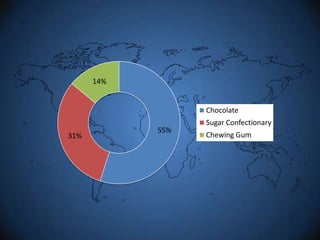

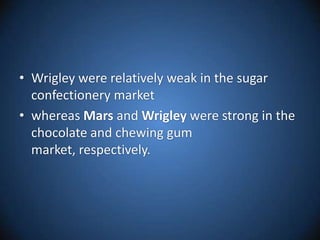

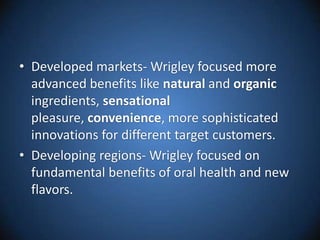

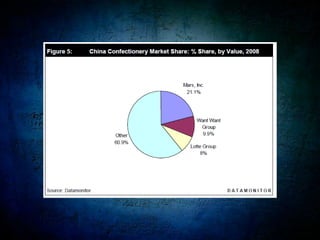

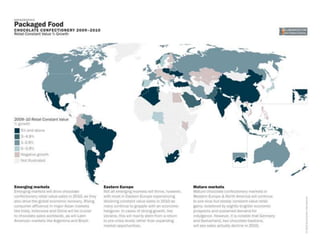

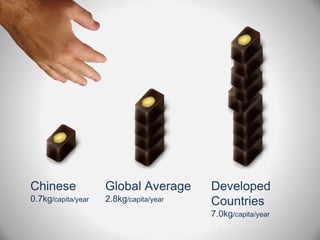

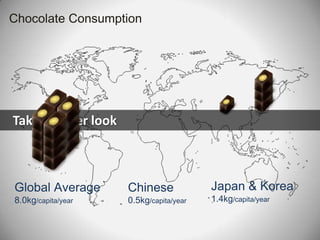

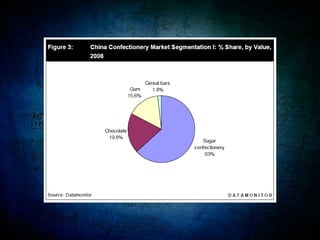

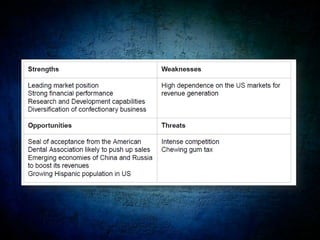

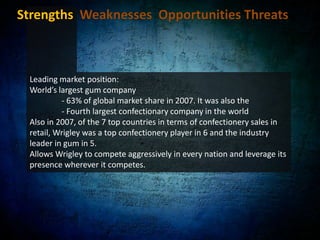

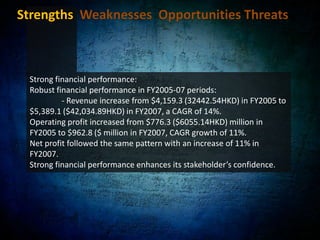

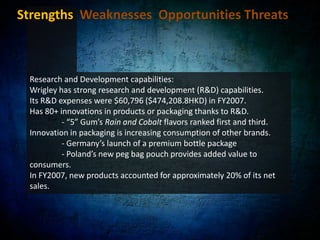

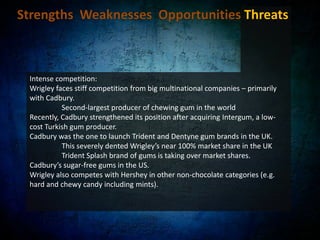

Wrigley has dominated the global gum market for over 100 years but faces new challenges adapting to changing consumer preferences and increasing competition. To strengthen its position, Wrigley is exploring social media marketing, focusing on health benefits to appeal to developing markets like China, and diversifying its product portfolio through the Mars acquisition. Wrigley's strengths include strong brands and R&D but it relies heavily on the US market and faces threats from low-cost competitors. Adapting to marketing trends and leveraging partnerships will be important to sustain growth in China's expanding confectionery industry.