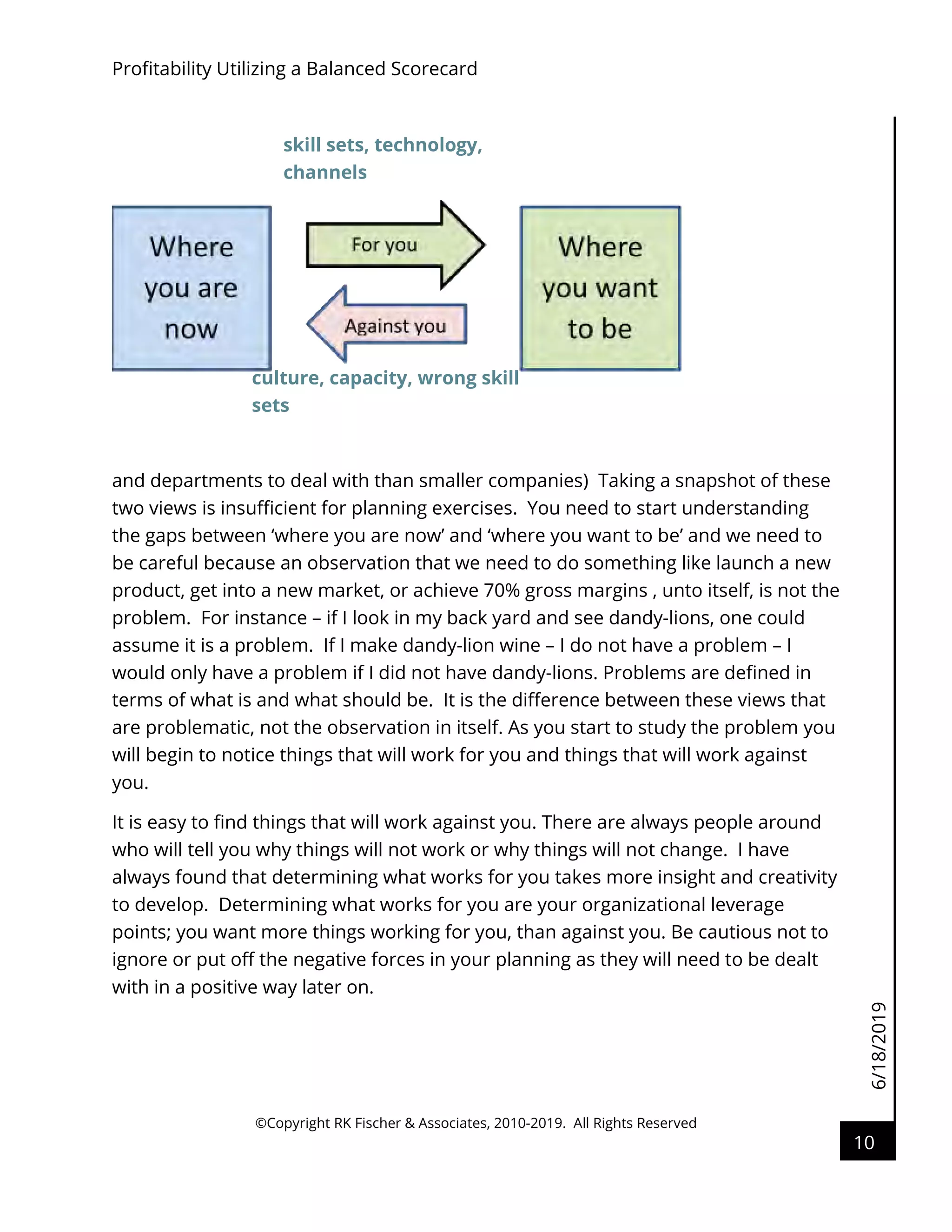

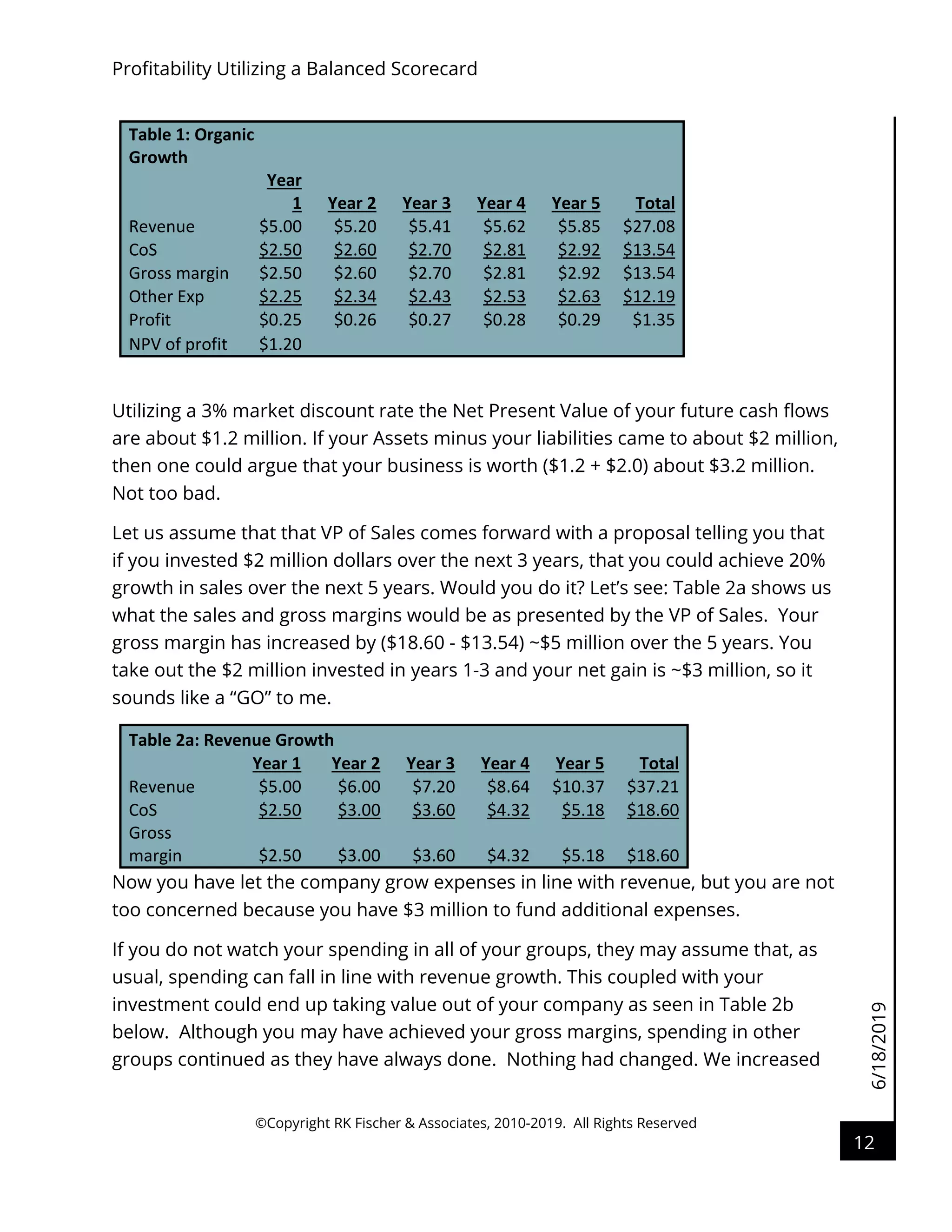

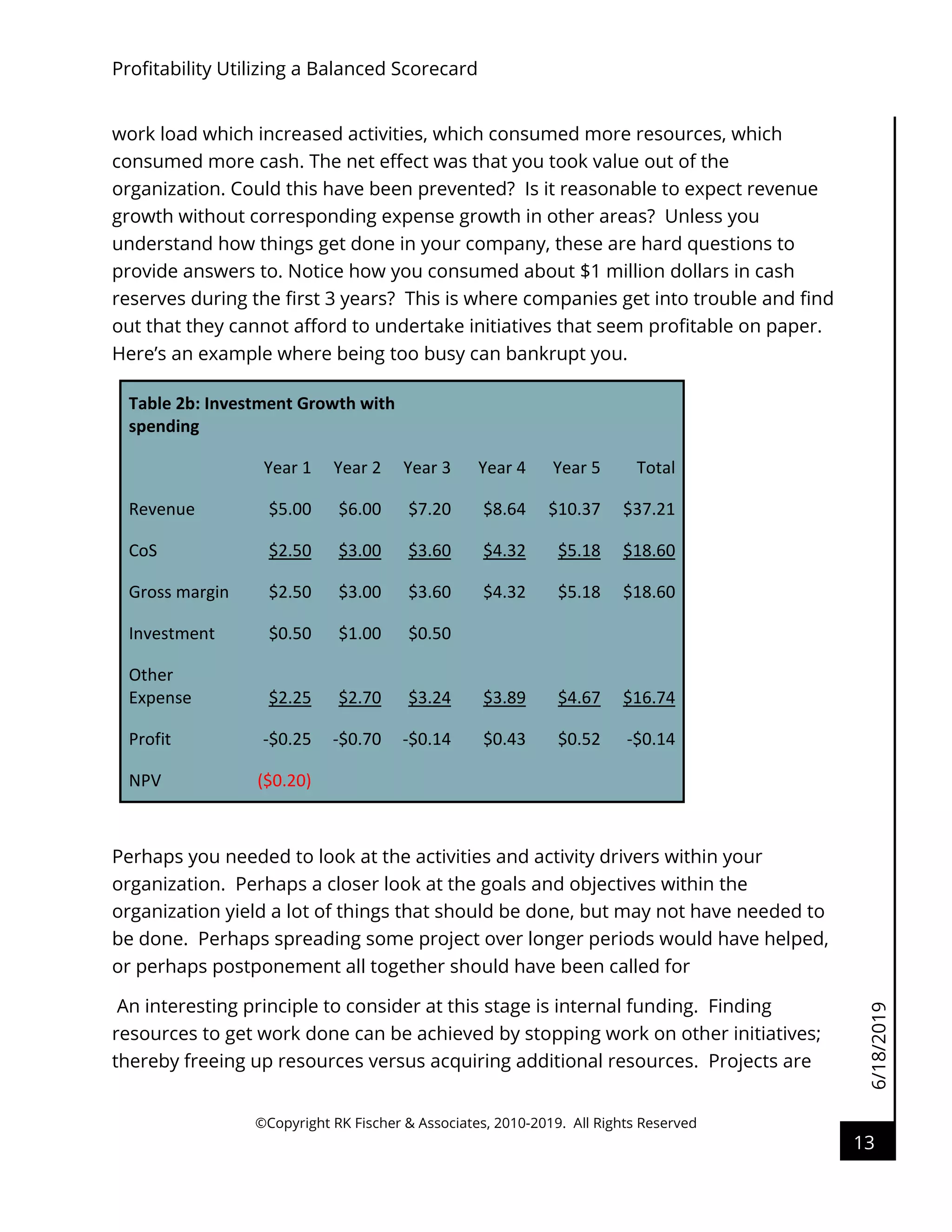

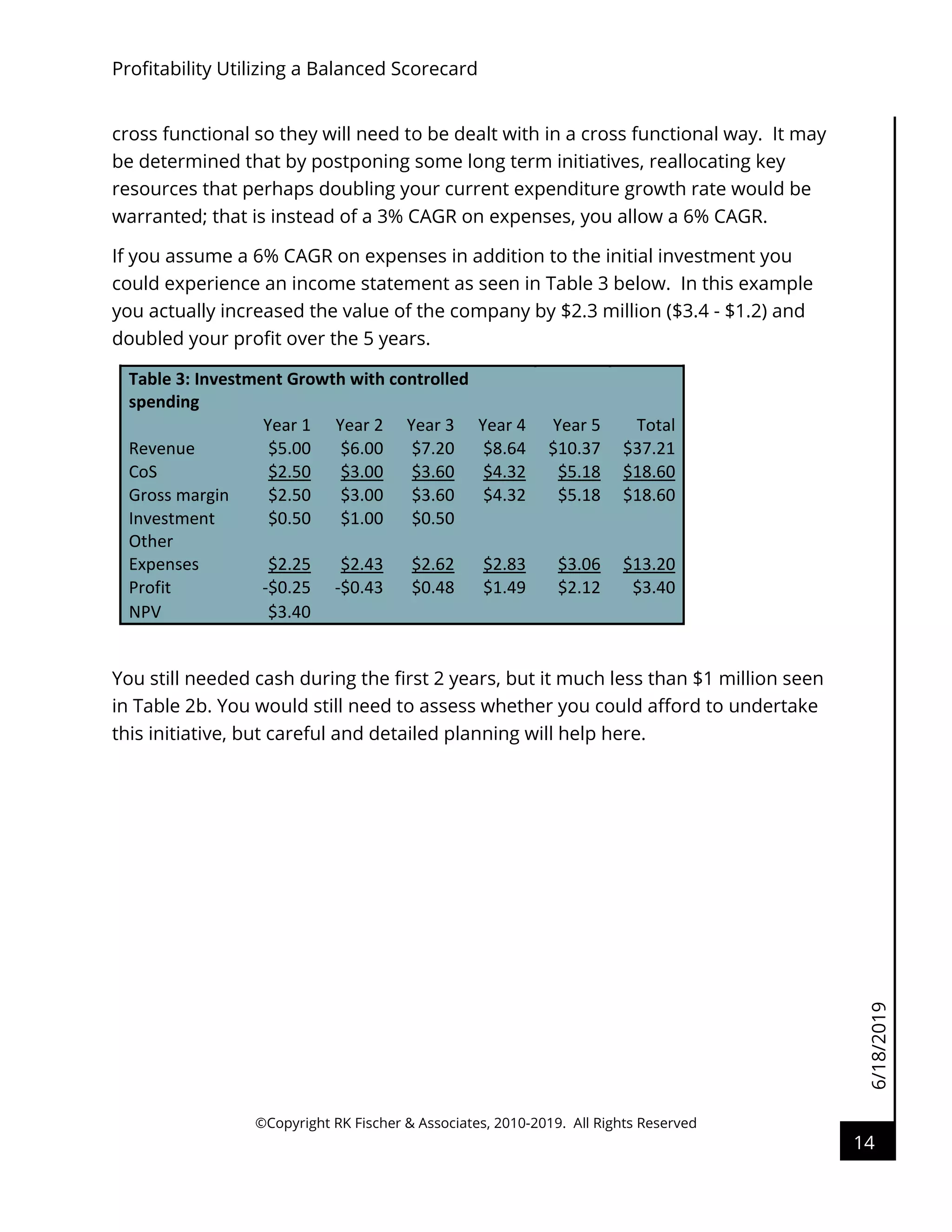

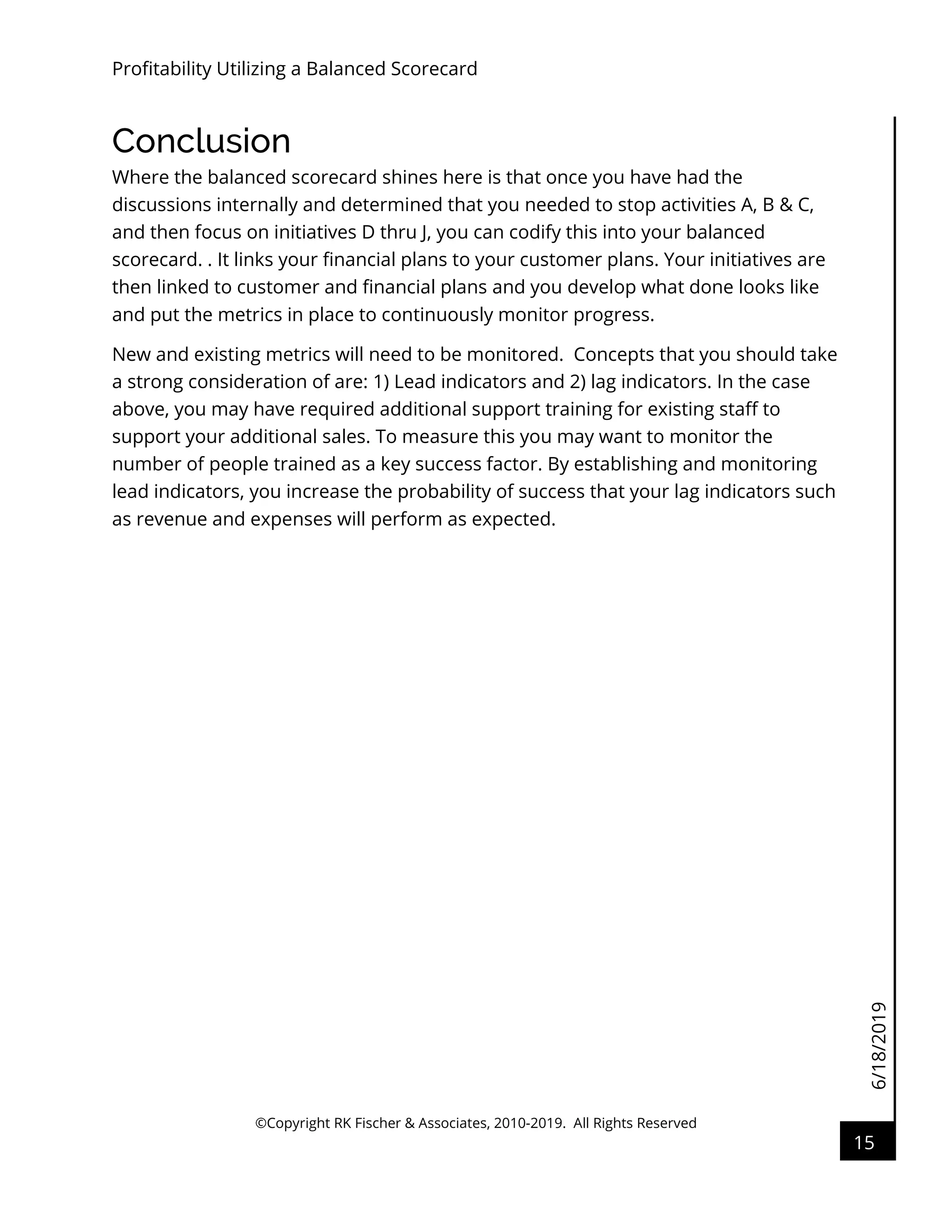

The document outlines the services provided by RK Fischer & Associates, a business consulting firm that aids owner-operated businesses in improving profitability and operational performance. It emphasizes the importance of self-assessment, strategic planning, and the balanced scorecard (BSC) process to achieve long-term business success. The firm focuses on personalized solutions tailored to each client's unique challenges and goals, with a team experienced in various industries and a commitment to helping small and medium businesses thrive.