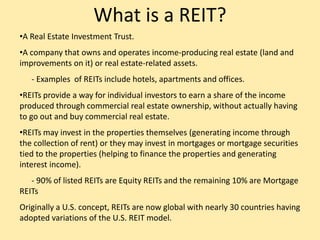

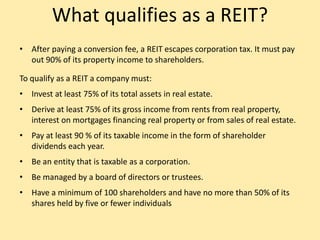

A REIT, or Real Estate Investment Trust, is a company that owns and operates income-producing real estate or real estate related assets. REITs allow individual investors to earn income from commercial real estate ownership without having to purchase properties directly. REITs invest in real estate properties or mortgages/mortgage securities tied to properties, generating income through rent collection or interest payments. To qualify as a REIT, a company must invest at least 75% of its assets in real estate, derive at least 75% of its income from real estate, and pay out at least 90% of its taxable income as dividends.