document

- 1. Before Directorate of Income-Tax (Systems), ARA Centre, E-2, Jhandewalan Extension, New Delhi-110055 “Accountant” as defined under Explanation to Section 288 of Income-Tax Act should not be allowed to appear before Income-Tax Authorities U/s 288(2)(iv) of Income-Tax Act, which is also in the interest of Govt. revenue (1) Even ignoring latest Court Verdict/Opinion/BCI Directions (See Attachment) about practice of law by only enrolled Advocates, Accountant in no case be allowed to appear before Income-Tax Authorities on the following grounds. Therefore, appearance clause for Accountant U/s 288(2)(iv) of Income-Tax Act required to be deleted from the statute book of Income-Tax Act :- (a) As Accountant is authorized to conduct Tax Audit for Revenue U/s 44AB of Income-Tax Act, he/she should not be allowed to appear & act again for the same interested assesse (Conflict of Interest), If allowed there is no meaning for independence of Auditor conducting tax audit for revenue. This is not allowed even before court of law as per the latest precedents on the issue. (b) Income-Tax Deptt. may disqualify only Income-Tax Practitioner for professional negligence U/s 288(5)(b) of Income-Tax Act, but can not take any action on Accountant for professional negligence. At the most, Income-Tax Deptt. may write to his/her professional body to seek action for professional misconduct U/s 288(5)(a) of Income-Tax Act. As Accountant is not issued any license to practice law, his/her professional body restrained to take any action for professional misconduct against the directions of Income-Tax Deptt. (c) Power of attorney (Vakalatnama) to practice law can only be given to Advocates. Practice of law in the Prerogative Power of Advocates. As appearance clause meant for Accountant Section 288(2)(iv) of Income-Tax Act induces Accountant to commit offence punishable U/s 45 of Advocates Act, such clause no longer required in the statute book of Income-Tax Act. . (d) If such appearance clause Section 288(2)(iv) for Accountant still retained in the statute book of Income-Tax Act, situation may arise that order of assessing authorities in Income-Tax Deptt. passed against the representation of Accountant become in-fructuous, bad in law, null & void, as it amounts to passing of the order without giving an opportunity of being heard to the assesse. Further, such orders can not be enforced by the Deptt. to recover revenue demands raised. (e) Accountant neither licensed to practice law to enable his/her professional body to take action for professional misconduct against the directions of Income-Tax Deptt. U/s 288(5)(a) nor the Income-Tax Deptt. could disqualify him/her for professional negligence. This incurable virus in the statute book of Income-Tax Act, require deletion of appearance clause for Accountant Section 288(2)(iv) of Income-Tax Act.. . (2) To sum-up only Legal Practitioners & Income-Tax Practitioners are accountable to Income-Tax Deptt. on date for professional negligence. As Legal Practitioners are licensed to practice all Indian laws under Advocates Act & Income-Tax Practitioners are specially licensed to practice Income-Tax Act, only these two class should be treated as Tax Professionals & allowed to appear before Income-Tax Authorities on preparation & filing of Income-Tax return on behalf of assesses. Therefore, Accountant who is treated as Tax Professional in the e-filing portal of Income-Tax Deptt. should also be deleted. B.S.K.RAO, B.Com, LL.B, MICA, Auditor & Tax Advocate, BDKRAO, Beside SBI, Tilak Nagar, Shimoga-577201(Karnataka State) MO: 0-9035089036 E-Mail : raoshimoga@gmail.com

- 2. Advocates alone are entitled to Practice, Plead and Act before the Revenue Authorities (1) Indian legislature provided special class of persons called Advocates in Advocates Act, 1961 to practice all Indian laws. Therefore, appearance clause not required in any Indian taxation statute. Bar Council of India Vs A.K.Balaji [SLP(Civil)No(s)17150-17154/2012] Dt.4.7.2012 (SC) & A.K.Balaji Vs Govt. of India (2012) 35 KLR 290 21.02.2012 (Madras HC) it was clearly held by Hon’ble Supreme Court and Madras High Court that Advocates alone are entitled to practice the Profession of Law both in litigious and non-litigious matters, nullifying the effect of Section 33 of Advocates Act. This also confirms to Section 29 of Advocates Act. In the interim order Dt.4.7.2012, apex court upheld the view of Madras HC that Indian Advocates alone entitled to practice law both in litigious & non-litigious matter & directed BCI to take action for illegal practice of law by Non-Advocates in India and also reserved the decision on the issue of foreign lawyers giving advice on laws of their country in India. The verdict of Supreme Court is declared law of land, binding on all throughout the territory of India under Article 141 of Indian Constitution and contravention liable for action under Article 129 read with Article 142(2) of Indian Constitution. (2) The constitution bench of Supreme Court of India in National Tax Tribunal case of Madras Bar Association Vs Union of India bearing No.150 of 2006 Dt.25.09.2014, it was ultimately held that Chartered Accountants & Company Secretaries to represent a party to an appeal before NTT, unconstitutional and unsustainable in law. In the instant case of Apex Court, it was also held that "In our understanding, Chartered Accountants & Company Secretaries would at the best be specialists in understanding & explaining issues pertaining to accounts". Further, Chartered Accountants conducting Tax Audit for Revenue can not appear & act again for the same assesse even in proceedings before Revenue Authorities (Due to Conflict of Interest). If explanations from Tax Auditor required, they may be called upon by issuing summons under CPC/Evidence Act only. Because, all the procedures laid down in Civil Procedure Code followed in the course of proceedings before revenue authorities requiring only Advocates to appear on behalf of assesses. (3) Professional misconduct in the course of appearance for Pleading & Acting (Practice of Law) before the Revenue Authorities purely covered under Advocates Act read with Bar Council of India Rules in India. I.e, only Bar Council in India issued license to enrolled Advocates (Legal Practitioners) to practice law in India U/s 29 of Advocates Act & take action for professional negligence in the course of Pleading & Acting. As CA, CMA & CS are not issued license to practice law, their professional body can not take action on members against the directions issued by Revenue Authorities for professional misconduct. Ultimately, it is clear that Revenue Deptt. can not catch hold Chartered Accountants (CA), Cost & Management Accountants (CMA) & Company Secretaries (CS) for professional negligence in the course of “Practice of Tax Law”. Other than Advocates can not practice law in India any more - See Attachment for Court Verdict/Opinion/BCI Directions B.S.K.RAO, B.Com, LL.B, MICA, Auditor & Tax Advocate, BDKRAO, Beside SBI, Tilak Nagar, Shimoga-577201 Karnataka State MO : 0-9035089036 E-Mail : raoshimoga@gmail.com

- 3. A.K. Balaji Vs. Government of India (2012) 35 KLR 290 (Mad.) IN THE HIGH COURT OF JUDICATURE AT MADRAS DATED : 21.02.2012 HEAD NOTE:- Advocates Act, 1961 - There is no bar for foreign lawyers or law firms to visit India for temporary periods on a "fly in and fly out" basis to advise their clients on foreign law and diverse international legal issues. They are however not permitted to practice Indian law, either in relation to litigation or advisory matters, unless they qualify and enroll as advocates and fulfill the requirements of the Act and Rules. The activities performed by BPOs and LPOs do not constitute practice of law and hence do not conflict with the Act. The Bar Council of India may take necessary steps in relation to the practice of law by chartered accountants and management firms, which is contrary to the Act. Bar Council of India Vs A.K.Balaji IN THE SUPREME COURT OF INDIA S.L.P. (Civil) No(s).17150-17154/2012 DATED : 04.07.2012 HEADNOTE:- In the meanwhile, it is clarified that Reserve Bank of India shall not grant any permission to the foreign law firms to open liaison offices in India under Section 29 of the Foreign Exchange Regulation Act, 1973. It is also clarified that the expression "to practice the profession of law" under Section 29 of the Advocates Act, 1961 covers the persons practicing litigious matters as well as non-litigious matters other than contemplated in para 63(ii) of the impugned order and, therefore, to practice in non-litigious matters in India the foreign law firms, by S.L.P. (Civil) No(s).17150-17154/2012 whatever name called or described, shall be bound to follow theprovisionscontainedintheAdvocates Act,1961.

- 4. Madras Bar Association Vs Union of India IN THE CONSTITUTION BENCH OF SUPREME COURT OF INDIA National Tax Tribunal Case No.150 of 2006 DATED : 25.09.2014 HEAD NOTE:- Keeping in mind the fact , that in terms of Section 15 of the NTT Act , the NTT would hear appeals from the Income Tax Appellate Tribunal and the Custom , Excise and Service Tax Appellate Tribunals (CESTAT) only on ‘’Substantial Questions of Law‘’, it is difficult for us to appreciate the propriety of representation , on behalf of a party to an appeal , through either Chartered Accountants or Company Secretaries , before NTT. The determination at the hands of NTT is shorn of factual disputes. It has to decide only “Substantial Question of Law”. In our understanding, Chartered Accountants and Company Secretaries would at the best be specialists in understanding and explaining issues pertaining to accounts. These issues would, fall purely within the realm of facts . We find it difficult to accept the prayer made by the Company Secretaries to allow them to represent a party to an appeal brfore the NTT . Even insofar as the Chartered Accountants are concerned , we are constrained to hold that allowing them to appear on behalf of a party before the NTT , would be unacceptable in law . We accordingly reject the claim of Company Secretaries , to represent a party before the NTT . Accordingly the prayer made by Company Secretaries in Writ Petition (Civil) No. 621 of 2007 is hereby declined. While recording the above conclusion, we simultaneously hold Section 13 (1) , insofar as it allows Chartered Accountants to represent a party to an appeal before the NTT, unconstitutional and unsustainable in law . Opinion of Supreme Court of New Jersey, USA (Advocates can practice both law & public accounts) HEAD NOTE:- The court must have had some kind of vision of the professional world converging in the future, for as early as 1964, it set rather interesting ground rules into place for the cross-employment restrictions of Legal and CPA professionals. In Opinion 23 (January 9, 1964), the court was asked: “May a member of the Bar of New Jersey engage in the practice of law in this State simultaneously with the practice of public accounting?” In response, the court’s opinion states: “… we find that the dual practices of law and accounting … by lawyers would not violate the Cannons of Professional Ethics. Nor does it appear to us that any other rules of our Supreme Court would be violated by such dual practices….”

- 5. -- N.J.L.J. --- (March -, 2013) Issued by UPLC March 12, 2013 COMMITTEE ON THE UNAUTHORIZED PRACTICE OF LAW Appointed by the Supreme Court of New Jersey OPINION 50 A Nonlawyer Who Holds a Power of Attorney May Not Engage in the Practice of Law The Committee on the Unauthorized Practice of Law received a complaint alleging that a nonlawyer attempted to represent a grievant in an attorney discipline matter. The nonlawyer argued that his conduct was permitted because the grievant had executed a power of attorney authorizing him to act as the grievant’s agent. The Committee hereby issues this Opinion to clarify that a nonlawyer holding a power of attorney is not authorized to act as a lawyer licensed in the State of New Jersey. A power of attorney does not permit a nonlawyer to provide legal services or advice, or represent the principal in any judicial or quasi-judicial forum. A nonlawyer who acts in this manner engages in the unauthorized practice of law. “A power of attorney is a written instrument by which an individual known as the principal authorizes another individual . . . known as the attorney-in-fact to perform specified acts on behalf of the principal as the principal’s agent.” N.J.S.A. 46:2B-8.2a. An “attorney-in-fact” is different from an “attorney-at-law”; an “attorney-in-fact” is not a lawyer but, rather, a person who merely has authorization to perform certain acts on behalf of a principal.

- 6. 2 A power of attorney cannot authorize an agent to perform acts that would be considered the practice of law.1 Only the New Jersey Supreme Court has the power to regulate the practice of law and to decide who is authorized to practice law. N.J. Const. (1947) Art. VI, sec. 2, par. 3; In re Opinion No. 26 of the Committee on the Unauthorized Practice of Law, 139 N.J. 323, 326 (1995) (the Court’s “power over the practice of law is complete”). Admission to practice law in New Jersey is a “privilege burdened with conditions.” In re Application of Matthews, 94 N.J. 59, 75 (1983). Lawyers seeking a license to practice law in New Jersey must have “good moral character, a capacity for fidelity to the interests of clients, and for fairness and candor in dealings with the courts.” In re Pennica, 36 N.J. 401, 434 (1962). The layman must have confidence that he has employed an attorney who will protect his interests. Further, society must be guaranteed that the applicant will not thwart the administration of justice. These exigencies arise because the technical nature of law provides the unscrupulous attorney with a frequent vehicle to defraud a client. Further, the lawyer can obstruct the judicial process in numerous ways, e.g., by recommending perjury, misrepresenting case holdings, or attempting to bribe judges or jurors. [Matthews, supra, 94 N.J. at 77 (quoting In re Eimers, 358 So.2d 7, 9 (Fla. 1978)).] 1 Powers of attorney often include provisions empowering the agent to “pursue claims and litigation.” This provision permits the agent to act on behalf of the principal as the client in a lawsuit. An attorney-in-fact (the holder of a power of attorney) may make decisions concerning litigation for the principal, such as deciding to settle a case, but a nonlawyer attorney-in-fact may not act as lawyer to implement those decisions. See 3 C.J.S. Agency, Paragraph 217, page 499 (2008). Nor may an agent appear on behalf of a principal in court as a pro se party; only the real party in interest – the principal, not a nonlawyer agent -- is permitted to appear in court pro se. R. 1:21-1(a).

- 7. 3 “The protection of the public and the assurance of the proper, orderly, and efficient administration of justice in New Jersey are ensured in our state through the requirement that only attorneys authorized to practice law in New Jersey may engage in legal activities.” In re Jackman, 165 N.J. 580, 585 (2000). See Rule 1:21-1(a) (requirements to practice law in New Jersey). Licensed lawyers must comply with the Rules of Professional Conduct and are subject to discipline for ethical violations. Rule 1:20-1(a). Licensed lawyers must participate in mandatory continuing legal education. Rule 1:42-1. Providing legal advice and representing parties in court or in quasi-judicial forums such as attorney discipline proceedings or administrative agency hearings is the practice of law. Stack v. P.G. Garage, Inc., 7 N.J. 118, 120-21 (1951); Slimm v. Yates, 236 N.J. Super. 558, 561 (Ch. Div. 1989); Tumulty v. Rosenblum, 134 N.J.L. 514, 517-18 (Sup. Ct. 1946); Committee on the Unauthorized Practice of Law Opinion 21, 100 N.J.L.J. 1118 (1977). “The practice of law in New Jersey is not limited to litigation. . . . One is engaged in the practice of law whenever legal knowledge, training, skill, and ability are required.” In re Jackman, supra, 165 N.J. at 586. The Committee considered whether it is in the public interest to permit nonlawyers who hold powers of attorney to provide legal services or represent parties in court or a quasi-judicial forum. Permitting nonlawyers who hold a power of attorney to practice law would expose members of the public to persons who are not bound by the Rules of Professional Conduct and who do not have any training in law. It would interfere with the orderly administration of justice and judges’ expectations that representatives appearing in court will act ethically. It would abrogate New Jersey’s

- 8. 4 licensing and admission requirements. The Committee finds that it is not in the public interest to permit the practice of law by nonlawyers who have been appointed agent of a principal pursuant to a power of attorney. Such conduct is the unauthorized practice of law. This decision of the Committee is consistent with the findings of courts in New Jersey and other jurisdictions. In Kasharian v. Wilentz, 93 N.J. Super. 479 (App. Div. 1967), the court rejected an attempt by an administrator ad prosequendum who sought to institute a wrongful death action. “[N]ominal representatives or even active fiduciaries of the persons in beneficial interest, not themselves lawyers, should not be permitted to conduct legal proceedings in court involving the rights or liabilities of such persons without representation by attorneys duly qualified to practice law.” Id. at 482. The Ohio Supreme Court recently found that a person holding a power of attorney is not authorized to file papers in court on behalf of the principal. The Ohio Court quoted the findings of its Board on Unauthorized Practice of Law: A durable power of attorney, naming a non-attorney as one’s agent and attorney-in-fact, does not permit that person to prepare and pursue legal filings and proceedings as an attorney-at-law. Since 1402, the law has recognized the distinction between an attorney-in-fact and an attorney-at law, and only attorneys-at-law have been permitted to practice in the courts. [Ohio State Bar Ass’n v. Jackim, 901 N.E.2d 792, 794 (Ohio 2009).] See also In re Estate of Friedman, 482 N.Y.S.2d 686, 687 (Surr. Ct. NY 1984) (principal “cannot use a power of attorney as a device to license a layman to act as her attorney in a court of record. To sanction this course would effectively circumvent the stringent licensing requirements of attorneys by conferring upon lay persons the same right to

- 9. 5 represent others by the use of powers of attorney”); Ross v. Chakrabarti, 5 A.3d 135, 141 (Ct. Special App. Maryland 2010) (power of attorney did not give agent right to provide legal advice or appear in court on behalf of principal; to confer such power would be to give a nonlawyer “the right to practice law in this State without meeting the educational, examination, and ethical standards established by the General Assembly and the Court of Appeals”); In re Conservatorship of Riebel, 625 N.W.2d 480, 482 (Minn. 2001) (a power of attorney does not authorize a nonlawyer to sign pleadings and appear for principal in court proceedings; “the attorney-in-fact may make decisions concerning litigation for the principal, but a nonlawyer attorney-in-fact is not authorized to act as an attorney to implement those decisions”); Mosher v. Hiner, 154 P.2d 372, 374 (Ariz. 1944) (prohibiting attorney-in-fact from filing case in court on behalf of principal; “if an attorney-in-fact could appear in cases in our courts there would be no need for a College of Law at our University”); Risbeck v. Bon, 885 S.W.2d 749, 750 (Ct. App. Missouri 1994) (while parties may represent themselves in court, an agent or attorney-in-fact who is not a licensed attorney may not represent another person in court); State v. Milliman, 802 N.W.2d 776, 780 (Ct. Appeals Minn. 2011) (“a principal of an agent cannot, by executing a power of attorney, authorize the agent to practice law if the agent is not an attorney-at-law”); Christiansen v. Melinda, 857 P.2d 345 (Alaska 1993) (nonlawyer holding a power of attorney cannot bring suit on behalf of another person). In sum, a nonlawyer holding a power of attorney is not authorized to act as a lawyer licensed in the State of New Jersey, cannot provide legal services or advice, and cannot represent the principal in any judicial or quasi-judicial forum. A nonlawyer who acts in this manner engages in the unauthorized practice of law.

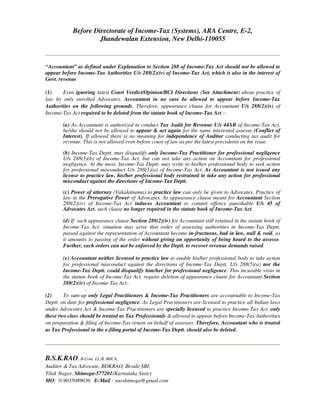

- 10. '6il8- ffif*sr r{ffiryw (siatut0ry Body GonstittltecJ Ty. *r{T. qT*r? '-.ris*-: l'c{ il ,':r ft. SHARI1^,A MA S f d, L.L.B." LL.t*., rl'1Brt SE trefcr!, t;;iiltil:i A.i..lNDtABAtl.itlEwDtllltj i:-,ir t:;r ri : rcffi fg,l bfi rcr::unc if o ii n cii;.i. c.r ii.; ii'i ;, i: $it ti rl;'.^.,w L)atr r)o Li f"icI I 0{in (li at. orrtr I l'el. Fax {$1}01 1.49?2$0cil ($1 i 01 1-49;1;t liO1 1 li under ttre Advocates Act, 1961) 21 qTSriJ rl;:fr,{J. 3Tfidl'f,Yrm4 qiilll ;T$ ffl;,-i'l - 110 C)0? 21, Rouse Averrue fnstitufioncl Areo New Delhi - 110 002 t).,(,t: t'); , 291 ,,:j{) r;r, i(hirrrcril) Sr.:lllctrtl)('t' [ 1.. :.lo tir, l. Lj:i('t't'I,"1Il ), (ll'11)"1" {,-'r.'rtl t'lt I lloirlll I)it'ttt:f 'l'i.t.r':t.ls Nut'tir liiot'li. li",', l)r'lirt- I l ()()o l. Itt'gi.sl.r'it t' i nc:r: rt'rt:'l'it x rirlrcrllit l^:c'l't'i'llrtnit]. III li: IVi.it i;lr:rlt'. Sn rttlrni;1r (.,t tt rr 1tlclx. llirrrg;i Iirr('- tih( ) ooc). Sir (s ) 'l'5i. l),rtr (;grrrtlii 1,i irrililr is i.l stelttrtor. l:ritl,, un(lcl tittt ..dvocrtttcrs ;c:l. t96r r*prc.q(:pLirr;:, irlil)roxirrrntelv L7 rnilliorr lnrvvc:r..'i t:f'llr* {:oLlntr| anci tllis is tltt: {.1'rrrir:ils 51r't,ilt,t,rr r.iir;t:liirrgin,g lltcsr-r frtnc:tiolis t.:f:fcclivci.r'{rii'i;rst 5o }jclit}:s. 'j'h* llar,Cotrrrr:ii t:i lrrrlilr i,s cr:nstitr.rtecl rtnclct''licctiorr'{ ol'thc .ic.JVC)ctit(l.ri Ai:l. rct(:r. it r,c:rrsists t;f it1rrr'lrl* ..ttorncr' (icltrtrt';.tl of' Irrr.litr artcl ItIotr'blt-: $0lit:ilor' r.{'i)t.r's(1t.}i. ill,.,,r. r{,.i)i.i lir i ,Sl.;tlt' liiit' L.or.tttt.:iis tli i}ti' liirt' ( tirtiitlil r:i' lrtclia (.Nl'i' Itlllrir 'l'6c. l)rilr. tl.rrrrr:t I ,.it lrrcliir ;tt its lrrcctirtp-. hclci Dll :i(q.:i."()1;3 ccltr-';icicrt'e:cl lhc: S[ritir. .,1't,,r. ,,,,r,rirl,,,rlrtir.,rr trrr N,lcirtirtrt' Cutlttttit.tcil. (:i)llsisLi]l.g ()1' Shi'i 5' rlir.r,r,titiri i,'tfir. 1,,irlt.irl lJriirl.cl I)ir.gc:t trrxc.s ic, r:l,,liti;cl lrcl.{()tt ritltct' Iiiirrl t.irtr lc:i;iii

- 11. -9- practitioncr undcr Scction 288 (z) of the Income'l'ax Act. 'Ihe Hon'ble Member of this Cqmrnittcc after thorough examination submit the report before the Ilar Council at its mccting hcld on zt).7.zor3,After consideration, Council accepted the report submittcd by the Sub-Committee in this regard. The operative parl of the Committee is reproduced below- 'I'hereforc in the above circtrrnstances aftcr perusal of ttre Acts & Rules. wc are of the opinion when the legal practitioners are the only class of pcrsons entitled to practice law U/s 29 of the Advocates Act , Lg6L ( Law Professionals), there is no justification for prohibiting Advocates to issue certificates or Reports in Incorne- 'I'ax Act. ('['his is wel] supported by Bar Council of India Vs. A. K. llalaji SLp (Cir.il) tTLSo-17t54/zotz).The aetivities performed by BPOs and LI)Os clcl not constitutc practice of law and hence do not conflict with the Act. 'l'hc Bar Council clf India may take necessary steps in relation to the practice of law by Chafl:cred Accountants and management firms, which is contrary to the Act. In vicw 9f thc ab<>vc, you arc kindly requested not to permit other than the legal practitioncrs unclcr Section 288 (z) of the Income Tax Act. The detailed report dated 3.6.2o13 submitted by Mr, S. Prabakaran and the other member which is also approved by the Council is enclosed for your reference and take necessary action. Yours sincerel Copy to : 1 . M r, S. I)rabakaran, Advocatc, Co* Charirman, Bar Council of india, 63, Bharathiyar Street, Venkatesan Nagar, Chennai- 600 O82.,Tamil Nadu. 2, iv|r. Rameshchandra G. Shah, Advocate Member, Bar Council of India, 301, Chanccllor Apartment, Opp, RTO, Ring Road, ()pp. I(rishi Mangal Hall, Surat-395 OO 1, Gujarat.