBILITY NOT ELIGIBLE Individuals, Proprietorship, Partnership Concerns, LLP , Pvt Ltd Company are eligible. GST registered borrower (where ever applicable) New/Existing Customer with Business operation for minimum 1 year. Individuals/units whose risk rating is upto Moderate Risk under IRR Partnership Firms with HUF as one of the Partners, Educational institutions, SHG, JLG are not eligible. Existing customer with SMA 2 during the last FY are not eligible. WC facility under the scheme may not be extended to customers who are already enjoying WC Facilities in any form with our Bank or other Banks Purpose To meet WC/Asset creation requirements Nature of Facility WCTL (to finance WC requirements/cash flow mismatch) Term Loan (to finance new asset creation) QUANTUM WCTL – Maximum upto Rs. 5 lakhs Term loan – Maximum upto Rs. 10 lakhs Agg. exposure per borrower under the scheme not to exceed Rs10 lakh SECURITY CGTMSE coverageApplicable

- 75. 630/21 22.09.21 : MSME SUGAM scheme for lending under Origination Tie-ups REPAYMENT WCTL: Minimum - 12 months; Maximum - 60 months Term Loans: Minimum - 12 months; Maximum - 84 months (including maximum moratorium period of 3 months) All loans under the scheme to be repaid in EMI ROI RLLR + 2.50% p.a. (No Liquidity Premium to be added additionally) MARGIN 20% Assessment For WCTL : LOWER of the following may be permitted 3 Times of the Cash accrual as per the latest Financial Statement/ ITR, subject to DE Ratio Not more than 4:1 , DSCR Should not be below 1 during the tenure of the loan OR Working Capital requirement as assessed under Turnover method. For Term Loan : 3 times of the cash accrual as per the latest Financial Statement/ ITR, subject to DE Ratio Not more than 4:1 DSCR Should not be below 1 during the tenure of the loan Disbursemen t In lump sum or in Maximum 3 tranches Product Code 753- For loans under Fin-tech arrangement

- 76. 691/21 25.10.21 : “NATIONAL PORTAL” – A SINGLE PLATFORM FOR ALL CREDIT LINKED GOVERNMENT SCHEMES Developed by Online PSB Loans Ltd. URL for National Portal is: www.jansamarth.in/home Schemes to be included on National Portal: Phase I: Education schemes:CSIS, Padho Pardesh,Dr.Ambedkar CSISOBCEBC Housing schemes:PMAY Agriculture infrastructureschemes:ACABC, AMI, AIF Livelihood schemes:NRLM, NULM Business activity schemes: PM SvaNidhi, Stand-up India, Mudra, PMEGP, Mudra Weaver, SRMS (*PM SvaNidhi & *PMEGP will be covered on integration of National Portal with portal being developed by SIDBI & KVIC) Phase II: State Government Schemes

- 77. 227/22 : CGTMSE- Additional guidelines and clarificationof existingguidelines. Additional guidelines: Wholesale Trade and Educational/TrainingInstitution are included as eligible activities under Credit Guaranteescheme of CGTMSE. Clarificationof existingguidelines: There is no stipulation of maximum loan limit under Hybrid/Partial CollateralSecurity Model of CGTMSE. In respect of coverage of WC limits, present/expected outstandingis requiredto be updated by the Bank (subject to maximumof guarantee amount) every year for calculation of fee on outstandingbasis 228/22 : CMR (CIBIL MSME RANK) guidelines linked to delegation of powersfor MSME loans above Rs. 10 lakhs to Rs. 10 Crores - Enablingof a new functionality under TransUnionCIBIL’s commercialbureau portal for generating CMR reports w.e.f.01.04.2022 CMR may be fetched in applicablecases, while drawing CIBIL’s Commercial CIRs (Credit Information Reports), by selecting the checkboxenabled for generationof the same. Branches shall opt for generation of CMR only in eligiblecases, i.e. while sanctioning MSME credit facilities(existing/new) with aggregate Loan quantum(Present & Proposed) of above Rs.10 lakhs and upto Rs.10 crores.

- 78. 283/22 : AUTOMATION OF EXTERNAL CREDIT RATINGs (ECRs)UPDATION IN CBS it is to be noted that manual feedingof ECRs under Fast Path BA189 has since been disabled for branches, as ECRsare updated on a daily basis centrally in CBS through API 345/22 : Revised Definitionof MSME – Additionalguidelinesin respect of obtentionand updationof Udyam RegistrationCertificate (URC) detailsof MSMEs Existing EM Part II & UAM of the MSMEs obtainedtillJune 30, 2020 shall remain valid till June 30, 2022 for classificationas MSMEs. URC details shall be updated in CGTMSE portal also, wherever possible, while submitting the applicationfor Guarantee Branches shall mandatorilyobtain and update the URC detailsin CBS (under CIM22 option) and also incorporate such details in the ‘Common Appraisal Memorandum’while appraising renewal and/orfresh/additionalexposure proposalsof MSMEs 384/22 : Processing/Upfrontcharges for Mudra Loans financed under ‘Shishu’ and ‘Kishore’ Categories stands waived w.e.f. 07.07.2022. (Tarun’ shall continue as per guidelines.)

- 79. 435/22 : Disbursementof MSME Term Loans – Reiteration of existingguidelines. DisbursementRequest Format for Loans NF – 1024 shall be obtained invariablyand a letter should be obtained fromthe borrowerauthorizingthe bank to releasethe funds to the supplierand the payment should be made directly to the vendor only along with the sanctioned margin from the borrower. 436/22 : Automationof collection of Commitment Charge (Corporates > FB/NFB : 10 CR) New screen LNX21 (Commitment Fees DisbursementSchedule Details) is introduced for maintainingthe disbursementschedule for term loans Manually collection for customersenjoying NFB facilities Accounts marked for waiver of commitment charges in screen BX202. Levy of commitment charges is not applicable in the following cases: ➢ --Limits sanctionedto sick / weak units. --Limits sanctionedfor Export credit (both pre-shipment and post-shipment) --Short term credit facilities linked to market benchmarks like MIBOR, (as put and call option with 24 hours’ notice is available) --Inland Bills extended by way of Bills Purchased/Discounted,Credit Limits granted to Commercial Banks, FinancialInstitutions,CooperativeBanks, RRB's

- 80. 454/2022 : REPHASEMENT/RESTRUCTURING/RESCHEDULING OF ACCOUNTS – ADVISORY TO ALL THE BRANCHES, ROs AND Cos ➢ ONLY PERMISSIBLE REPHASEMENTS/RESCHEDULING/RESTRUCTURINGto be done through CBS as per Bank/RBI IRAC scheme guidelinesduly backed by supporting documents with concurrence of sanctioning authority ➢ LNX25/ALX25 optionsallowsthe Branch to Restructure/Reschedule the account with or without Capitalisation ofarrears Branches should not resort to capitalizationof arrearswhile switching over to RLLR r 469/22 : New Product Code-2000 For Opening Of MSME WC Limits (OD/OCC)in CBS/LAPS Sl No. Product Code 1 215 2 255 3 275 4 280 5 285

- 81. 513/22 : MSME Sulabh – Modification of guidelines on: MSME Sulabhs to handleall fresh and enhancement of MSME loan proposals(Except Loans against Deposit/Approved Securities and Gold Loans) beyond cumulative cut off limits of Rs 25.00 Lakh or branch delegated power whichever is less in case of Small, Medium, Large and VLB branches. RecommendingAuthoritiesfor Sulabh power proposals: 1. Processing Officer of Sulabh 2. Section Head of Sulabh 3. Concerned Branch Head RecommendingAuthority for above Sulabh power ( RO/CO/HO) proposals: 1. Processing Officer of Sulabh 2. Section Head of Sulabh 3. Concerned Branch Head 4. Sulabh Head

- 82. 539/22 : Introduction of M/s NADL (NeSL ASSET DATA LIMITED) as an Account aggregator 541/22 : LOANS AND ADVANCESAGAINST SHARES/DEBENTURES:REVISED LIST OF COMPANY No fresh loans/advances shall be granted against securities held in materializedform. No fresh loans shall be granted against securities which are not appearingin the approved list Companieswith external rating of “A” and above are only considered in the approvedlist In the cases where loans/advancesare outstandingagainstthe security of shares/ debentures of those companies which are not appearingin the present consolidatedlist branches shall initiatesteps to get the related accountsregularized either by way of substitution with shares/debenturesof Companies (As per Annexure-I) of adequate value or by way of recovery within 3 months from the date of this circular. Circle head level CACs i.e., CGM/GM-CO-CAC/DGM-CO-CACis empowered to permit further extension of time of not more than 3 months for the Substitution, if required Branches are advised to review the loans against shares/debenturesat least on a fortnightly basis to ensure adequacy of margin

- 83. 571/22 : Introduction of a New ProductCode- 2001- MSME- SHG OD OCC & 637 – SHG-TL. 649/22 : ECAIRated Accounts – External Credit AssessmentInstitutions (ECAI) Rating will only be applicablefor Risk Weightage and Pricing of Loans & Advances purpose when Press Release (PR) issued by ECAI contains Bank’s name and the CorrespondingCredit Facilities. ECAIrating without above disclosurewill be treated as unrated and will attract risk weights of 100 % or 150 % instead of applicable 20 % on Credit Risk Weighted Assets Computation. 660/22 : CONSOLIDATED GUIDELINES ON CANARAEASY EQUIPMENT FINANCE (CEEF) Existing clients/New clients who are rated AAA/AA/Aor up to CNR V Low Risk-III – MINIMUM 10 LACS & MAX 100 CR Other Existing/New Clientswho are rated BBB/BB or CNR VI Normal/CNRVIII ModerateRisk- MIN 10 LAC & MAX 50CR Line of Credit: 20% of the regular sanctioned workingcapital limits (FB + NFB) to our existing clients only who are having one year of satisfactorydealing with us subject to a maximum amount of Rs.25.00 crores

- 84. 584/22 : Automation of Credit related Service Charges Collectionof Service Charges for issuance of SolvencyCertificate, CapabilityCertificate, Modification ofTerms & Conditionsof Sanction, NOC in respect of exposuresof Rs. 1 crore & above and Waiver of Project Appraisalis automated Solvency Certificate Capability Certificate Solvency Certificate issued Applicable Charges Upto Rs.1. Lakhs Rs.750/ Rs1Lakhs to Rs.25 Lakhs Rs.3000/- Rs.25 Lakhs to Rs.50 Lakhs Rs.6000/- >Rs.50 Lakhs 0.10% of the solvency certificate amount, minimum of Rs.60000 Capability Certificate issued up to Applicable Charges Upto Rs.5 lakh Rs 500 Above Rs.5 lakhs Rs.100/- per lakh subject to a maximumof Rs.1,500/- Additional capabilitycertificatein respect of the same student for applyingto other Universities/same university within 12 months from the issue of original capabilitycertificate Rs 100/- Per certificate

- 85. 584/22 : Automation of Credit related Service Charges Modification in Terms & Conditions of sanction NOC charges in respect of exposuresof Rs.1 crore &above Sanctioned Amount Applicable charges (Per Instance of modification) Upto Rs 1 crore Rs 5,000/- Above Rs 1 crore upto Rs 10 crore Rs 15,000/- Above Rs 10 crore upto Rs 50 crore Rs 50,000/- Exposure Charges applicable Upto 10 crore Rs 1 Lakh Above Rs.10 Crore and upto Rs.50 C Rs.3 lakh Above Rs.50 Cr Rs.5 Lakh

- 86. 600/22 : Introductionof New Internal Risk Rating Model – “CIRM Hybrid Model” for Domestic borrowershaving exposure above Rs. 2 Crore to Rs. 5 Cr WEF 1.10.22. Present CIRM model is assessedbased on Industry Risk, Business Risk, Financial Risk & Management Risk.Weightage for Immovable Prime and / or immovablecollateral are outside the purview of CIRM Model In view of the above, new internal risk rating model – CIRM Hybrid Model for borrowers having exposure above Rs.2 crore to Rs. 5 crore has been introduced, wherein borrower providingsufficient Immovable Prime and / or immovable collateral would be benefited. Further, all the riskparametersunder this model are objective in nature which is not influenced judgementally by the rating use Salient featuresof the CIRM HYBRID MODEL are as under: 1.Applicablefor the Manufacturing, Trading, Services, Agriculture & allied activities (wherever balance sheet is available)as under: New Borrower(except Greenfield projects) havingexposure above 2 Cr to 5 Cr (irrespective of turnover). Existing borrowerhaving exposure above 2 Cr to 5 Cr (irrespective of turnover).

- 87. 600/22 : The model applicability is described as under 15% haircuts will be applied, where immovableproperty is vacant landunder Security Coverage Risk Parameter Risk scoring is in the range of 0 to 11 where score ‘11’ is low risk & score of ‘0’ is high risk SI Borrower Category Existing CIRM Module NewCIRM HybridModel 1 Manufacturing Large Exposure Module & SME-Manufacturing Module CIRM Hybrid Model will be applicable for exposure above Rs.2 cr to 5 cr. Note: For exposure above Rs.5 crore existing CIRM model will continue 2 Trading Large Trader Module& Small Trader Module 3 Services Large Exposure Module& Services Module 4 NBFC NBFC Module 5 Real Estate Real Estate Module No Change – Respective CIRM Module will be applicable for exposure above Rs. 2 6 Broker Broker Module 7 Banking Bank Module 8 infra-Port, InfraRoad, Infra-Power & Greenfield Projects Supervisory Slotting Module

- 88. 623/22 : AUTOMATION OF COLLECTION OF PROJECTAPPRAISAL CHARGES Collection of Project Appraisal Chargeshas been automated in respect of all charges related to Project Appraisalsundertaken by PAG / PAC with immediateeffect PROJECTAPPRAISAL FEES (AS PER CIR NO:50/2021 VETTING FEES (AS PER CIR NO:50/2021) Project Cost Schedule of Fees where Appraisal Report is strictly for internal use Schedule of Fees where Appraisal Report is to be shared with the customer/ other lenders Rs.2Crore& above And up to Rs.10 Crore 0.50% of the project cost with minimum of Rs.1 Lakh; maximum Rs.5 Lakh 1.00% of the project cost with minimum of Rs.2 Lakh; maximum Rs.10 Lakhs AboveRs.10 Cr and up to Rs.50Cr 0.40% of the project cost with minimum of Rs.5.00 Lakhs; Maximum Rs.20Lakh 0.75% of the project cost with minimum of Rs.10.00 Lakhs; Maximum Rs.37.50 lakhs Above Rs.50 Crore and upto 100 crore 0.35% of the project cost with minimum of Rs.20 Lakhs; maximum Rs.35Lakhs 0.60% of the project cost with minimum of Rs.37.50 Lakhs; maximum Rs.60 Lakhs Above Rs.100 Crore 0.30% of the project cost with minimum of Rs.35 Lakhs Maximum of Rs.3 Cr. 0.50% of the project cost with minimum of Rs.60 Lakhs; Maximum Rs.5 Cr NATURE OF CHARGES APPLICABLE CHARGES Vetting of information Project Cost Charges Memorandum/TEV report prepared by other banks/ financial institutions (To be collected upfront) Rs.2 Crore& above and up to Rs.10 Crore Rs.50,000/- Above Rs.10 Crore and up to Rs.50 Crore Rs 1 lakh Above Rs.50 Crore and up to Rs.100 Crore Rs 2 lacs Above Rs.100 Crore Rs 3 alcs