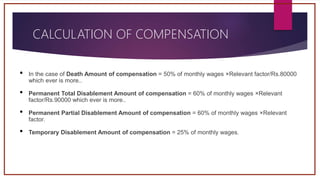

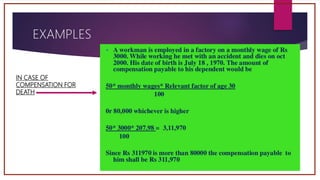

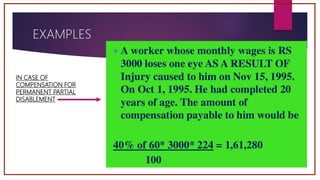

The Workmen's Compensation Act of 1923 provides financial protection to workers and their dependents in the event of accidental injuries related to employment. The Act covers a range of workers in hazardous occupations, excluding armed forces and certain insured individuals, and outlines specific calculations for compensation based on the nature of the injury or death. Its objective is to offer relief and encourage motivation and efficiency in the workforce.