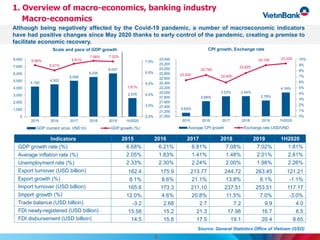

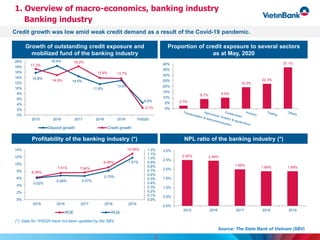

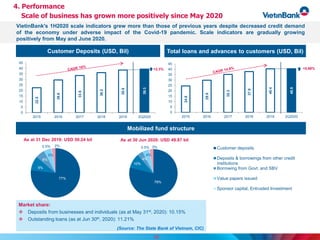

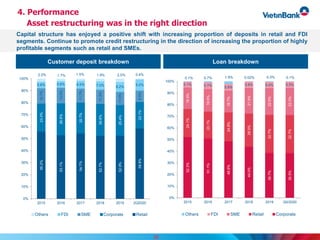

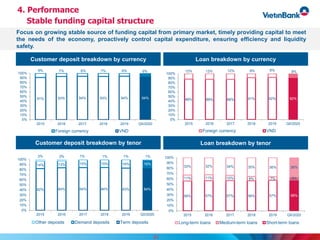

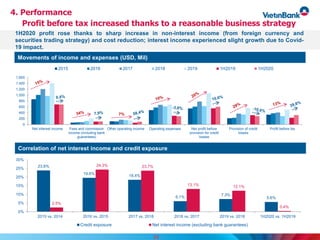

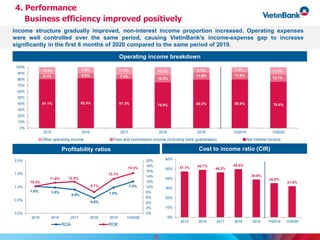

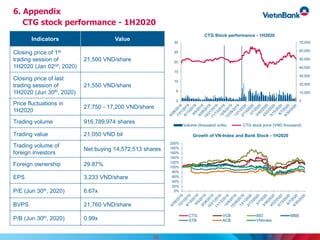

This document provides an overview of macroeconomic conditions and the banking industry in Vietnam, and details about VietinBank. The macroeconomic section notes GDP growth rates from 2015 to the first half of 2020, inflation rates, unemployment, export/import figures, FDI, and exchange rates. It also discusses credit growth and profitability in the banking industry. The document then profiles VietinBank, outlining its history, mission, organizational structure, investment highlights including a strong innovation focus, extensive network, credit ratings, technology platform, and human resources. Performance metrics and business orientation for 2020 are also reviewed.