Virgin Mobile is considering two pricing strategies for entering the US mobile market:

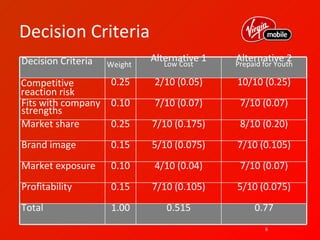

1. A cheaper rate plan targeting 18-29 year olds with subsidized handsets and hidden fees.

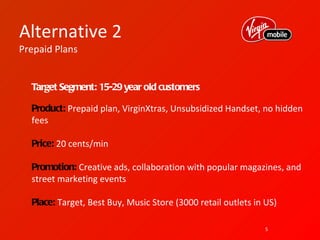

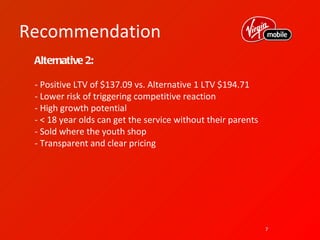

2. Prepaid plans targeting 15-29 year olds with unsubsidized handsets and transparent pricing.

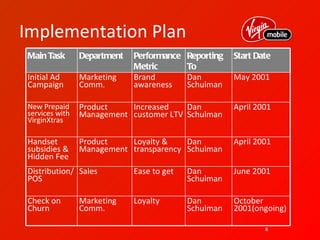

Analysis shows the prepaid option has lower risk of competitive reaction and higher growth potential given the target demographic. It is recommended to pursue the prepaid strategy and implement an advertising campaign, prepaid service offerings, and distribution through retail partners to acquire the youth market.