Mbf 403 crm and it in banking

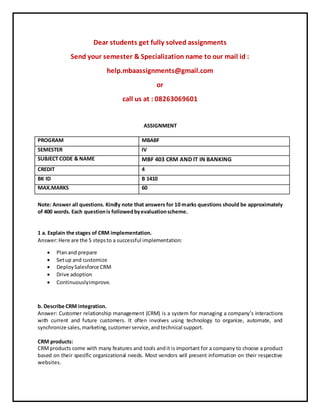

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601 ASSIGNMENT PROGRAM MBABF SEMESTER IV SUBJECT CODE & NAME MBF 403 CRM AND IT IN BANKING CREDIT 4 BK ID B 1410 MAX.MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each questionis followedbyevaluationscheme. 1 a. Explain the stages of CRM implementation. Answer:Here are the 5 stepsto a successful implementation: Planand prepare Setup and customize DeploySalesforce CRM Drive adoption Continuouslyimprove. b. Describe CRM integration. Answer: Customer relationship management (CRM) is a system for managing a company’s interactions with current and future customers. It often involves using technology to organize, automate, and synchronize sales,marketing,customerservice,andtechnical support. CRM products: CRMproducts come with many features and tools andit is important for a company to choose a product based on their specific organizational needs. Most vendors will present information on their respective websites.

- 2. c. Explain CRM workflow Answer: workflow in CRM provides the facility to automate your business processes. Workflows are triggered when a specified event occurs in the system, such as a record being created or field being updated, and can be set to automatically perform actions including sending emails and creating or updatingotherrecordsinCRM. Some simple examplesofCRM workflow: 2 a. Explain the various CRM initiativesinBanks. Answer: Customer relationship management is a broad approach for creating, maintaining and expanding customer relationships. CRM is the business strategy that aims to understand, anticipate, manage and personalize the needs of an organization's current and potential customers. At the heart of a perfect strategy is the creation of mutual value for all parties involved in the business process. It is aboutcreatinga sustainable b. Explain Analytical CRM. Answer: Analytical CRMsupports organizational back-office operations and analysis. It deals with all the operations and processes that do not directly deal with customers. Hence, there is a key difference between operational CRM and Analytical CRM. Unlike from operational CRM, where automation of marketing, sales-force and services are done by direct interaction with customers and determining customer’s needs, analytical CRM is designed to analyze deeply the customer’s information and data and unwrap or disclose the essential convention and intension of behavior of customers on which capitalizationcanbe done bythe organization. 3 a. What is core banking? Answer: Core banking is a banking service provided by a group of networked bank branches where customers may access their bank account and perform basic transactions from any of the member branch offices. Core banking is often associated with retail banking and many banks treat the retail customers as their core banking customers. Businesses are usually managed via the Corporate banking divisionof the institution.Core bankingcoversbasicdepositingandlendingof money. Normal core bankingfunctionswill include b. Explain the significance ofcore banking. Answer:A core bankingsystemisthe software usedtosupportabank’smostcommon transactions. Elementsofcore banking include:

- 3. Making andservicingloans. Openingnewaccounts. Processingcashdepositsandwithdrawals. Processingpaymentsandcheques. Calculatinginterest. 4 Withthe helpof a flowchart diagram discuss the working of E-pins. Answer: E-PINs are similar to Call and Text Cards but are given via secured paper slips or via text message.EachE-PIN has a card numberand a PIN numberwhichyoucan use to reload. 5 a. Explain the role of technologyinbanks. Answer: The banking sector has embraced the use of technology to serve its client’s faster and also to do more with less. Emerging technologies have changed the banking industry from paper and branch based banks to ”digitized and networked banking services. Unlike before, broadband internet is cheap and it makes the transfer of data easy and first. Technology has changed the accounting and management system of all banks. And it is now changing the way how banks are delivering services to theircustomers. b. Describe cheque clearingusing MICR technology. Answer: Cheque truncation is the conversion of a physical cheque into a substitute electronic form for transmission to the paying bank. Cheque truncation eliminates cumbersome physical presentation of the cheque and saves time and processing costs. To settle a cheque, it has to be presented to the drawee bank for payment. Originally this was done by taking the cheque to the drawee bank, however as cheque usage increased this became cumbersome and banks arranged to meet each day at a central locationtoexchange chequesandsettle the money. 6 Define disasterrecoveryand contingency operationsplanning. Answer: Disaster recovery is the area of security planning that deals with protecting an organization from the effects of significant negative events. Significant negative events, in this context, can include anything that puts an organization’s operations at risk: crippling cyberattacks and equipment failures, for example,aswell ashurricanes,earthquakesandothernatural disasters. A disasterrecoveryplan(DRP) documentspolicies,

- 4. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601