Mbf 402 & treasury management

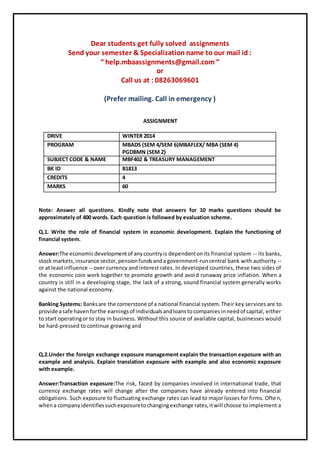

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE WINTER 2014 PROGRAM MBADS (SEM 4/SEM 6)MBAFLEX/ MBA (SEM 4) PGDBMN (SEM 2) SUBJECT CODE & NAME MBF402 & TREASURY MANAGEMENT BK ID B1813 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q.1. Write the role of financial system in economic development. Explain the functioning of financial system. Answer:The economicdevelopmentof anycountryis dependentonits financial system -- its banks, stock markets,insurance sector,pensionfundsanda government-runcentral bank with authority -- or at leastinfluence -- over currency and interest rates. In developed countries, these two sides of the economic coin work together to promote growth and avoid runaway price inflation. When a country is still in a developing stage, the lack of a strong, sound financial system generally works against the national economy. Banking Systems: Banksare the cornerstone of a national financial system.Their key services are to provide asafe havenforthe earningsof individualsandloanstocompaniesinneedof capital, either to start operatingor to stay in business. Without this source of available capital, businesses would be hard-pressed to continue growing and Q.2.Under the foreign exchange exposure management explain the transaction exposure with an example and analysis. Explain translation exposure with example and also economic exposure with example. Answer:Transaction exposure:The risk, faced by companies involved in international trade, that currency exchange rates will change after the companies have already entered into financial obligations. Such exposure to fluctuating exchange rates can lead to major losses for firms. Often, whena companyidentifiessuchexposuretochangingexchange rates,itwill choose to implement a

- 2. hedgingstrategy,usingforwardratestolockinan exchange rate and thuseliminatethe exposure to the risk. A firmhas transactionexposure whenever it has contractual cash flows (receivables and payables) whose values are subject to unanticipated changes in exchange rates due to a contract being denominated in a foreign currency. To realize the domestic value of its foreign-denominated cash flows,the firmmustexchange foreign currency for domestic currency. As firms negotiate contracts with set prices and delivery dates in the face of a volatile foreign exchange market with exchange rates constantly fluctuating, the firms face Q.3.Explain the individual currency limits with individual gap limit and aggregate gap limit. Write about the value at risk. Answer:Using unique online currency transactions, we examine the performance, trading activity, drawdown,andtimingabilitiesof individual currency traders. Evidence from 428 currency accounts duringthe 2004–2009 periodshowsthatcurrencytraders earnpositive abnormal returns,evenafter accounting for transaction costs. The results also show that day traders not only trade more frequently than non-day traders, but also outperform them in terms of raw, a passive benchmark and risk-adjusted returns. Usinga unique onlinecurrencytransactionsdataset,we examine the performance, trading activity, drawdown, and timing abilities of individual currency traders. Evidence from 428 accounts during the 2004–2009 period shows that currency Q.4 Write short notes on: a) Methods of cash-flow forecasting Cash flow forecasting or cash flow management is a key aspect of financial management of a business,planningitsfuture cashrequirementstoavoidacrisisof liquidity. Cash flow forecasting is importantbecause if abusinessrunsoutof cash and is notable to obtainnew finance,itwill become insolvent. Cashflowisthe life-bloodof all businesses—particularly start-ups and small enterprises. As a result,itisessential thatmanagementforecast(predict) whatisgoingtohappentocash flow to make sure the business has enough to survive. b)Liquidity forecasting For market operations to be effective, the Reserve Bank must construct forecasts of exogenous liquiditymovements.Eachmorning, forecasts of that day's flows are needed to guide the direction and size of market operations. Forecasts of future system cash movements are also required, to ensure appropriate preferred terms are selected so that unwinding repos smooth rather than exacerbate system cash movements.

- 3. To construct its liquidity forecasts, the Reserve Bank gathers information from a wide variety of sources.Extensiveliaison is conducted with many departments and agencies within the Australian Government and other clients to ascertain the timing and size of their payments and receipts. Longer-term information is available from Australian Government Budget papers, and observed historical patterns provide important c) Market instruments In the financial marketplace, a distinction is made between the capital markets and the money markets.The capital market is a source of intermediate-term to long-term financing in the form of equity or debt securities with maturities of more than one year. The money market provides very short-termfundstocorporations, municipalities and the United States government. Money market securities are debt issues with Q.5.Capital adequacy is one of the major indicators of the financial health of a banking entity. Explain about capital adequacy and its ratio measures. Also explain the ratios that are necessary under the assets quality. Capital adequacy and its ratio measures Explanation of ratio under assets quality Answer:Capital AdequacyRatio(CAR),alsoknownasCapital toRisk(Weighted)AssetsRatio (CRAR), is the ratio of a bank's capital to its risk. National regulators track a bank's CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. It is a measure of a bank's capital. It is expressed as a percentage of a bank's risk weighted credit exposures. This ratio is used to protect depositors and promote the stability and efficiency of financial systems around the world. Two types o Q.6.Treasury has become an integral part of all business functions. Explain the areas in which Information technology plays an effective role. Write about cloud technology and treasury applications. Answer:Information technology (IT) has become a vital and integral part of every business plan. From multi-national corporations who maintain mainframe systems and databases to small businesses that own a single computer, IT plays a role. The reasons for the omnipresent use of computertechnology in business can best be determined by looking at how it is being used across the business world. Communication: For many companies, email is the principal means of communication between employees, suppliers and customers. Email was one of the early drivers of the Internet, providing a simple and Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ”

- 4. or Call us at : 08263069601 (Prefer mailing. Call in emergency )