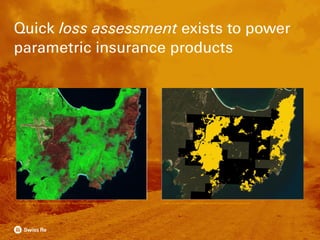

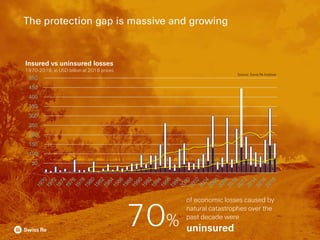

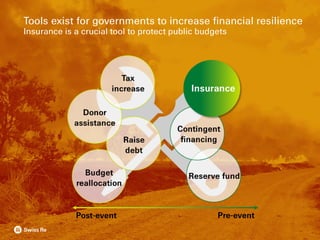

This document discusses adapting to climate change in wildfire management. It notes that 70% of economic losses from natural disasters over the past decade were uninsured, creating a large protection gap. Insurance can help governments increase financial resilience by providing funds for emergency response, reconstruction, and supporting uninsured households after disasters. Parametric insurance in particular provides fast payouts based on an index or trigger without a claims assessment process, making it an affordable option. However, changes in disaster frequency and severity due to climate change make risk assessment challenging.

![~5 ~10 ~15

Out of pocket

Contingent

financing

Reserve funds

Insurance/

Reinsurance

Insurance is

most effective

to cover severe,

sudden and

accidental

events outside

otherwise

available

financial means

Loss

Loss return period

Return period [years]

>15-1000](https://image.slidesharecdn.com/1-200120132903/85/Wildfire-Workshop-Presentation-Gary-Lemcke-8-320.jpg)