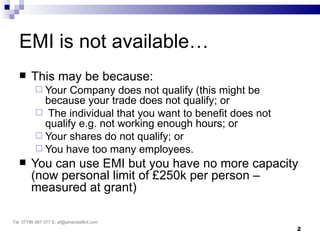

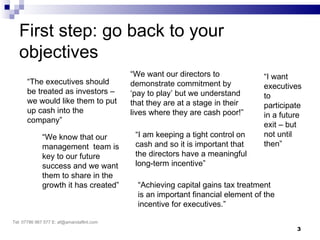

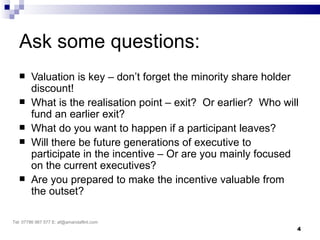

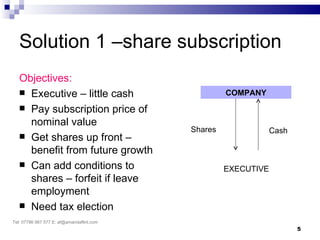

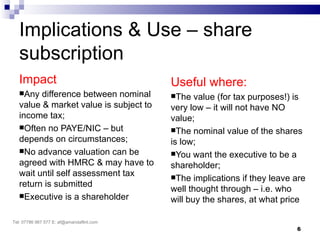

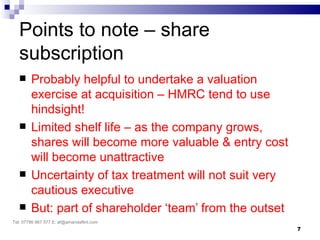

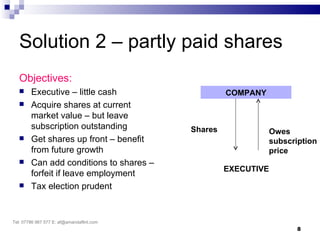

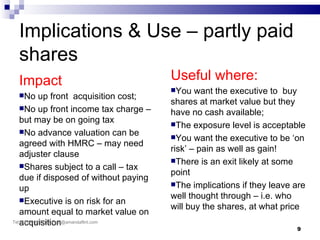

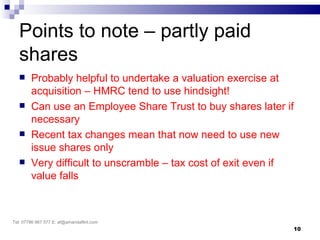

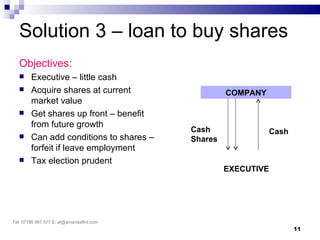

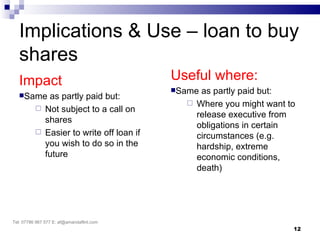

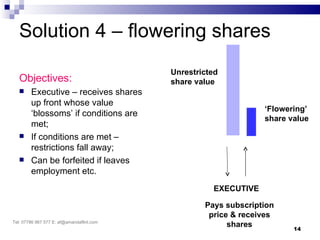

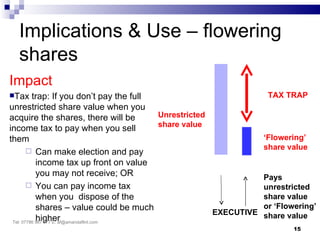

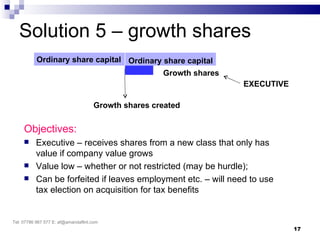

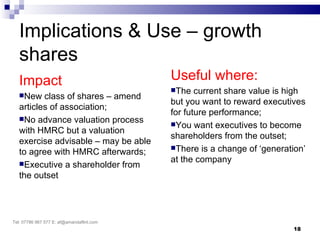

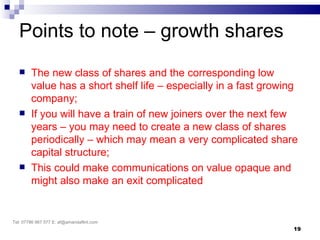

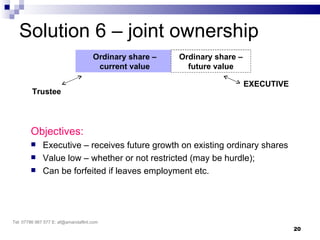

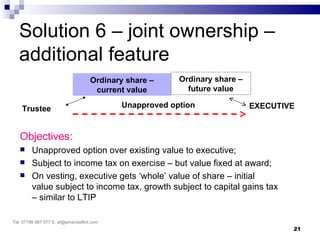

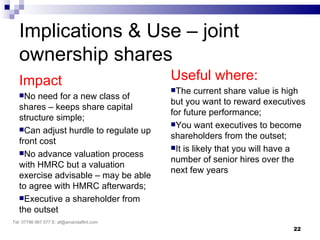

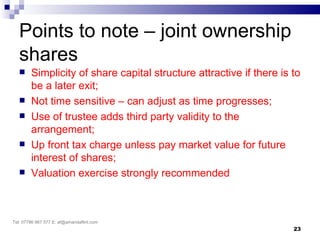

This document outlines various options and considerations for companies regarding the issuance of Employee Management Incentives (EMI) when certain criteria are not met. It discusses alternative solutions such as share subscriptions, partly paid shares, loans to buy shares, flowering shares, growth shares, and joint ownership structures, highlighting their implications, impacts, and the importance of tax planning and compliance. It emphasizes the need for careful evaluation of company objectives and ongoing communication with executives to ensure effective implementation of these incentives.