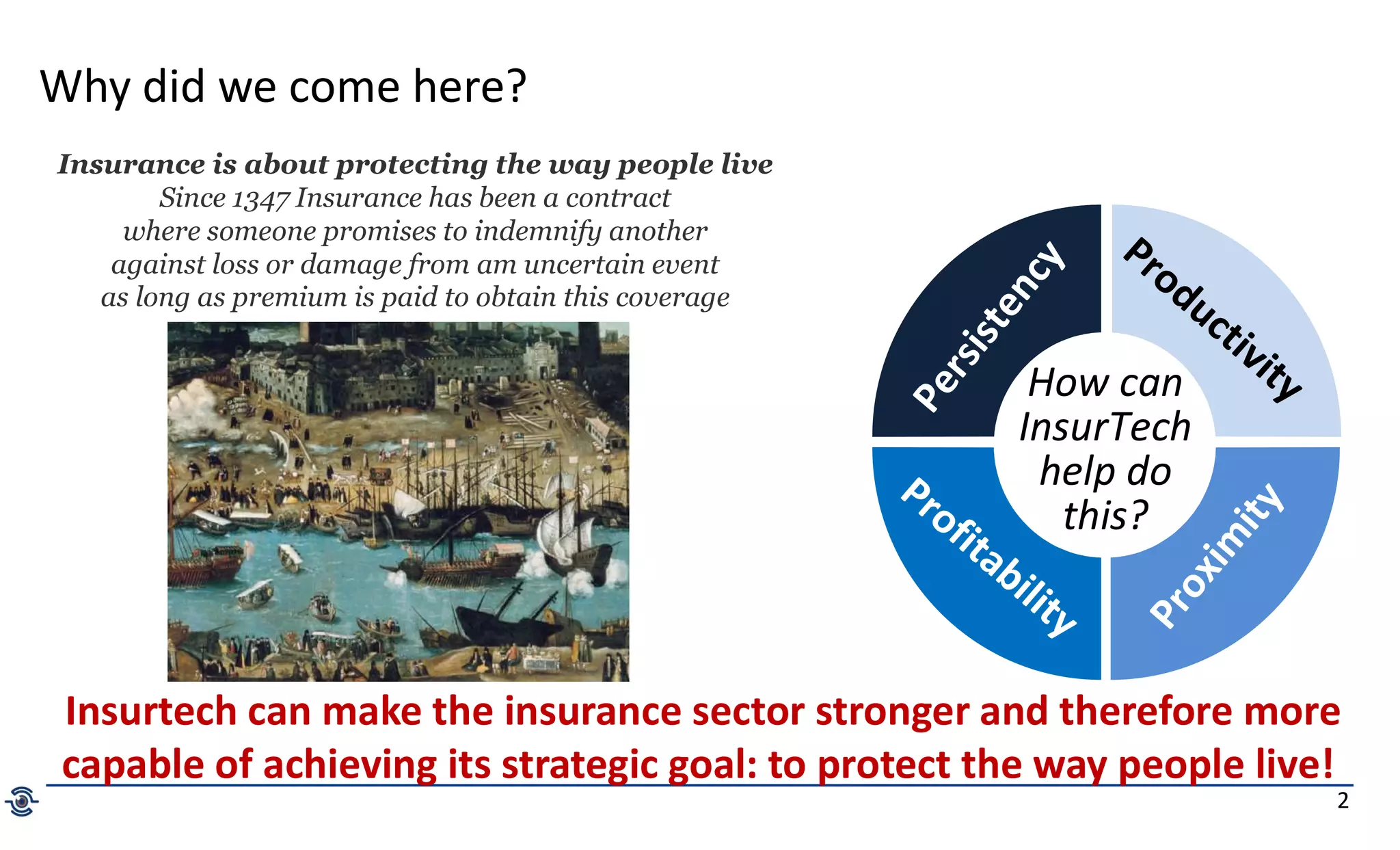

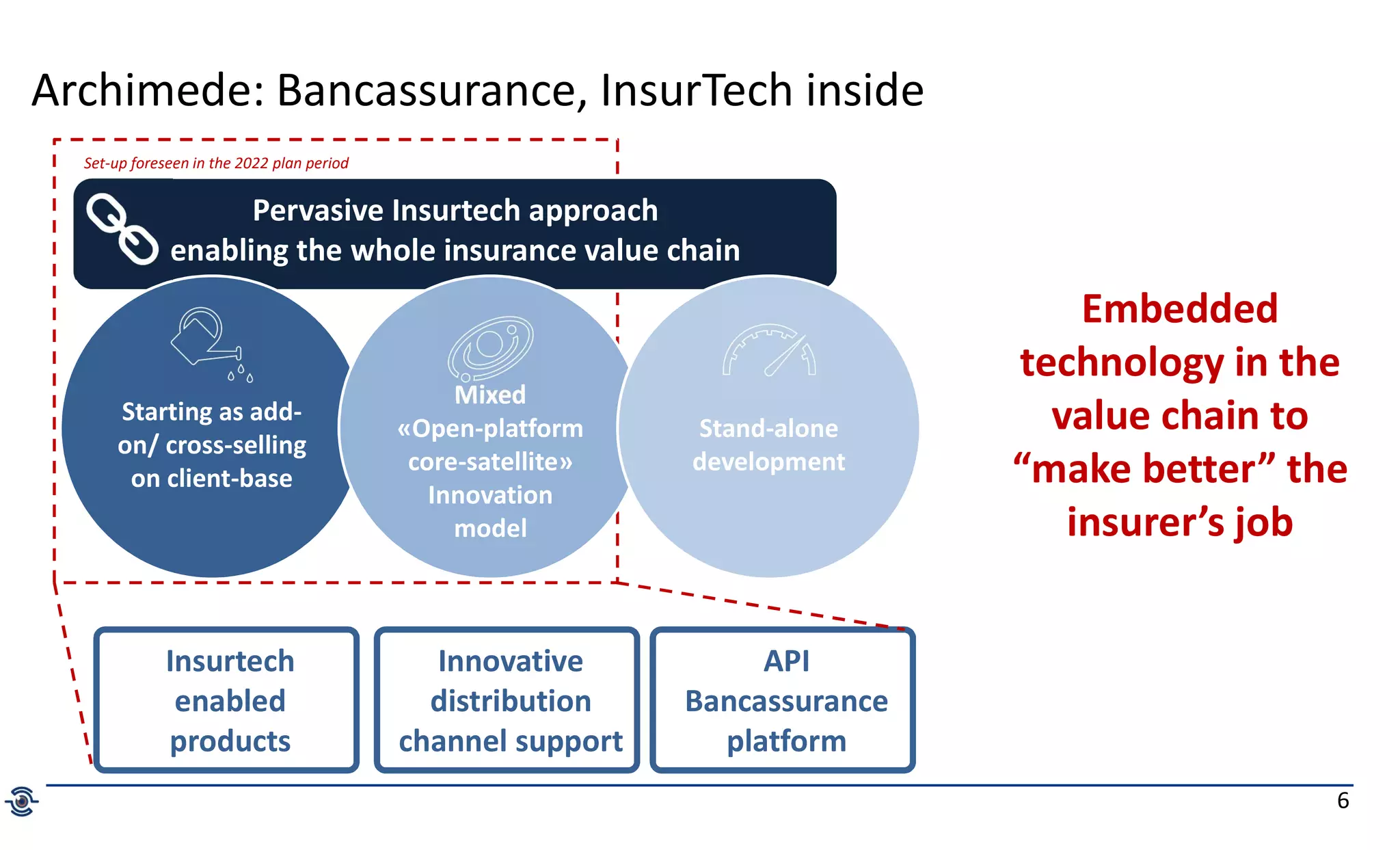

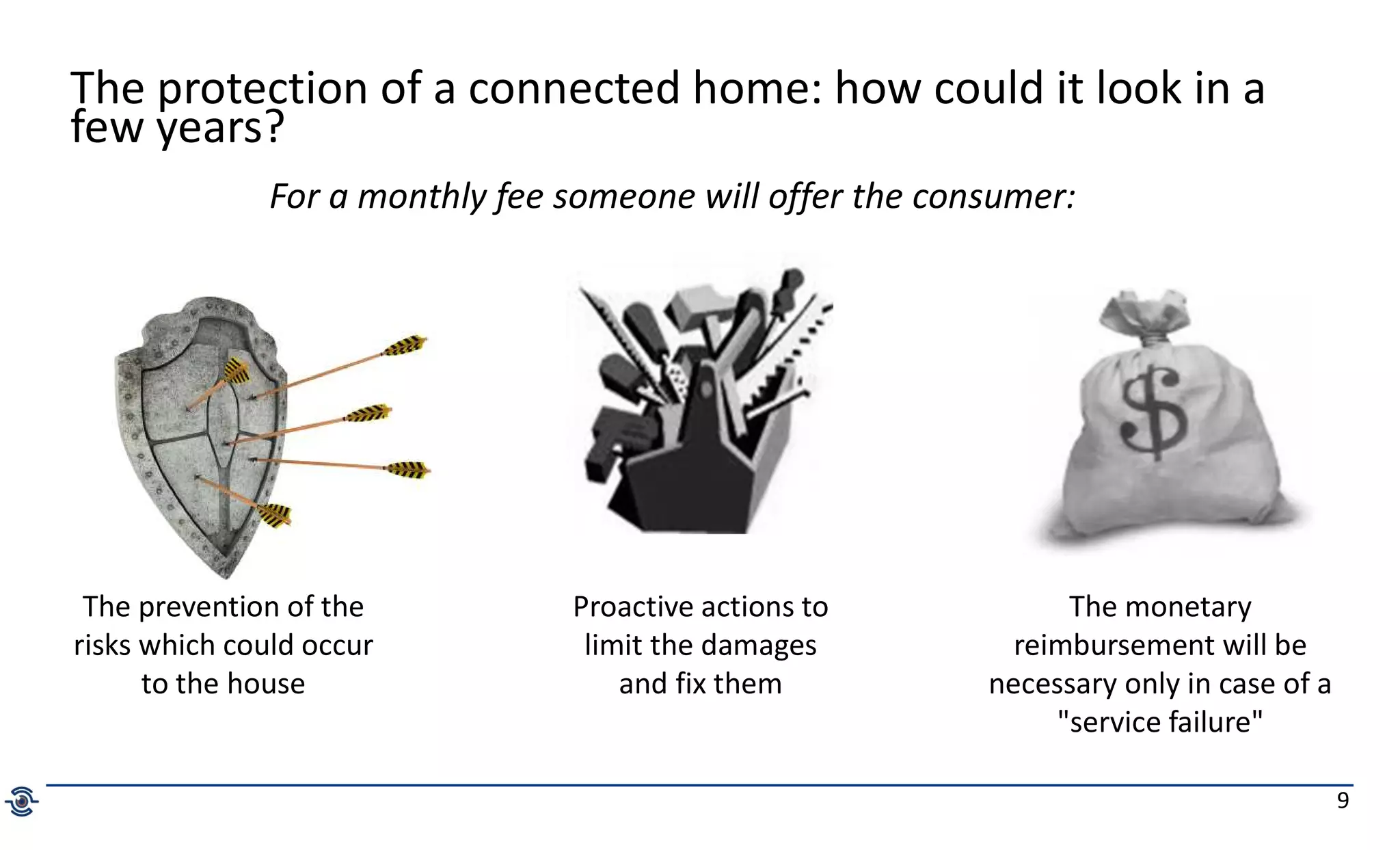

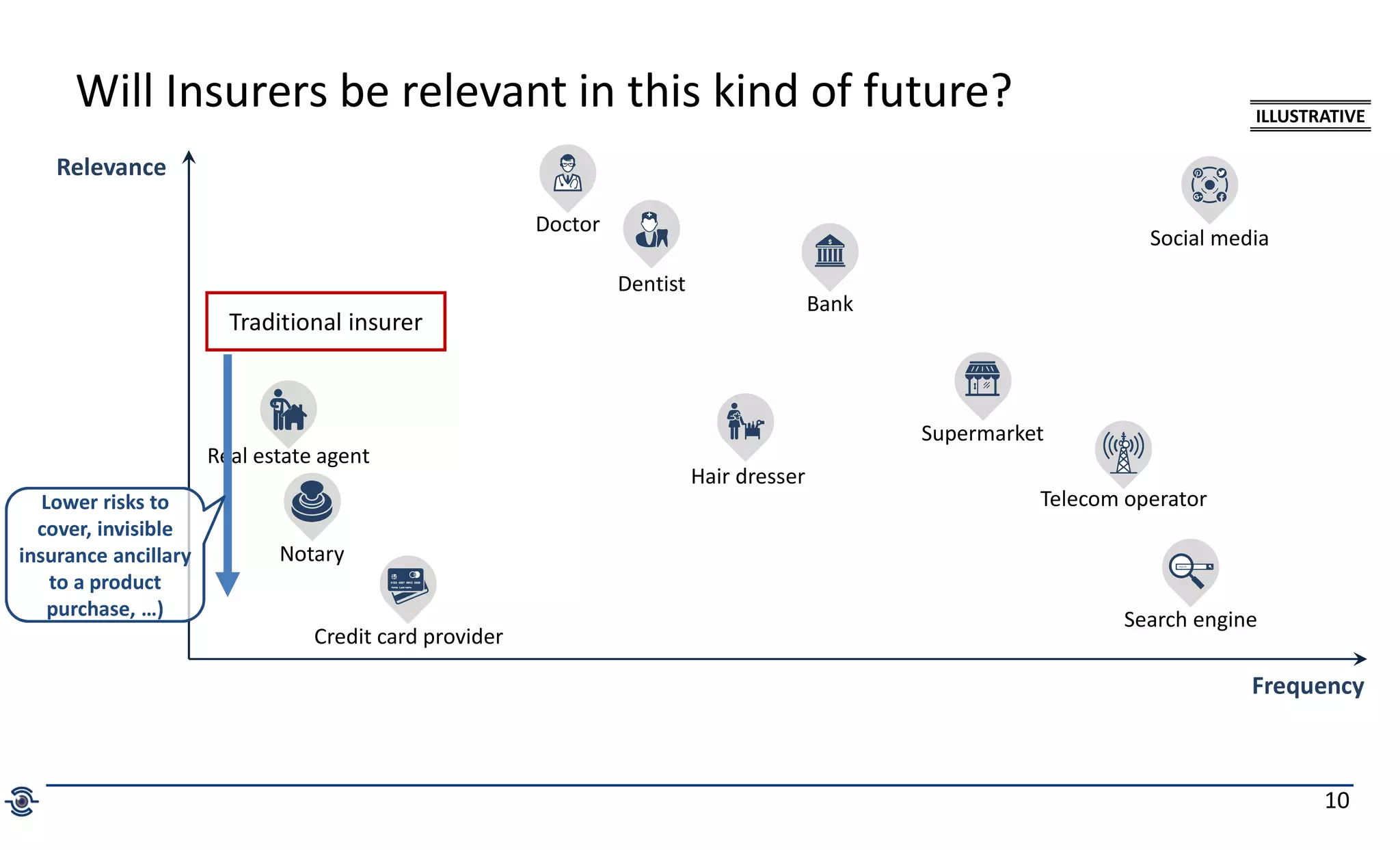

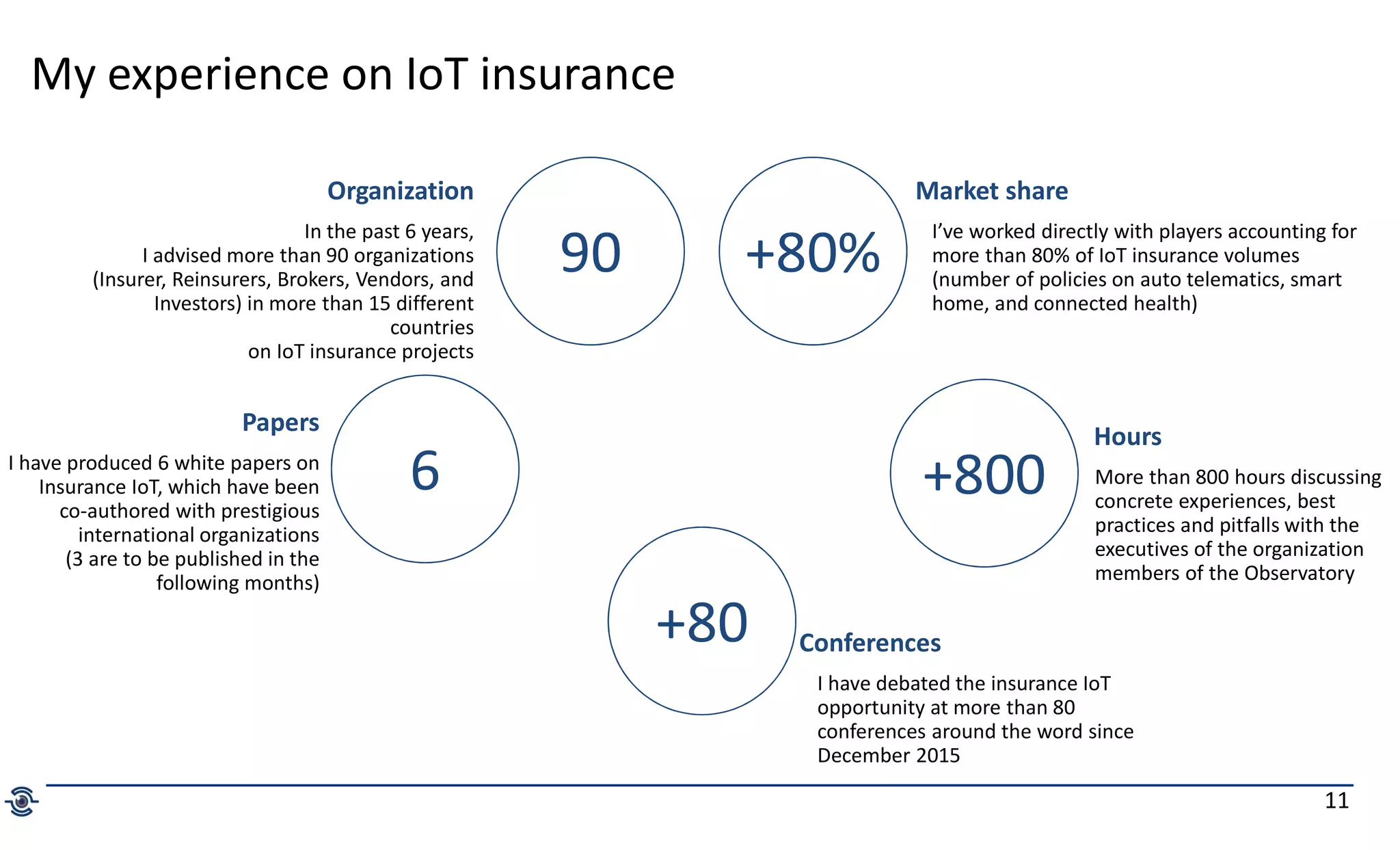

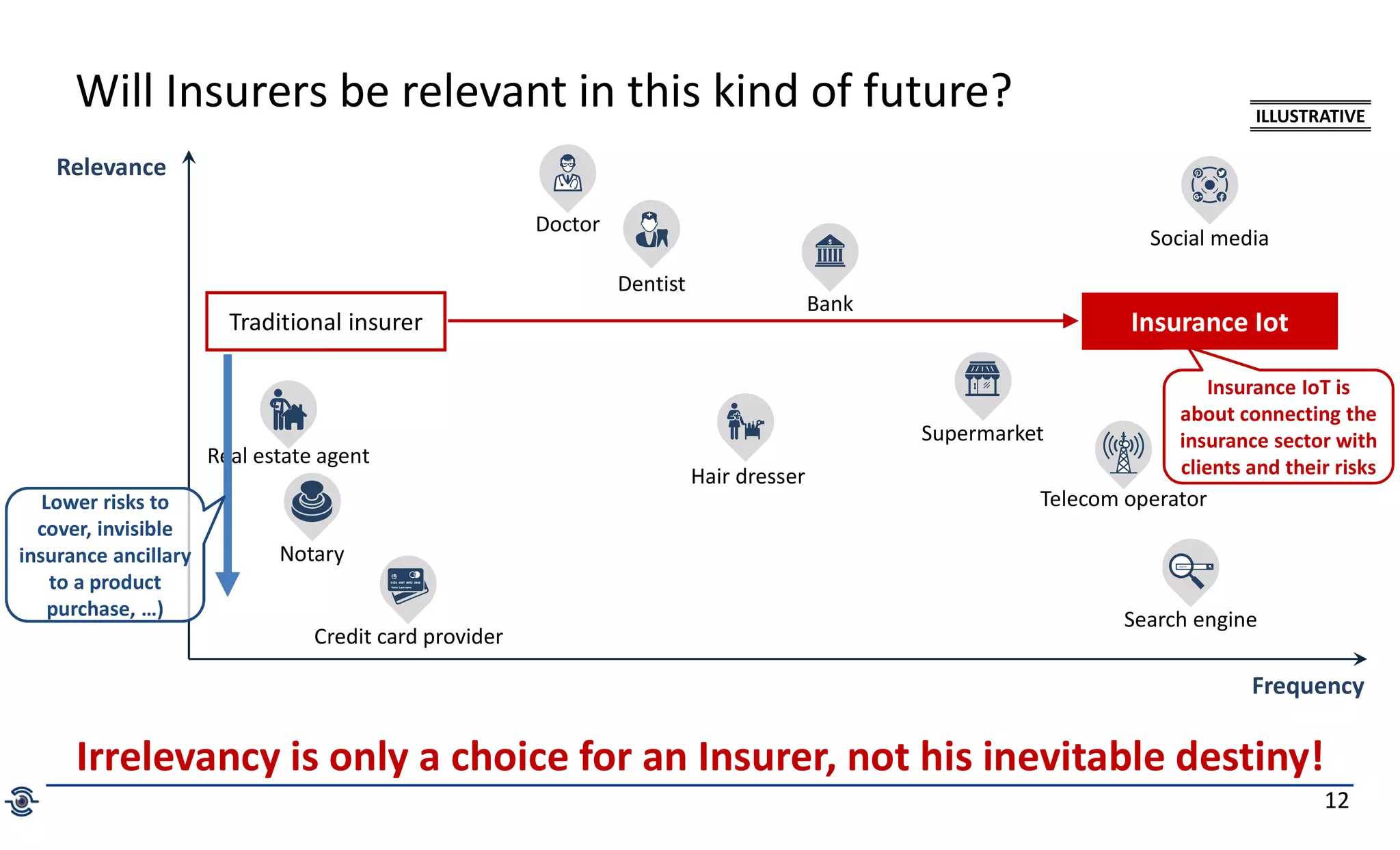

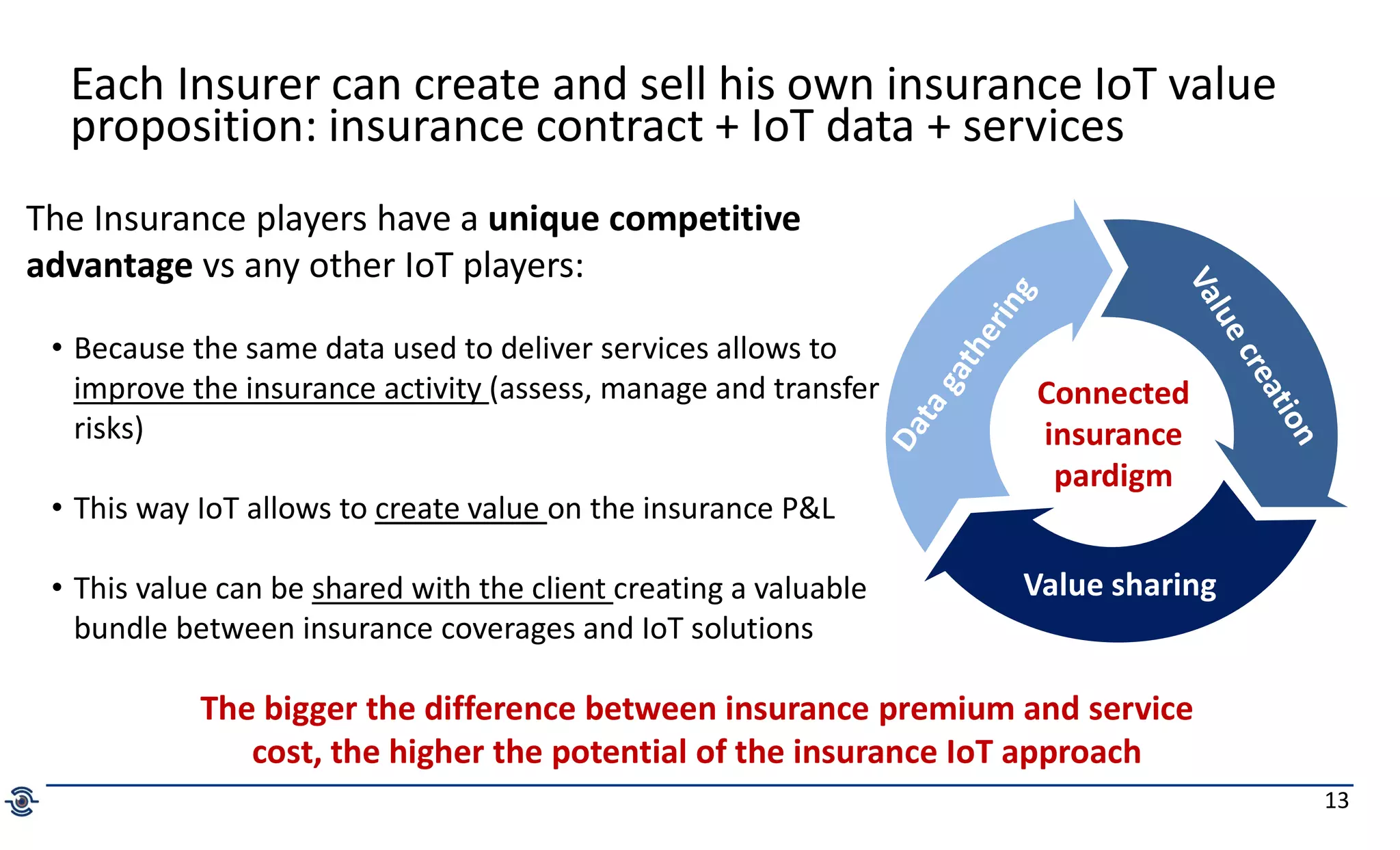

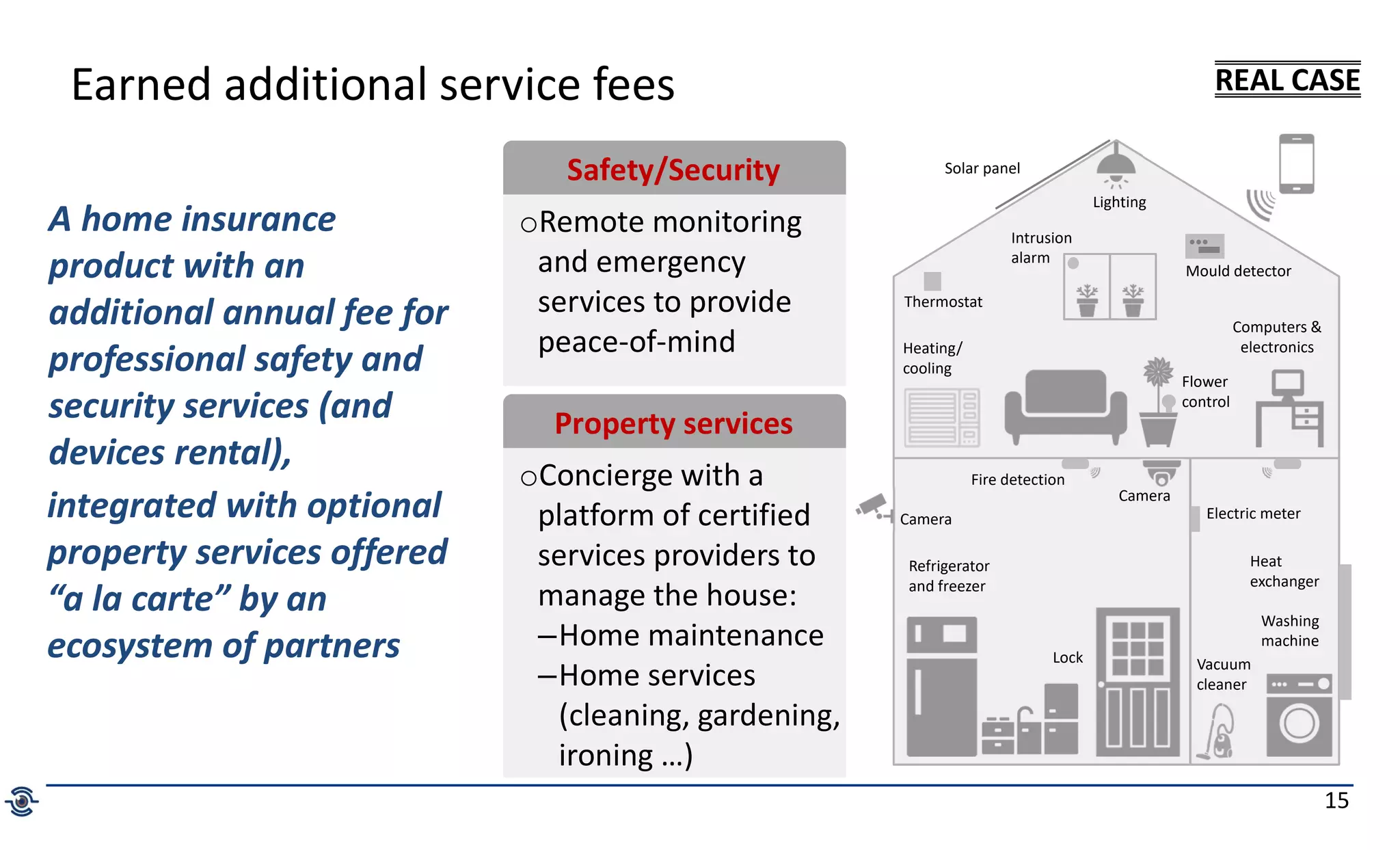

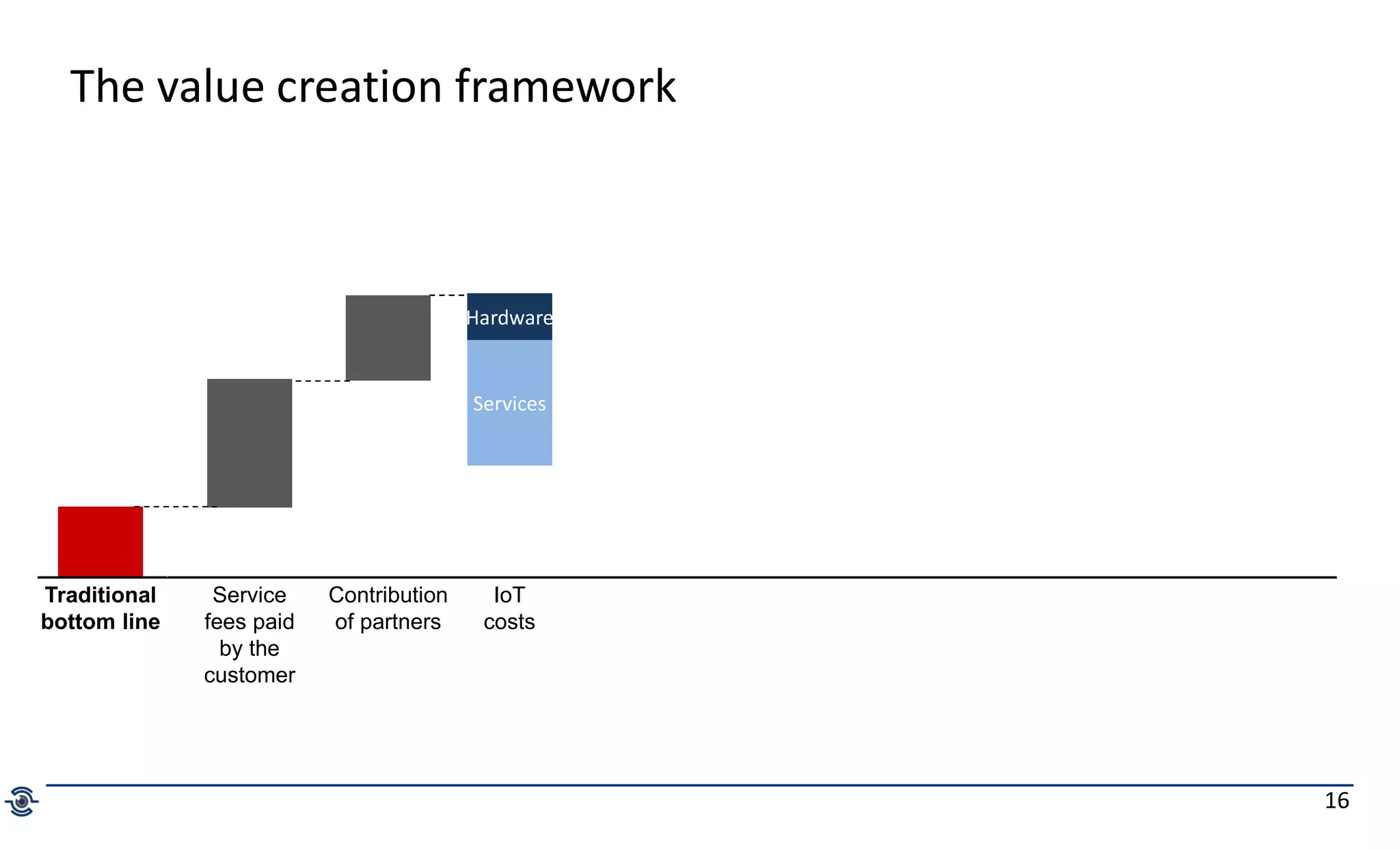

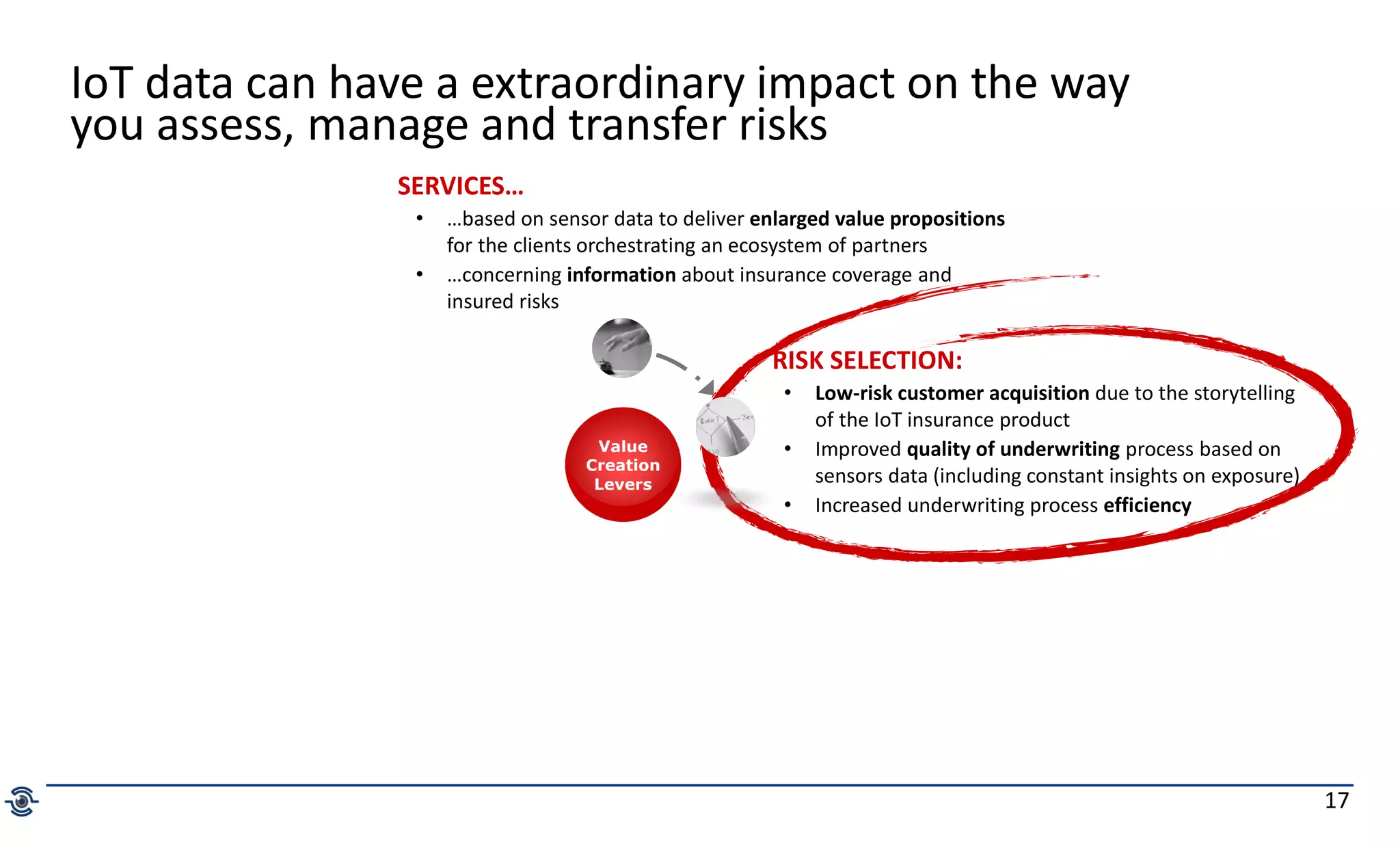

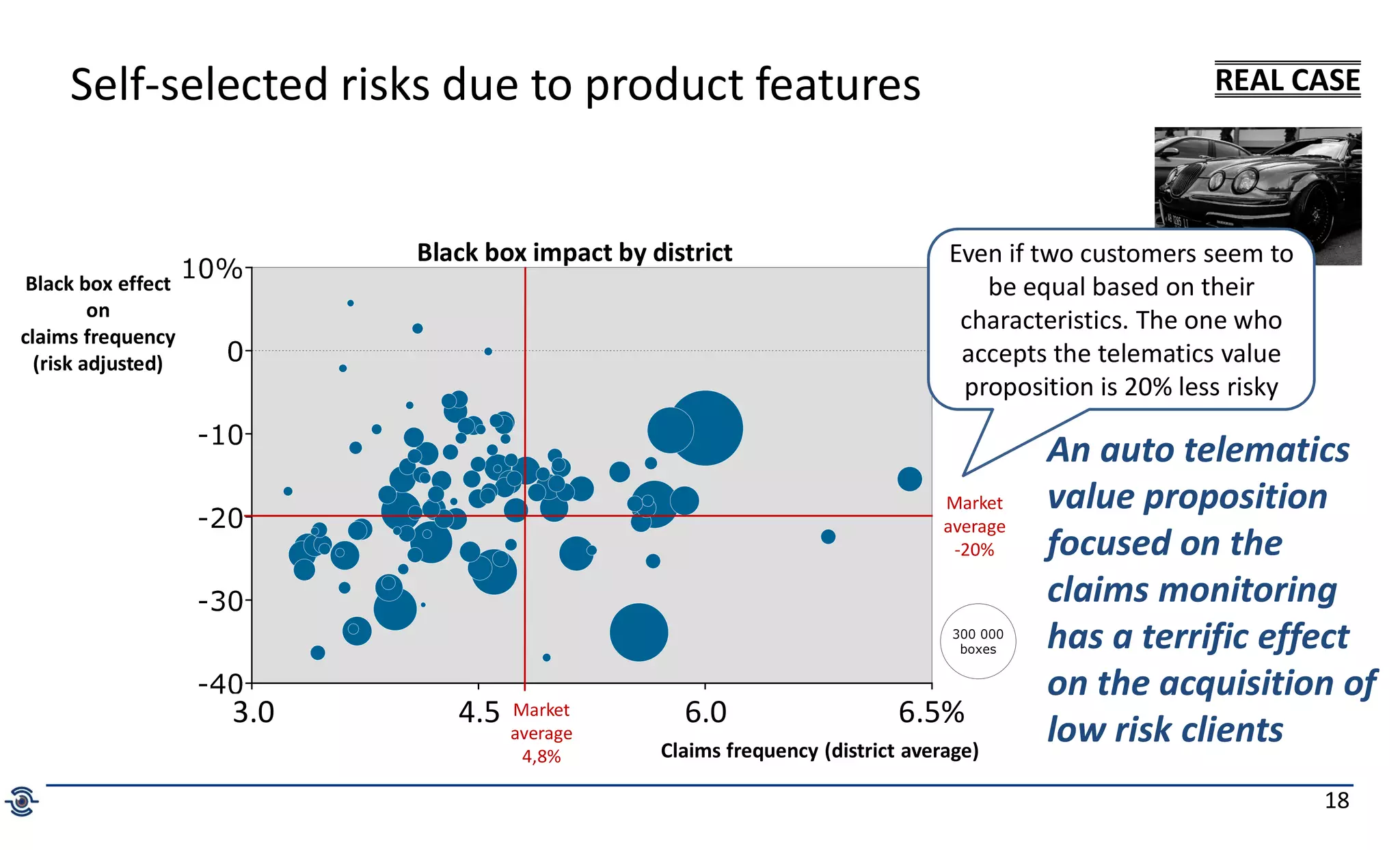

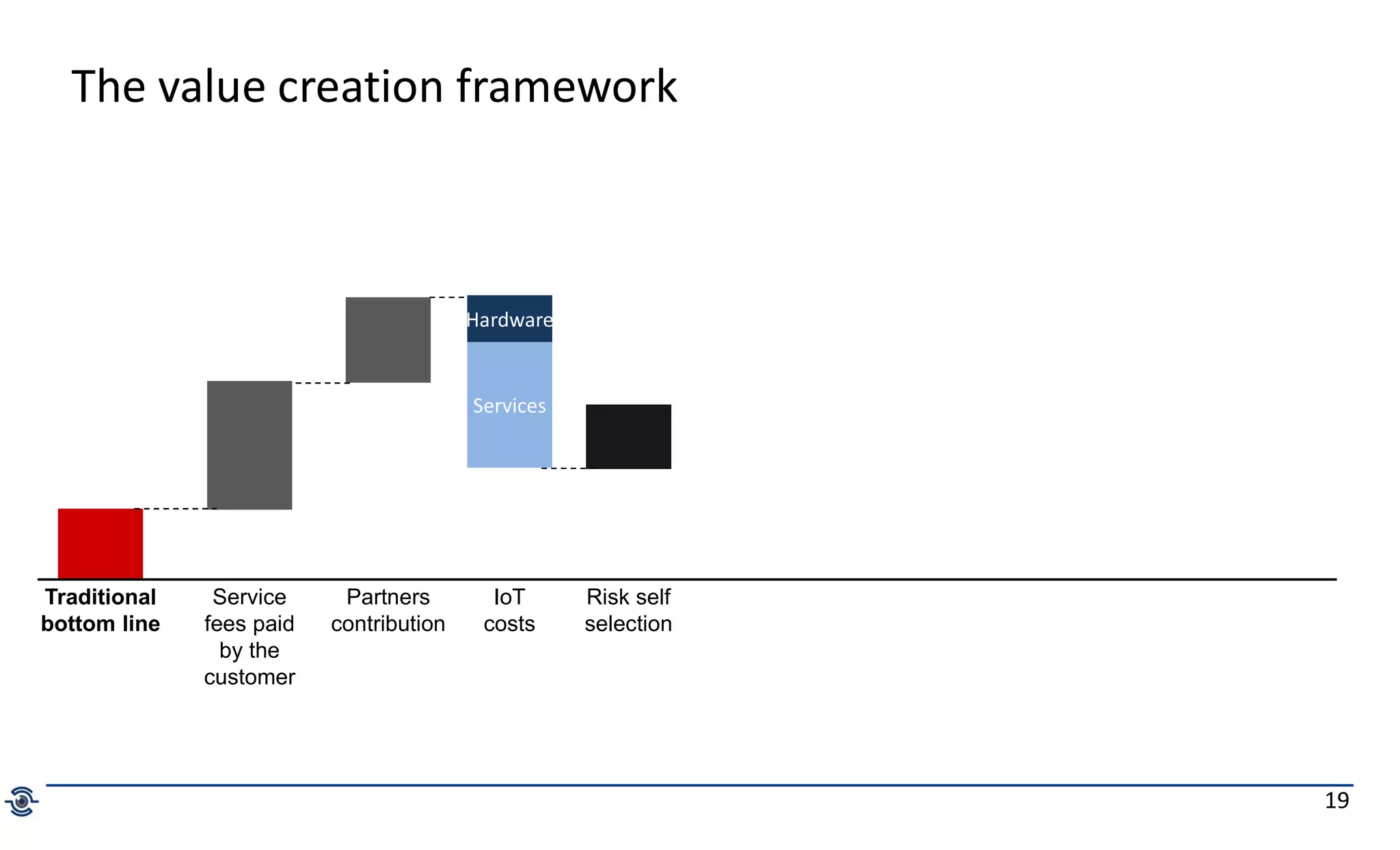

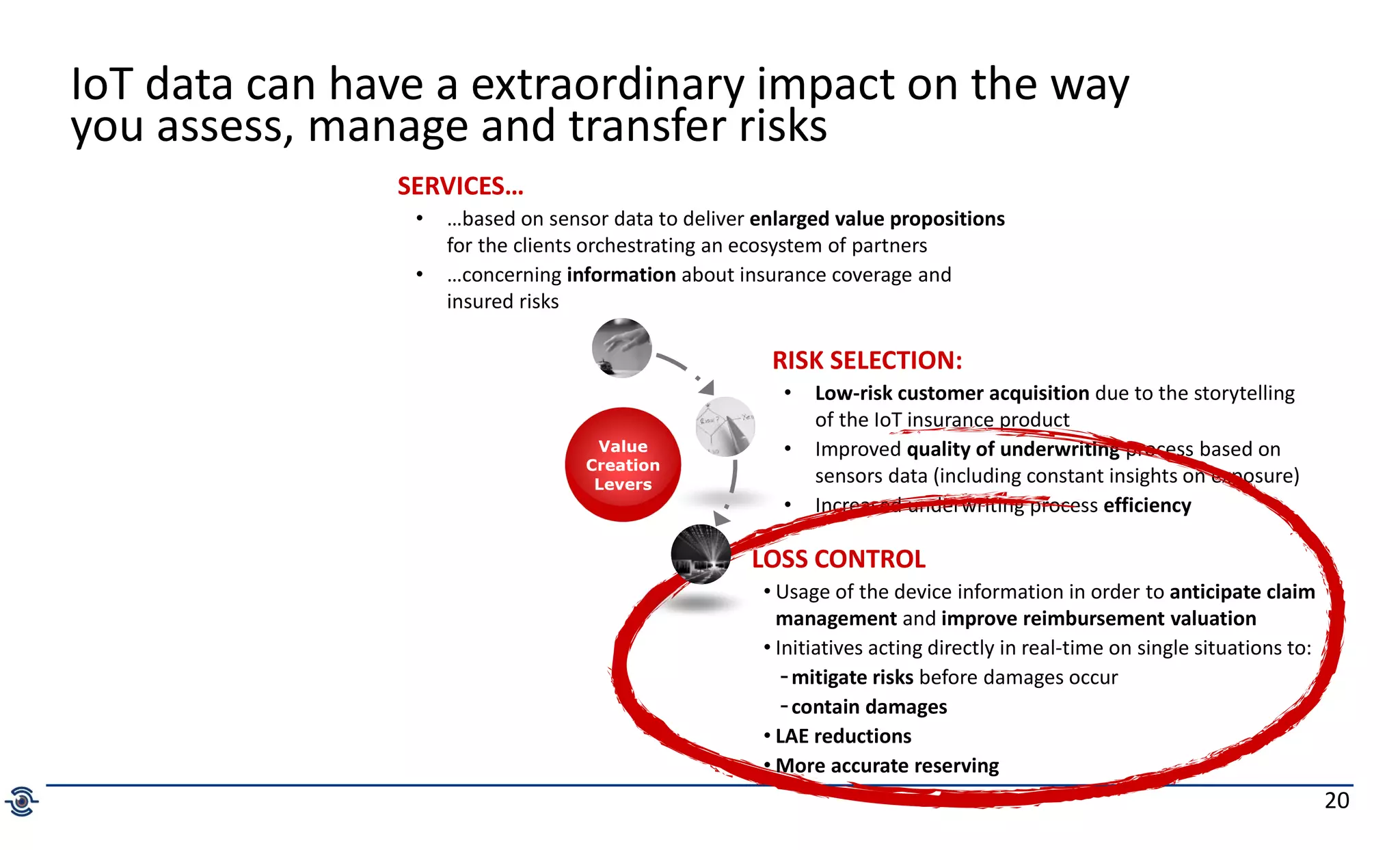

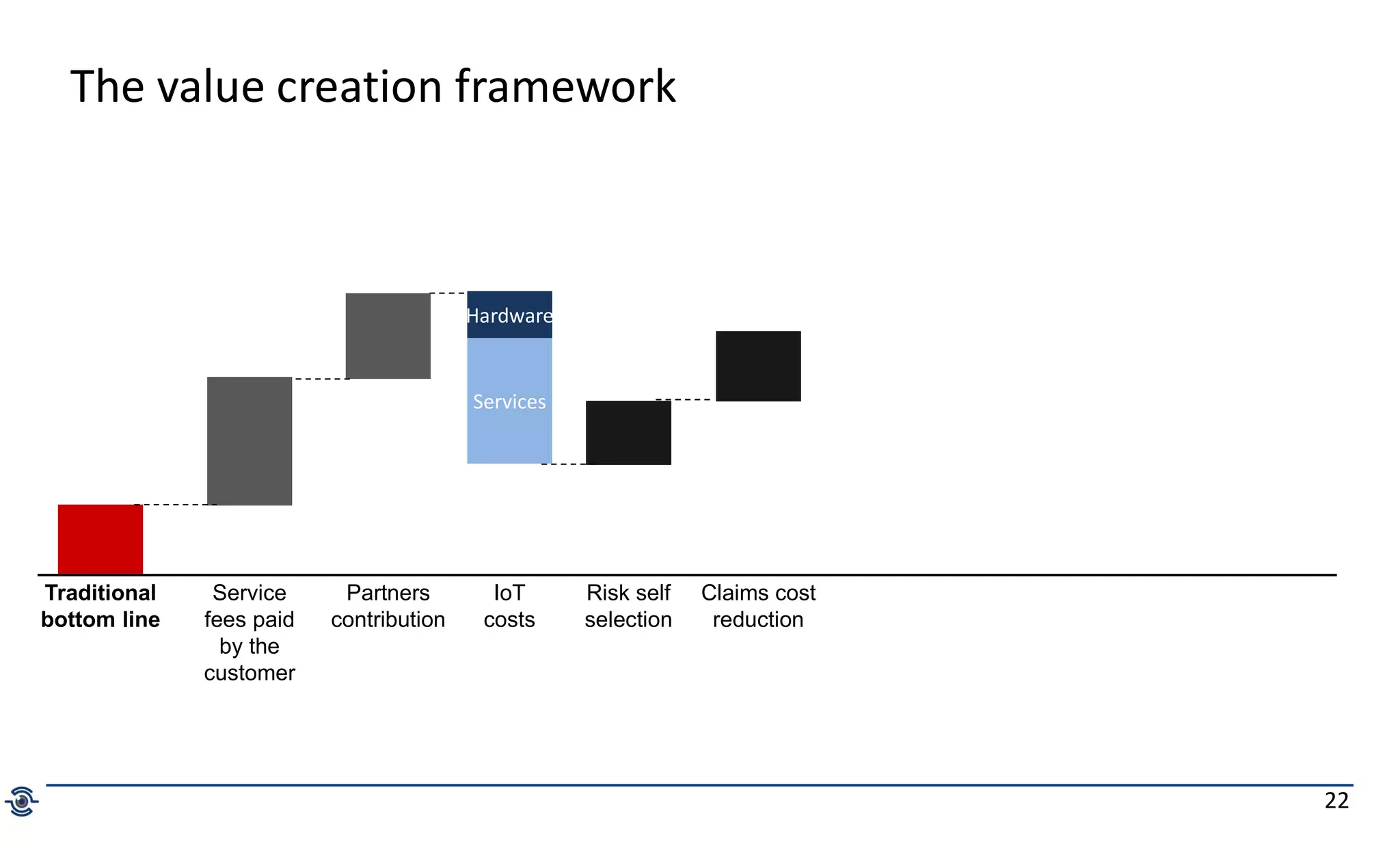

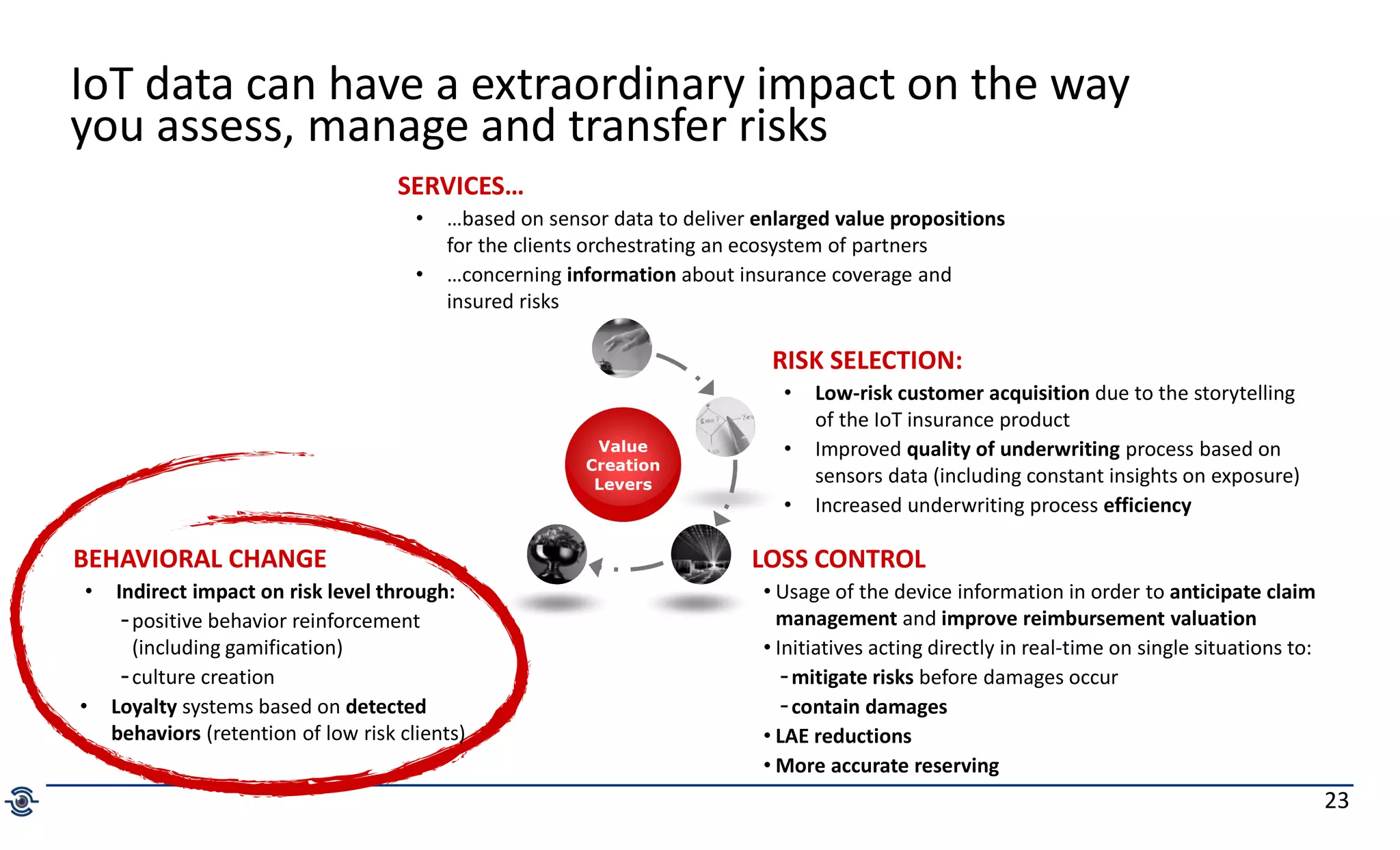

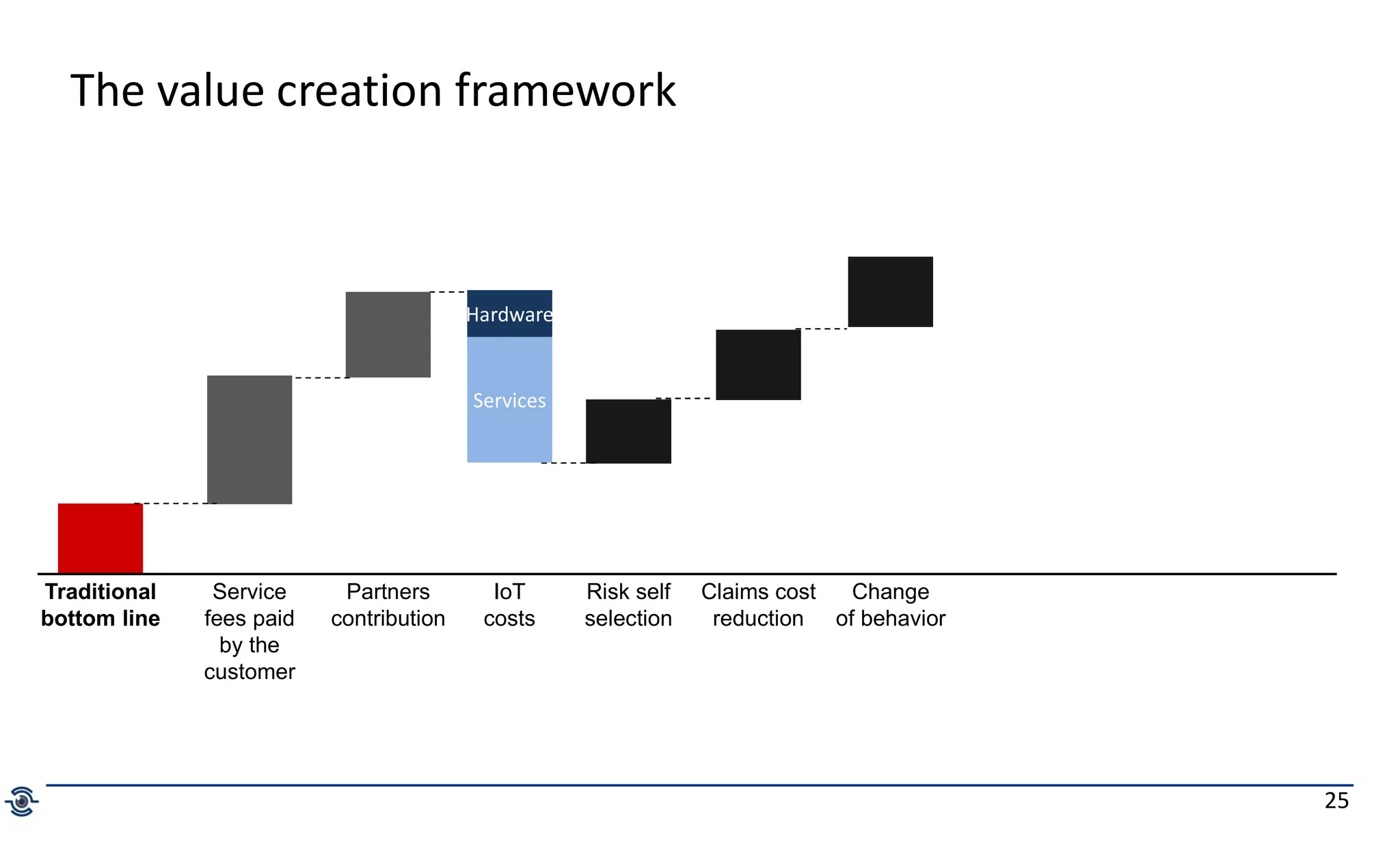

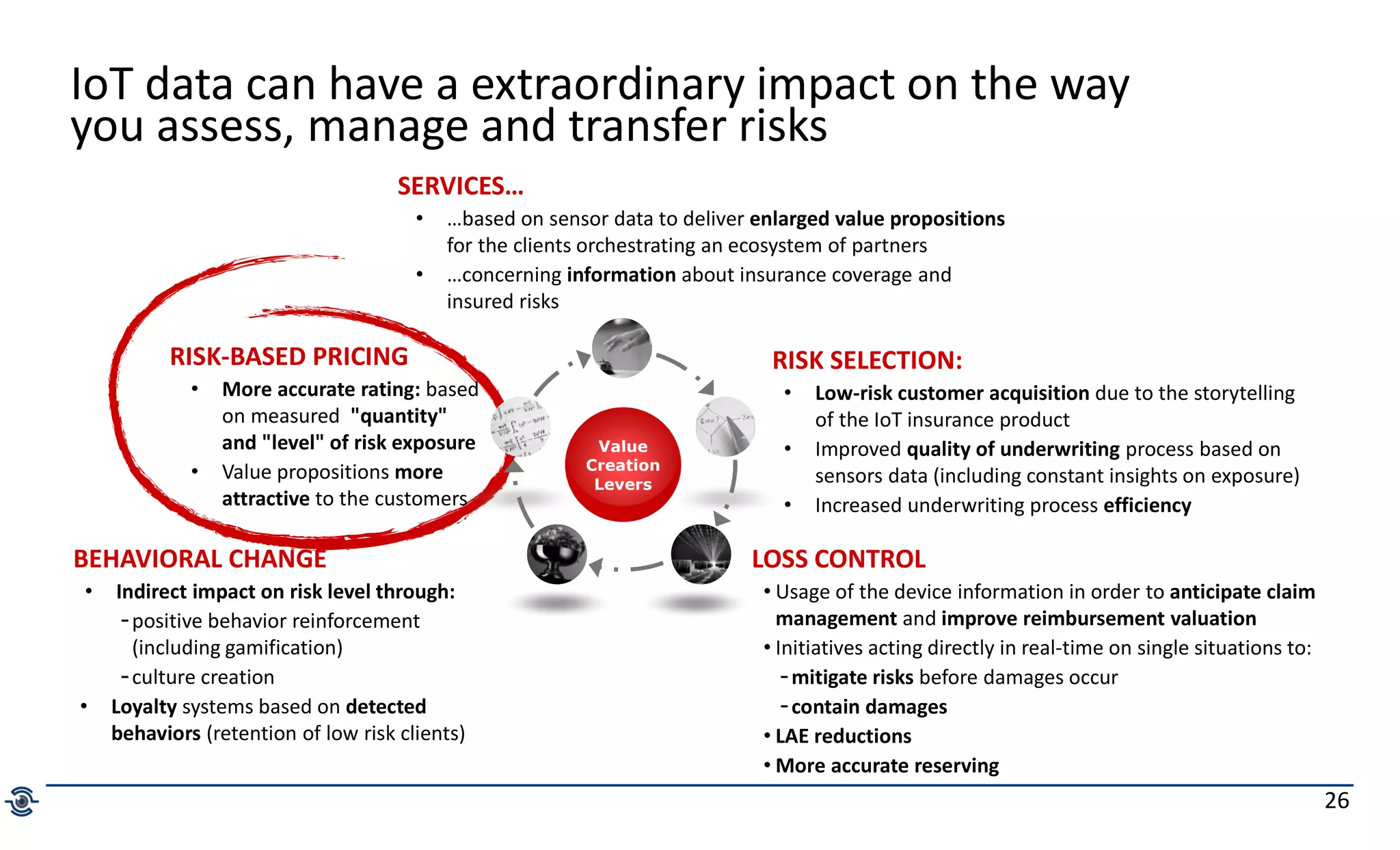

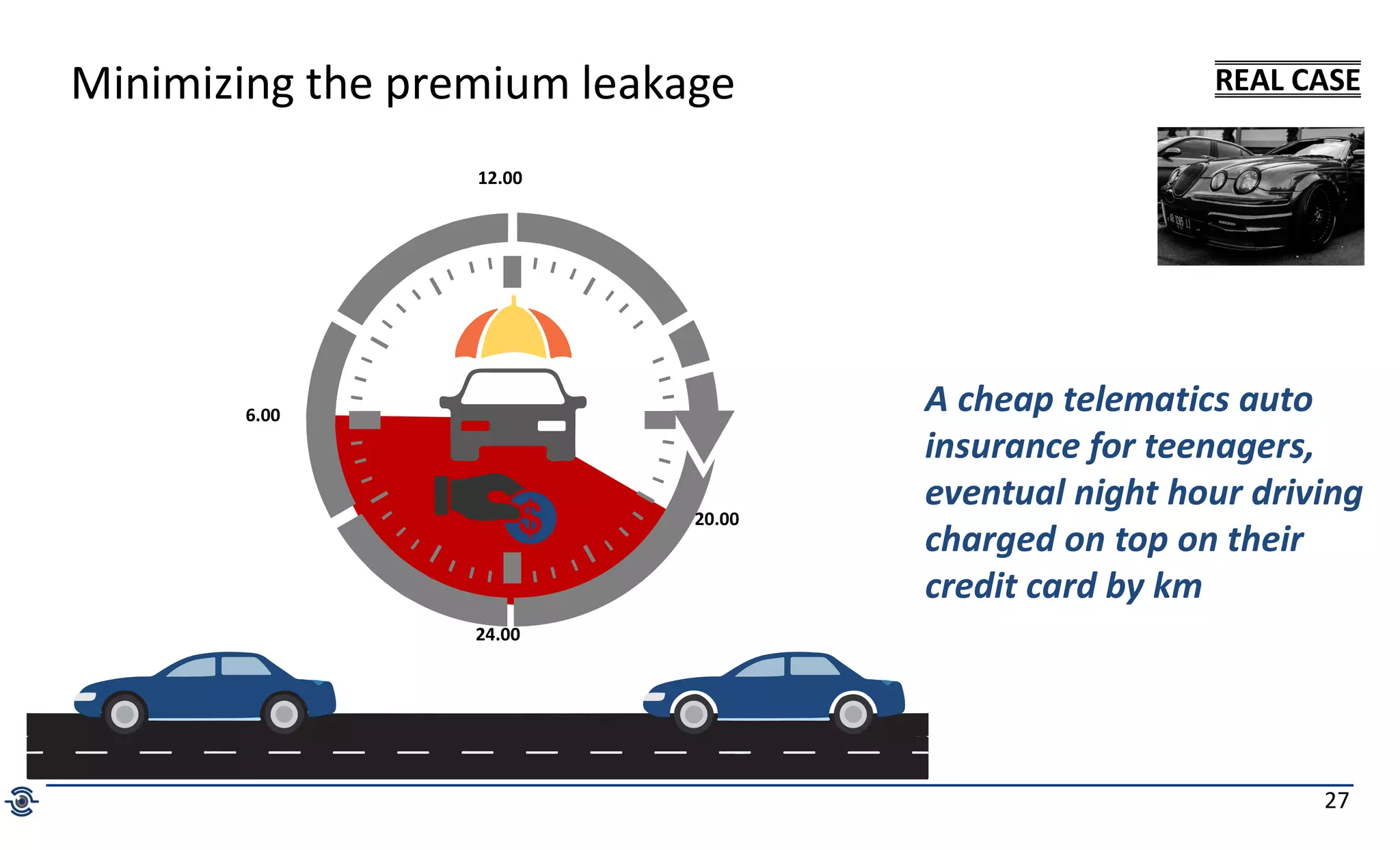

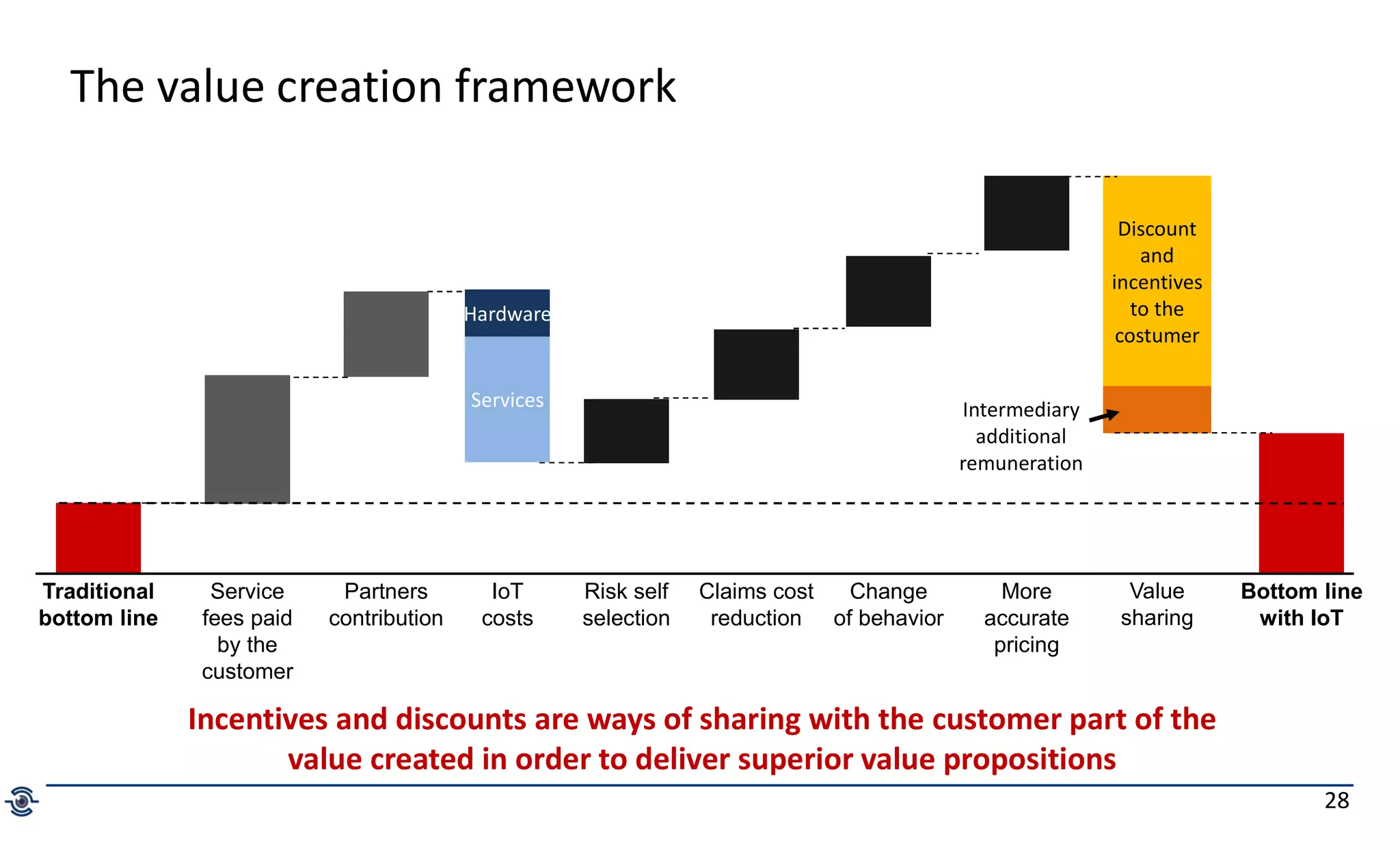

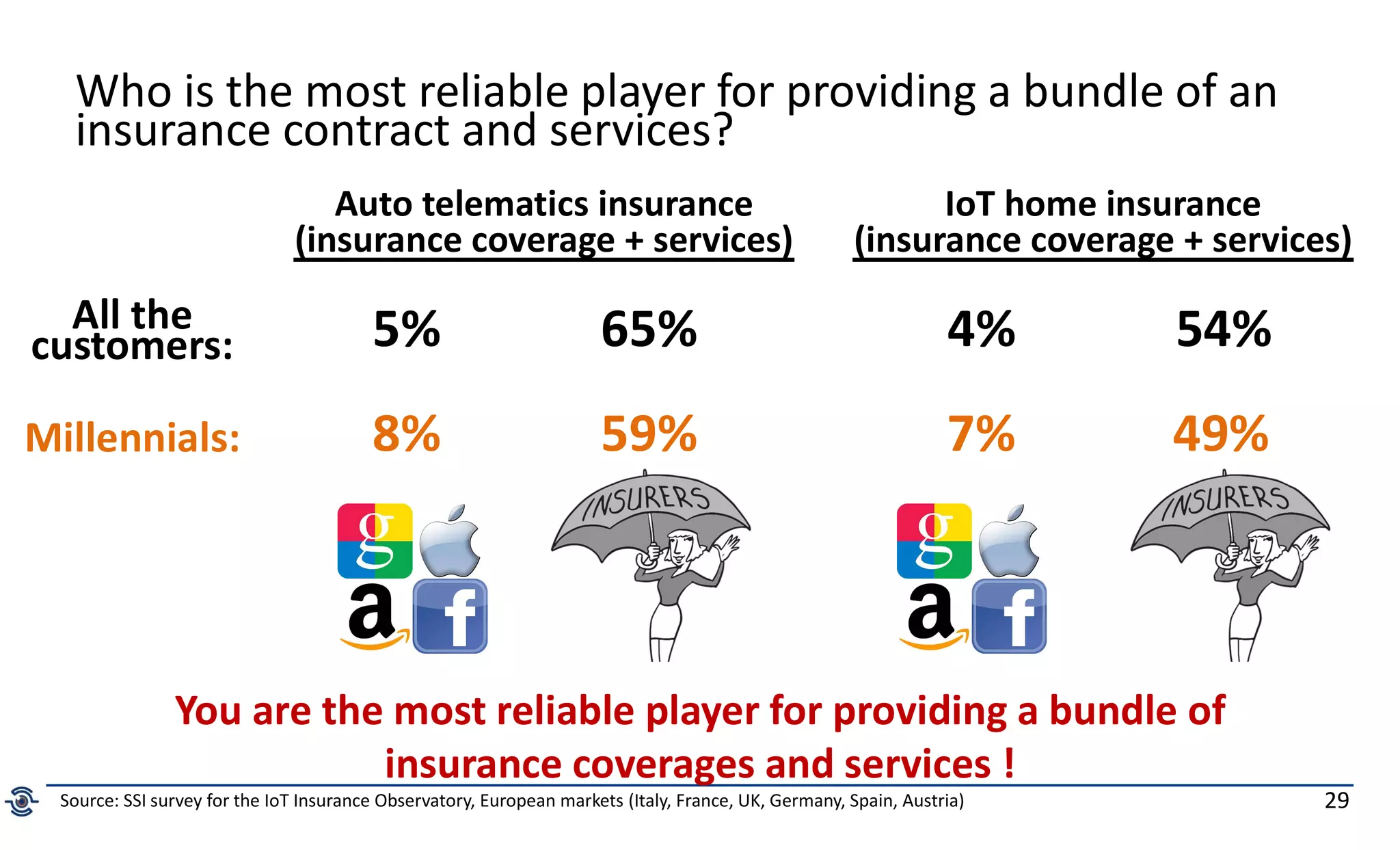

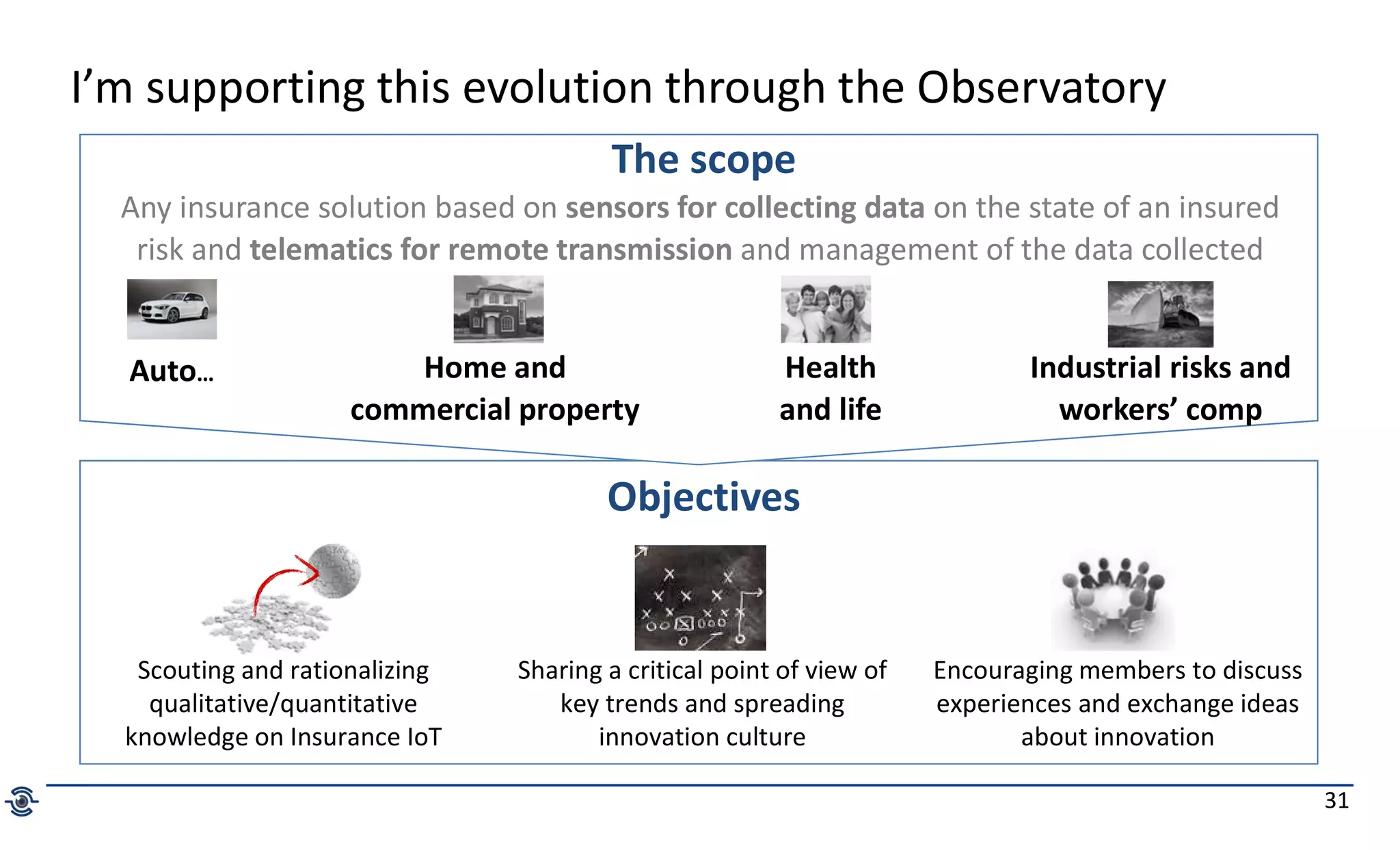

The document discusses the evolution of the insurance industry in the age of insurtech, highlighting how technology can enhance the assessment, management, and transfer of risks. It emphasizes that all insurance entities must adopt insurtech strategies to remain relevant, and details the potential benefits of IoT-enabled insurance products. The author, Matteo Carbone, outlines various strategies for insurers to leverage data and technology to create value-added services for clients, thereby improving customer engagement and retention.