The document critiques the restrictions imposed by the Income Tax Act Section 44AB, highlighting that it limits compliance opportunities for non-CA tax professionals and results in a narrow tax base in India. It argues for broader recognition of cost accountants as equally competent in various accounting domains compared to chartered accountants. Additionally, it questions the rationale for the audit requirements under Section 44AB and suggests these restrictions deviate from the original legislative intent.

![GOVERNMENT OF INDIA

INCOME.TM DEPARTMENT

OFFICE OF THE ADDITIONAL DIRECTOR OF INCOME TAX (CPC)(e-Filing)

Centralised Processing Centre, I Floor, Prestige Alpha Building,

No. 48/1, 4Sl2,Beratenagrahara, Hosur Road, Bangalore-560 100.

dd l. DIT/CPC(e-Fi li ne)/Rrt/ 2oLs-L6/ Dated: 04/06/20L5

The CPIO,

CPC, Bangalore

Madam,

sub: Application u/s 6(3) of the RTI Act, 2005 filed by shri B s K Rao - reg.

Ref: F.No/l nfo/46/ AprnlcPto/2oL5-!6 dated 25/05l2oL5

With reference to the above mentioned application. The response in respect of

the said RTI application is as follows:-

Yours faithfully

Deputy Director(Systems)

CPC, e-Filing,Bangalore.

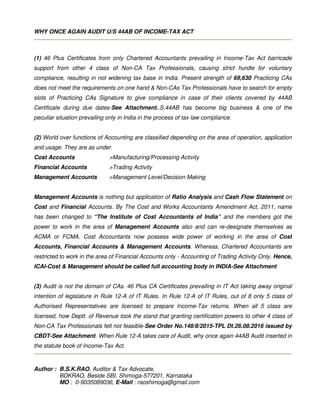

Particulars Asst. Year 20I2-t3 Asst.Year 2Ot3-L4 Asst. Year 1OL4-L5

Total lncome-Tax Admitted in ITR-4

(nupees tn Crores) 43996 4366135604

Total lncome-Tax Admitted in ITR-5

(Rupees ln Crores) 2]-282 25294 27942

Total lncome-Tax Admitted in ITR-6

(Rupees ln Crores) 242707 262628 29033s

Number of Tax Audit Cases Covered 1871845 L757697 L832547

Number of Unique Auditors signed 69L47 59133 59630

EXHIBIT-2](https://image.slidesharecdn.com/wa44abexhibits-160909154957/85/Wa44-ab-exhibits-2-320.jpg)