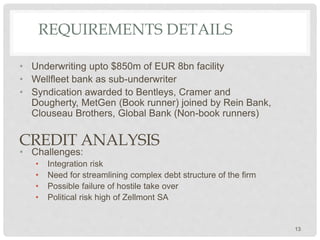

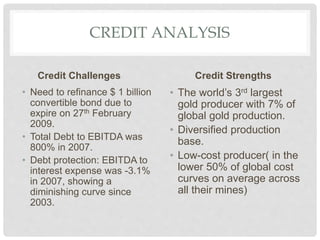

Wellfleet Bank, established in London in 1847, has grown to hold $329 billion in assets and operates in 78 countries after multiple acquisitions. The bank's main focus is on corporate and consumer banking, particularly in syndicated and leveraged loans, but it faces significant risks including default, regulatory challenges, and high concentration in its corporate banking segment. Notable proposals include a $850 million facility for Ashar Industries and refinancing a $1 billion convertible bond for Gatwick Gold Corporation, both presenting various credit and operational risks.