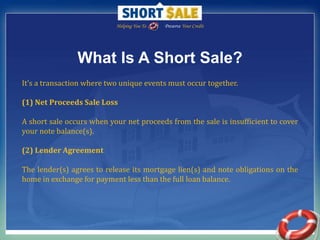

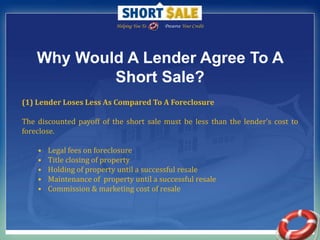

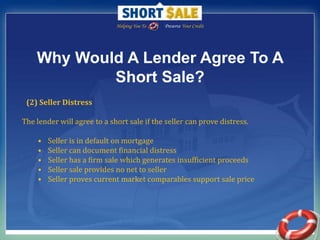

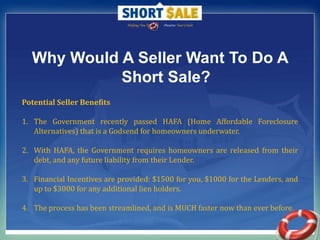

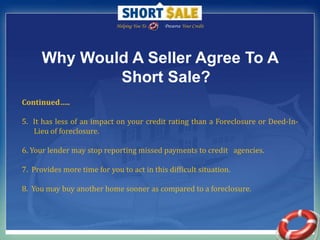

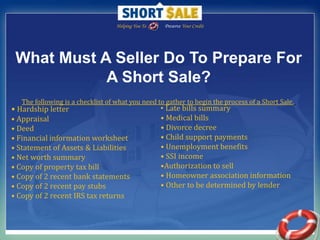

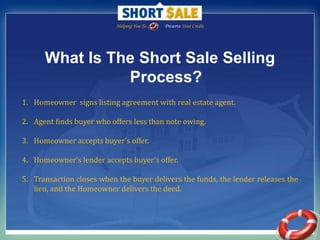

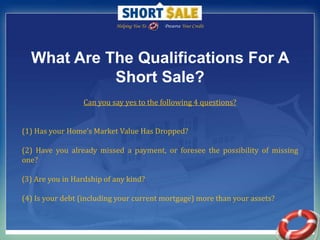

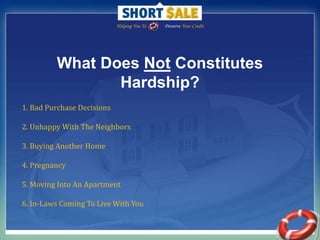

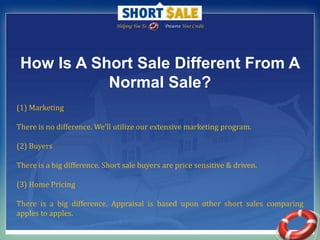

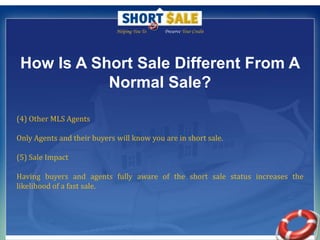

The document explains the concept of a short sale, where a homeowner sells their property for less than the mortgage amount with lender approval to avoid foreclosure. It outlines the benefits for both lenders and sellers, the process and necessary qualifications for a short sale, as well as the consequences, which include credit impacts and potential tax implications. The document also emphasizes the importance of consulting with professionals and preparation for the short sale process.