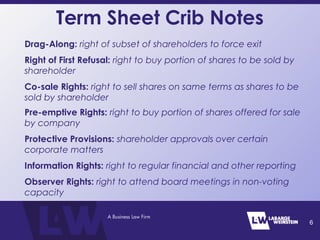

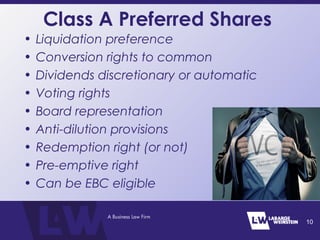

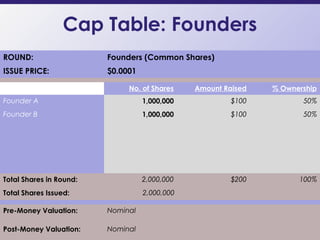

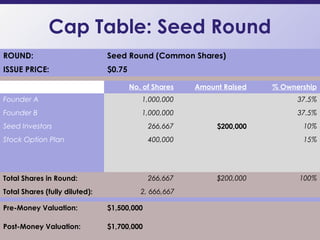

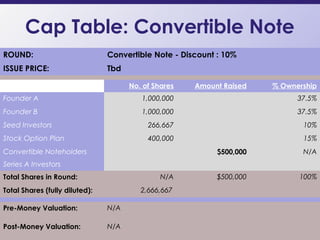

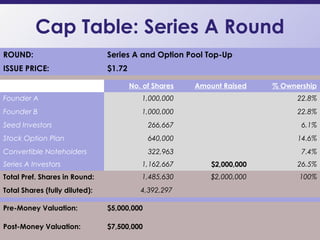

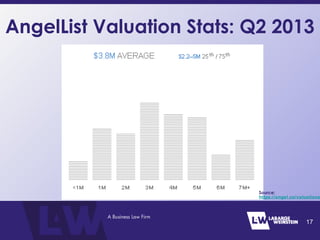

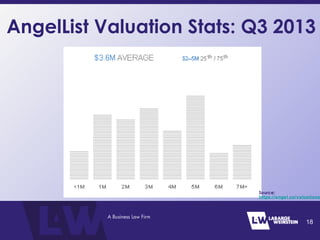

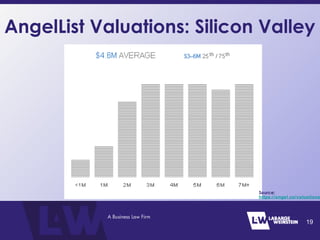

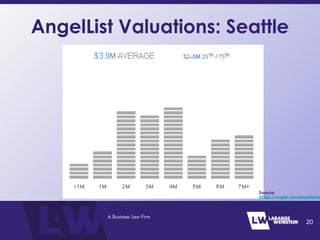

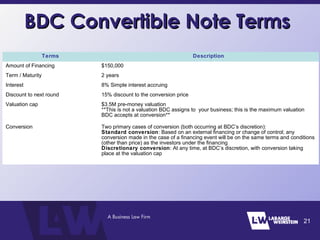

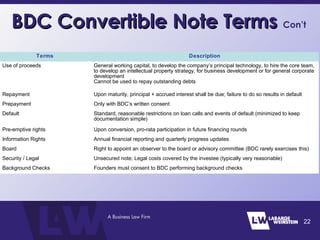

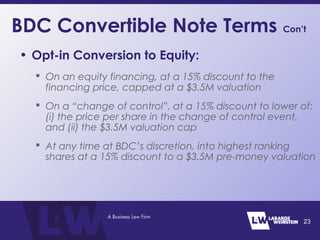

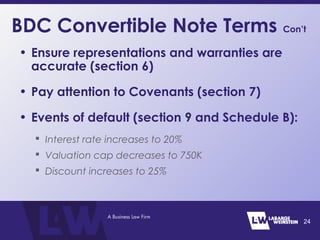

This document summarizes a presentation on seed financing structures for startups. It discusses common share equity, convertible debt, and preferred shares as options for seed financing. It also covers topics like capitalization tables, valuation, and terms of convertible notes from the Business Development Bank of Canada (BDC). Examples of capitalization tables are provided to illustrate how ownership is allocated for founders, investors, and option pools through different financing rounds.