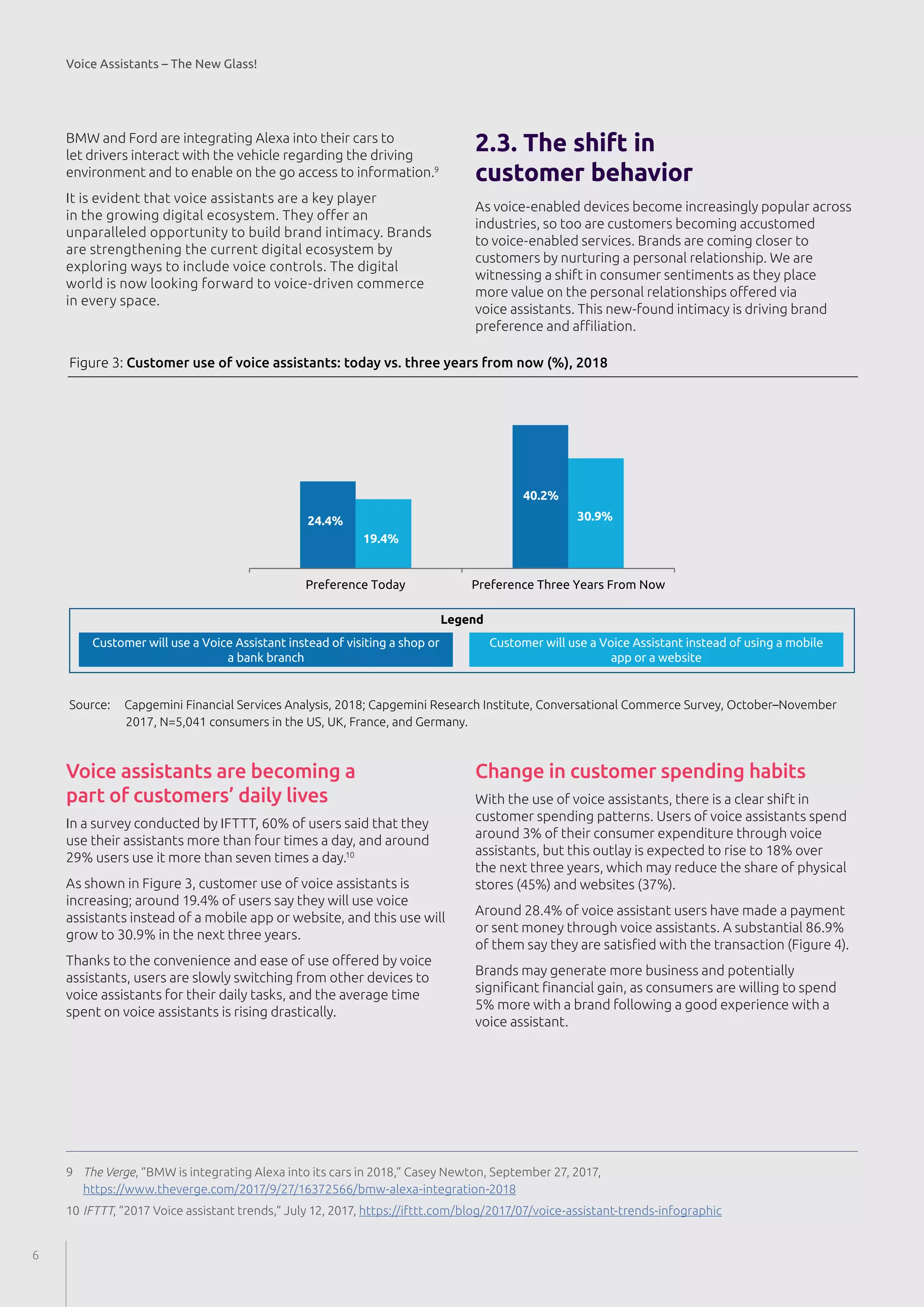

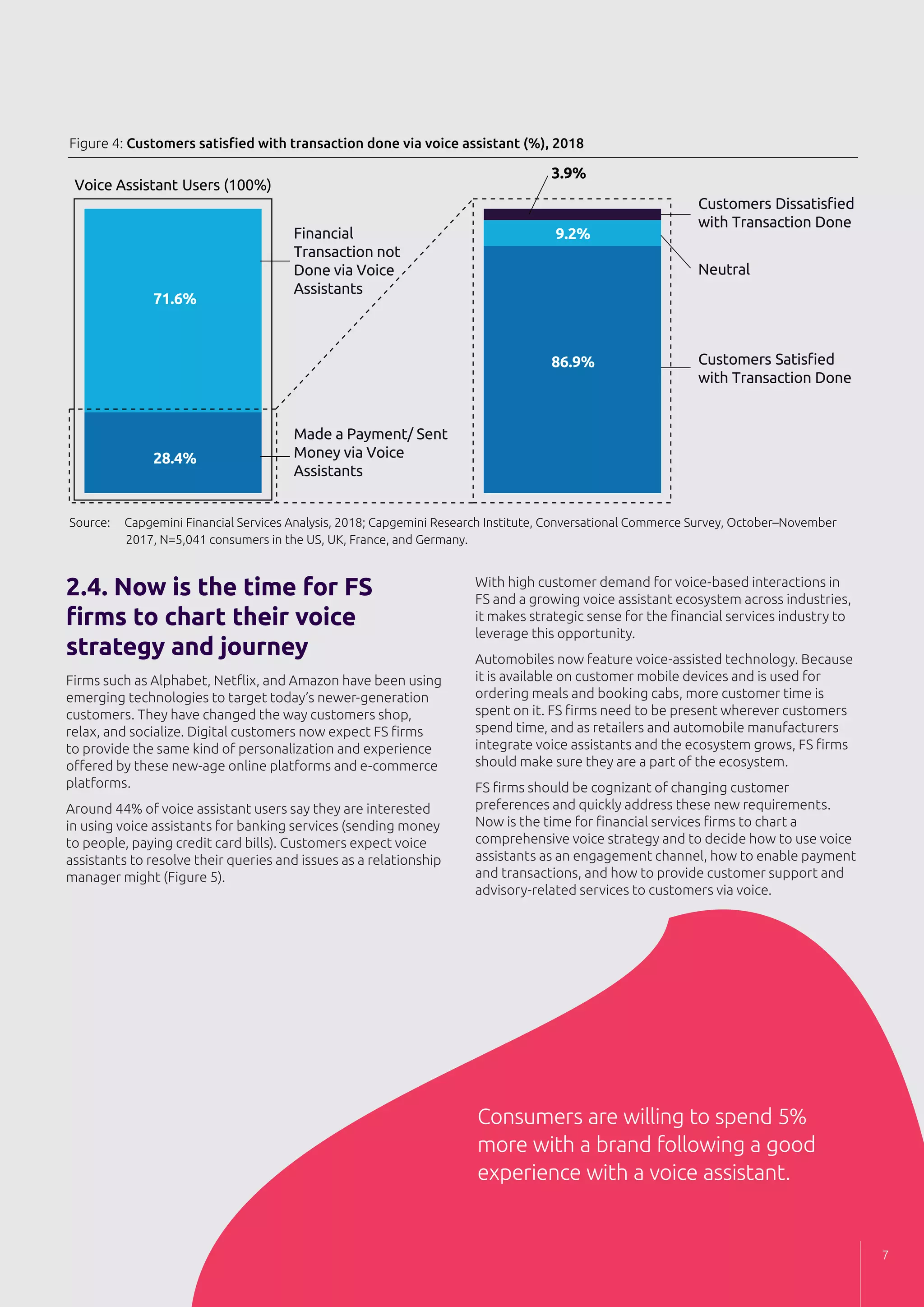

This document discusses the rapid adoption of voice assistants and the opportunities they present for financial services firms. It notes that voice assistant usage has increased significantly in recent years, especially among younger demographics, and is expected to continue growing quickly. Retail and e-commerce companies have started capitalizing on voice shopping. Now financial services firms need to develop strategies to engage customers through this new voice channel, like using voice assistants to provide personalized products and services or improve customer service. The document argues voice is becoming a critical new interaction method and financial companies must adopt a voice strategy to succeed.