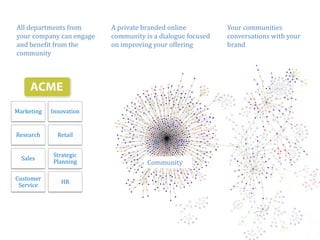

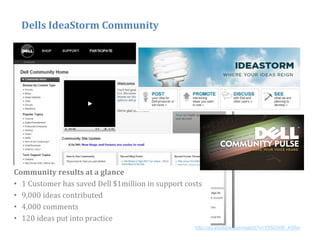

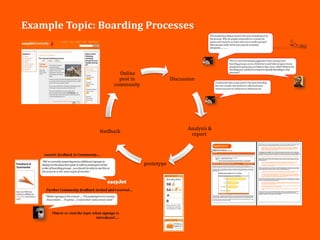

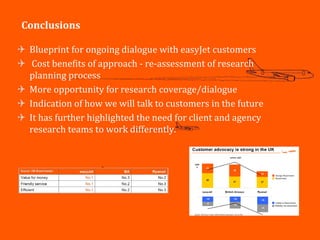

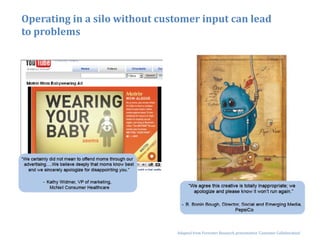

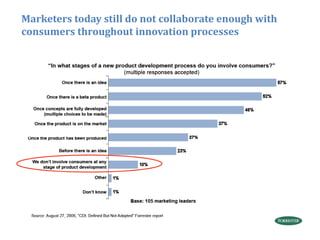

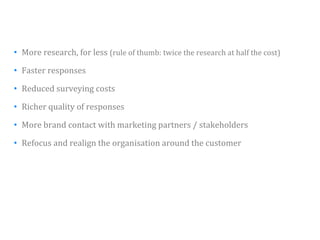

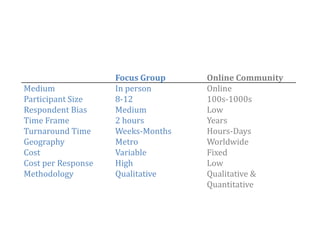

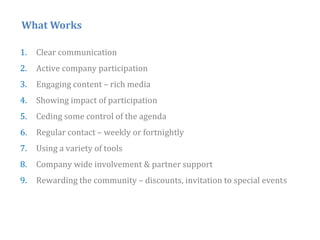

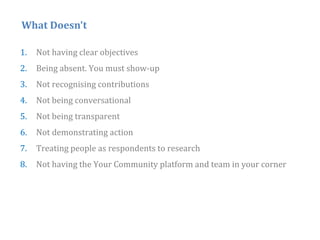

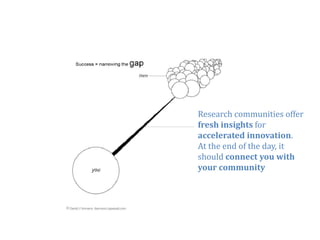

The document discusses the concept of Market Research Online Communities (MROCs), which provide a platform for ongoing dialogue between companies and consumers to generate ideas and feedback. It highlights various case studies demonstrating the effectiveness of MROCs in innovation and customer engagement, showcasing successful examples from companies like Dell and EasyJet. Key features and advantages of MROCs over traditional research methods are outlined, emphasizing cost efficiency, faster responses, and enhanced consumer involvement in product development.