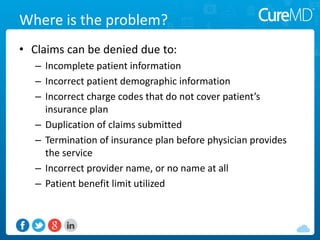

This document discusses how medical practices can reduce denied claims and improve revenue. It notes that practices typically lose 7-10% of revenue to denials that could be resubmitted. It recommends keeping denials below 4% and identifies common reasons for denials like incomplete information. It suggests practices review denial reports, train front desk staff to collect accurate data, ensure accurate coding, have clear policies, and address any issues found to minimize denials and resubmit successfully. Technology like EHRs can help by automating tasks and identifying errors.