The document summarizes India's EXIM (export-import) policy. Some key points:

1) EXIM policies are provisions related to foreign trade incorporated in the national trade policy and are announced every 5 years. They aim to balance trade and support economic development.

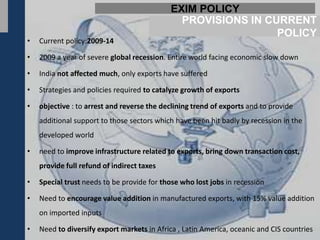

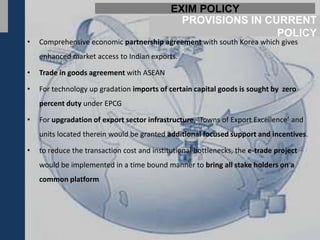

2) The objectives of current 2009-2014 policy include providing access to raw materials to boost growth and making key sectors competitive. It also aims to arrest the declining export trend and provide support to badly affected sectors.

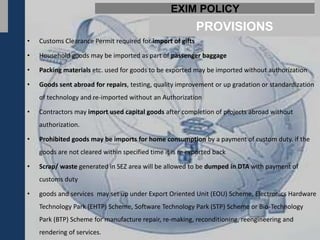

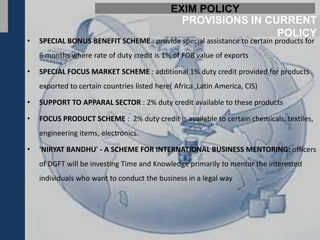

3) The policy outlines import restrictions and provisions around exports/imports including licensing requirements. It also describes various incentive schemes to promote exports, diversify markets, and reduce transaction costs.