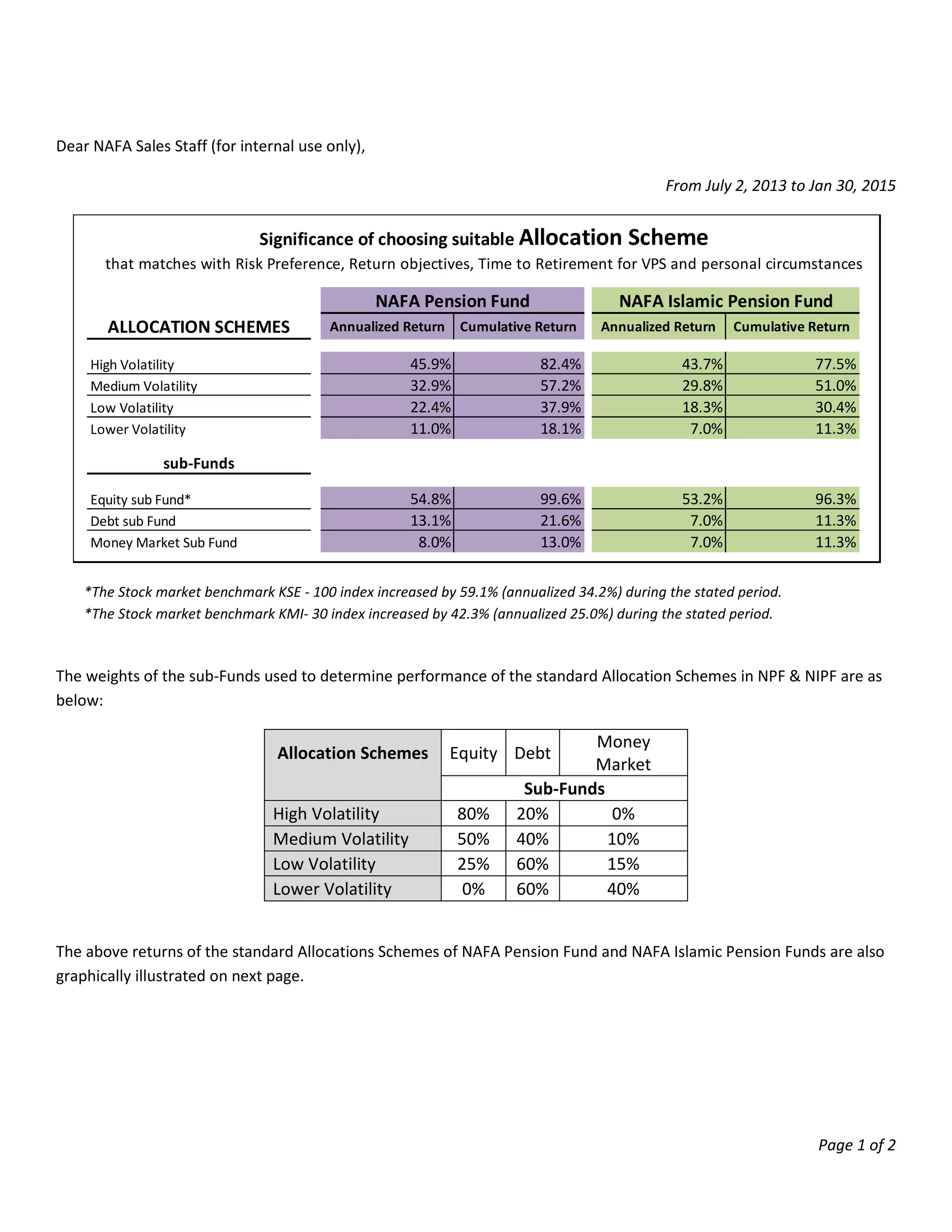

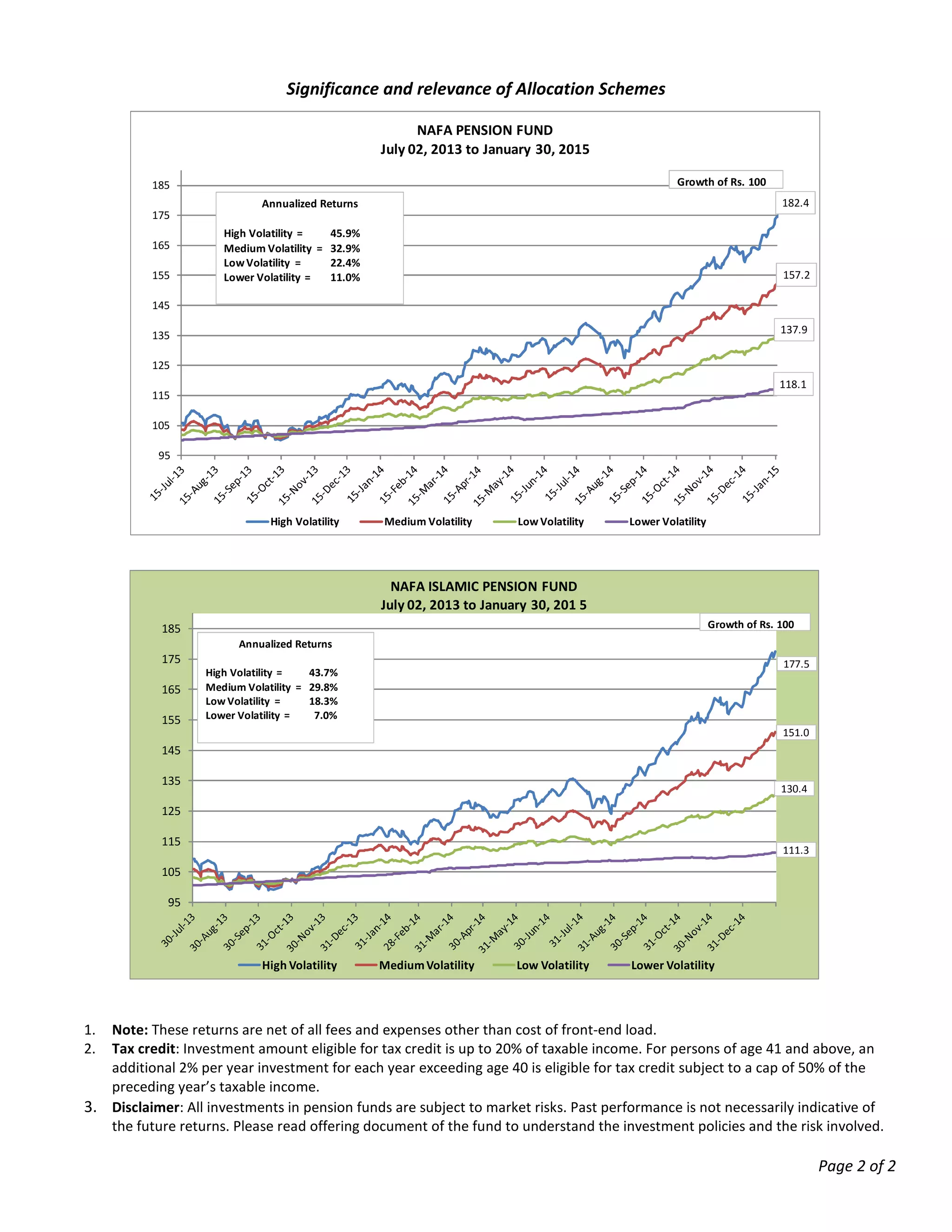

The document discusses the performance of various allocation schemes for the NAFA Pension Fund and NAFA Islamic Pension Fund between July 2, 2013 and January 30, 2015. The high volatility allocation scheme saw the highest annualized returns of 45.9% and 43.7% respectively, while the lower volatility allocation scheme saw the lowest returns of 11% and 7%. Graphs on the second page illustrate the growth of Rs. 100 under each allocation scheme for both funds over this period. The document emphasizes choosing an allocation scheme that matches an individual's risk preference, return objectives, and time to retirement.