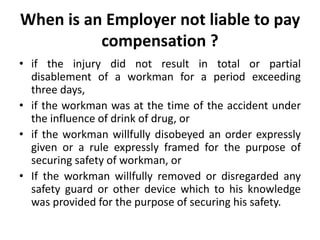

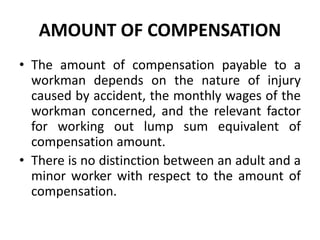

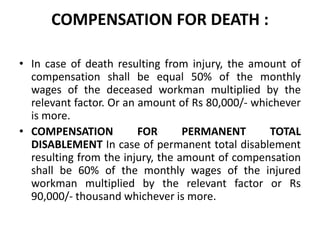

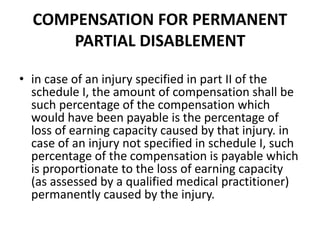

The Workmen's Compensation Act aims to provide relief to workmen and their dependents for accidents arising from employment. It covers all workers, including casual laborers, and establishments not covered by ESI. Employers must compensate workers for death, permanent or temporary disablement, or occupational diseases. Compensation amounts depend on wages and injury type. The Act is administered by state authorities to ensure compliance.