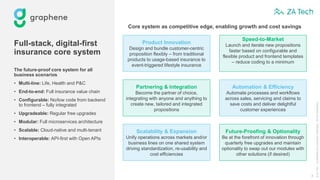

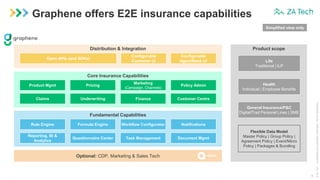

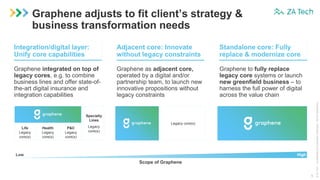

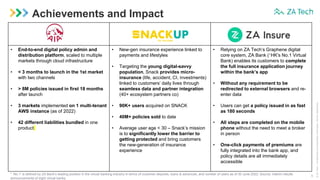

The document describes ZA Tech, an insurtech company that provides SaaS solutions to insurers across Asia and Europe. It has over 800 employees focused on R&D and delivery and has issued over 250 million policies annually. ZA Tech's core offering, called Graphene, is a full-stack, digital-first insurance platform that supports the entire insurance value chain and can be customized to meet different business needs.