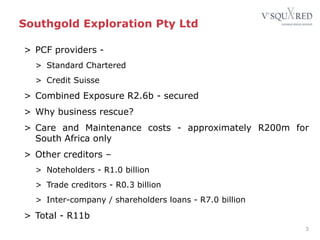

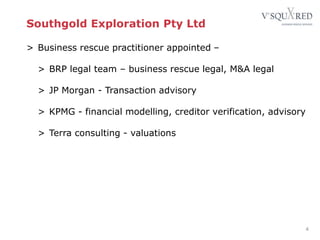

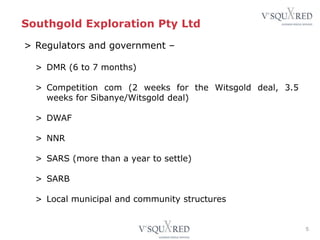

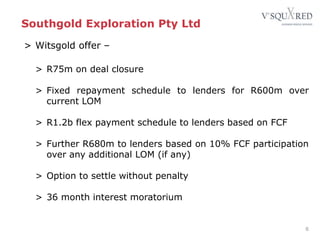

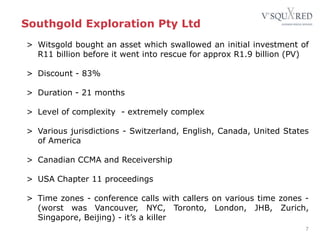

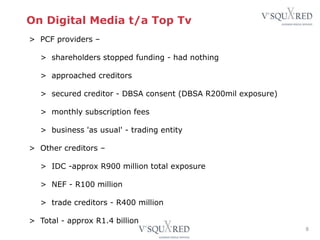

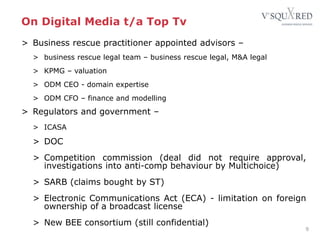

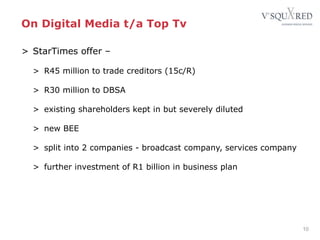

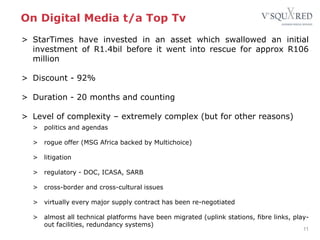

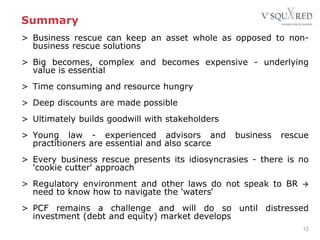

This document discusses two case studies of companies, Southgold Exploration Pty Ltd and On Digital Media t/a Top TV, that underwent business rescue in South Africa. For both companies, significant discounts were achieved through business rescue, with Southgold seeing an 83% discount and On Digital seeing a 92% discount. However, both cases were also extremely complex, time-consuming, and resource-intensive due to issues such as multiple jurisdictions, regulations, politics, and litigation. The document emphasizes that while business rescue can preserve asset value, complexity drives up costs, and regulatory barriers remain a challenge in South Africa. Experienced advisors like business rescue practitioners and legal counsel are essential to navigate complex business rescue cases.