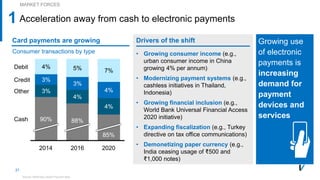

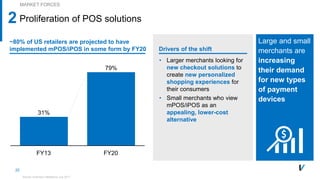

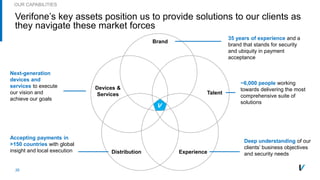

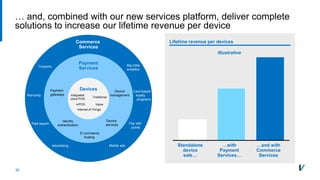

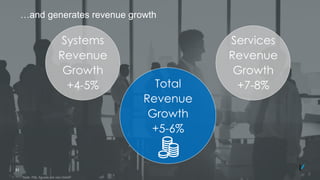

This document outlines Verifone's strategy to build and connect next-generation payment devices with expanded services. It discusses key market forces like the shift from cash to electronic payments and growing consumer expectations for omni-channel experiences. Verifone will leverage its assets like global scale and experience to launch devices and connect clients to its services platform, enabling the future of payments and commerce. This strategy aims to increase Verifone's revenue per device and generate total revenue growth of 5-6% annually through 2017-2020.