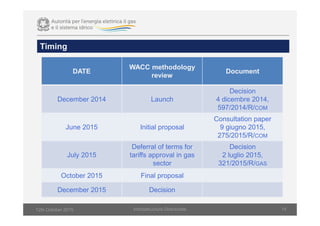

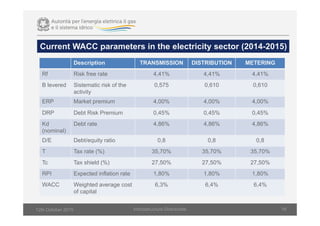

The document summarizes Andrea Oglietti's presentation on the Italian energy regulator's review of its WACC calculation methodology. The presentation outlines reasons for the review, including changes in capital markets since the global financial crisis. It then covers the regulator's general approach and initial views on estimating components of the WACC like the risk-free rate, equity risk premium, debt costs, and inflation adjustments. The presentation also discusses setting activity-specific parameters and potential mid-period reviews of the WACC.