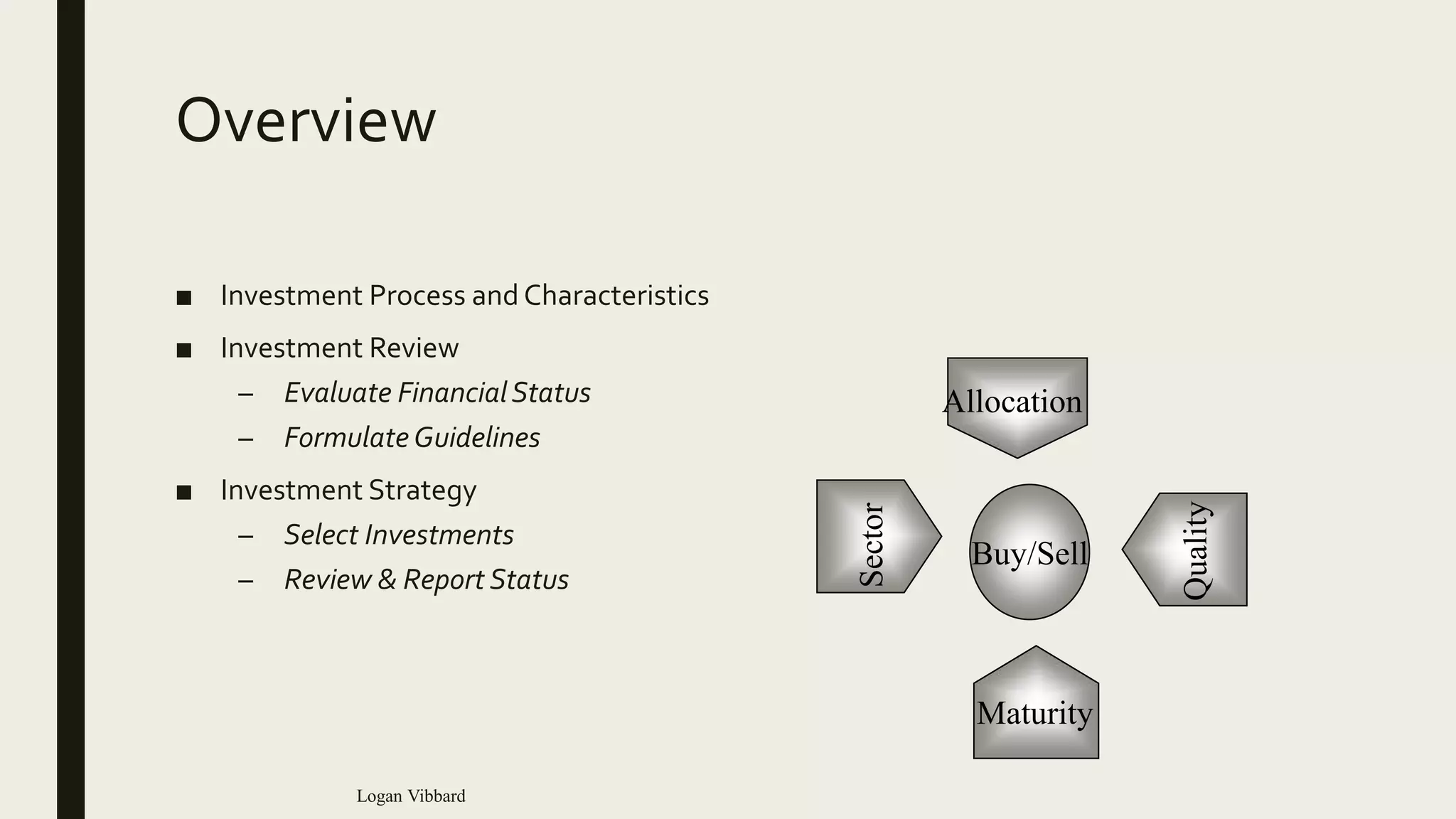

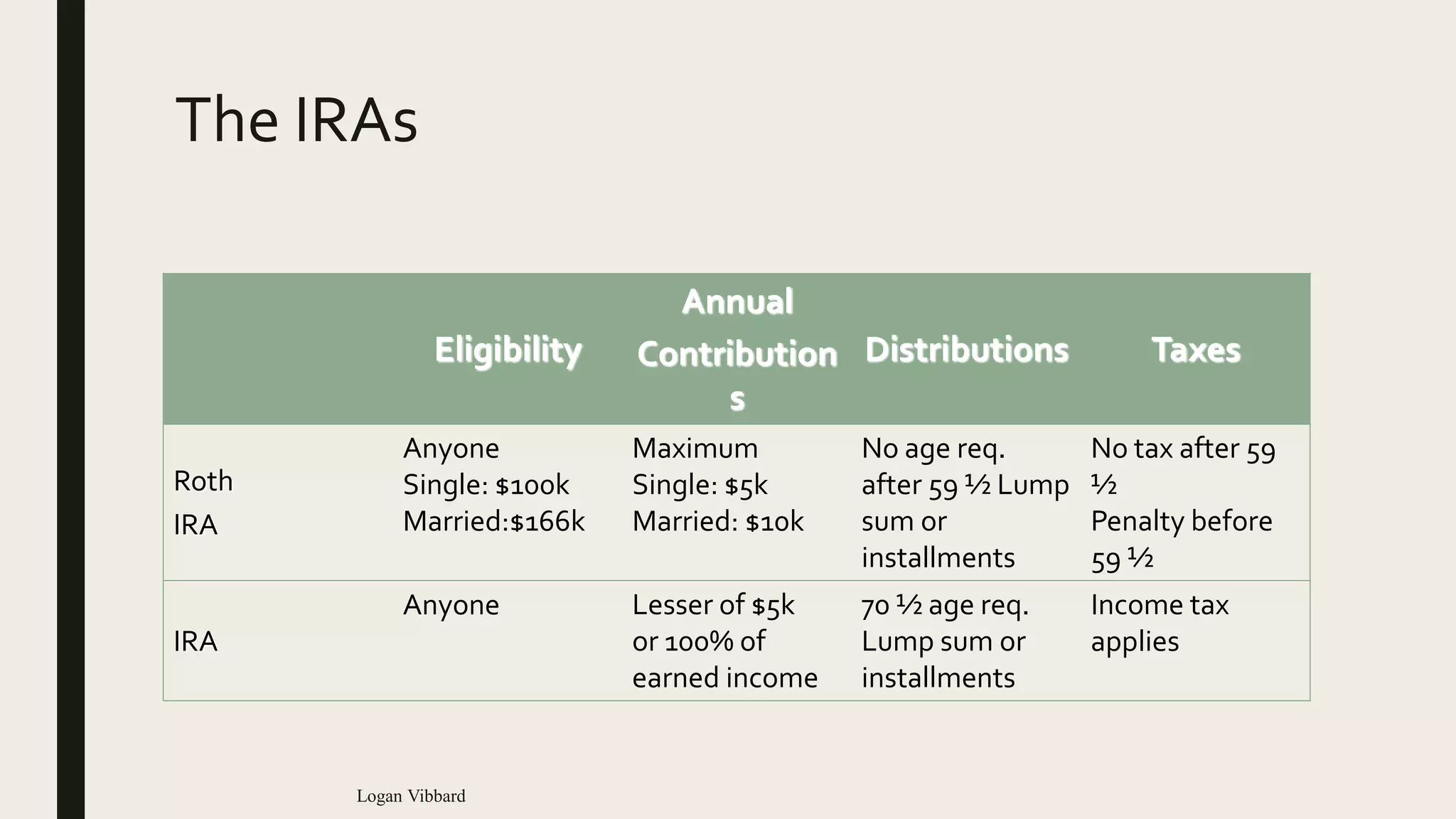

Thomas Lincoln & Associates provides investment advisory services using a quantitative investment process focused on relationships. Their presentation outlines a basic investment strategy of evaluating a client's financial status, formulating guidelines, selecting investments, and reviewing performance. It also reviews IRA and pension plan options, eligibility requirements, contribution limits, distribution rules, and tax implications.