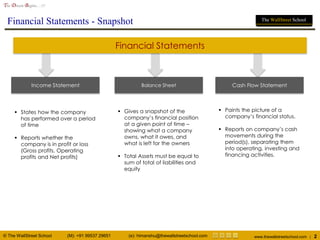

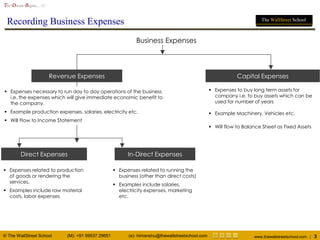

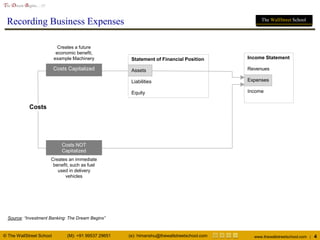

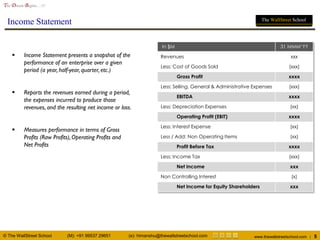

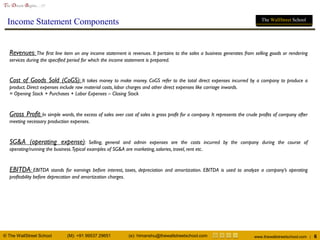

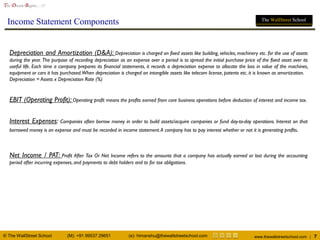

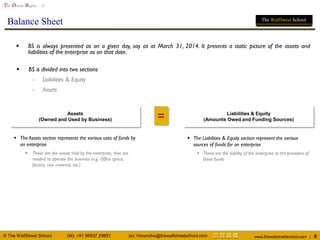

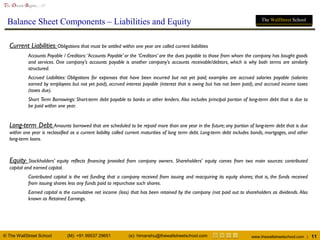

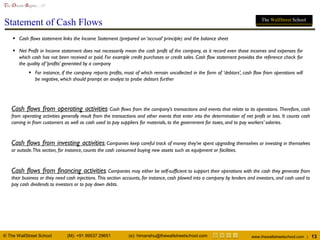

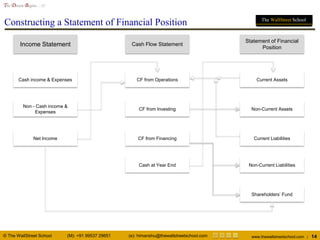

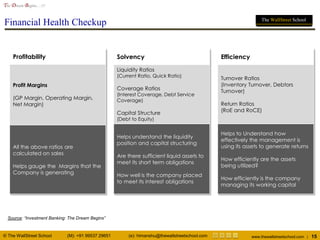

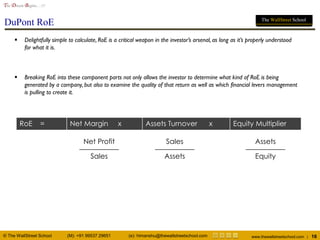

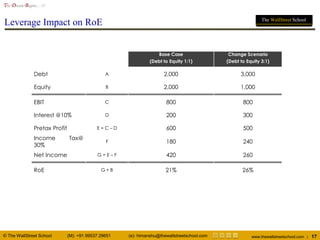

The document provides a detailed overview of financial statements relevant to investment banking, including income statements, balance sheets, and cash flow statements. It covers their components, how to analyze profitability, solvency, and efficiency, as well as key metrics like return on equity (ROE) and leverage effects. It also discusses different company reports such as 10-K and 10-Q filings that are vital for understanding corporate financial health.