Mb0045 financial management

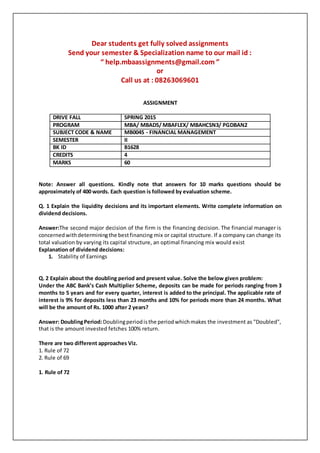

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 ASSIGNMENT DRIVE FALL SPRING 2015 PROGRAM MBA/ MBADS/ MBAFLEX/ MBAHCSN3/ PGDBAN2 SUBJECT CODE & NAME MB0045 - FINANCIAL MANAGEMENT SEMESTER II BK ID B1628 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q. 1 Explain the liquidity decisions and its important elements. Write complete information on dividend decisions. Answer:The second major decision of the firm is the financing decision. The financial manager is concernedwithdeterminingthe bestfinancing mix or capital structure. If a company can change its total valuation by varying its capital structure, an optimal financing mix would exist Explanation of dividend decisions: 1. Stability of Earnings Q. 2 Explain about the doubling period and present value. Solve the below given problem: Under the ABC Bank’s Cash Multiplier Scheme, deposits can be made for periods ranging from 3 months to 5 years and for every quarter, interest is added to the principal. The applicable rate of interest is 9% for deposits less than 23 months and 10% for periods more than 24 months. What will be the amount of Rs. 1000 after 2 years? Answer: DoublingPeriod:Doublingperiodisthe periodwhichmakes the investment as "Doubled", that is the amount invested fetches 100% return. There are two different approaches Viz. 1. Rule of 72 2. Rule of 69 1. Rule of 72

- 2. Q. 3 Write short notes on: 3a) Operating Leverage: It is a measurement of the degree to which a firm or project incurs a combination of fixed and variable costs. 1. A business that makes few sales, with each sale providing a very high gross margin, is said to be highly leveraged. A business that makes many sales, 3b) Financial Leverage:Financial leverage refers to the use of debt to acquire additional assets. Financial leverage is also known as trading on equity. 3c) CombinedLeverage:Operatingandfinancial leverage canbe combinedinto an overall measure called "total leverage. " Q. 4 Explain the factors affecting Capital Structure. Solve the below given problem: Given below are two firms, A and B, which are identical in all aspects except the degree of leverage employed by them. What is the average cost of capital of both firms? Answer: The general factors which are affecting the capital structure are as follows:- 1) Company constitution:In companiescapital structure isvery important as many companies treat it as a different entity. Private companies considers control factor as important whereas public company finds cost factor more important. Factors Determining the Capital Structure:The various factors which influence the decision of capital structure are: 1. Cash Flow Position Q. 5 Explain all the sources of risk in capital budgeting with examples. Solve the below given problem: Answer: Sources of risk in capital budgeting Capital budgetingisusedtoascertainthe requirementsof the long-terminvestments of a company. Examples of long-term investments are those required for replacement of equipments and The different techniques used for capital budgeting include: Profitability index

- 3. Q. 6. Explain the objectives of Cash Management. Write about the Baumol model with their assumptions. Answer: Objectives of Cash Management Cash managementreferstoa broad areaof finance involving the collection, handling, and usage of cash. It involves assessing market liquidity, cash flow, Objective of cash management In order to ensure you meet the objectives of an effective cash management policy, the financial managermust ensure thatthe companymeetsthe payment schedule and also minimize idle funds committed to cash balances. Meeting Cash Balances: The financial manager must ensure he has enough cash in hand to pay suppliers, creditors, employees, shareholders, banks, etc… Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601