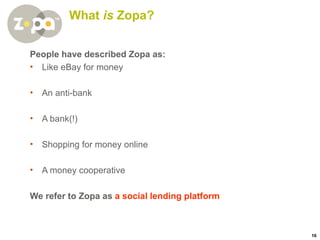

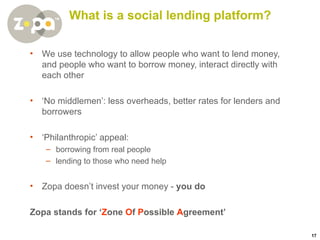

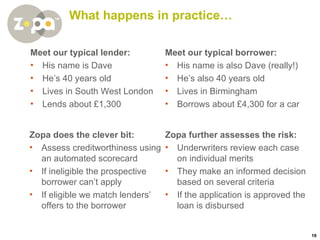

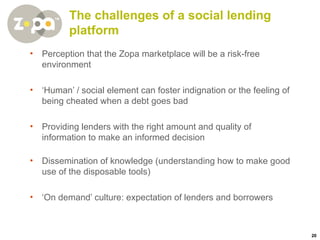

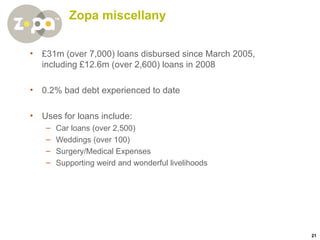

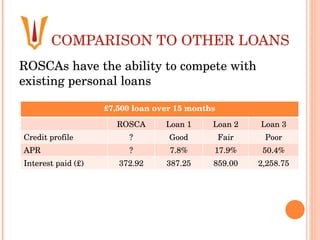

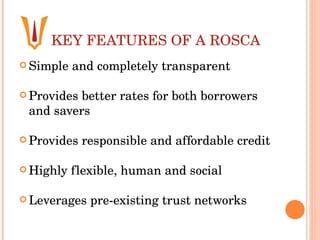

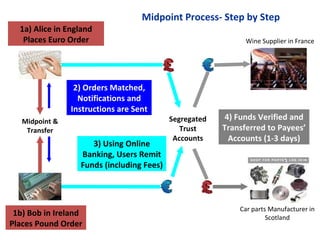

The document discusses a January 2009 event focused on peer-to-peer finance, particularly highlighting the role of innovation in challenging economic times. Key topics include Zopa, a social lending platform that allows direct interaction between lenders and borrowers, and the emerging concept of rotational savings and credit associations (ROSCAs). It emphasizes the potential for individuals to replace traditional financial institutions and the importance of aligning incentives to foster responsible financial behavior.

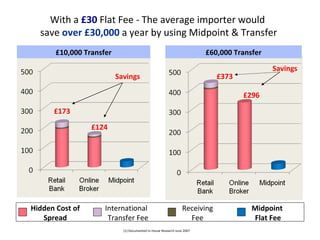

![“ The Foreign Exchange Revolution” Todd Veri – CEO Midpoint & Transfer Ltd [email_address]](https://image.slidesharecdn.com/webank-v10-1232963201538320-2/85/Webank-V1-0-35-320.jpg)

![Disintermediates Foreign Exchange No Spread – Serious Savings Disruptive, marketable, and scalable For further information: email - [email_address]](https://image.slidesharecdn.com/webank-v10-1232963201538320-2/85/Webank-V1-0-43-320.jpg)